Check out our Discord Chat Server, SourceCrypto, for more up to the minute collaborative curation.

The following are links to archives of the channels, which is a browser based alternative to accessing the discord server, directly. However, I've been making other discord servers to cover a wider range of topics, and this site will have it's own server soon, too.

- Other Files

- Introduction

- Starter Pack

- Risk Management

- General

- Indicators

- Divergence

- Arbitrage

- Wyckoff

- Manipulation

- Economics

- Leverage

- Tools-N-Apps

- Protocols

- Historical

- Speculation-Market Theses

- Books

- Videos

- Podcasts

- Resources

- Twitter Follows

- Closing

** These are now all in the /_posts directory

- chart-patterns.md - resources related to various chart patterns.

- Intro

- Chart Patterns

- Triangles

- Flags and Pennants

- Wedges

- Rectangles

- Double Bottoms

- Double Tops

- Triple Bottoms and Tops

- Cup With Handle

- Head and Shoulders

- Dead-Cat Bounce

- Gaps

- Rounding Bottoms

- Rounding Tops

- Bump-and-Run Reversals

- Diamond Tops and Bottoms

- Hanging Man

- Inside Days

- Outside Days

- Measured Move Down

- Measured Move Up

- Pipe Bottoms and Tops

- Scallops

- Broadening Formations

- Statistics

- Resources

- candlesticks.md - a start

- evaluation.md -Cryptocurrency Evaluation and Why ICO's Fail

- economics.md - crypto-economics

- quant.md - Quant-Crypto Trading and Data Science

- [pinescript.md]_posts/2019-02-08-pinescript.md) - Learn TradingView\Pinescript.

- /CryptoQF - An organized directory of Crypto Quantamental's content

What follows is a collection of links as I arranged them some time ago. I won't have time to work much on this site, but I will try to pack some real value in what time I do have available to update this resource. There is a long road before it's as complete and functional, as I'd like. In the next month or so I'll put some solid work into it.

I'm beginning serious study of Technical Analysis with books that have come recommended by experienced traders:

- John J.Murphy - Technical Analysis Of The Financial Markets.pdf

- Bulkowski - Encyclopedia of Chart Patterns

-

Learn then Implement

learn to trade alts on binance using momentum/patterns/oscillators , the learn price action as you go

some of the best alt traders around dont use price action / candles only - @Waingro - Shadow traders on twitter.

- stare at the minute chart for two weeks

Search for almost anything and add any or all of the following sites to successive search queries — depending on what your looking for.

-

Investopedia - Investopedia has chart school where you can learn basic patterns, and its encyclopedia includes knowledge on most subjects in trading, including cryptocurrency.

-

BabyPips - has a chart school and a lot of pattern related information.

-

Thomas Bulkowski is an internationally known author and trader with 35+ years of market experience and regarded as a leading expert on chart patterns.

Bulkowski has run stats on more chart patterns than anyone. I would recommend getting your hands on copies of hist Encyclopdia of Chart Patterns and\or his Encyclopedia of Candlestick Patterns if you can.

-

Candle Scanner - has similar data, some overlapping with Bulkowsky, but more focused on candlestick patterns.

-

TradingView - tons of user created ideas, scripts, education and more.

-

Node Binance Trader - a cryptocurrency trading bot development framework for the Binance exchange using Node.JS.

- Risk Management for Trading

"Trading crypto-currency is a gold rush. While selling shovels is traditionally the best way to wealth in such a scenario, doing wise investments is essential once you have some money. I consider trading an entertaining and challenging pastime. Maybe the most important aspect of trading is risk management. While resources like BabyPips provide great learning material, their section on risk management is confusing. I believe, the biggest issue is that they approach the topics in the wrong order, so here is a better introduction to risk management for traders (crypto or forex or otherwise)."

- One of the Most Important Concepts in Trading

"When trading you need some way to manage your risk. One of the most effective and notable strategies is the R method. When talking to new traders I like to give the example of a poker player. You start out small and overtime you end up building your bankroll/trading capital to a sizable amount. What makes the R multiple so helpful is it allows you to size your position relative to risk. This allows you to understand the risks required when trading and risk what you are comfortable with. I am shocked everyday on twitter by the amount of people unaware of these risk management concepts."

