Table of Contents

- About The Project

- Getting Started

- Usage

- Constant Product AMM

- Impermanent Loss on Uniswap v2

This project shows how to interact with the main functions of Uniswap V2

To get a local copy up and running follow these simple example steps.

-

npm

npm install npm@latest -g

-

hardhat

npm install --save-dev hardhat

npm install @nomiclabs/hardhat-ethers @nomiclabs/hardhat-waffle

run:

npx hardhat

verify:

npx hardhat verify --network goerli "contract address" "pair address"

-

Clone the repo

git clone https://github.com/Aboudoc/Uniswap-v2.git

-

Install NPM packages

npm install

-

Dependencies

npm i @uniswap/v2-core @uniswap/v2-periphery

If you need testnet funds, use the Alchemy testnet faucet.

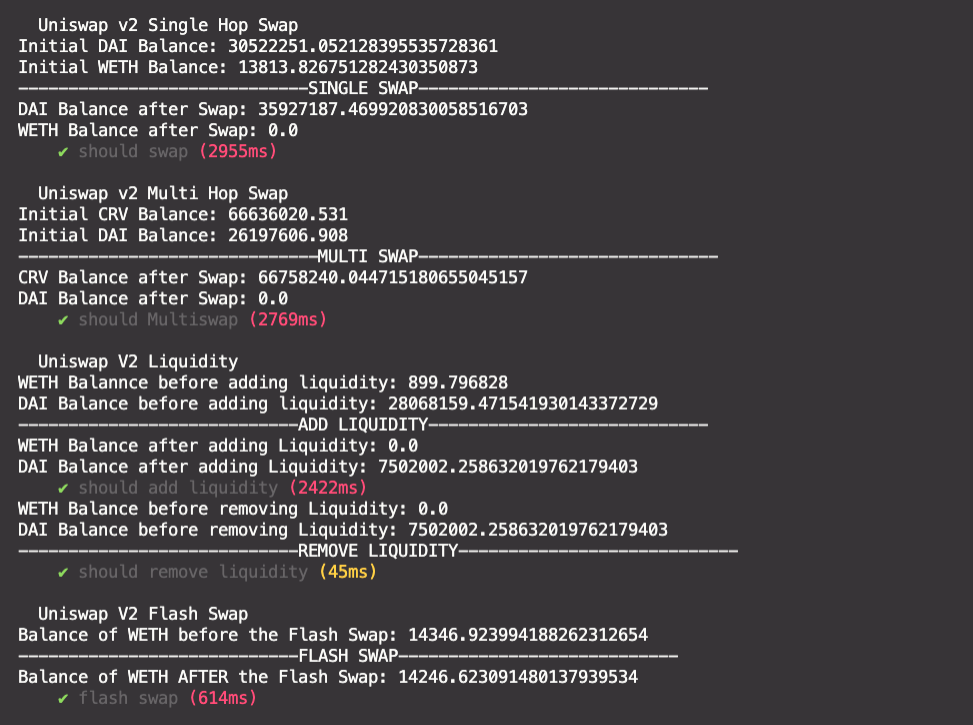

This project shows how to swap, add and remove liquidity

Uniswap V2 is a Constant product AMM (automated market maker) <=> a decentralized exchange where 2 tokens are traded. You can find a deep overview of CPAMM in this repo

