fastquant allows you to easily backtest investment strategies with as few as 3 lines of python code. Its goal is to promote data driven investments by making quantitative analysis in finance accessible to everyone.

- Easily access historical stock data

- Backtest trading strategies with only 3 lines of code

* - Both Yahoo Finance and Philippine stock data data are accessible straight from fastquant

pip install fastquant

All symbols from Yahoo Finance and Philippine Stock Exchange (PSE) are accessible via get_stock_data.

from fastquant import get_stock_data

df = get_stock_data("JFC", "2018-01-01", "2019-01-01")

print(df.head())

# dt close volume

# 2019-01-01 293.0 181410

# 2019-01-02 292.0 1665440

# 2019-01-03 309.0 1622480

# 2019-01-06 323.0 1004160

# 2019-01-07 321.0 623090

Note: Symbols from Yahoo Finance will return closing prices in USD, while symbols from PSE will return closing prices in PHP

Daily Jollibee prices from 2018-01-01 to 2019-01-01

from fastquant import backtest

backtest('smac', df, fast_period=15, slow_period=40)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 102272.90

| Strategy | Alias | Parameters |

|---|---|---|

| Relative Strength Index (RSI) | rsi | rsi_period, rsi_upper, rsi_lower |

| Simple moving average crossover (SMAC) | smac | fast_period, slow_period |

| Exponential moving average crossover (EMAC) | macd | fast_period, slow_period |

| Moving Average Convergence Divergence (MACD) | emac | fast_perod, slow_upper, signal_period, sma_period, sma_dir_period |

| Bollinger Bands | bbands | period, devfactor |

backtest('rsi', df, rsi_period=14, rsi_upper=70, rsi_lower=30)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 132967.87

backtest('smac', df, fast_period=10, slow_period=30)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 95902.74

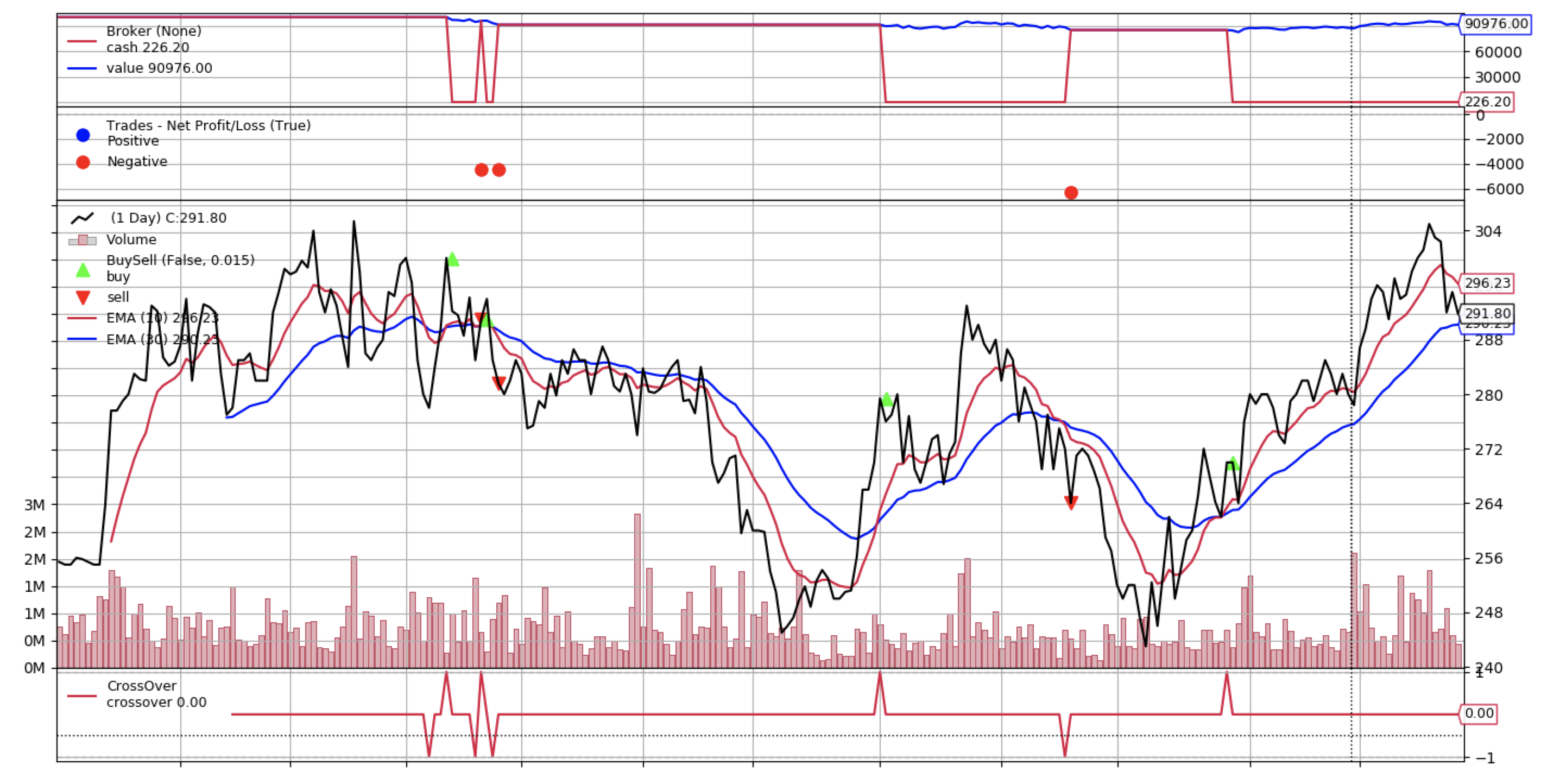

backtest('emac', df, fast_period=10, slow_period=30)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 90976.00

backtest('macd', df, fast_period=12, slow_period=26, signal_period=9, sma_period=30, dir_period=10)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 96229.58

backtest('bbands', df, period=20, devfactor=2.0)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 97060.30

See more examples here.