- Winning in Sideways and Bear Markets

What we’re going to do is place bigger bets and get more of your money working for you by creating a stop loss system. I use a variation on the Turtle Traders trailing stop loss, which is the ATR or Average True Range times a multiplier. So I might have ATR X 2. That tells me where to set my stop loss on any given trade.

- @CryptoCred on trading plans

Have a trading plan for the day/session. Here's a basic outline you can use:

- (Thesis) What's price reaching for?

- (Setup) What does price have to do for me to enter a trade?

- (Entry) Where might a Setup arise?

- (Risk) Where would the Setup fail?

- (Reward) What's the Setup target?

- @wolfofpoloniex - Bare Basics of trading Cryptocurrency

I have found that BASIC TA (Triangles, patterns, fib levels) is almost always more powerful than the more advanced stuff like Harmonics (Gartley / Butterfly patterns)

- ToneVays: This is a quick reference on Technical Trading and what you need to know

- The Biggest Regret of New Crypto Traders "I should have taken profits when the prices where up!"

- Does Technical Analysis Work?

- ABCD Pattern Trading

The ABCD pattern (AB=CD) is one of the classic chart patterns which is repeated over and over again. The ABCD pattern shows perfect harmony between price and time and is also referred to as ‘measured moves’. It was developed by Scott Carney and Larry Pesavento after being originally discovered by H.M Gartley.

- Elliott Wave Principle - Key to Market Behaviour Book Review

- "Elliott Wave Principle by Frost and Prechter is widely considered to be the most comprehensive overview of Elliott Wave Theory ever written. First published in 1978 and written by two men who understood Elliott’s ideas better than anyone, it has stood the test of time and continues to find new print runs and new fans.\n\nThis book is a must read for anyone who is truly interested in the way markets move on both short and long time frames. But it comes with a warning - this is one seriously dense book! At times it reads more like a mathematical proof; at times like an economic history textbook."

- Trading Fibonacci retrace and expansion to pinpoint entries and exits

Fibonacci is a sequence found in us and our genes, our mentality, nature and our universe. Its is a universal, multidimensional language, that in my belief is used far beyond our personal human lifetimes and this world.\n\nFibonacci sequences in trading financial instruments is an extremely powerful thing. We can use 50% and 61.8% retraces of a move up or down as an entry into a position with a very tight stop loss, and we can then use a 121% Fibonacci expansion level as our price target as explained in the video below."

- Harmonic Pattern GARTLEY

"The harmonic patterns way of trading is an entirely different approach to trading the markets and is based on the discovery by H.M. Gartley whose findings were presented in his book in 1935 entitled “Profits in the stock market”. The book was a lengthy one at that and back in the days it sold for a premium. The most famous aspect of H.M Gartley’s book is the Gartley 222 Pattern, named after the page number where H. M. Gartley outlines the trading methodology using the Gartley pattern."

- @HsakaTrades TA Lessons

"TA Lessons:\n\n\ni) Supply & Demand \nii) Support & Resistance \niii) Swing Failure Pattern \niv) Trading Ranges \nv) Divergences \nvi) Trends & Reversals \nvii) Miscellaneous\n\nMost of my trading setups are a concoction of the aforementioned"

- The Pyramid trade management strategy [ϟ]

Using this Pyramid technique we can safely lock in profits, eventually giving us what we know as a ''free trade'' Whereby a trade has moved enough in our favour, and has given us the signals we need to place a stop loss in a place that completely eradicates any fear of loss .

- The Road To Becoming A Shark In The Crypto Markets, Part 1.

"Almost a decade ago the founder of Cryptol0gy, R1S1N6, was in a position where most people are today. All he had was a hundred dollars on his father’s Forex account, and all he could dream of was turning that into a luxury car and a Rolex watch. While those things seemed unattainable at the time for him, he has shown that it’s possible. It was possible in the regular financial markets, and now with crypto, it’s easier than ever. It won’t happen overnight, but it can happen faster than you might expect."

- Conquer Professional Cryptocurrency Trading With This Unique, Easy & Free Guide, Part 2.

"By applying technical analysis. A tool employed to evaluate assets and attempt to forecast their future movement by analyzing statistical probabilities gathered from trading activity, such as price movement and volume.Start by putting your own beliefs about Bitcoin and agenda aside, and realize that market price movements are not purely random: they move in identifiable patterns and trends that repeat themselves over time."

