What is the overall Commons Configuration strategy?

This strategy is designed to ensure the stability of the ABC throughout the early stages of Commons Development while prioritizing small funding proposals that make an impact in the space and expanding the utility of the TEC token and the role of the Token Engineering Commons within this industry.

Advanced Settings Modified? Yes

Summary

Module 1: Token Freeze & Token Thaw

| Parameter |

Value |

| Token Freeze |

18 Weeks |

| Token Thaw |

52 Weeks |

| Opening Price |

1.5 wxDAI |

Module 2: Augmented Bonding Curve

| Parameter |

Value |

| Commons Tribute |

50.00% |

| Entry Tribute |

1.00% |

| Exit Tribute |

12.00% |

| *Reserve Ratio |

22.34% |

*This is an output. Learn more about the Reserve Ratio here.

Module 3: Tao Voting

| Parameters |

Value |

| Support Required |

88% |

| Minimum Quorum |

8% |

| Vote Duration |

7 days(s) |

| Delegated Voting Period |

4 day(s) |

| Quiet Ending Period |

2 day(s) |

| Quiet Ending Extension |

2 day(s) |

| Execution Delay |

1 day(s) |

Module 4: Conviction Voting

| Parameter |

Value |

| Conviction Growth |

42 day(s) |

| Minimum Conviction |

0.8% |

| Spending Limit |

11.0% |

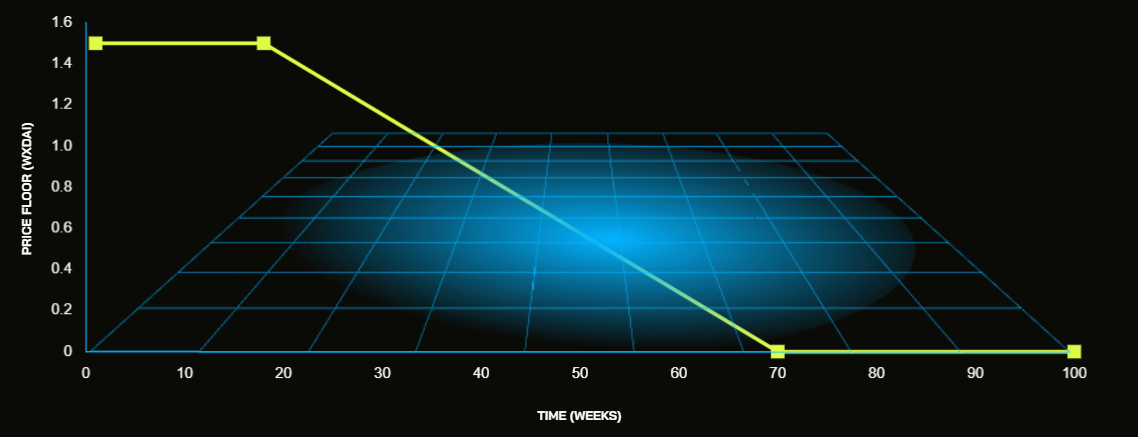

Module 1: Token Freeze and Token Thaw

Data:

| Duration |

% of Tokens Released |

Price Floor of Token |

| 3 months |

0.00% |

1.50 wxDAI |

| 6 months |

15.38% |

1.27 wxDAI |

| 9 months |

40.38% |

0.89 wxDAI |

| 1 year |

65.38% |

0.52 wxDAI |

| 1.5 years |

100.00% |

0.00 wxDAI |

| 2 years |

100.00% |

0.00 wxDAI |

| 3 years |

100.00% |

0.00 wxDAI |

| 4 years |

100.00% |

0.00 wxDAI |

| 5 years |

100.00% |

0.00 wxDAI |

- Token Freeze: 18 weeks, meaning that 100% of TEC tokens minted for Hatchers will remain locked from being sold or transferred for 18 weeks. They can still be used to vote while frozen.

- Token Thaw: 52 weeks, meaning the Hatchers frozen tokens will start to become transferable at a steady rate starting at the end of Token Freeze and ending 52 weeks later.

