You want to play with "millions" on the blockchain then try https://uniswap.org/docs/v2/smart-contract-integration/using-flash-swaps/. This contract is able to arbitrage between DEX on the blockchain without providing any own capital. Basically is usable on the Binance Smart Chain and provides callbacks for common DEX, feel free to extend.

This is not a full project, build your or own infrastructure around it!

- https://github.com/yuyasugano/pancake-bakery-arbitrage

- https://github.com/Uniswap/uniswap-v2-periphery/blob/master/contracts/examples/ExampleFlashSwap.sol

All examples are more or less overengineered for a quick start, so here we have a KISS solution.

- Reduce overall contract size for low gas fee on deployment

- Provide a on chain validation contract method to let nodes check arbitrage opportunities

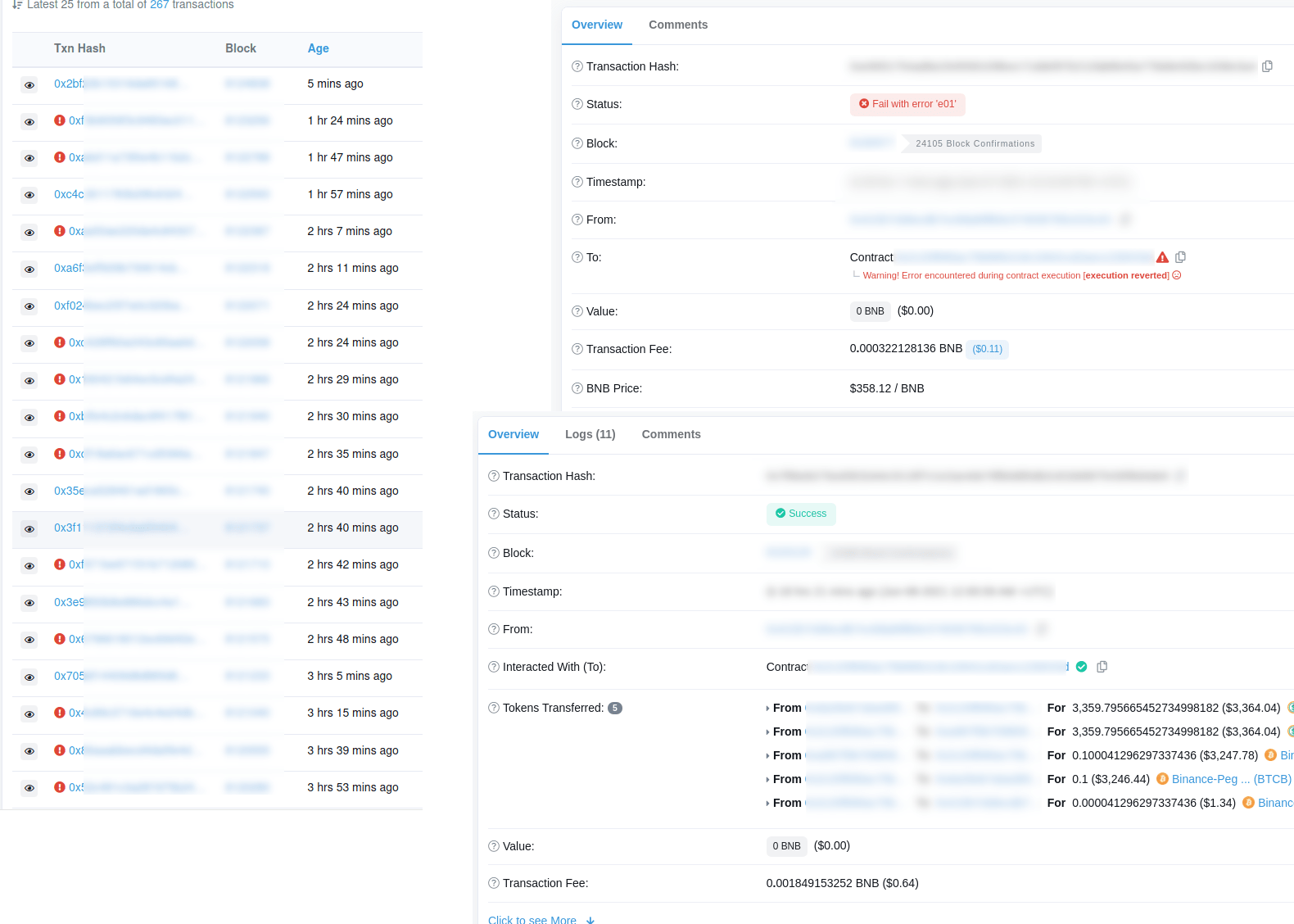

- Stop arbitrage opportunity execution as soon as possible if its already gone to reduce gas fee on failure

- Interface callbacks for common DEX on "Binance Smart Chain" are included

Basically arbitrage opportunity dont last long, your transaction must make it into the next block. So you have <3 seconds watching for opportunities, decide and execute transaction. Sometimes there are also a chance to 2-3 have block, see example below.

