https://arxiv.org/abs/2004.10178

Pushpendu Ghosh, Ariel Neufeld, Jajati K Sahoo

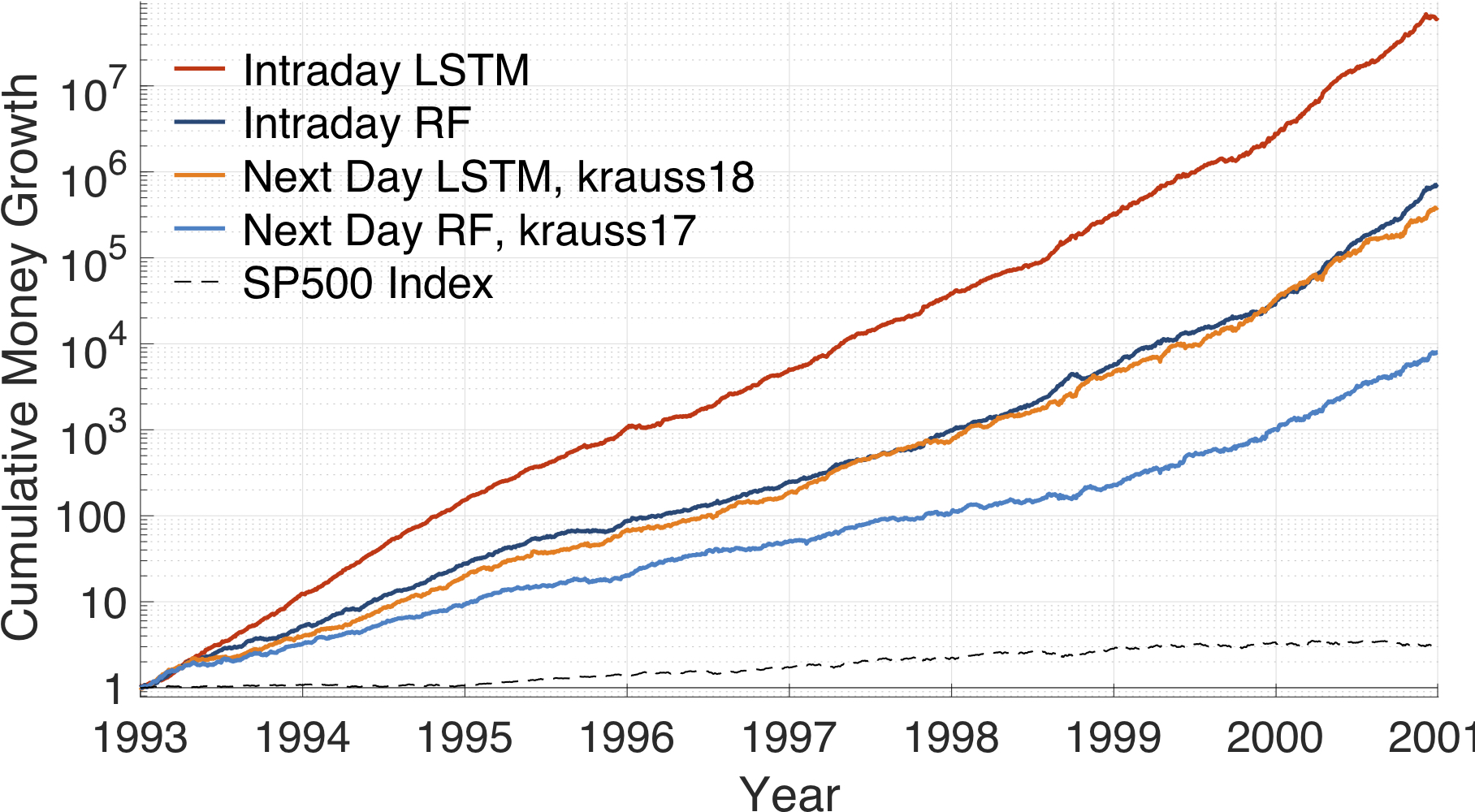

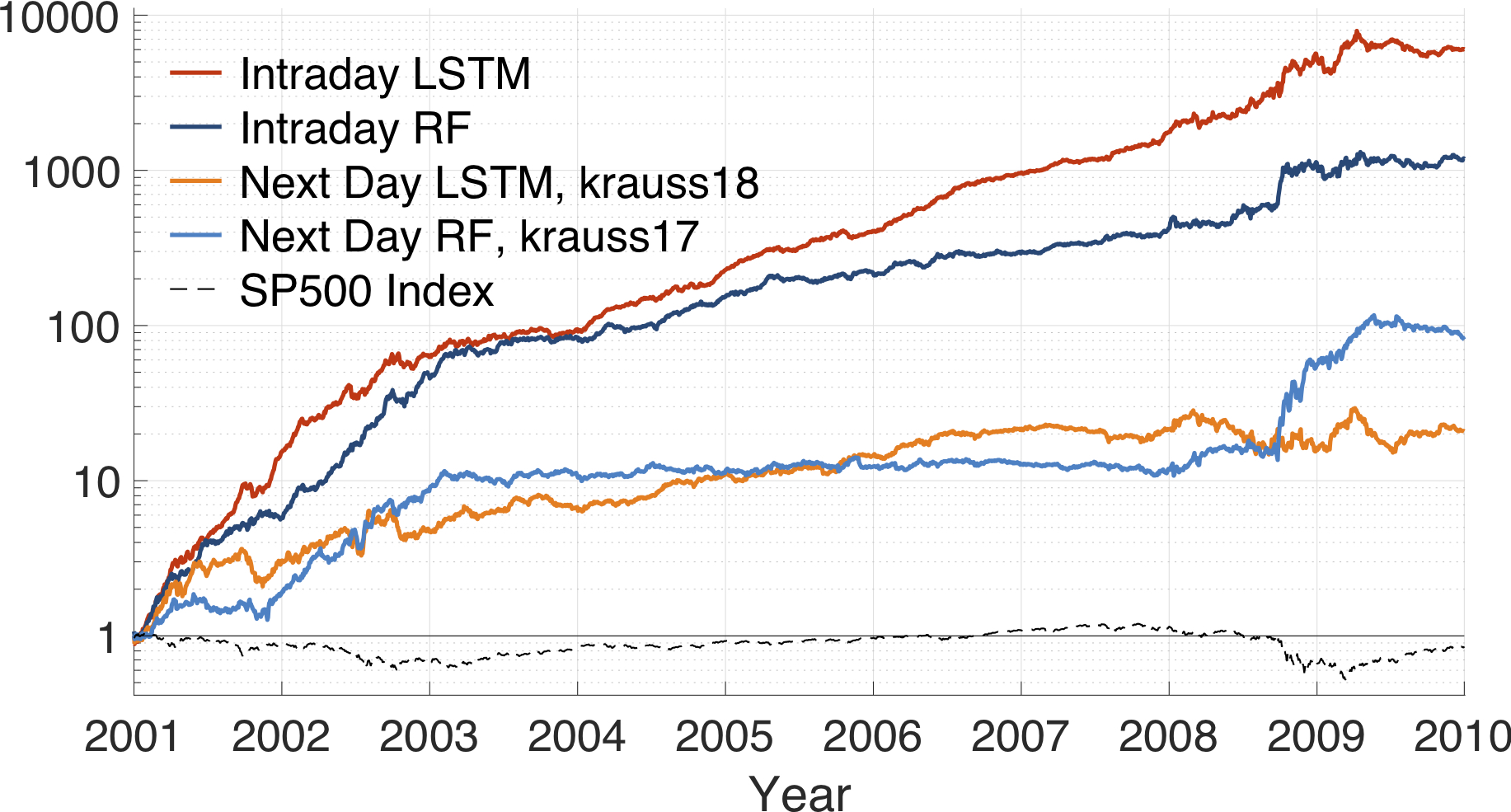

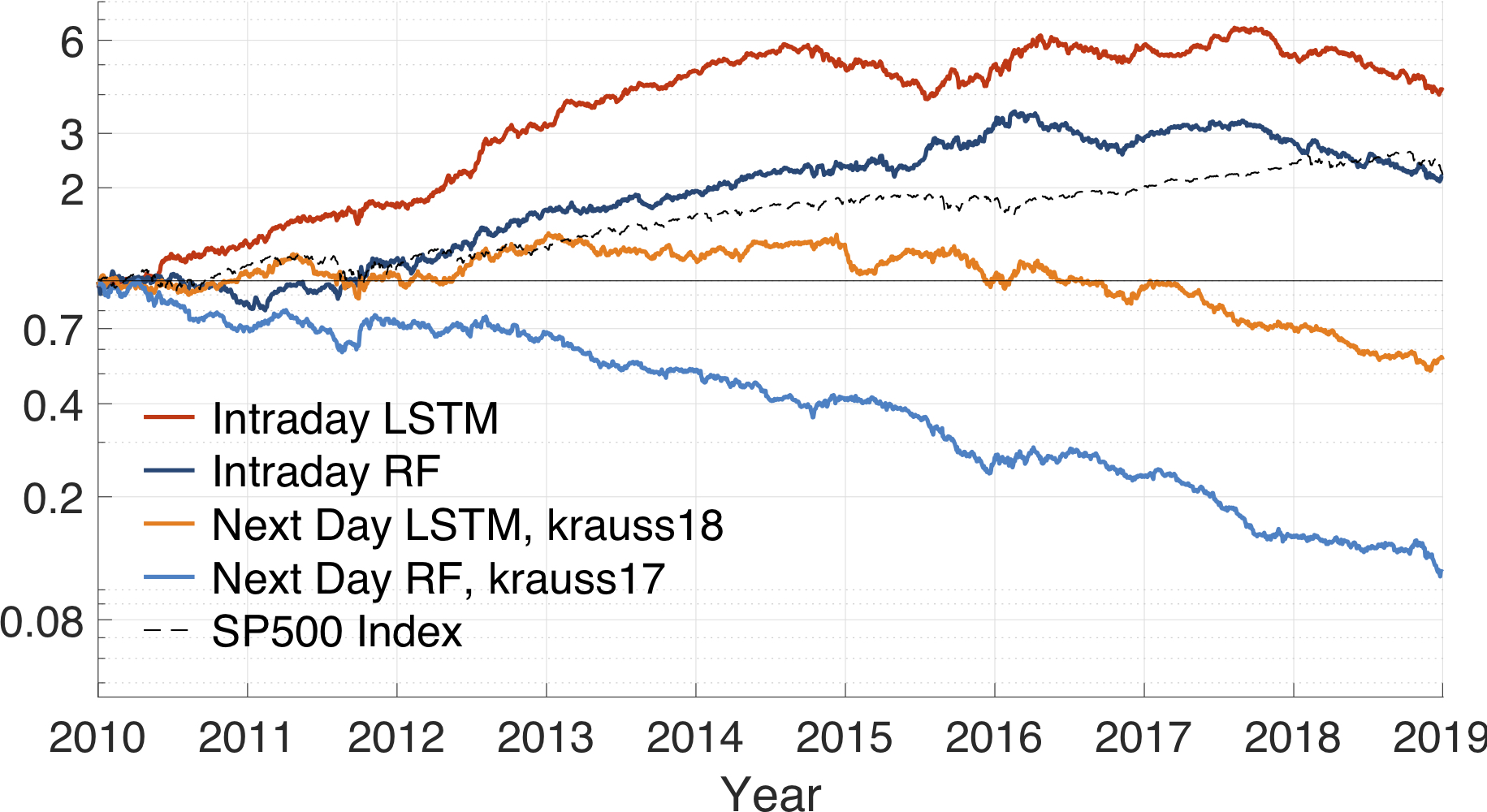