- Opening Price: 1.5 wxDAI, meaning for the initial buy, the first TEC minted by the Augmented Bonding Curve will be priced at 1.5 wxDAI making it the price floor during the Token Freeze.

Strategy:

Opening Price is balanced allowing for initial token buyers to get in at a perceived bargain even after the initial buy-in. The Token Freeze (18 weeks) provides a 4+ month buffer to allow enough economic activity to occur on the ABC while minimizing the amount of time for value-aligned members to begin putting their tokens to use. The Token Thaw period (1 year) allows for a responsible amount of time to effectively distribute potential sell pressure placed on the ABC.

Module 2: Augmented Bonding Curve (ABC)

Data:

| Step # |

Current Price |

Amount In |

Tribute Collected |

Amount Out |

New Price |

Price Slippage |

| Step 1 |

1.84 |

5000.00 wxDAI |

50.0 |

2682.44 TEC |

1.85 |

0.22% |

| Step 2 |

1.85 |

50000.00 TEC |

886.83 |

87795.82 wxDAI |

1.7 |

4.10% |

| Step 3 |

1.7 |

3000.00 wxDAI |

30.0 |

1745.13 TEC |

1.7 |

0.15% |

NOTE:

We're very bullish on TEC so we provide the BUY scenario at launch to compare proposals... to explore this proposal's ABC further Click the link below to see their parameters in your dashboard, be warned this will clear any data you have in your dashboard:

| Allocation of Funds |

wxDAI |

| Common Pool (Before Initial Buy) |

655611.79 |

| Reserve (Before Initial Buy) |

655611.79 |

| Common Pool (After Initial Buy) |

657611.79 |

| Reserve (After Initial Buy) |

853611.78 |

ABC Configuration Table

| Reserve (wxDai) |

Supply (TEC) |

Price (wxDai/TEC) |

| 10,000 |

768,477 |

0.06 |

| 50,000 |

1,100,959 |

0.20 |

| 100,000 |

1,285,349 |

0.35 |

| 200,000 |

1,500,624 |

0.60 |

| 300,000 |

1,642,900 |

0.82 |

| 400,000 |

1,751,956 |

1.02 |

| 500,000 |

1,841,506 |

1.22 |

| 600,000 |

1,918,062 |

1.40 |

| 700,000 |

1,985,267 |

1.58 |

| 800,000 |

2,045,382 |

1.75 |

| 900,000 |

2,099,918 |

1.92 |

| 1,000,000 |

2,149,932 |

2.08 |

| 1,250,000 |

2,259,825 |

2.48 |

| 1,500,000 |

2,353,771 |

2.85 |

| 1,750,000 |

2,436,243 |

3.22 |

| 2,000,000 |

2,510,014 |

3.57 |

| 2,500,000 |

2,638,313 |

4.24 |

| 3,000,000 |

2,747,995 |

4.89 |

| 3,500,000 |

2,844,278 |

5.51 |

| 4,000,000 |

2,930,406 |

6.11 |

| 5,000,000 |

3,080,193 |

7.27 |

| 7,500,000 |

3,372,233 |

9.96 |

| 10,000,000 |

3,596,082 |

12.45 |

| 15,000,000 |

3,937,035 |

17.05 |

| 20,000,000 |

4,198,375 |

21.32 |

| 50,000,000 |

5,152,085 |

43.44 |

| 100,000,000 |

6,014,986 |

74.42 |

- Commons Tribute: 50.00%, which means that 50.00% of the Hatch funds (655611.79 wxDAI) will go to the Common Pool and 50.00% (655611.79 wxDAI) will go to the ABC's Reserve.

- Entry Tribute: 1.00% meaning that from every BUY order on the ABC, 1.00% of the order value in wxDAI is subtracted and sent to the Common Pool.

- Exit Tribute: 12.00% meaning that from every SELL order on the ABC, 12.00% of the order value in wxDAI is subtracted and sent to the Common Pool.