- Cryptocurrency Trading — 9 Guidelines to Make Bank and Avoid Getting Rekt

"If you like to have some structure and basis for trading cryptocurrency, these rules/guidelines can help you improve your trading strategy. Take what you want. Or leave it all. Either way, good luck."

- Ugly Old Bitcoin Standard Bearer

"Trading Blog, and some Crypto Politicing"

- @AriDavidPaul on trading the News

"1/ "What news or event could reverse the bear trend?" Is the question I get asked most frequently. I think it's the wrong question based on a faulty assumption. People often mistakenly assume that the current trend (bull or bear) will continue until some exogenous event."

- @CryptoCred on bad trading habits

"I traded like crap this week. \n\nSloppy, rushed, arrogant. \n\nI’ve worked through all my losing trades in August so far and identified some common mistakes. \n\nI’ve compiled them into a list of questions — I hope you find it helpful. "

- @ercwl on the majority of coins being -90%

"1/ Plenty of coins & ICOs are now down -90%. Hopefully the people who'll never be receptive the following commentary have left crypto twitter by now, but they'll surely be back for the next bull run. Making this thread to use as a reminder for when the idiocy returns 👇"

- @CarpeNoctom shares ideas on CME Futures$BTC contract dates

"@CarpeNoctom shares ideas on CME Futures $BTC contract dates"

- Conditional Sell orders in Bittrex

"How to use a Conditional Sell order in Bittrex"

- The 25 Point Mantra: discipline of

"The success that a trader achieves in the markets is directly correlated to one’s trading discipline or lack thereof. Trading discipline is 90 percent of the game. The formula is very simple:Trade with discipline and you will succeed; trade without discipline and you will fail."

- @alistairmilne on patience

"Investing is about conviction and patience. Daily news and volatility are noises meant to distract you from your investment thesis and shake out the weak hands"

- @CryptoHornHairs shares Position Size Calculator [D]

"🎚️ Get dialed in with this easy to use position size calculator made by @Corn_crypto 🎚️\n\nMake a copy of the doc for yourself, enter your stack size, entry, risk % per trade, and stop loss, then the rest is Google doc magic 🙏🧙♂️"

- Technical Analysis Rating Research

"Technical Indicators Rating by Performance on the daily charts"

- Trading Cryptocurrencies - Order Blocks, ICT, & Bitcoin Targets

"A live twitch session exploring order-blocks, ICT concepts, and entry-signals through looking at Bitcoin, Ethereum & $Lend price-action."

- How i became a crypto-mining millionarie in under 2 years during a bear market

"Have the mindset in crypto that everyone is against you. They are using you for their own benefit/gains. No matter what type of relationship you have with individuals you meet online at the end of the day it means nothing. You steal 100k? Its forgotten after a while, You donated 100k? it's forgotten after a while. Nobody truly gives a shit. It's just them reacting too a certain situation in the moment. The reality is they only care about themselves and theirs nothing wrong with that. I remember reading threads on /r/cryptocurrency in the last bull-run where everyone was holding hands, singing kumbaya, and talking about lambos... Did you guys all think you were gonna make gains? Someone has to lose for the other person to win. High majority of this space works just like a ponzi and it should be treated as such."

- @ThinkingUSD on indicators

"There is no magic indicator, person, paid group or system that can transform you into a consistently profitable trader. Every indicator that has been made was made by someone for THEMSELVES, they used it to fix or enhance a certain aspect of their trading system/style."

- Mr.Anderson on MACD

"Why MACD is Terrible.\n\nI know people LOVE indicators. But, just about all indicators are terrible (if you use them like the masses). Let's have some fun by looking at where these indicators struggle and then let's see if we can figure out some ways to make these indicators work a bit better"

- Ichimoku Cloud Definition: Day Trading Terminology

"The Ichimoku Cloud is among the most versatile technical indicators. It identifies support and resistance levels, gauges momentum, identifies the direction of trends and provides trading signals.\n\nWith one single glance, traders can identify the trends in securities and examine further signals within that trend. While this indicator might seem complicated, it is actually a very simple indicator that is highly useful for all traders."

- @cryptocred on EMA

"Here's a harsh truth:\n\nOver ~90% of Twitter traders would be better off trading a super basic EMA crossover strategy than whatever made-up wholly discretionary 'plan' they're following right now.\n\nIf you're going to trade manually, make sure it's worth your time and money."

