[Kraków 09.2019] There are steps which I took to choose flat & mortgage loan. It might be helpfull if you are about to buy a real estate.

//TODO

Recommended:

- book: "Negocjuj" Wojciech Woźniczka, http://negocjujizwyciezaj.pl/

- podcast: https://tiny.pl/tjz6d

- Nominal interest rate nominal interest rate = bank's margin + wibor

-

bank's margin - constants thru loan period.

-

wibor (Warsaw Interbank Offer Rate)- volatile thru loan period. It's set by bank institutions. During a loan period bank updates wibor every 3 or 6 months. Exemplary, your installment value is evaluated on the base of wibor=2% but after 3 months installment can be a litte bit lower or higher depending on actual value of wibor.There is no limitation on this coefficient. It can be 0%, 10% or -5% as well. In case of negative value, bank just takes it as 0% of course. The good news is that thru the recent 10 year, it hasn't risen to much. Moreover, probably by the 2021 wibor will have been changed and another benchmark will be applied. More here https://tiny.pl/tjz36

-

const on the market there are some banks which offer constatns nominal interest rate. That means thru a loan period wibor is frozen and its initial value is taken from the day you sign agreement to you bank.

Conclusions: Always take a look on bank's margin.

- Installment

-

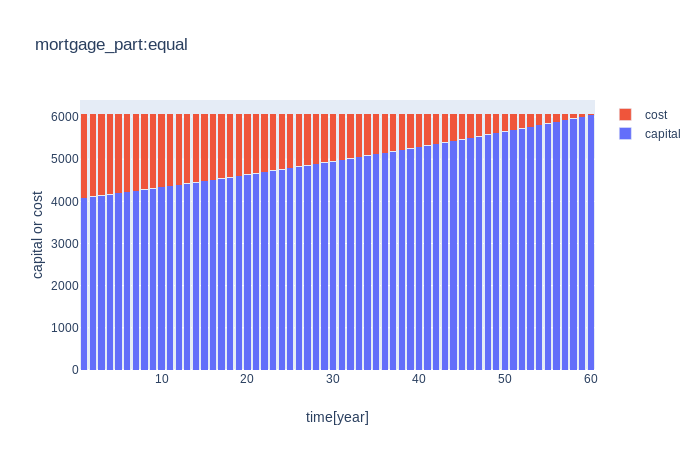

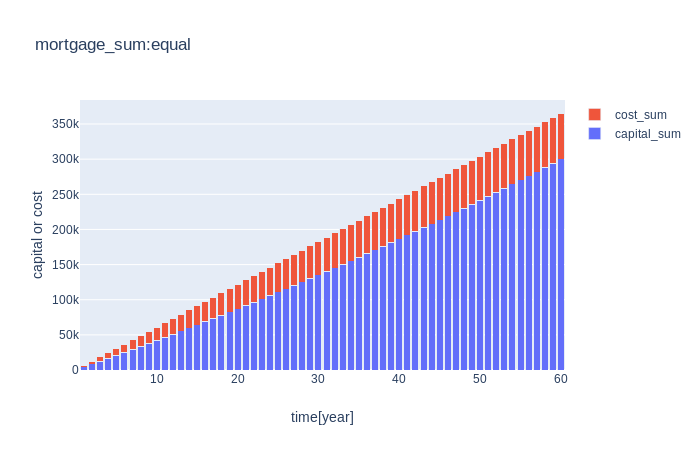

equal

Thru entire loan period your installment value is equal, that's mean you pay the same amount of many each month. In case of option with floating nominal interest rate(wibor), bank updates installment every 3 or 6 months An installment value is set by equation: https://tiny.pl/tj3h3 -

