- This is a classification machine learning problem to identify the customers of a mid-sized bank that could show a higher intent towards a recommended credit card :credit_card:.

- In this project we have combined the predictions made by XGBOOST and LightGBM using Stacking.

- Credit Card Lead Prediction.ipynb

- Credit Card Lead Prediction.ipynb (nbviewer) (Click on this link if the notebook doesnot load on Github.)

The dataset train.csv is used for training. The train dataset had 2,45,725 records with 11 features.

The dataset consisted the following attributes :

- ID : Unique Identifier for a row

- Gender : Gender of the Customer

- Age : Age of the Customer (in Years)

- Region_Code : Code of the Region for the customers

- Occupation : Occupation Type for the customer

- Channel_Code : Acquisition Channel Code for the Customer (Encoded)

- Vintage : Vintage for the Customer (In Months)

- Credit_Product : If the Customer has any active credit product (Home loan, Personal loan, Credit Card etc.)

- Avg_Account_Balance : Average Account Balance for the Customer in last 12 Months

- Is_Active : If the Customer is Active in last 3 Months

- Is_Lead(Target) : If the Customer is interested for the Credit Card (0 : Customer is not interested , 1 : Customer is interested)

The project has been divided into the following steps :

In this step features having missing values and outliers, target variable distribution, numerical feature distribution, categorical feature distribution, Univariate and Bivariate Analysis was performed.

Some of the data insights are given below. (For the detail EDA please refer to the ipynb notebook)

- Customers aged between 40-60 have greater interest in credit cards whereas customers in their 20s and 30s and less interested

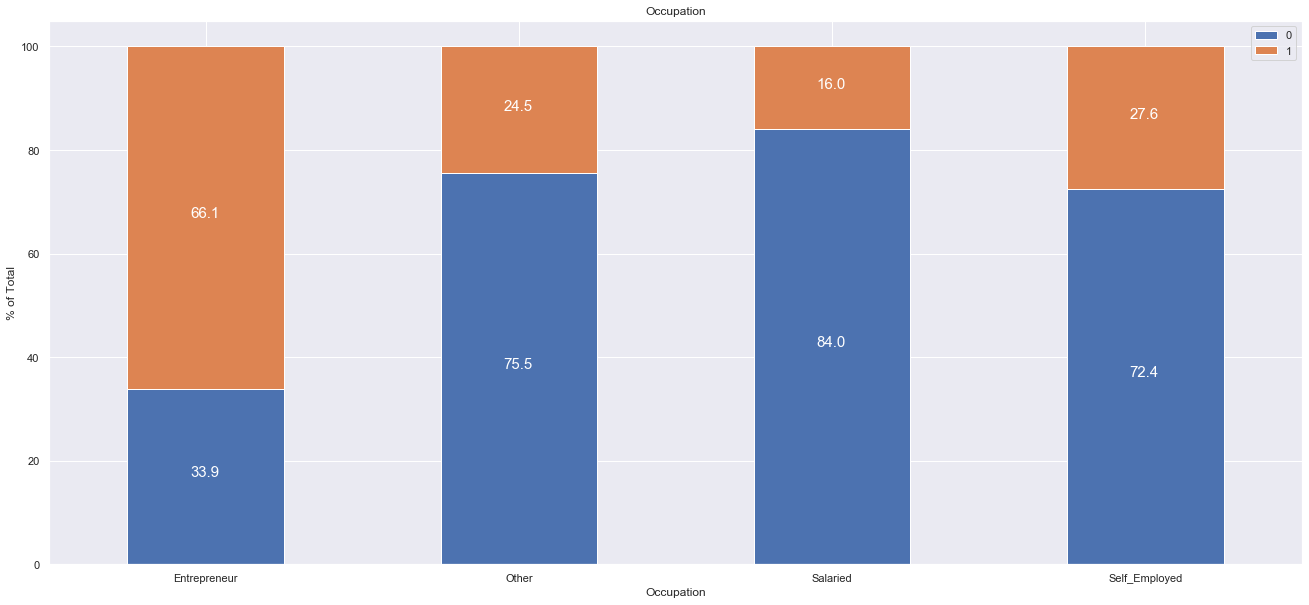

- Salaried person are less likely to take up credit cards. Only among Entrepreneur the number of customers interested to take up credit cards is more. 66% of total Customers falling in Entrepreneural category in Occupation have shown interest in the past followed by 27.6% Self Employed, 24.5% in Others category and 16% Salaried.There are only 2 Entrepreneurs who don't have any credit product.

- Number of Customers having credit products who are interested in Credit Card is more than those who donot have a Credit Product.

- The Missing Value in the Credit_Product column is imputed with No_Info

- The categorical features (Gender, Region_Code, Occupation, Channel_Code, Credit_Product, Is_Active) were One Hot Encoded.

- About 76.27% customers are not interested in credit card, and about 23.72% are interested in credit card. To address this imbalance Oversampling techniques like SMOTE is used.

- In Modelling both LightGBM and Xgboost is used.

- For combining the predictions made by XGBoost and Light GBM, stacking is used

- The models are tuned using Randomized Search CV

- To check for overfitting 5 kfold cross validation was performed

- In this project ROC-AUC score was used as evaluation metric.

- The Xgboost model gave a ROC-AUC score of 0.879 while the LightGBM model gave a ROC-AUC score of 0.876

Age and Vintage has highest correlation (0.63) in train dataset and (0.62) in test dataset.