Strategy:

The Commons Tribute (70%) will allow for a substantial amount of funds to be available for distribution granting the TEC Token more opportunity for external utility. The Entry Tribute (1%) is extremely low which encourages economic activity to occur on the ABC from individual buyers as well as providing for buy-side arbitrage opportunities on secondary markets. The Exit Tribute (12%) de-incentivizes sell-side arbitrage opportunities and individual sell-offs while providing a method for raising significant funds for the Commons Pool by agents wishing to exit the TEC economy.

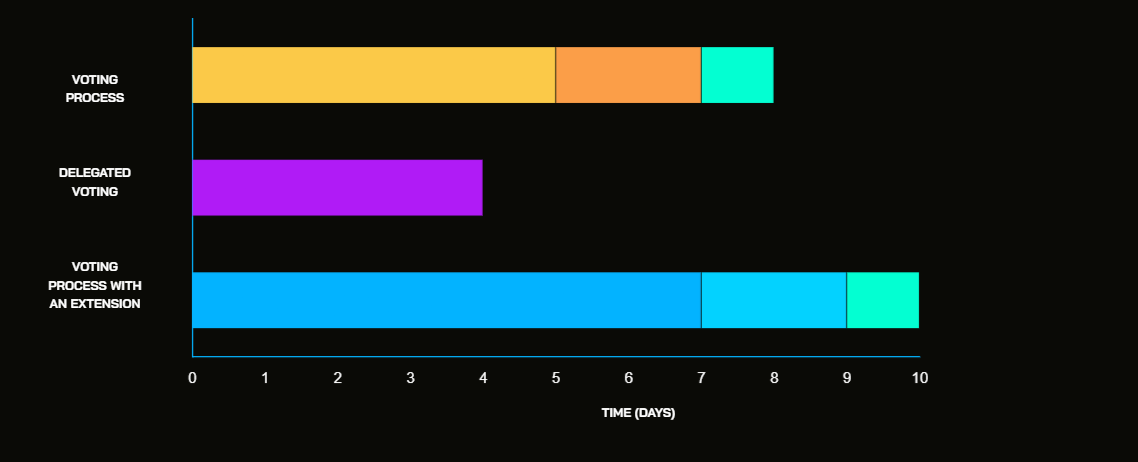

Module 3: Tao Voting

Data:

| # of Quiet Ending Extensions |

No Extensions |

With 1 Extension |

With 2 Extensions |

| Time to Vote on Proposals |

7 days |

9 days |

11 days |

| Time to Review a Delegates Vote |

3 days |

5 days |

7 days |

| Time to Execute a Passing Proposal |

8 days |

10 days |

12 days |

- Support Required: 88%, which means 88% of all votes must be in favor of a proposal for it to pass.

- Minimum Quorum: 8%, meaning that 8% of all tokens need to have voted on a proposal in order for it to become valid.

- Vote Duration: 7 day(s), meaning that eligible voters will have 7 day(s) to vote on a proposal.

- Delegated Voting Period is set for 4 day(s), meaning that Delegates will have 4 day(s) to use their delegated voting power to vote on a proposal.

- Quiet Ending Period: 2 day(s), this means that 2 day(s) before the end of the Vote Duration, if the vote outcome changes, the Quiet Ending Extension will be triggered.

- Quiet Ending Extension: 2 day(s), meaning that if the vote outcome changes during the Quiet Ending Period, an additional 2 day(s) will be added for voting.

- Execution Delay: 1 days(s), meaning that there is an 1 day delay after the vote is passed before the proposed action is executed.

Strategy:

The TAO Voting parameters provide a voting system that requires a high amount of support (78%), and a moderate quorum (10%) of participation. The Vote Duration (10 days) allows a sufficient amount of time for community engagement. Delegated Voting (7 days) will end slightly before the active voting period, allowing community members (3 days) an opportunity to alter the outcome of the vote. If the voting outcome is changed, there will be a quiet ending extension of (2 days) for final community engagement. The execution delay (3 days) is sufficient time for the community to prepare for voting outcomes.