[7920960] [6/1/2021, 5:50:37 PM]: alive (bsc-ws-node.nariox.org) - took 308.42 ms

[7920991] [6/1/2021, 5:52:09 PM]: [bsc-ws-node.nariox.org] [BAKE/BNB ape>bakery] Arbitrage opportunity found! Expected profit: 0.007 $2.43 - 0.10%

[7920991] [6/1/2021, 5:52:09 PM] [bsc-ws-node.nariox.org]: [BAKE/BNB ape>bakery] and go: {"profit":"$1.79","profitWithoutGasCost":"$2.43","gasCost":"$0.64","duration":"539.35 ms","provider":"bsc-ws-node.nariox.org"}

[7920992] [6/1/2021, 5:52:13 PM]: [bsc-ws-node.nariox.org] [BAKE/BNB ape>bakery] Arbitrage opportunity found! Expected profit: 0.007 $2.43 - 0.10%

[7920992] [6/1/2021, 5:52:13 PM] [bsc-ws-node.nariox.org]: [BAKE/BNB ape>bakery] and go: {"profit":"$1.76","profitWithoutGasCost":"$2.43","gasCost":"$0.67","duration":"556.28 ms","provider":"bsc-ws-node.nariox.org"}

[7921000] [6/1/2021, 5:52:37 PM]: alive (bsc-ws-node.nariox.org) - took 280.54 ms

- You have a time window of 1000ms every 3 seconds (blocktime on BSC) and you should make it into the next transaction

- Websocket connection is needed to listen directly for new incoming blocks

- Public provided Websocket are useless

bsc-ws-node.nariox.orgsimply they are way behind notify new blocks - Use a non public provider; or build your own node (light node helps) and better have multiple owns; let the fastest win

- Spread your transaction execution around all possible providers, first one wins (in any case transactions are only execute once based on

nonce) - Find suitable pairs with liquidity but not with much transaction

- You can play with full pair liquidity, but dont be too greedy think of a price impact you would have

- Common opportunities are just between 0,5 - 1%

- Do not estimate transaction fee, just calculate it once and provide a static gas limit. Simply its takes to long

- There is block parameter until the transaction is valid, so you can abort execution eg after +3 blocks

- Payback is directly calculated by calling the foreign contracts so its project independent (no hardcoded fee calculation)

- The profit is transferred to the owner / creator of the contract :)

The contract is plain and simple [contracts/Flashswap.sol] some basic hints:

Check arbitrage opportunity between DEX. Read only method the one blockchain

function check(

address _tokenBorrow, // example: BUSD

uint256 _amountTokenPay, // example: BNB => 10 * 1e18

address _tokenPay, // example: BNB

address _sourceRouter,

address _targetRouter

) public view returns(int256, uint256) {

Starts the execution. You are able to estimate the gas usage of the function, its also directly validating the opportunity. Its slow depending on connected nodes.

function start(

uint _maxBlockNumber,

address _tokenBorrow, // example BUSD

uint256 _amountTokenPay,

address _tokenPay, // our profit and what we will get; example BNB

address _sourceRouter,

address _targetRouter,

address _sourceFactory

) external {

As all developers are lazy and just forking projects around without any rename a common implementation is possible. Basically the pair contract call the foreign method of the contract. You can find them the naming in any pair contract inside the swap() method.

Example: https://bscscan.com/address/0x0eD7e52944161450477ee417DE9Cd3a859b14fD0#code: if (data.length > 0) IPancakeCallee(to).pancakeCall(msg.sender, amount0Out, amount1Out, data);

Extend method if needed:

# internal callback

function execute(address _sender, uint256 _amount0, uint256 _amount1, bytes calldata _data) internal

# foreign methods that get called

function pancakeCall(address _sender, uint256 _amount0, uint256 _amount1, bytes calldata _data) external

function uniswapV2Call(address _sender, uint256 _amount0, uint256 _amount1, bytes calldata _data) external

Its not a full infrastructure, but a working workflow, if you deploy the contract.

cp env.template .env # replace values inside ".env"

node watcher.jsstarted: wallet 0xXXXX - gasPrice 5000000000 - contract owner: 0xXXXX

[bsc-ws-node.nariox.org] You are connected on 0xXXXX

[8124531] [6/8/2021, 7:53:20 PM]: [bsc-ws-node.nariox.org] [BUSD/BNB pancake>panther] Arbitrage checked! Expected profit: -0.015 $-4.99 - -0.15%

[8124532] [6/8/2021, 7:53:21 PM]: [bsc-ws-node.nariox.org] [BUSD/BNB pancake>panther] Arbitrage checked! Expected profit: -0.015 $-4.99 - -0.15%

[8124533] [6/8/2021, 7:53:24 PM]: [bsc-ws-node.nariox.org] [BUSD/BNB pancake>panther] Arbitrage checked! Expected profit: -0.014 $-4.71 - -0.14%

[8124534] [6/8/2021, 7:53:27 PM]: [bsc-ws-node.nariox.org] [BUSD/BNB pancake>panther] Arbitrage checked! Expected profit: -0.014 $-4.61 - -0.14%

- Designed to have multiple chain connectivities, play with some non public providers to be faster then the public once. Its all designed as "first win"