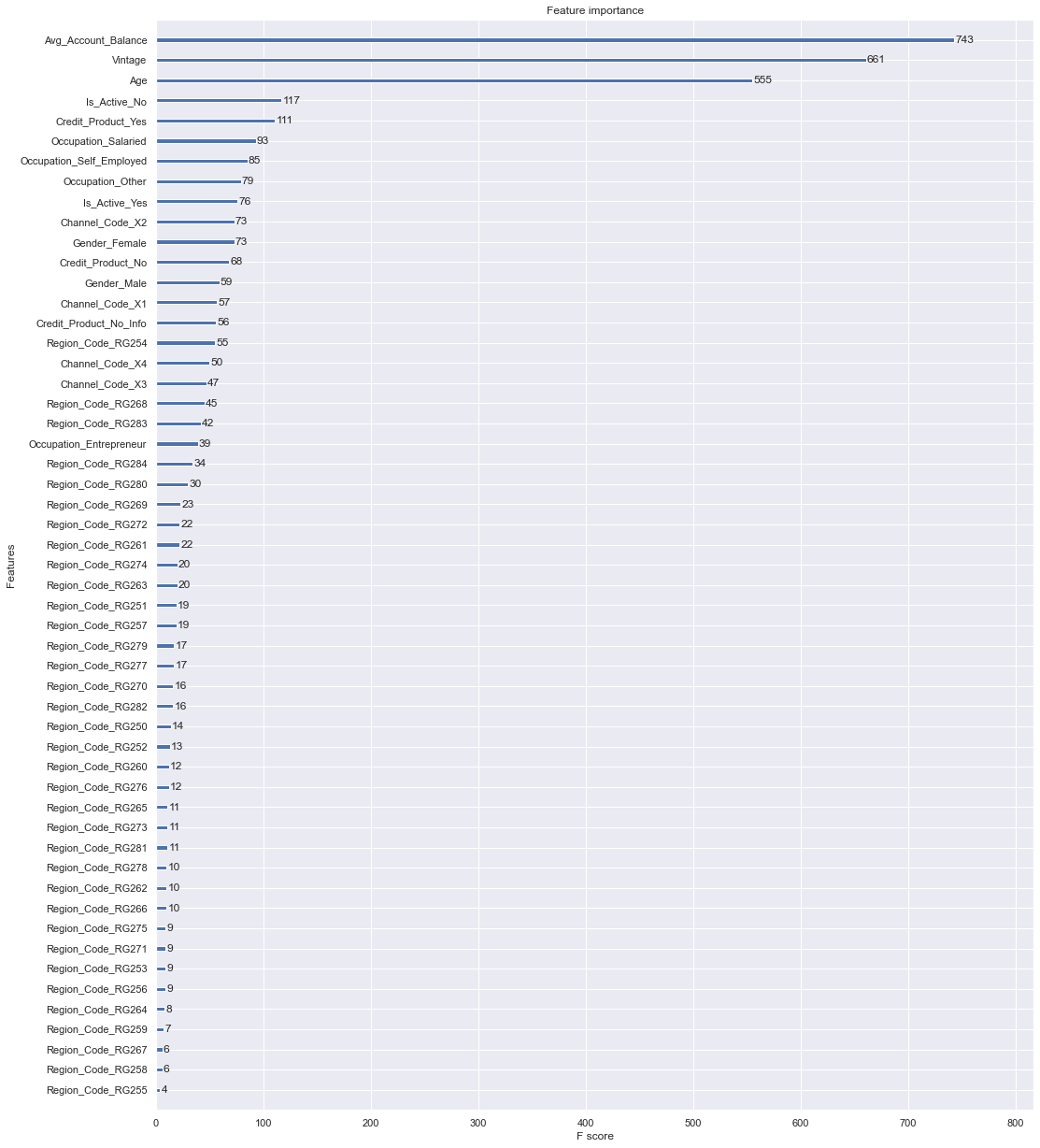

In the XGBoost model, the top 5 features of importance are : Avg_Account_Balance, Vintage, Age, Is_Active_No and Credit_Product_Yes.

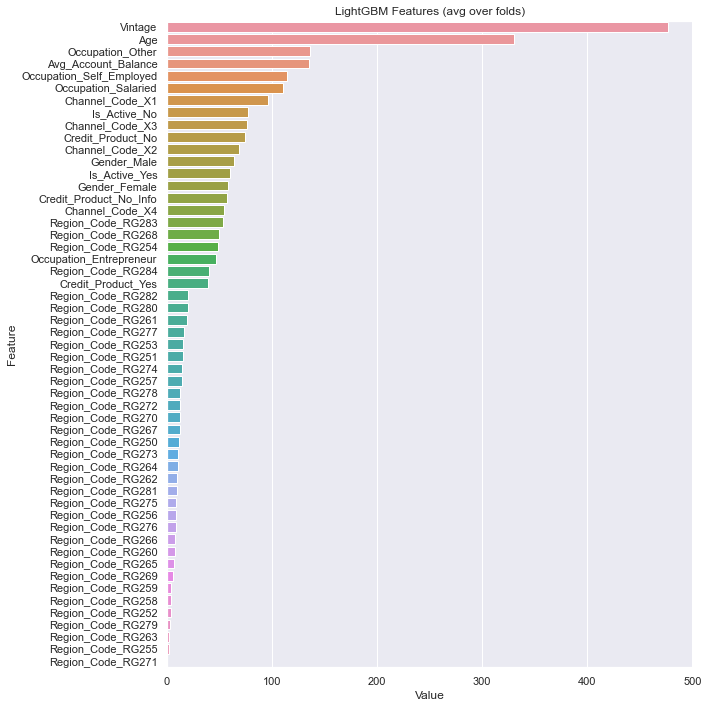

In the LightGBM model, the top 5 features of importance are : Vintage, Age, Occupation_Other, Avg_Account_Balance and Occupation_Self_Employed.

- Abhishek Chowdhury - Github Profile