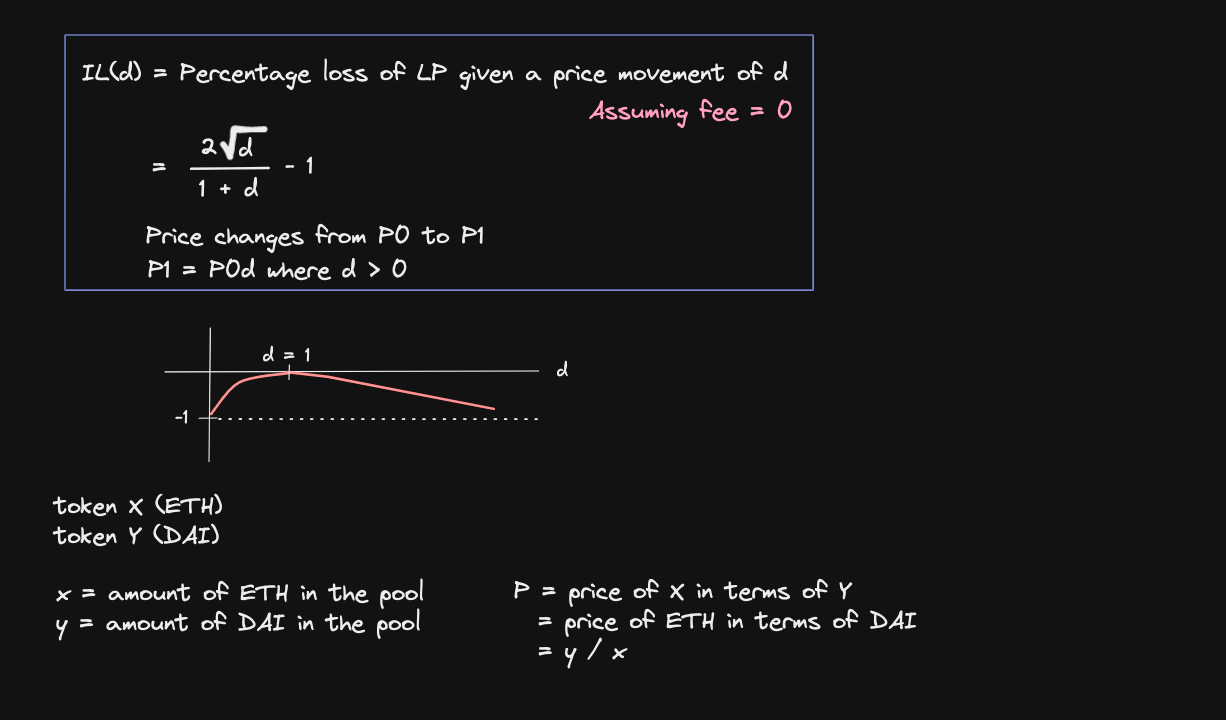

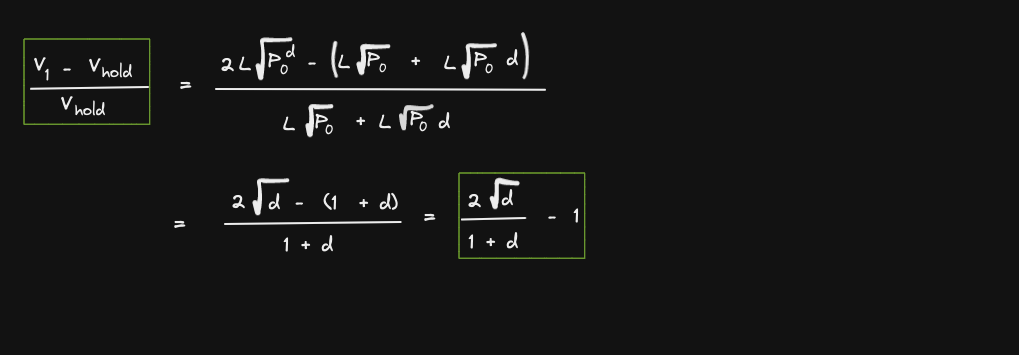

How to calculate Impermanent Loss in a constant product AMM?

If the price does not change at all, the d = 1 and there is no loss in providing liquidity to CPAMM