- Bollinger Bands

"Bollinger Bands are a technical analysis tool, specifically they are a type of trading band or envelope. Trading bands and envelopes serve the same purpose, they provide relative definitions of high and low that can be used to create rigorous trading approaches, in pattern recognition, and for much more. Bands are usually thought of as employing a measure of central tendency as a base such as a moving average, whereas envelopes encompass the price structure without a clearly defined central focus, perhaps by reference to highs and lows, or via cyclic analysis. We'll use the term trading bands to refer to any set of curves that market technicians use to define high or low on a relative basis."

- @CryptoSays on Ichimoku

- CNBC ‘REVERSE BITCOIN PRICE INDICATOR’ HITS BULLSEYE AGAIN

"As Bitcoinist previously reported, cryptocurrency traders had become aware of CNBC’s miscalculation of Bitcoin’s short-term behavior, with one even earning an invitation to speak on the network after publishing the ‘reverse indicator’ theory."

- Beginners Guide to: How to use Moving Averages to Day Trade?

"The two basic and commonly used moving averages are the simple moving average (SMA), which is the simple average of a security over a defined number of time periods, and the exponential moving average (EMA), which gives greater weight to more recent prices. The most common applications of moving averages are to identify the trend direction and to determine support and resistance levels. While moving averages are useful enough on their own, they also form the basis for other technical indicators such as the Moving Average Convergence Divergence (MACD)."

- @trader_davis on divergence

- https://www.babypips.com/learn/forex/9-rules-for-trading-divergences

- The Relative Strength is not an Overbought/Oversold Indicator

"The Relative Strength Index is never an overbought/oversold indicator. If you did not learn Relative Strength Index from the original text, then it is very likely that you have been taught the wrong thing right from the beginning - that RSI is an overbought/oversold indicator. I want to tell you straight away that this is wrong."

- @CryptoCred on RSI and Divergence

"Important point about RSI: \n\nAfter a big move/candle there will almost always be a regular divergence. \n\nDon’t use it to try to snipe the bottom or top.\n\nDivergences work better when they form during a discernible trend, NOT after a bazooka candle like yesterday."

- Best RSI Guide for Cryptocurrency You’ll Ever Find

"As mentioned before, you only need one type of indicator. So, if you’re using both the RSI and the Stochastic RSI, you’re wasting your time. They both are leading(1) momentum(2) indicators that look at the same thing — is a crypto oversold or overbought? Therefore, you just need one. Study the both of them or another momentum indicator that makes the same determination and choose one.\n\nUnderstanding How and When to Use the Indicator"

- Divergence and Hidden Divergence

"Although divergence is not an indicator in that it is not mathematical construct, it is often said to be a leading indicator, hence its inclusion in this section.\n\nDivergence refers to the difference in movement between an oscillating indicator, such as MACD, CCI, RSI, Stochastic, etc., and the price action of the underlying financial instrument."

- How Traders Use Cryptocurrency Arbitrage to Make Profits

"Arbitrage is the simultaneous buying and selling of an asset class on different markets in order to profit from a price discrepancy between them. For example, a trader might notice that a specific token is selling for less on Exchange A than on Exchange B. An arbitrage trader would buy said token on Exchange A and sell it for a higher price on Exchange B, making a risk free profit in the process."

-

"image of Wyckoff Events and Phases"

-

Distribution Schematic #1: Wyckoff Events and Phases

"image of Wyckoff Events and Phases"

- How Fear Is Being Used to Manipulate Cryptocurrency Markets

"To ensure the cryptocurrency movement moves along the right path, we who participate in it must teach ourselves to be skeptical not only of sensationalized statements, but also of skeptical statements themselves. We must be aware of how easily we are manipulated when our fear systems are triggered, and adjust our investing behavior accordingly. Those who have the time should actively try to bring clarity to the discussion when they have reliable information or insight."

- The Anatomy of a Pump & Dump Group

"Members of the core layer agree on a coin and inform the outer rim about it. Even inside the core layer there are often several levels – for example, those who paid entry (averaging 1 – 10 BTC) generally get their information 5-6 seconds before others. That's plenty of time to buy the coin at a lower price. Others join in afterwards and only 10-30 seconds later do the outer rims find out which coin was picked and go into hardcore shopping."