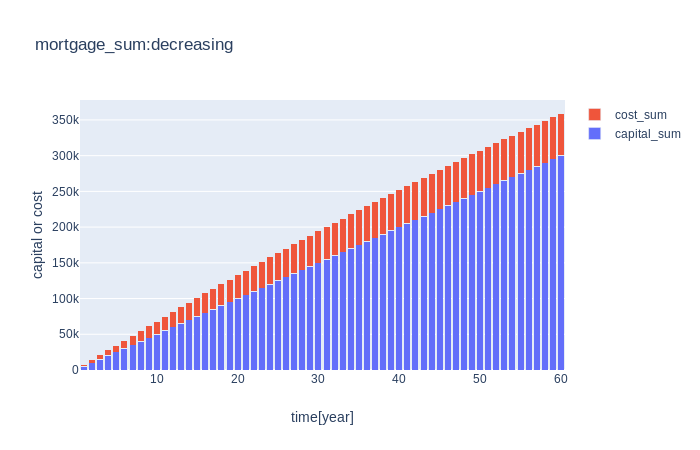

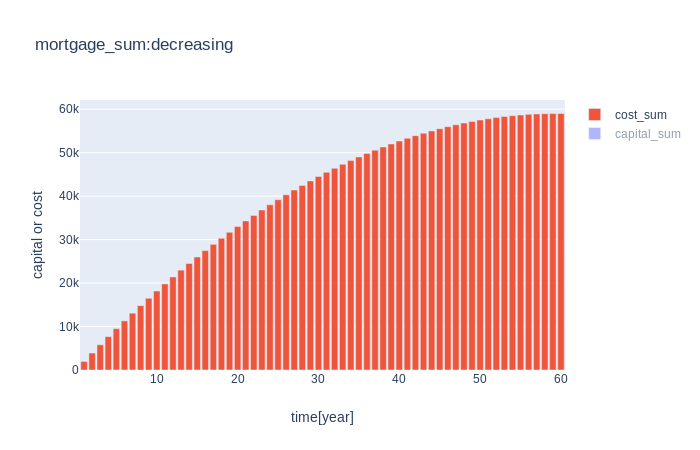

decreasing

In this case a value of the very first installment is sum of capital to be pay(amount of credit) and nomianl interes from capital to be pay. After each month capital to be pay is decreasing so bank's interes also and as a result you pay less installment each monthLet's check how some coefficients influence on mortgage cost. Simulation carrid out by using python script calc.py. Another ReadMe.md attached to script tells you how to use it.

'-l', '--loan', "Amount of credit [ex. 300000]" '-bi', '--bank_interest', "Bank interest [ex. 2%]" '-w' '--wibor' "Warsaw Interbank Offered Rate [ex. 2%]" '-y' '--loan_diuration' "A loan duration [ex. 20 year]" '-it' '--installment_type' "An installement type [equal/decreasing]"Installment [ python3 calc.py -l 300000 -bi 5 -w 3 -y 20 -it equal ]

Installment [ python3 calc.py -l 300000 -bi 5 -w 3 -y 20 -it decreasing ]simulation 3 equal On each 1 borrowed unit you will pay 1,79 unit decreasing On each 1 borrowed unit you will pay 2 unit Conclusions: It would be better to take decreasing installment for as short period as possible.

-

Overpayment

//TODO: -

Additional cost. Directly linked to loan

-

bank's interest for granding the loan

Additional bank's income for the fact it lent you many. You pay it once. Some bank doesn't take it. -

real estate appraisal (about 400zl)

If its possible, get such appraisal from a guy which is not delegated by bank. It would be convinient for you especially when you are going to submit an loan applicaiton to more than one bank -

temporary insurance

Increased nominal interest rate by the time bank will be written in land and mortgage register. -

real estate insurance

-

life insurance

pay attention to it. Don't save money for that. -

unemployment insurance

if required, get as chap as possible -

additional costs

like bank account, credit card etc.Conclusions: Pay attention to additional loan costs.

- Additional cost. Not directly linked to loan (secondary market)

- PCC 2%

- agent 2% (you can negotiate)

- notary (max 1010zl + 0,4% above 60 000zl) often agent office has discount so it souldn't take more than 1500zł

- court fees (<1000)

- What amount of credit shoud I take?

- rule 30/20/20

30 - installment max 30% your monthly income

20 - own contribution min. 20%

20 - load period max 20 year

- Buffer

You shoud have additional bank account where 3x installment is always kept.