if the price changes either down or up, then the LP will experience some loss

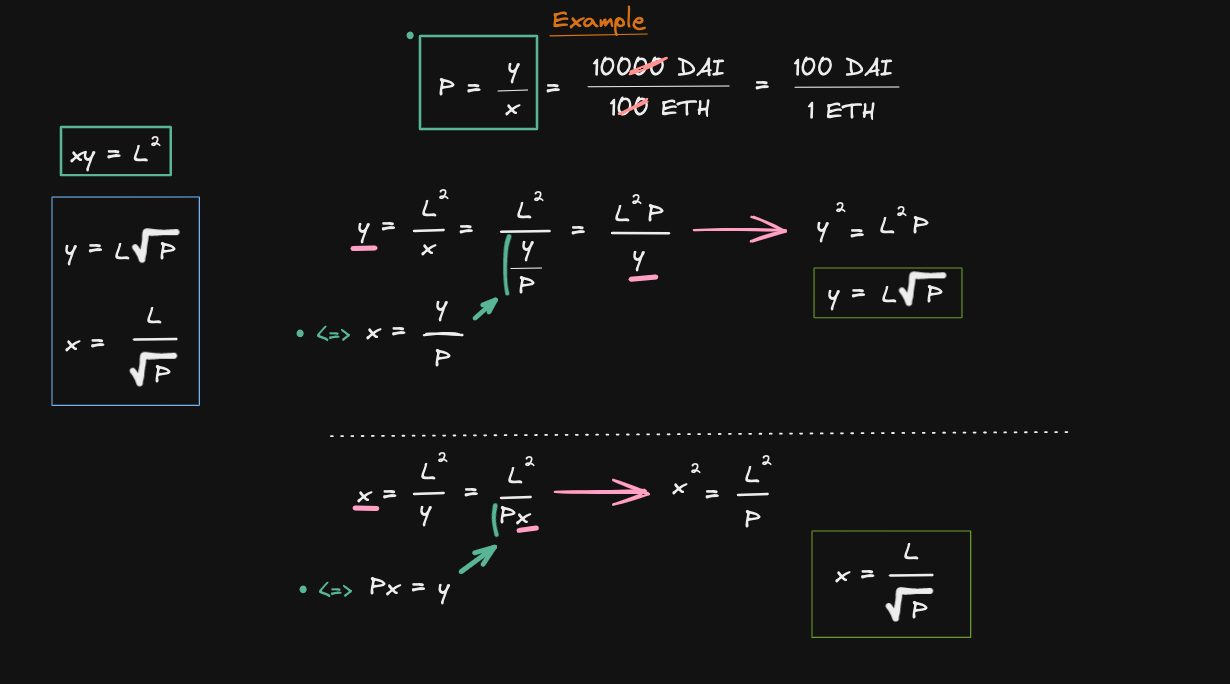

Let's see how to derive this equation. Find x and y

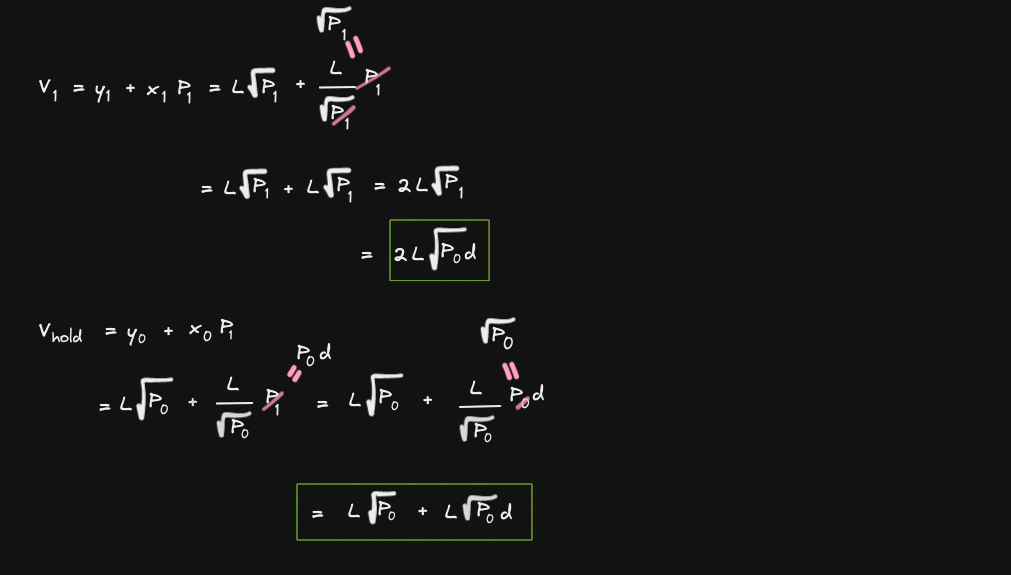

We solved y and x in terms of L and P. We are now ready to solve IL(d)