- Stop loss hunting: Whale manipulation strategies

"Stop-loss hunting is the act of intentionally pushing the price down through a major support level to trigger stop-loss orders, creating a flash-crash which can then be used to buy coins on the cheap.\n\nIt is incredibly easy to do with anything that has low volume at any point during the day, which is a vast majority of cryptos outside the top 15."

- Manipulation: Vital information on market movement and how to read WHALE efforts for $profit!

"Majority believe that markets move randomly and reflect the collective wisdom of investors, the truth is quite the opposite.The invisible hand is a myth. Market prices have always been manipulated by the government's visible hands through influencing laws and regulation. Insiders control markets and manipulate them up or down for profit. Manipulation is everywhere, undeniable and unavoidable. It happens on a very large scale throughout every single financial market out there, stock, bonds, commodities, currencies and so forth. There are other types of manipulation, such as social and news manipulation, hence I called it: The Game of Deception."

- How to trade ALTS keeping in mind BTC Price action?

[T

"So you must have came across this dilemma of whether to trade ALTs or not when you are shaky about BTC Price Action."

- @AltcoinPsycho on Alt Season

"Altcoin trading tip:\n\nUse ETH as your leading indicator for "when alt season?", and wait for it to bottom out before buying alts. \n\nUntil then - the rest is just noise "

- @Wolf__Daddy on accumulation phases

"The next phase in $Crypto appears to be the accumulation phase, accumulation phases often last a lot longer than most people expect, so there will be plenty of time to accumulate, no need to rush or fomo during an accumulation phase. This is the time to research and plan ahead."

- Fully Diluted Market Value

"When someone asks you how much of a company you own, the answer could be two very different numbers. You might own 10,000 shares and there might be 1mm shares issued and outstanding. That would suggest you own 1% of the company. And that would be correct, as of right now.\n\nWhat is often not calculated in these sorts of numbers is future dilution, particularly dilution that is visible if you look closely. The most common form of future dilution that is visible are outstanding options and warrants to issue stock that have not been exercised."

- @CryptoCred on Trading -w- Leverage

"Nearly every day, whether on Twitter, Telegram, or Discord, I see traders struggling to understand how to calculate their position sizes and generally make sense of leveraged trading.\n\nIn this article, I’ll break the concepts down to first principles and give you a very simple way to calculate position size, as well as understand how and when to employ leverage."

- Deribit, Bitcoin Options and Volatility

"For those unfamiliar with options, there are two types of options: Call options and put options.

- Calls give the option holder the right, but not the obligation, to buy the underlying security at the strike price.

- Put options give the option buyer the right, but not the obligation, to sell the underlying security at the strike price on or before the expiration date.

- You would buy a call option if you are bullish on the underlying, and buy a put option if you were bearish. The cost or price of an option is called the ‘option premium’."

- @CryptoCred Quiz on Bitmex

"John & Rob are trading on BitMEX\n\nJohn buys 100 XBTUSD contracts at 2X leverage at $6,000.\n\nRob buys 100 XBTUSD contracts at 50X leverage at $6,000.\n\nPrice moves up 1% from their entries — they both close their positions.\n\nAssume all else is equal.\n\nWho made more money/XBT?"

- @CryptoCred Answer on Bitmex

"The answer: ‘Same’.\n\nThey have the same position size and they’re both up 1%.\n\nRob using higher leverage does NOT mean that he’s trading with more than 100 contracts!\n\nHigher leverage simply means Rob puts up less collateral (margin) to open the same 100 contract position."

- Secrets of the Bitmex Masters

- https://blocksdecoded.com/cryptocurrency-trading-simulators/

- aggr.trade

"Charts"

- Six New and Improved Cryptocurrency Analysis Tools

"It’s not just cryptocurrencies that are multiplying: so is the number of sites striving to keep track of them. We’ve previously profiled analytical sites that offer an alternative to Coinmarketcap, the runaway market leader. It is the bitcoin of price analysis platforms. Since then, several new contenders have emerged, each aiming to impact upon CMC’s market dominance and make a name for themselves. A number of alternative blockchain explorers and crypto monitoring sites have also upped their game, adding a string of new features, as the following roundup shows."