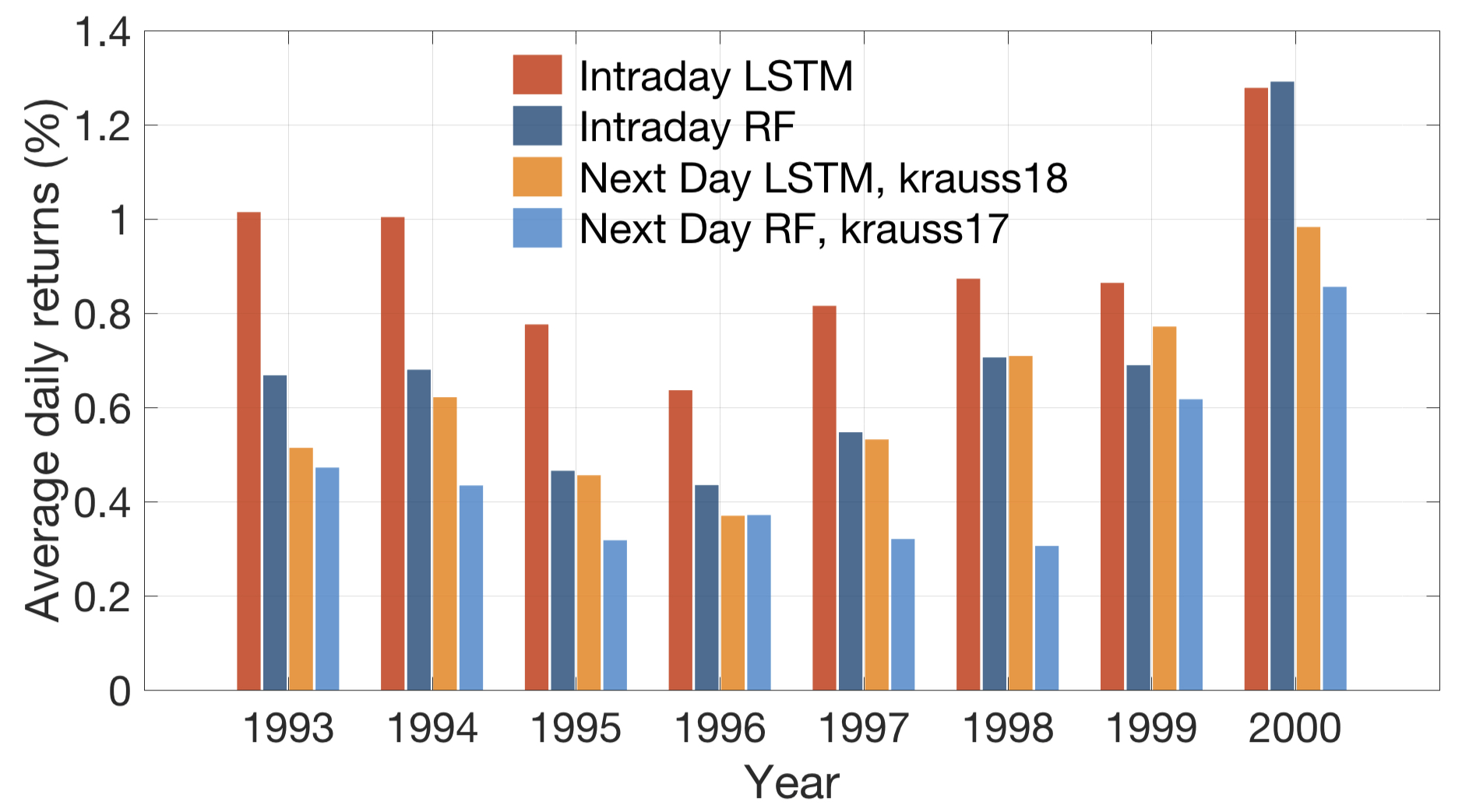

We employ both random forests on the one hand and LSTM networks (more precisely CuDNNLSTM) on the other hand as training methodology to analyze their effectiveness in forecasting out-of-sample directional movements of constituent stocks of the S&P 500, for intraday trading, from January 1993 till December 2018.