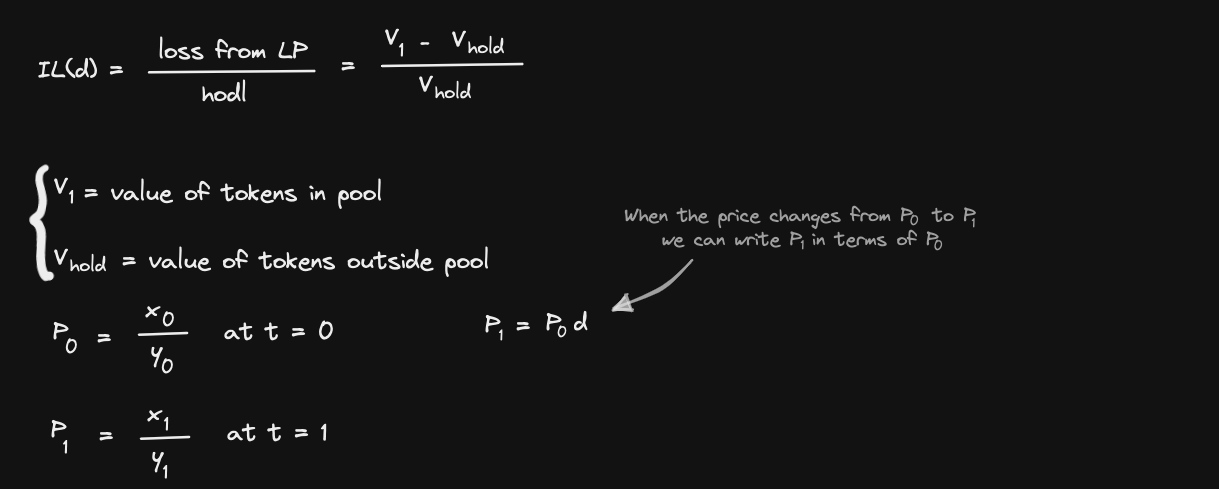

Le's find out what are V1 and Vhold in terms of token y.

Below we multiplied x1 by P1 to get the price of x1 in term of y

We are now ready to solve the equation of IL(d)

This contract introduces 2 functions to swap tokens on Uniswap V2

swapExactTokensForTokens - Sell all of input token.

swapTokensForExactTokens - Buy specific amount of output token.

- Address of tokens (2 or 3) and the address of the router

- Set interfaces for tokens and router

- Transfer

amountInfrommsg.sender - Approve

amountIntorouter - Set the

path - Call

swapExactTokensForTokenson IUniswapV2Router

- Transfer

amountInMaxfrommsg.sender - Approve

amountInMaxtorouter - Set the

path - Call

swapTokensForExactTokenson IUniswapV2Router and store amount of WETH spent by Uniswap in amounts (uint[]) - Refund excess WETH to

msg.sender. Amount of WETH spent by Uniswap is stored in amounts[0]

Sell DAI and buy CRV.

However there is no DAI - CRV pool, so we will execute multi hop swaps, DAI to WETH and then WETH to CRV.

- Address of tokens and the address of the router

- Set interfaces for tokens and router

This function will swap all of DAI for maximum amount of CRV. It will execute multi hop swaps from DAI to WETH and then WETH to CRV.

- Transfer

amountInfrommsg.sender - Approve

amountIntorouter - Setup the swapping

path - Send CRV to msg.sender

This function will swap minimum DAI to obtain a specific amount of CRV. It will execute multi hop swaps from DAI to WETH and then WETH to CRV.

- Transfer

amountInMaxfrommsg.sender - Approve

amountInMaxtorouter - Setup the swapping

path - Call

swapTokensForExactTokenson IUniswapV2Router and store amount of DAI spent by Uniswap in amounts (uint[]) - Refund DAI to

msg.senderif not all of DAI was spent. Amount of DAI spent by Uniswap is stored in amounts[0]

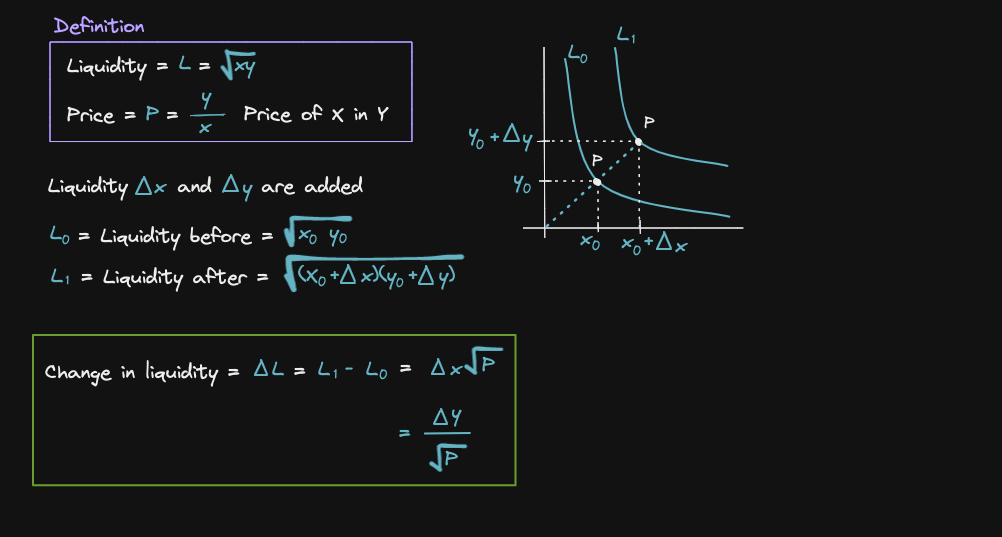

When we add or remove tokens from a Uniswap V2 pool, the liquidity changes.

