This is a repository dedicated to benchmarking automatic differentiation libraries for research purposes. This benchmark has only been tested on MacOS Catalina.

First clone the repository:

git clone https://github.com/JamesYang007/ADBenchmark.git

Then run the setup script to install all dependencies (and their dependencies):

./setup.sh

Note that the setup will use GCC10.

If this is not available, you have to manually change the compiler version to the one that is available

by editing all instances of gcc-10 and g++-10 in setup.sh.

If you must run the setup again for a particular library,

delete the folder associated with that library in lib and run the script again.

We have not provided scripts for the following changes and we ask the users to manually make these changes:

- Add

math::in front ofapplyinlib/stan-dev-math/stan/math/rev/functor/adj_jac_apply.hppline513. Compiling with C++17 standard raises error due to ambiguity withstd::apply.

To build benchmarks:

./clean-build.sh -DCMAKE_C_COMPILER=gcc-10 -DCMAKE_CXX_COMPILER=g++-10

If GCC10 is not available, just replace gcc-10 and g++-10 with the correct alias for the available version

(e.g. gcc-8 and g++-8 if GCC8 is available).

This will create directories for each library in the current directory

and build each test as a separate executable in these directories.

Note: for the safest build results, use the same compiler that you used in setup.

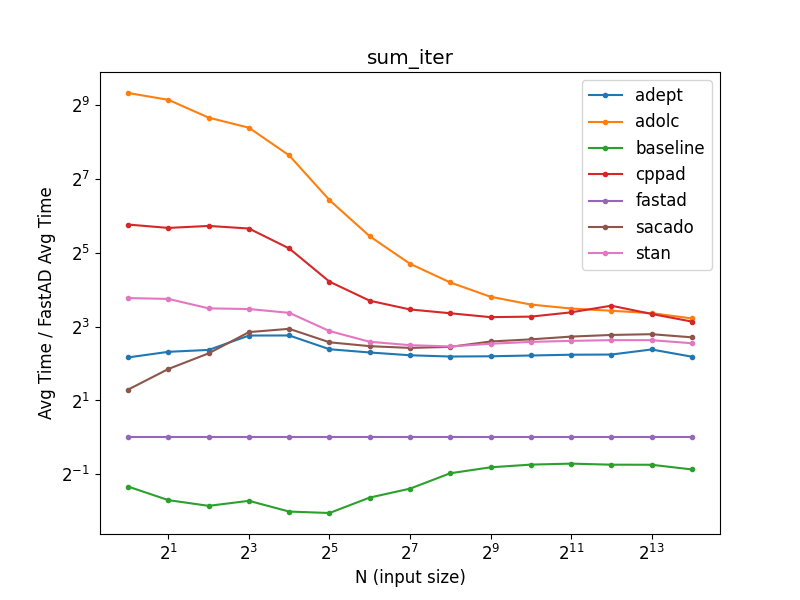

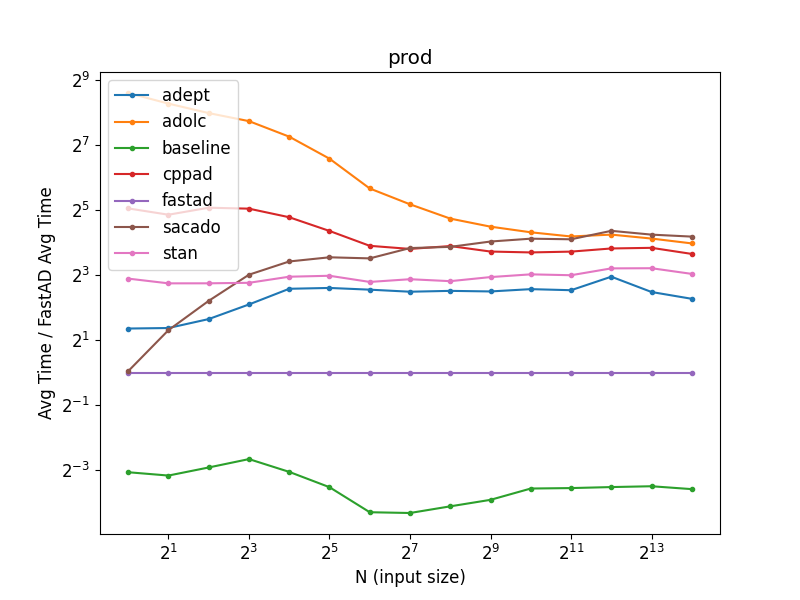

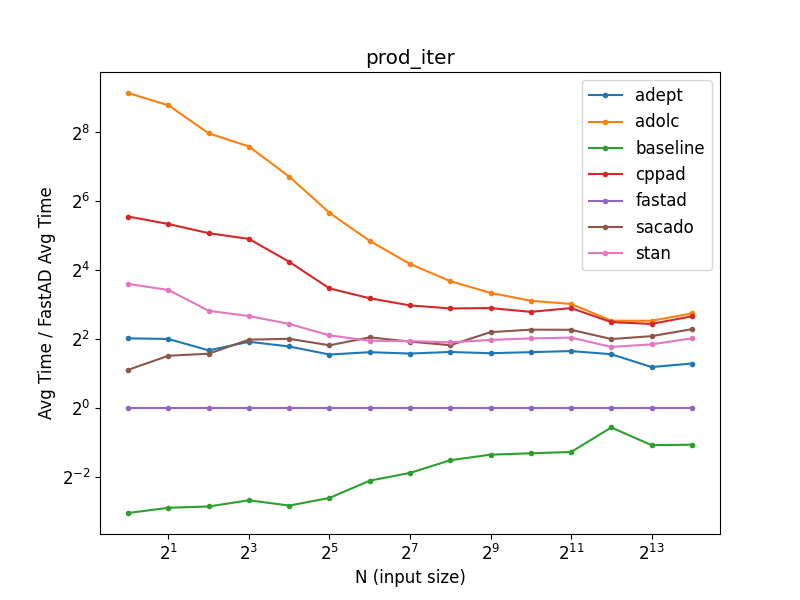

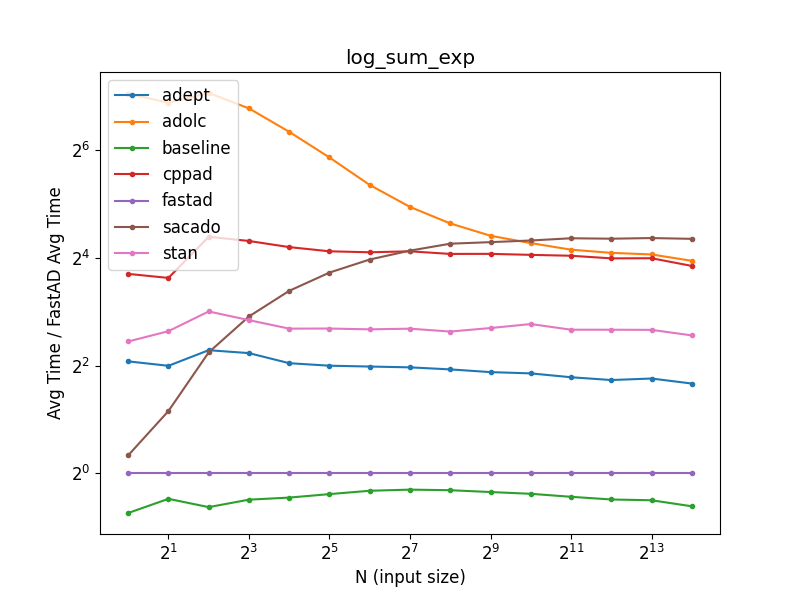

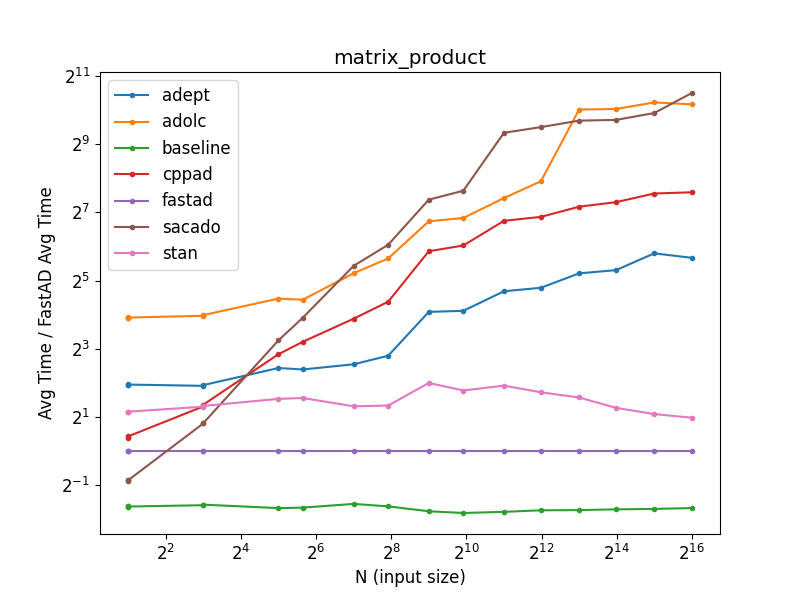

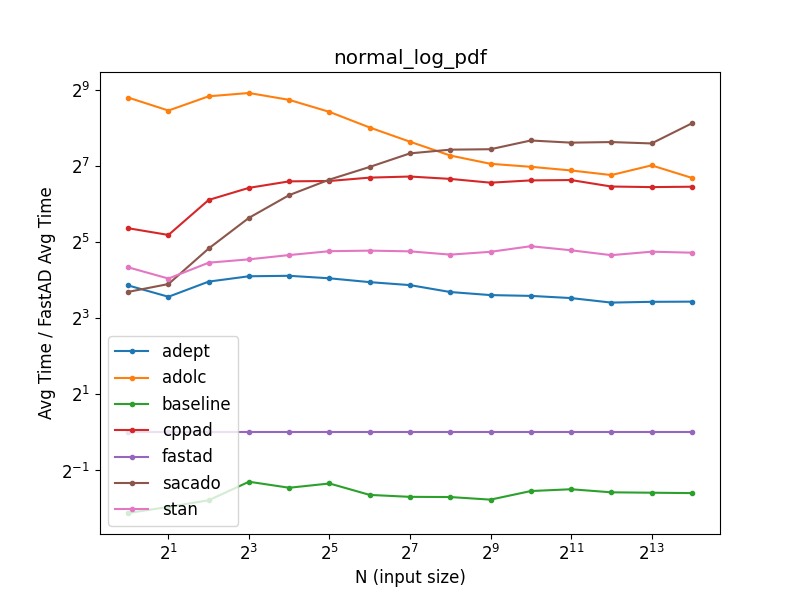

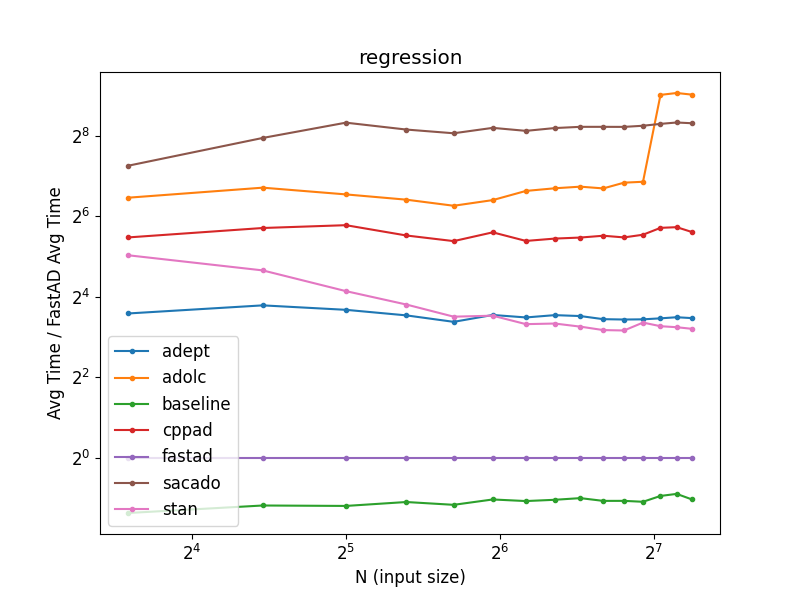

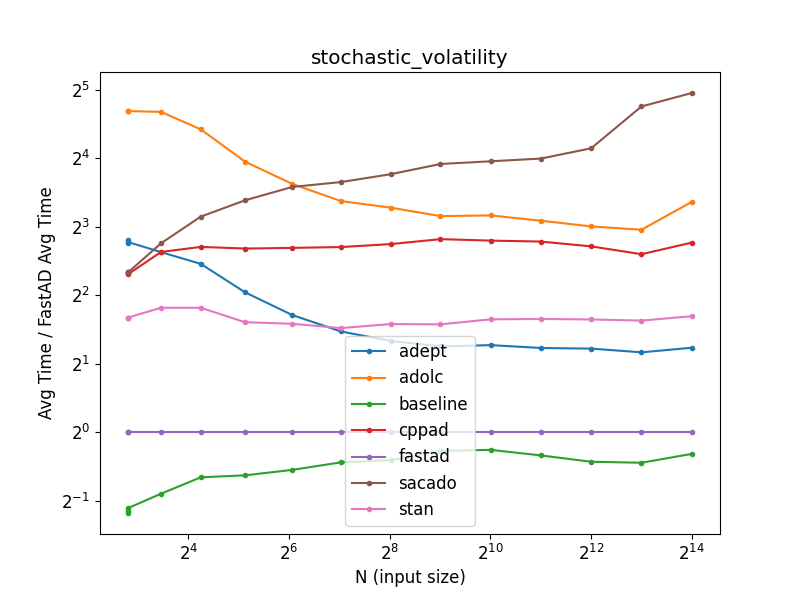

We wrote a Python script in analyze called analyze.py that

scrapes build/benchmark directory for all tests in each library,

runs the benchmark programs, plots the relative time against FastAD,

and saves the absolute times (in nanoseconds) and the plots for each test in docs/data and docs/figs, respectively.

To run the script:

cd analyze

python3 analyze.py

It is important to be inside analyze directory.