pip install scikit-learn==0.20.4

pip install tensorflow==1.14.0

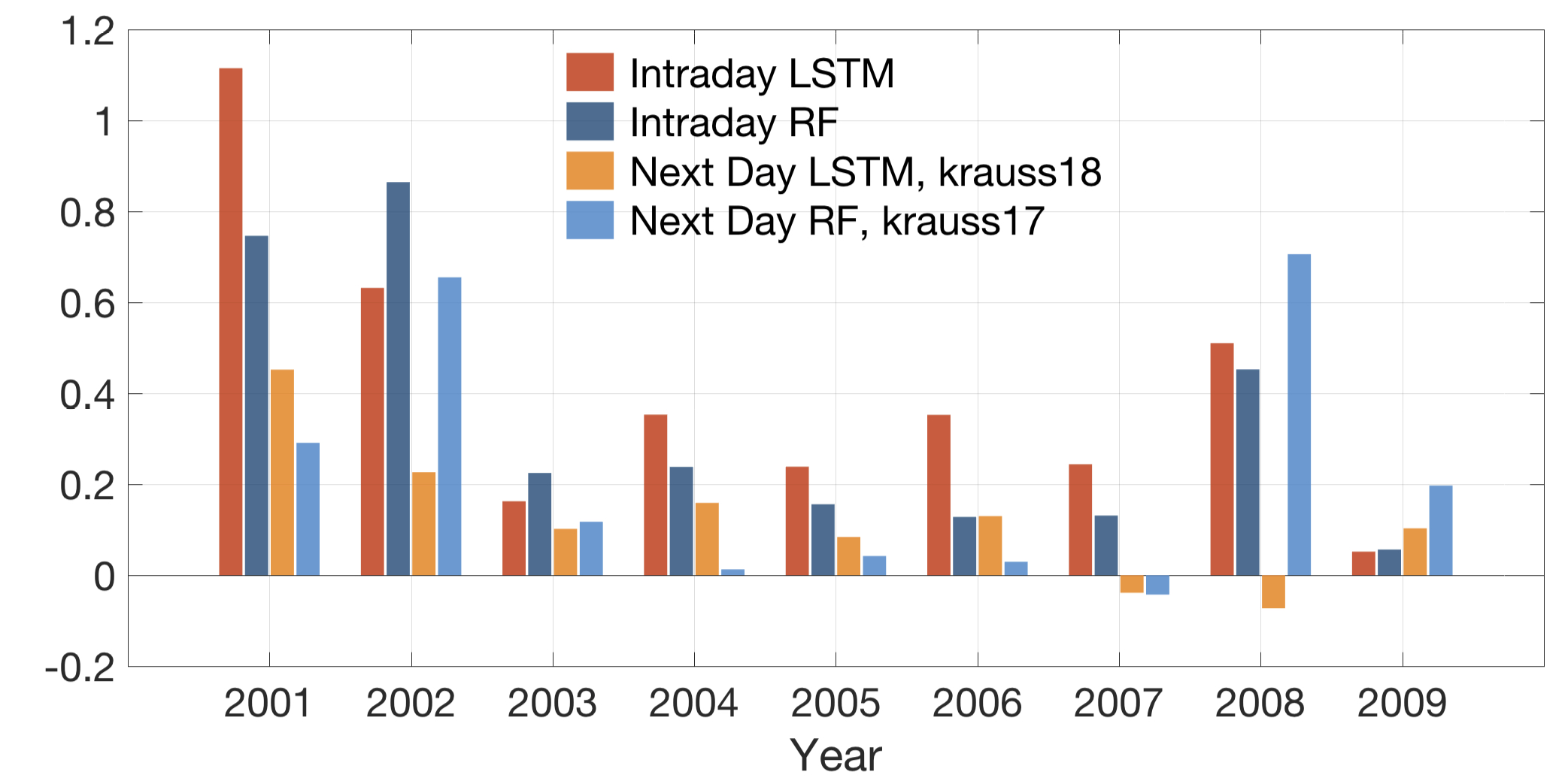

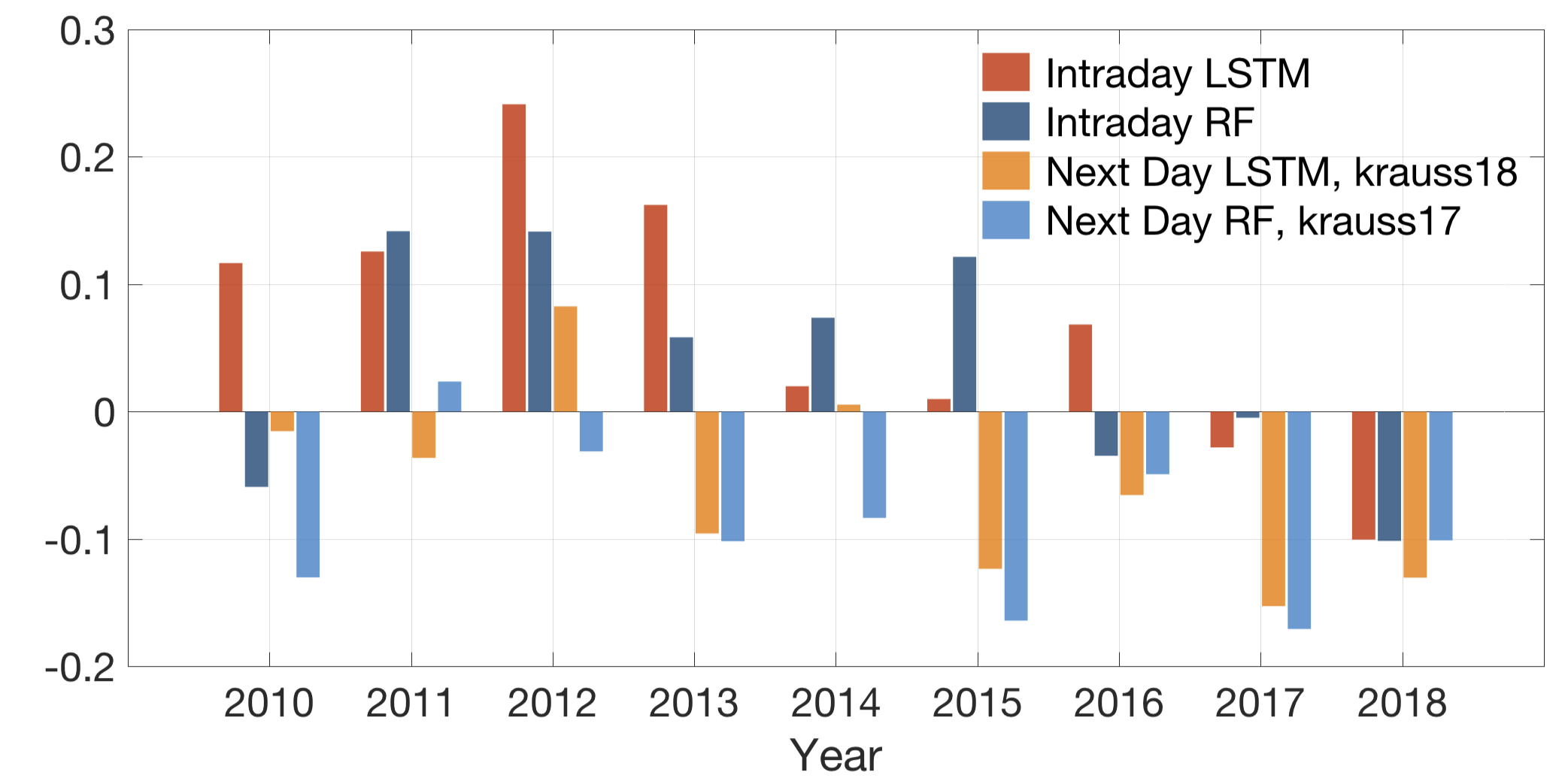

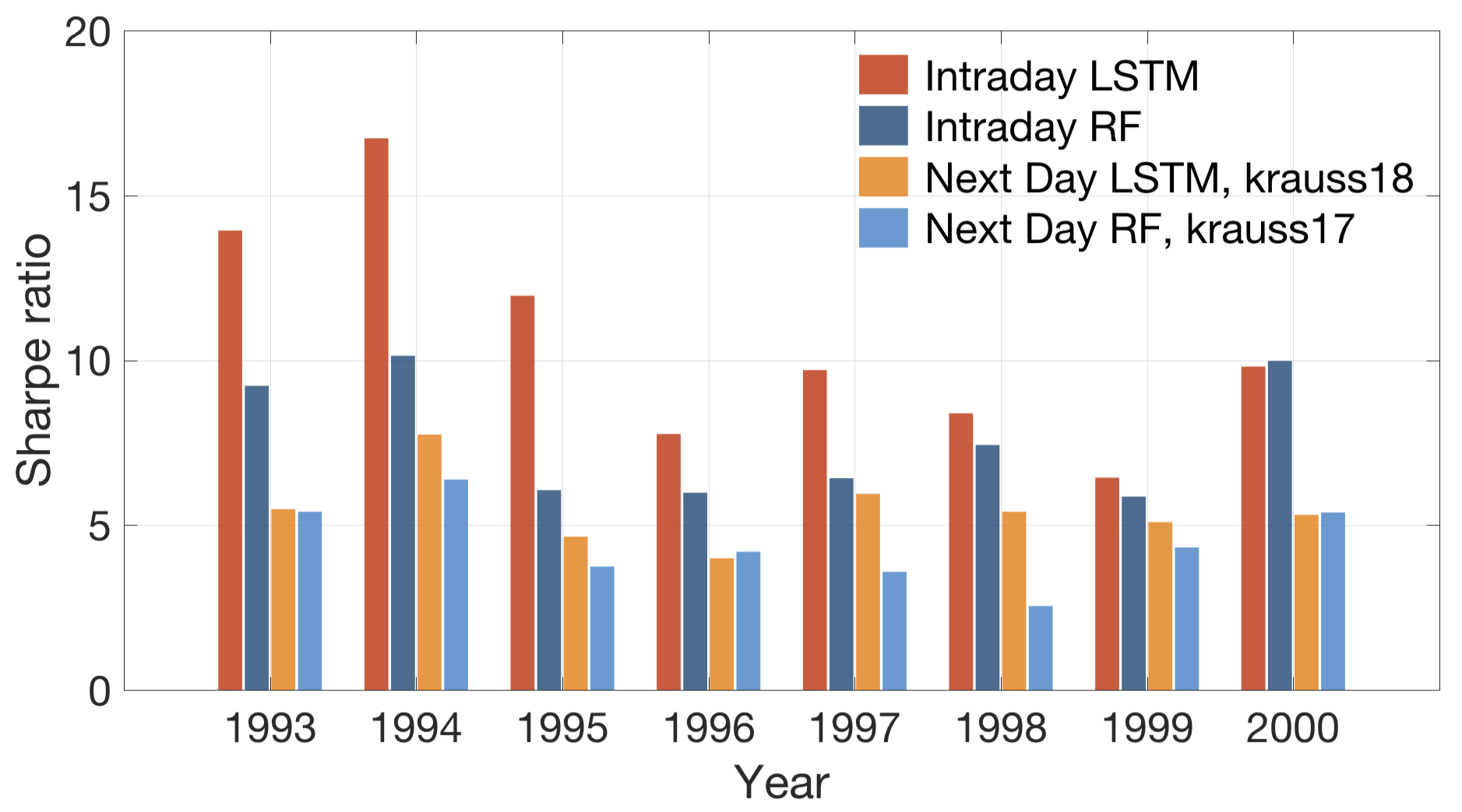

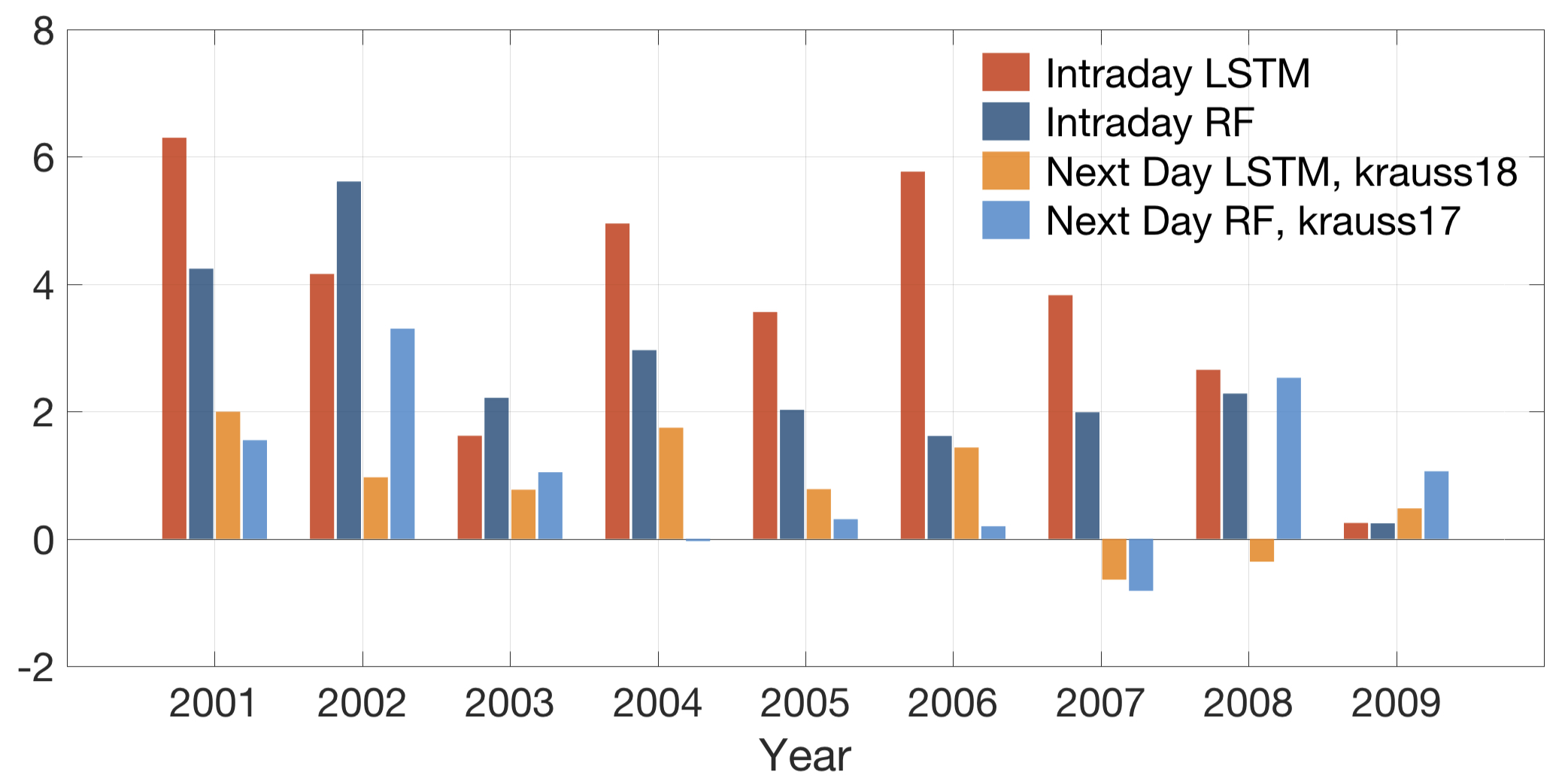

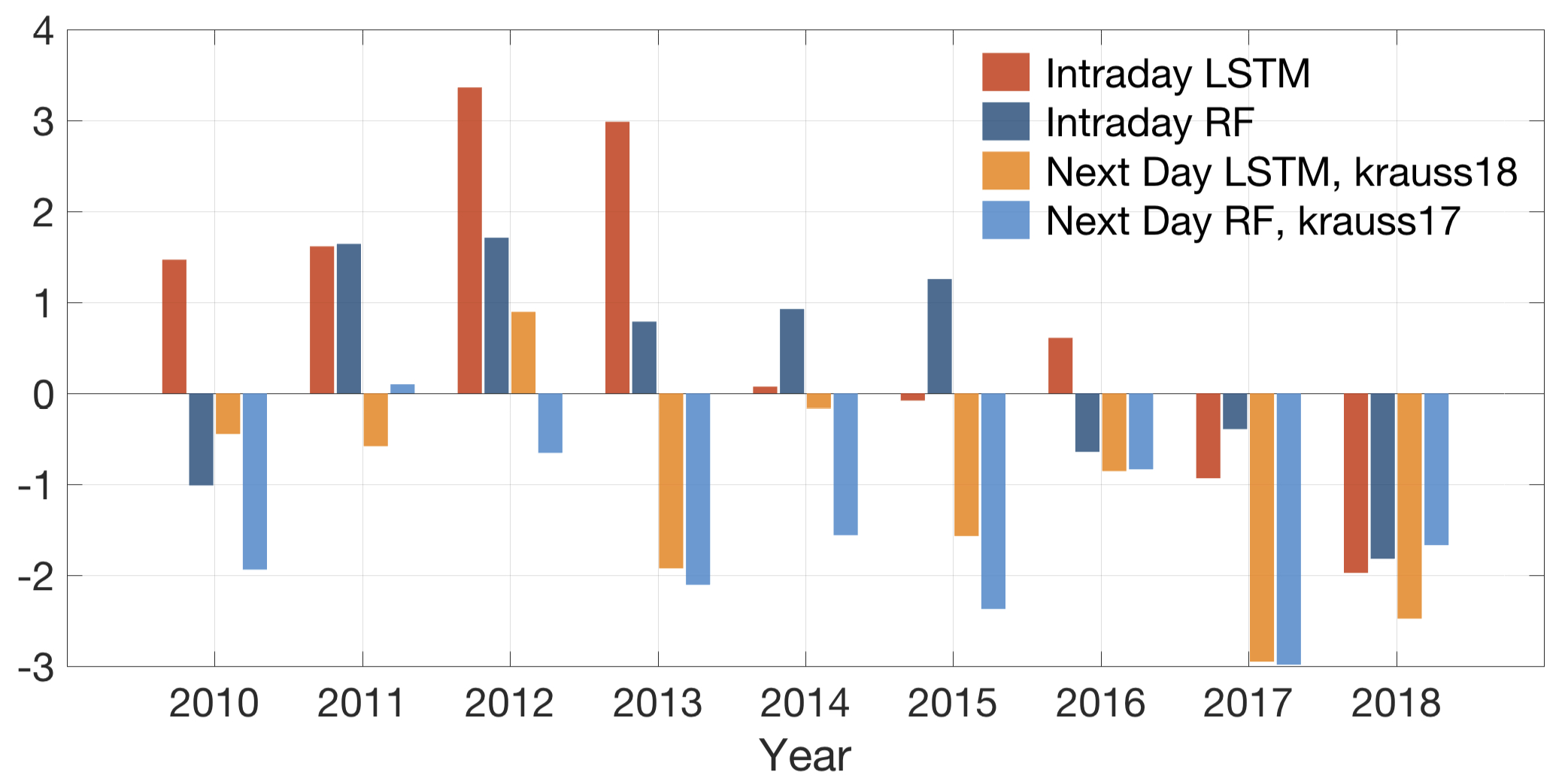

We plot three important metrics to quantify the effectiveness of our model: Intraday-240,3-LSTM.py and Intraday-240,3-RF.py, in the period January 1993 till December 2018.

Intraday LSTM: Intraday-240,3-LSTM.py

Intraday RF: Intraday-240,3-RF.py

Next Day LSTM, krauss18: NextDay-240,1-LSTM.py [1]

Next Day RF, krauss17: NextDay-240,1-RF.py [2]

The first author gratefully acknowledges the NTU-India Connect Research Internship Programme which allowed him to carry out part of this research project while visiting the Nanyang Technological University, Singapore.

The second author gratefully acknowledges financial support by the NAP Grant.

[1] Fischer, Thomas, and Christopher Krauss. "Deep learning with long short-term memory networks for financial market predictions." European Journal of Operational Research 270.2 (2018): 654-669.

[2] Krauss, Christopher, Xuan Anh Do, and Nicolas Huck. "Deep neural networks, gradient-boosted trees, random forests: Statistical arbitrage on the S&P 500." European Journal of Operational Research 259.2 (2017): 689-702.