- VentureCoinist Trading Alerts Bot

"Bitcoin Trading Alerts\n\nThe Coinist Bot is an automated strategy analyzing Bitcoin and other large cap alts. It has the ability to profit in a bull OR bear market as it looks for both long and short opportunities. The algorithm runs 24/7, monitoring price changes, and sending timely notifications."

- Buy Percentage Tool

"Buy Percentage Tool"

- StockCharts: Chart School

"These articles will introduce you to the concepts, strategies and common terminology of technical analysis, as well as other financial analysis methods and important investing topics."

- Twitter Sentiment Analysis Metrics

"Averages Tweets and Hearts"

- OnChainFX

"good alternative to CMC - multi blockchain explorer"

- VentureCoinist trading bot

"What I like about the 🤖:\n\n\nIt's free\nIt will probably outperform the signal service you could pay for\nNo hindsight, everything tweeted/timestamped\nNo larping screenshots\n\nSome of you even researched or want to build your own strats, which imo is the best."

- chainz.cryptoid.info

"more visual global charts - Blockchain Explorers"

- coinlib.io/global-crypto-charts

"more visual global charts - heat map"

- tensorcharts.com

"Charts w sentiment analysis"

- Fear and Greed Index

"bitmex margin information - "

- https://tucsky.github.io/SignificantTrades/#

- coinfarm.online

"Bitmex margin data"

- datamish.com

"charting + info of any coins on cmc"

- BitScreener

"buy market % + other indicator signals -"

- CryptoMiso

"Github commit history of 783 cryptocurrencies based on most popular repo"

- https://www.coinsignals.trade/

- Whalewatch.io

- https://autoview.with.pink/

- https://www.multicoincharts.com/

- https://cryptoxscanner.com/

- https://athcoinindex.com/

- https://www.turtlebc.com/tools/buy_percentage?period=3years

- isky Notifications

application combined with Telegram to get push notifications. Needs binance API key . Please, DO UNCHECK Trading checkbox while creating key (leave only readonly)

- https://deltabalances.github.io/ -> lets you export all trades from ED, Kyber, 0x and others at one place + token balances + wraped eth balance for any ETH wallet.

- https://www.tradingview.com/script/HAOqXwg4-Killzones-Daily-Open-Weekly-Open-Monthly-Open-by-bartbtc/

I've created an indicator that :

- Displays the previous day's, week's, month's open on the current period's price action.

- Displays a vertical bar at the daily open. (The first 30-60 minutes from the daily open is commonly where the high/low of the day is made)

- Displays London/NY opens as vertical bars (london close is an option, but I have disabled it by default. I have removed Asia as I believe it is not useful - deal with it!)

Features:

- Displays daily data/killzones only on timeframes lower than 60minutes (you can modify this in the settings as you wish)

- Displays weekly open only on timeframes lower than weekly

- Displays monthly open only on timeframes lower than monthly

- Sierra Chart - High Performance Trading Platform

"Sierra Chart is a professional Trading platform for the financial markets which is integrated with many externally available trading services. It supports Live and Simulated trading. Both manual and automated trading is supported.\nSierra Chart is a complete Real-time and Historical, Charting and Technical Analysis platform for the financial markets.\nSierra Chart fully supports the open specification Data and Trading Communications Protocol for the community.\nSierra Chart provides an optional high quality direct CME / CBOT / NYMEX / COMEX / Eurex / ICE / HKFE / Euronext / LIFFE / NYSE / NASDAQ / TSX / Montréal Futures / Cash Indices realtime market data feed. There is an additional cost for real-time exchange data. Real-time Forex/CFD data is included at no additional cost.\nSupport for charting and trading in the Cryptocurrency markets.\nSierra Chart uses the very best engineering and design practices to produce well-organized, fast and ultra rocksolid software and services. We continue to strive to be as best as we can be.\n\ntrading platform with lots of features, like footprint charts, heatmaps and all that . has poloniex, bitmex, bitfinex and okcoin currently" https://cryptocoincharts.info https://coincheckup.com/

- Compound Finance [D]

"Compound is a money market protocol on the Ethereum blockchain — allowing individuals, institutions, and applications to frictionlessly earn interest on or borrow cryptographic assets without having to negotiate with a counterparty or peer. Each market has dynamic interest rates, which float in real-time as market conditions adjust."