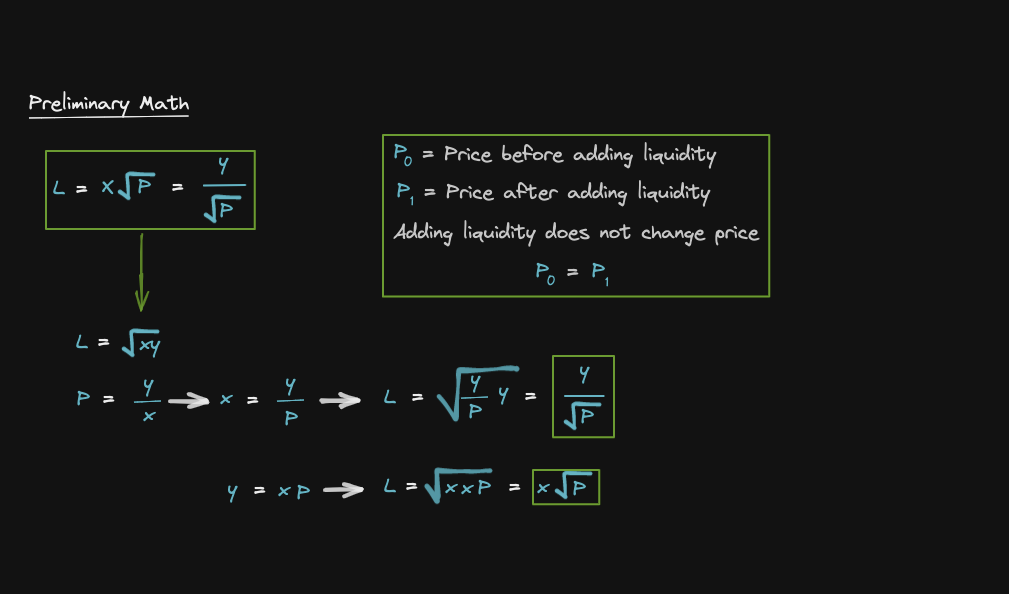

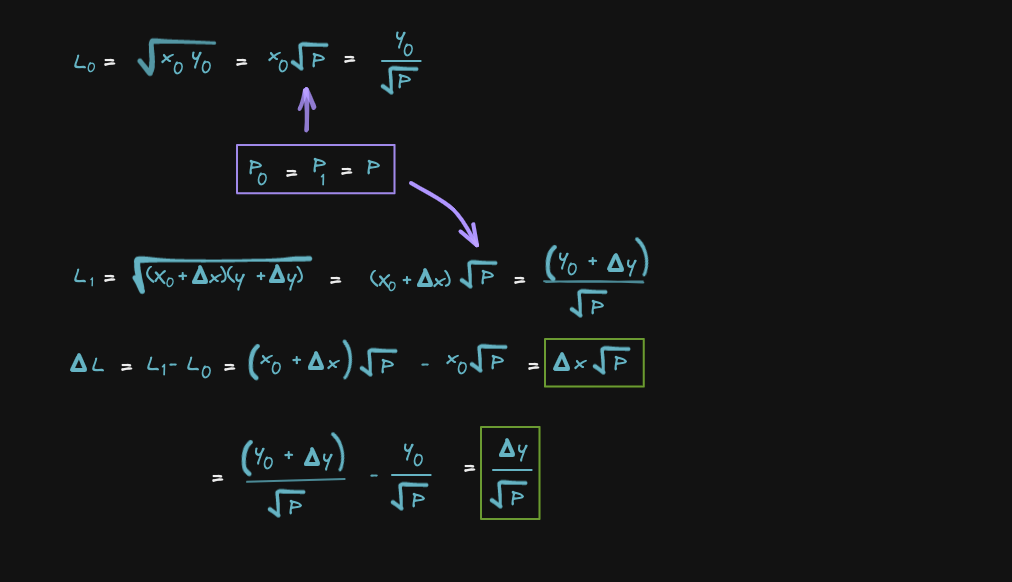

Let's see how to derive the liquidity delta

As always, we start with the definition:

Preliminary math to derive these equations (green square)

Now we have the math needed, let's now derive the equation for the liquidity delta

Deposit your tokens into an Uniswap V2 pool to earn trading fees.

