jquants-algo is a python library for algorithmic trading with japanese stock trade using J-Quants on Python 3.8 and above.

$ pip install jquants-algo

from jquants_algo import Algo

import pprint

class MyAlgo(Algo):

def strategy(self):

fast_ma = self.sma(period=3)

slow_ma = self.sma(period=5)

# golden cross

self.sell_exit = self.buy_entry = (fast_ma > slow_ma) & (

fast_ma.shift() <= slow_ma.shift()

)

# dead cross

self.buy_exit = self.sell_entry = (fast_ma < slow_ma) & (

fast_ma.shift() >= slow_ma.shift()

)

algo = MyAlgo(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

ticker="7203", # TOYOTA

size=100, # 100 shares

)

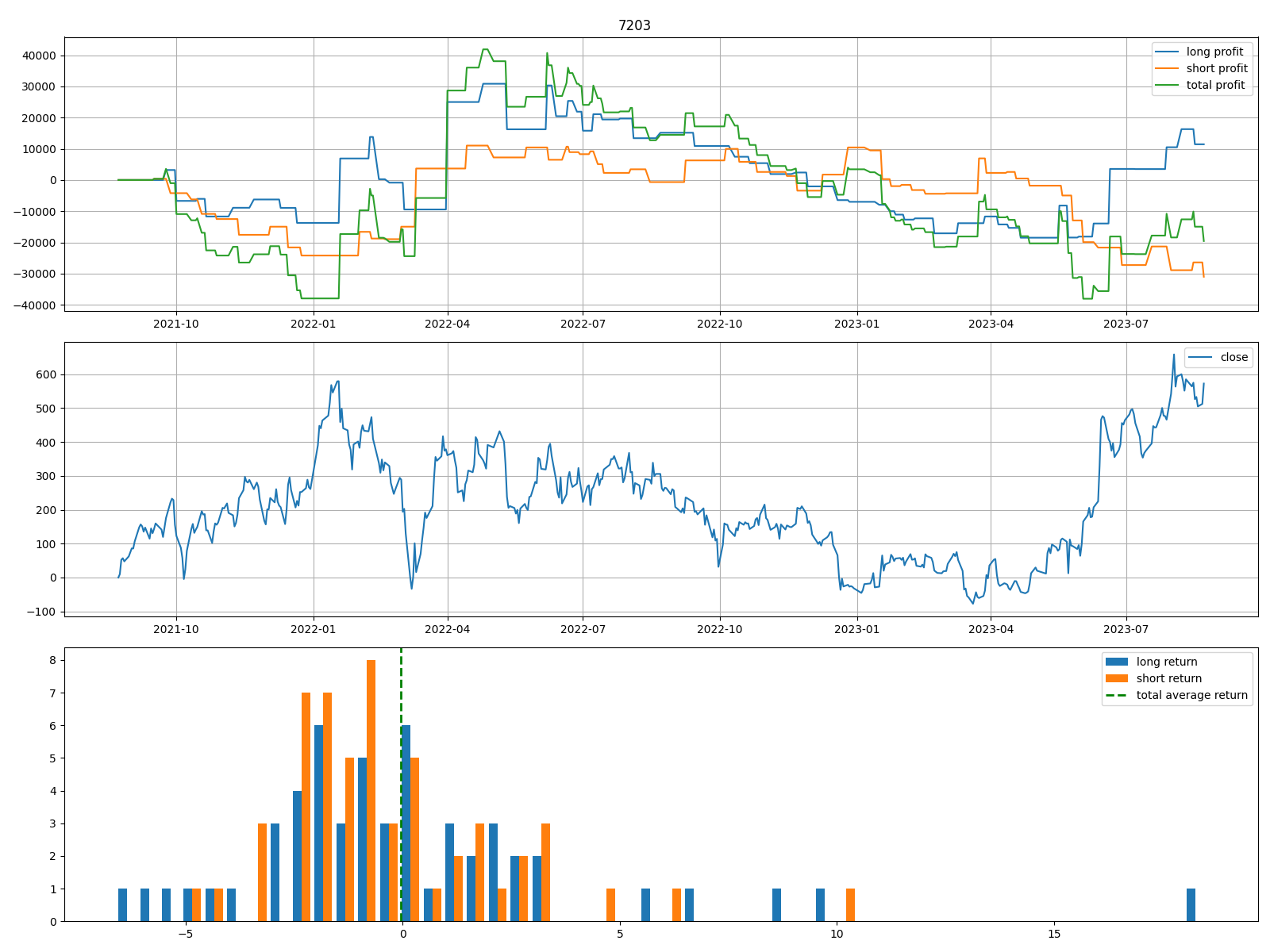

pprint.pprint(algo.backtest()){'long': {'average return': '0.156',

'maximum drawdown': '49350.000',

'profit': '11450.000',

'profit factor': '1.080',

'riskreward ratio': '1.455',

'sharpe ratio': '0.038',

'trades': '54.000',

'win rate': '0.426'},

'short': {'average return': '-0.238',

'maximum drawdown': '42050.000',

'profit': '-31020.000',

'profit factor': '0.754',

'riskreward ratio': '1.319',

'sharpe ratio': '-0.091',

'trades': '55.000',

'win rate': '0.364'},

'total': {'average return': '-0.043',

'maximum drawdown': '79950.000',

'profit': '-19570.000',

'profit factor': '0.927',

'riskreward ratio': '1.423',

'sharpe ratio': '-0.013',

'trades': '109.000',

'win rate': '0.394'}}from jquants_algo import Algo

import pprint

class MyAlgo(Algo):

def strategy(self):

fast_ma = self.sma(period=3)

slow_ma = self.sma(period=5)

# golden cross

self.sell_exit = self.buy_entry = (fast_ma > slow_ma) & (

fast_ma.shift() <= slow_ma.shift()

)

# dead cross

self.buy_exit = self.sell_entry = (fast_ma < slow_ma) & (

fast_ma.shift() >= slow_ma.shift()

)

algo = MyAlgo(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

ticker="7203", # TOYOTA

size=100, # 100 shares

)

pprint.pprint(algo.predict()){'buy entry': True,

'buy exit': False,

'close': 2416.5,

'date': '2023-08-22',

'sell entry': False,

'sell exit': True}from jquants_algo import Algo

import pprint

class MyAlgo(Algo):

def strategy(self):

rsi = self.rsi(period=10)

ema = self.ema(period=20)

lower = ema - (ema * 0.001)

upper = ema + (ema * 0.001)

self.buy_entry = (rsi < 30) & (self.df.Close < lower)

self.sell_entry = (rsi > 70) & (self.df.Close > upper)

self.sell_exit = ema > self.df.Close

self.buy_exit = ema < self.df.Close

algo = MyAlgo(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

ticker="7203", # TOYOTA

size=100, # 100 shares

outputs_dir_path="outputs",

data_dir_path="data",

)

pprint.pprint(algo.backtest())

pprint.pprint(algo.predict())- Simple Moving Average 'sma'

- Exponential Moving Average 'ema'

- Moving Average Convergence Divergence 'macd'

- Relative Strenght Index 'rsi'

- Bollinger Bands 'bbands'

- Market Momentum 'mom'

- Stochastic Oscillator 'stoch'

- Average True Range 'atr'

For help getting started with J-Quants, view our online documentation.