-

"Interesting symmetry in between the timing of $DOGE cycles over the last few years\n\nDoge has long been a signal for #altseason"

-

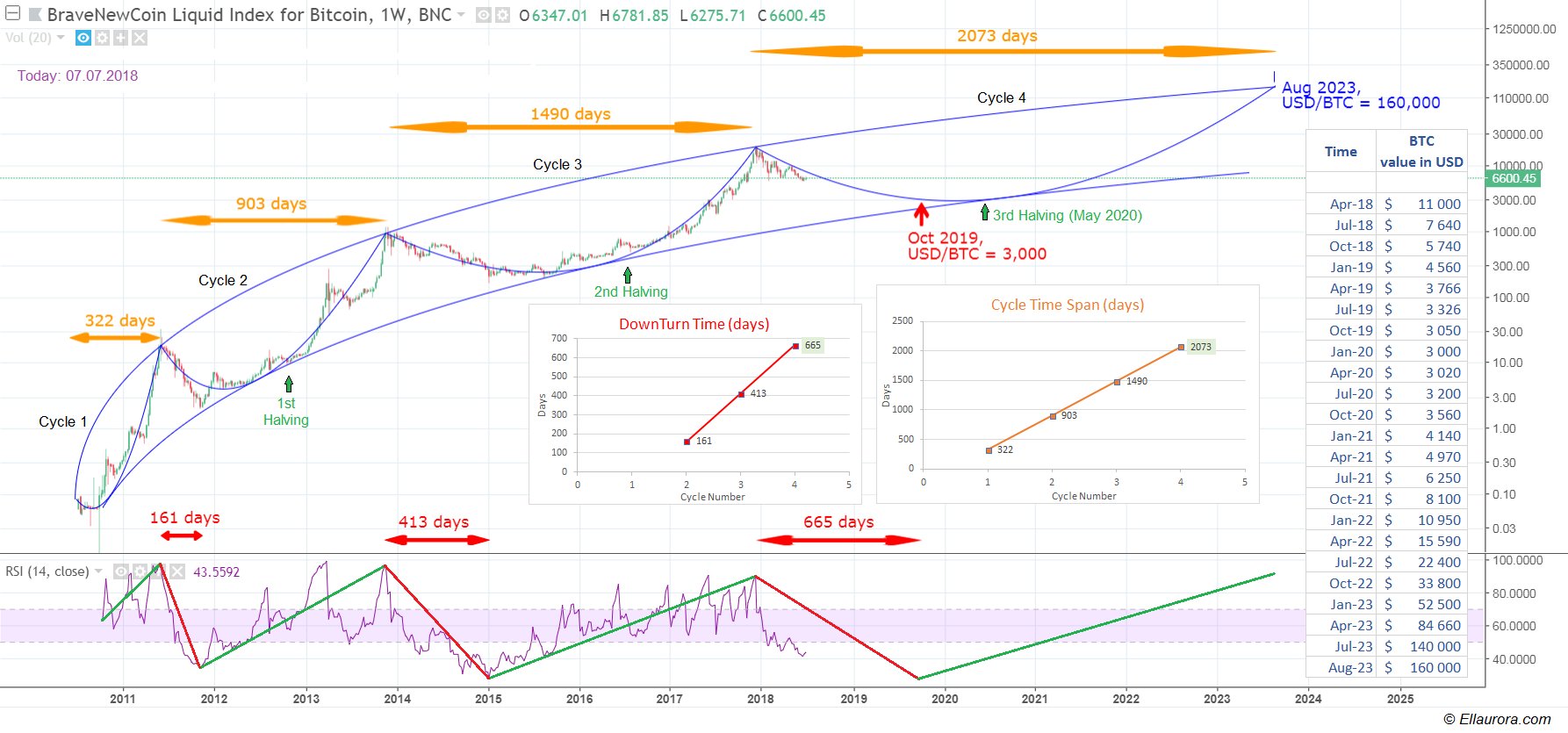

@JimAllmendinger share image of market cycles

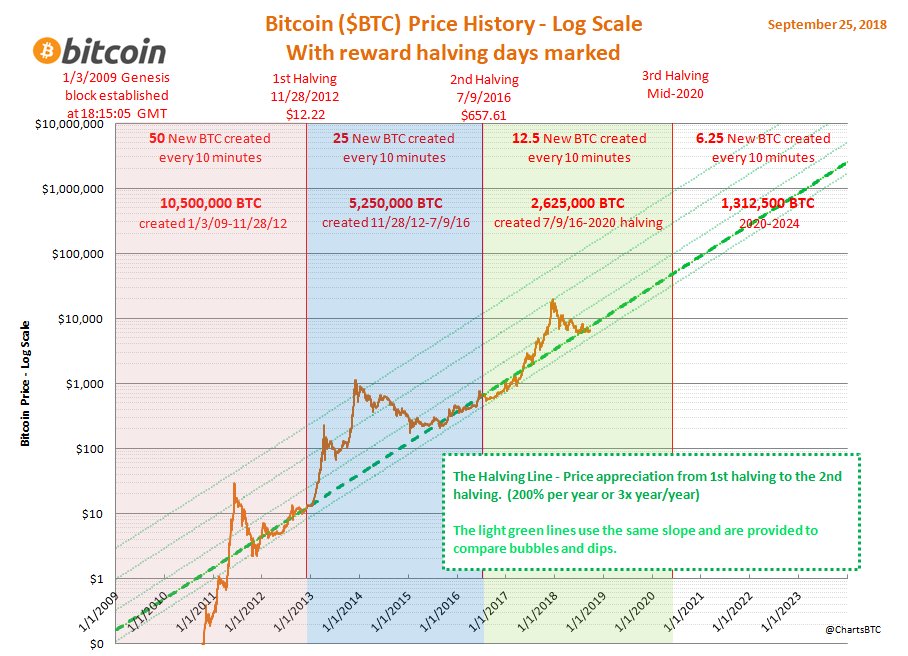

"@JimAllmendinger Bitcoin has a 4 year cycle that's programmed into the system."

-

@Lucid_TA speculating on market movements

"A lot of people were talking about how bullish the bull whale was. Counter-narrative is that someone with deep pockets held the price up and continued pushing it higher, while simultaneously opening derivative shorts before dumping accumulated spot on market."

-

@RyanSAdams Twitter thread on future bubbles

"10 takes on the future of crypto from the depths of a bear market:\n\nThe 2017 run-up & 2018 freefall is only a micro-bubble—the crypto mega bubble is yet to come"

-

@KunalDaSen shares a potential growth pattern for Bitcoin

"Bitcoin long term price prediction, with the 'halving' effect factored in. What do you think ?"

-

LibTA Technical Analysis Library 📚 FREE Books & Trading Courses on Cryptos, Forex and Investing

"📊Forex/Crypto books for FREE 🎓Download books for complete beginners, basic concepts and techniques of trading as Chart Patterns, Day Trading, Elliott Wave Principles, Ichimoku, Psychology Of Trading, etc."

-

"a collection of book collections related to trading"