This is called adding liquidity.

Remove liquidity to withdraw your tokens and claim your trading fees.

- Address of tokens and the addresses of the router and the factory. Declare pair variable

- Set interfaces for tokens, router and factory

- Setup pair (IERC20) by calling getPair() on factory

This function adds liquidity to the Uniswap WETH - DAI pool.

- Transfer

wethAmountDesiredanddaiAmountDesiredfrommsg.sender - Approve

amountwethAmountDesiredanddaiAmountDesiredtorouter - Call

addLiqiuidity()onrouterand storewethAmount,daiAmountandliquidityreturned from the function call - Refund to msg.sender, excess WETH and DAI that were not added to liquidity

This function removes liquidity from the Uniswap WETH - DAI pool.

- Transfer

liquidityfrommsg.sender - Approve

liquiditytorouter - Call

removeLiqiuidity()onrouter

Tokens in the pool can be borrowed as long as they are repaid in the same transaction plus fee on borrow.

This is called flash swap.

The contract inherit from IUniswapV2Callee

- Address of tokens and the address of the factory

- Set WETH and factory interface then declare pair (IUniswapV2Pair)

- Call getPair() on factory and store the result inside pair variable (which is a IUniswapV2Pair interface)

- Prepare data of bytes to send. This can be any data, as long as it is not empty Uniswap will trigger a flash swap. For this example, we encode WETH and msg.sender.

- Call

swap()on pair. Find belowswap()fromIUniswapV2Pair

function swap(

uint amount0Out,

uint amount1Out,

address to,

bytes calldata data

) external;amount0Out: Amount of token0 to withdraw from the pool => 0

amount1Out:Amount of token1 to withdraw from the pool => wethAmount

to: Recipient of tokens in the pool => address(this)

data: Data to send to uniswapV2Call => data

This function is called by the DAI/WETH pair contract after we called pair.swap.

Immediately before the pool calls this function, the amount of tokens that we requested to borrow is sent. Inside this function, we write our custom code and then repay the borrowed amount plus some fees.

- Require that

msg.senderis pair. Only pair contract should be able to call this function. - Require

senderis this contract. Initiator of the flash swap should be this contract. - Decode

data. Inside flashSwap we've encoded WETH and msg.sender. - Once the data is decoded, we would write our custom code here (arbitrage). We only emitted events for this example

- Calculate total amount to repay

- Transfer fee amount of WETH from caller (about 0.3% fee, +1 to round up)

- Repay WETH to pair, amount borrowed plus fee

When we fork 🍴 the mainnet, we have the current state of the blockchain running locally on our system, including all contracts deployed on it and all transactions performed on it.

- Setup hardhat.config

- Find a whale on etherscan

hardhat.config.js

networks: {

hardhat: {

forking: {

url: `https://eth-mainnet.alchemyapi.io/v2/${process.env.ALCHEMY_API_KEY}`,

},

},

}Note: Replace the ${} component of the URL with your personal Alchemy API key.

.config

const DAI = "0x6B175474E89094C44Da98b954EedeAC495271d0F";

const DAI_WHALE = process.env.DAI_WHALE;

module.exports = {

DAI,

DAI_WHALE,

};.env

ALCHEMY_API_KEY=...Terminal 1

npx hardhat test --network localhostTerminal 2

ALCHEMY_API_KEY=...

npx hardhat node --fork https://eth-mainnet.g.alchemy.com/v2/$ALCHEMY_API_KEYThis contract assumes that token0 and token1 both have same decimals

Consider Uniswap trading fee = 0.3%

(...soon)

- Uniswap V3 TWAP

- Further reading

- Deploy script

- Unit test

See the open issues for a full list of proposed features (and known issues).

Contributions are what make the open source community such an amazing place to learn, inspire, and create. Any contributions you make are greatly appreciated.

If you have a suggestion that would make this better, please fork the repo and create a pull request. You can also simply open an issue with the tag "enhancement". Don't forget to give the project a star! Thanks again!

- Fork the Project

- Create your Feature Branch (

git checkout -b feature/AmazingFeature) - Commit your Changes (

git commit -m 'Add some AmazingFeature') - Push to the Branch (

git push origin feature/AmazingFeature) - Open a Pull Request

Distributed under the MIT License. See LICENSE.txt for more information.

Reda Aboutika - @twitter - reda.aboutika@gmail.com

Project Link: https://github.com/Aboudoc/Uniswap-v2.git