With businesses moving online, fraud and abuse in online systems is constantly increasing as well. Traditionally, rule-based fraud detection systems are used to combat online fraud, but these rely on a static set of rules created by human experts. This project uses machine learning to create models for fraud detection that are dynamic, self-improving and maintainable. Importantly, they can scale with the online business.

Specifically, we show how to use Amazon SageMaker to train supervised and unsupervised machine learning models on historical transactions, so that they can predict the likelihood of incoming transactions being fraudulent or not. We also show how to deploy the models, once trained, to a REST API that can be integrated into an existing business software infracture. This project includes a demonstration of this process using a public, anonymized credit card transactions dataset provided by ULB, but can be easily modified to work with custom labelled or unlaballed data provided as a relational table in csv format.

To get started quickly, use the following quick-launch link to launch a CloudFormation Stack create form and follow the instructions below to deploy the resources in this project.

| Region | Stack |

|---|---|

| US East (N. Virginia) |  |

| US East (Ohio) |  |

| US West (Oregon) |  |

-

On the stack creation page, check the box to acknowledge creation of IAM resources, and click Create Stack. This should trigger the creation of the CloudFormation stack.

-

Once the stack is created, go to the Outputs tab and click on the SageMakerNotebook link. This will open up a Jupyter notebook named

sagemaker_fraud_detectionin a SageMaker Notebook instance where you can run the code. Follow the instructions in the notebook to run the solution. You can useCells->Run Allfrom the Jupyter menu to run all cells, and return to the notebook later after all cells have executed. The total time to run all cells should be around 40 minutes.

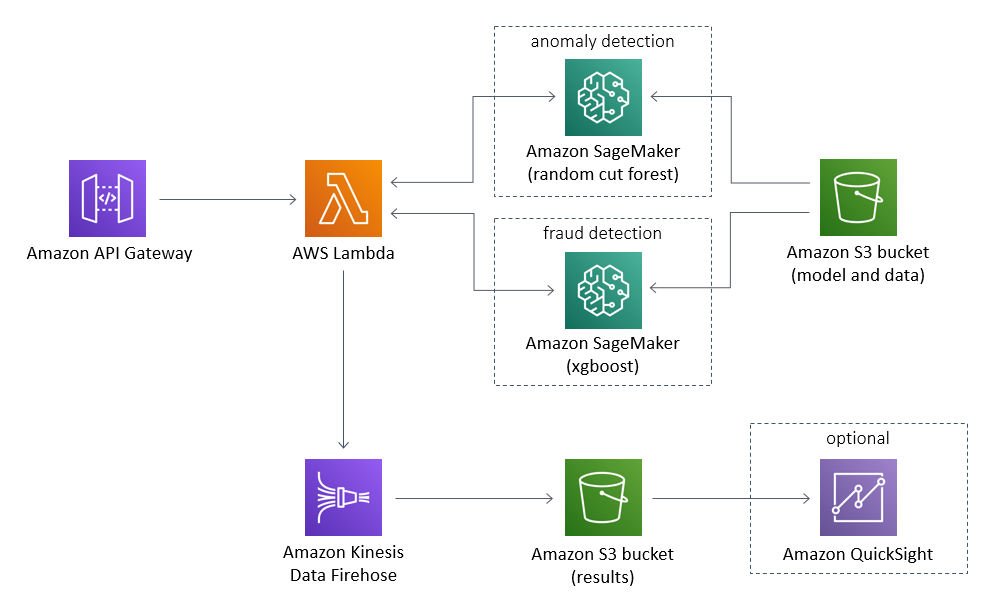

The project architecture deployed by the cloud formation template is shown here.

The project uses Amazon SageMaker to train both a supervised and an unsupervised machine learning models, which are then deployed using Amazon Sagemaker-managed endpoints.

If you have labels for your data, for example if some of the transactions have been annotated as fraudulent and some as legitimate, then you can train a supervised learning model to learn to discern the two classes. In this project, we provide a recipe to train a gradient boosted decision tree model using XGBoost on Amazon SageMaker. The supervised model training process also handles the common issue of working with highly imbalanced data in fraud detection problems. The project addresses this issue into two ways by 1) implementing data upsampling using the "imbalanced-learn" package, and 2) using scale position weight to control the balance of positive and negative weights.