-

"Trading Books Shared Directory"

-

Crypto Trader Central Books Library

"Bunches of Trading Books"

-

"Trading Books Shared Directory"

-

"obligatory watching"

-

@CryptoCred Price Action Webinar #1

"Price Action Webinar #1 - Retests"

- Flippening Podcast

"Flippening - For Cryptocurrency Investors (Bitcoin, Ethereum, and Cryptoasset Investing)"

-

@cryptostaker's Learning Center [tele] cryptostaker.club

"Oscillators, Bollinger Bands, Commodity Channel Index, Fast Stochastic, KST (Short term, Intermediate term, Long term), MACD, Momentum, Relative Strength Index, Slow Stochastic"

-

"lots of good articles and videos on trading"

-

BabyPips - "Learn Forex Trading."

-

"Busted Patterns, Candlesticks, Chart Patterns, Elliott Wave, Event Patterns, Fundamentals, Market Review, Pattern, Pattern Rank, etc"

-

"Technical Analysis is the forecasting of future financial price movements based on an examination of past price movements. Like weather forecasting, technical analysis does not result in absolute predictions about the future. Instead, technical analysis can help investors anticipate what is "likely" to happen to prices over time."

- @TheCryptoDog Trading FF

"Here are some of the best traders I know and learn from"

- @CryptoCred on Bitmex Leverage Traders to Follow

- Ramano says he only follows OG's 2015 or earlier.

- @YORK780 #FF

- The Crypto Dog's #FF