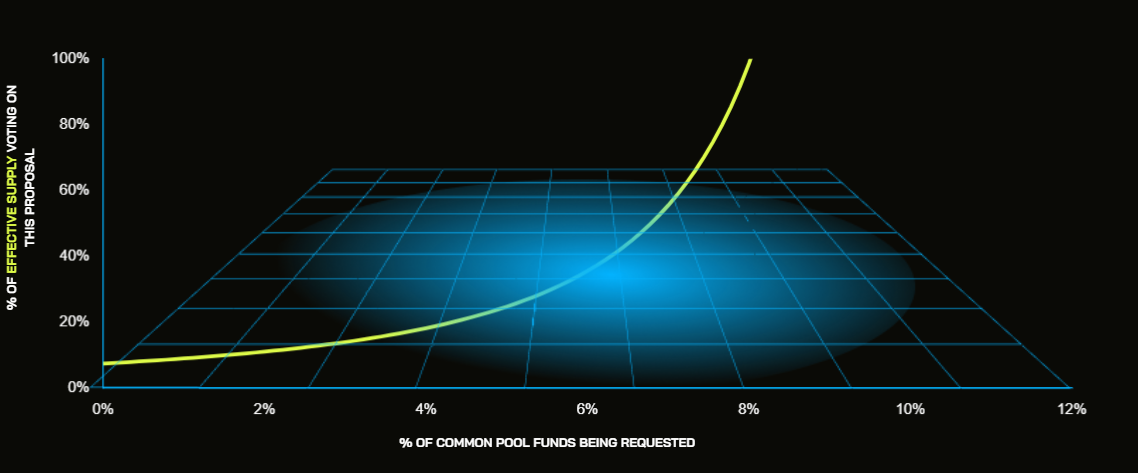

Module 4: Conviction Voting

Data:

| Proposal |

Requested Amount (wxDAI) |

Common Pool (wxDAI) |

Effective supply (TEC) |

Tokens Needed To Pass (TEC) |

| 1 |

1,000 |

100,000 |

1,500,000 |

14519 |

| 2 |

5,000 |

100,000 |

1,500,000 |

40333 |

| 3 |

25,000 |

100,000 |

1,500,000 |

Not possible |

| 4 |

1,000 |

750,000 |

1,500,000 |

12296 |

| 5 |

5,000 |

750,000 |

1,500,000 |

13598 |

| 6 |

25,000 |

750,000 |

1,500,000 |

24703 |

- Conviction Growth: 42 day(s), meaning that voting power will increase by 50% every 42 days that they are staked behind a proposal, so after 14 days, a voters voting power will have reached 75% of it's maximum capacity.

- Minimum Conviction: 0.8%, this means that to pass any funding request it will take at least 0.8% of the actively voting TEC tokens.

- The Spending Limit: 11.0%, which means that no more than 11.0% of the total funds in the Common Pool can be funded by a single proposal.

Strategy:

With the conviction voting module, I set the Spending Limit (11%) on the lower side ensuring that we fund proposals incrementally if possible, and not risk a large amount of funds on any single project. The Minimum Conviction (0.8%) reduces the minimum effective supply which reflects the spending limit strategy -- allowing for an abundance of funding proposals all with the chance of passing with smaller amounts of tokens staked. The Conviction Growth (42 days) ensures that proposals are passed too quickly and that the community has an opportunity to move their tokens between proposals without impacting their conviction too quickly.

*Advanced Settings

This will be empty or non-existent if the user did not change any advanced settings from their default. Any settings changed from default will show up here

| Parameter |

Value |

| Common Pool Amount |

0 wxDAI |

| HNY Liquidity |

100 wxDAI |

| Garden Liquidity |

1 TEC |

| Virtual Supply |

1 TEC |

| Virtual Balance |

1 wxDAI |

| Transferable |

|

| Token Name |

Token Engineering Commons |

| Token Symbol |

TEC |

| Proposal Deposit |

200 wxDAI |

| Challenge Deposit |

400 wxDAI |

| Settlement Period |

5 days |

| Minimum Effective Supply |

0.01% |

| Hatchers Rage Quit |

60000 wxDAI |

| Initial Buy |

200000 wxDAI |

*Learn more about Advanced Settings on the TEC forum