If you don't have labelled data or if you want to augment your supervised model predictions with an anomaly score from an unsupervised model, then the project also trains a RandomCutForest model using Amazon SageMaker. The RandomCutForest algorithm is trained on the entire dataset, without labels, and takes advantage of the highly imbalanced nature of fraud datasets, to predict higher anomaly scores for the fraudulent transactions in the dataset.

Both of the trained models are deployed to Amazon SageMaker managed real-time endpoints that host the models and can be invoked to provide model predictions for new transactions.

The model training and endpoint deployment is orchestrated by running a jupyter notebook on a SageMaker Notebook instance. The jupyter notebook runs a demonstration of the project using the aforementioned anonymized credit card dataset that is automatically downloaded to the Amazon S3 Bucket created when you launch the solution. However, the notebook can be modified to run the project on a custom dataset in S3. The notebook instance also contains some example code that shows how to invoke the REST API for inference.

In order to encapsulate the project as a stand-alone microservice, Amazon API Gateway is used to provide a REST API, that is backed by an AWS Lambda function. The Lambda function runs the code to preprocess incoming transactions, invoke sagemaker endpoints, merge results from both endpoints if necessary, store the model inputs and model predictions in S3 via Kinesis Firehose, and provide a response to the client.

The example dataset used in this solution was originally released as part of a research collaboration of Worldline and the Machine Learning Group (http://mlg.ulb.ac.be) of ULB (Université Libre de Bruxelles) on big data mining and fraud detection.

The dataset contains credit card transactions from European cardholders in 2013. As is common in fraud detection, it is highly unbalanced, with 492 fraudulent transactions out of the 284,807 total transactions. The dataset contains only numerical features, because the original features have been transformed for confidentiality using PCA. As a result, the dataset contains 28 PCA components, and two features that haven't been transformed, Amount and Time. Amount refers to the transaction amount, and Time is the seconds elapsed between any transaction in the data and the first transaction.

More details on current and past projects on related topics are available on https://www.researchgate.net/project/Fraud-detection-5 and the page of the DefeatFraud project

We cite the following works:

- Andrea Dal Pozzolo, Olivier Caelen, Reid A. Johnson and Gianluca Bontempi. Calibrating Probability with Undersampling for Unbalanced Classification. In Symposium on Computational Intelligence and Data Mining (CIDM), IEEE, 2015

- Dal Pozzolo, Andrea; Caelen, Olivier; Le Borgne, Yann-Ael; Waterschoot, Serge; Bontempi, Gianluca. Learned lessons in credit card fraud detection from a practitioner perspective, Expert systems with applications,41,10,4915-4928,2014, Pergamon

- Dal Pozzolo, Andrea; Boracchi, Giacomo; Caelen, Olivier; Alippi, Cesare; Bontempi, Gianluca. Credit card fraud detection: a realistic modeling and a novel learning strategy, IEEE transactions on neural networks and learning systems,29,8,3784-3797,2018,IEEE

- Dal Pozzolo, Andrea Adaptive Machine learning for credit card fraud detection ULB MLG PhD thesis (supervised by G. Bontempi)

- Carcillo, Fabrizio; Dal Pozzolo, Andrea; Le Borgne, Yann-Aël; Caelen, Olivier; Mazzer, Yannis; Bontempi, Gianluca. Scarff: a scalable framework for streaming credit card fraud detection with Spark, Information fusion,41, 182-194,2018,Elsevier

- Carcillo, Fabrizio; Le Borgne, Yann-Aël; Caelen, Olivier; Bontempi, Gianluca. Streaming active learning strategies for real-life credit card fraud detection: assessment and visualization, International Journal of Data Science and Analytics, 5,4,285-300,2018,Springer International Publishing

deployment/fraud-detection-using-machine-learning.yaml: Creates AWS CloudFormation Stack for solution

source/lambdamodel-invocation/index.py: Lambda function script for invoking SageMaker endpoints for inference

notebooks/srcpackageconfig.py: Read in the environment variables set by cloudformation stack creationgenerate_endpoint_traffic.py: Custom script to show how to send transaction traffic to REST API for inferenceutil.py: Helper function and utilities

sagemaker_fraud_detection.ipynb: Orchestrates the solution. Trains the models and deploys the trained model

setup/on-start.sh: Bash script to setup sagemaker notebook environment with necessary dependencies

This project is licensed under the Apache-2.0 License.