Submission project for HackTheMoney | ETHGlobal 2022

We build a decentralized exchange for cross chain swaps, allowing users to swap any token from any chain, in short - An Interchain DEX.

The popular exchange Uniswap is our starting point for the DEX, which we augment by implementing cross-chain compatibility powered by the SWING api. The first brick is laid by deploying the Uniswap FactoryV3 contract on Fantom.

Considering the lack of initial liquidity and for the scope of this hackathon, we continue our project on Polygon Mumbai, where the Uniswap contracts are officially deployed and liquidity for 3 token pairs is available. Polygon shares similarity with Fantom by using the PoS consensus, yet it does not provide the asynchronous aspect of the Lachesis algorithm.

Lachesis is a break-through aBFT consensus algorithm developed by Fantom.

Below are the key properties of Lachesis algorithm:

Asynchronous: Participants have the freedom to process commands at different times.

Leaderless: No participant plays a “special” role.

Byzantine Fault-Tolerant: Functional in a presence of up to one-third of faulty nodes and

malicious nodes.

Final: Lachesis's output can be used immediately. Transactions are confirmed within 1-2 seconds.

The SWING api finds the best & the most efficient bridge in terms of fees and duration. Using SWING, we provide cross-chain swaps and in the future prospect of inter-chain liquidity. Given the option to select a receiver network, the user can choose to swap his/her token to a different chain.

Swing API v0 enables cross-chain token transfers and token swaps through Multichain(Anyswap), Wormhole,

Celer Bridge, deBridge, Hop Bridge, Hyphen bridge, Connext(NXTP), Rainbow bridge, Synapse .

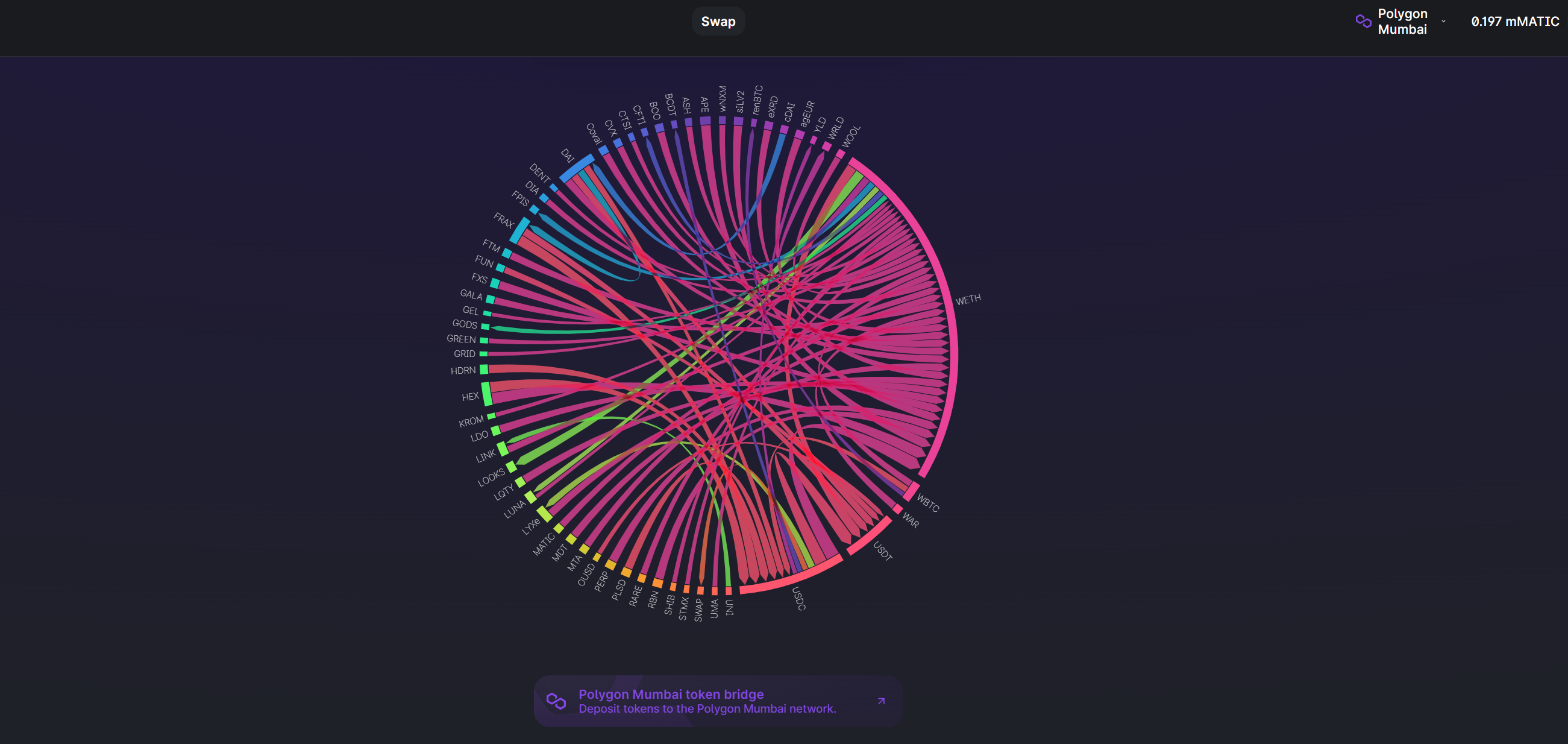

For analytic purposes, we add an interactive dashboard which visualises in real time the swaps between tokens on Uniswap. The data is fetched from TheGraph, specifically the UniswapV3 subgraph. For now the user can observe current trends, such as the momentary dump of alt-coins. In relation to an inter-chain liquidity pool, this data could be used to train ML models to predict demand/supply, avoid shortage and move liquidity when the bridge conditions are most favorable.

TheGraph:

- Build a subgraph which tracks all inter-chain swaps and liquidity.

- Brute-force pattern recognition.

Migrating to Fantom

- Migrating uniswap liquidity pools to Fantom and bridge the swaped tokens.

- Facilitate migration to Fantom.

- alternative Idea: implement P2P swap with Lachesis algorithm.

Deploying Uniswap contracts to Fantom testnet. ✅

UniswapV3Factory deployed to: 0x341EC1a1fc2480F400cf33fDc2aC5C95Bdaa3f37

Fantom mainnet:

- Weth: 0x74b23882a30290451A17c44f4F05243b6b58C76d

PolygonZero and codeBase