CFM group assignment

-

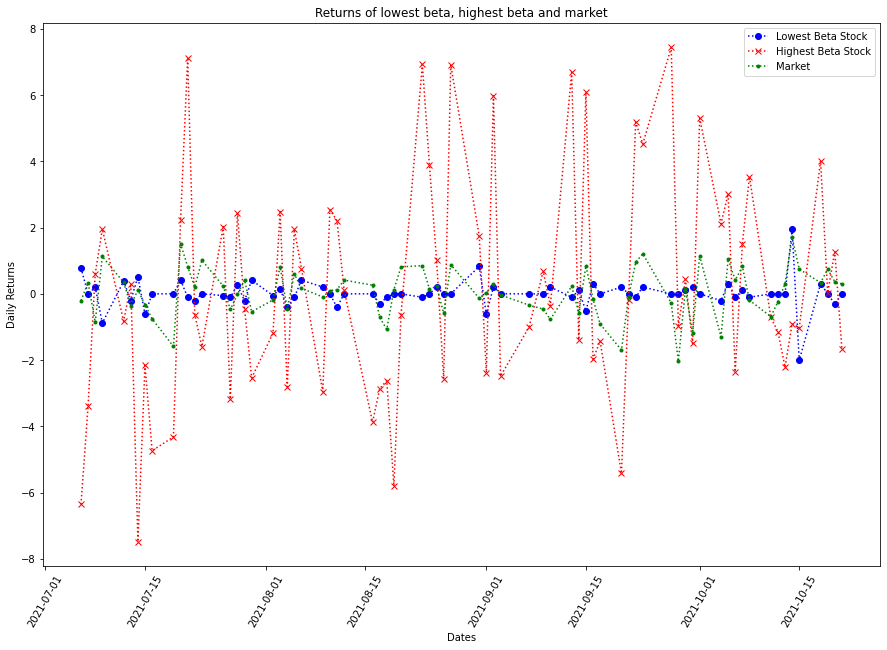

Target either the riskiest or safest portfolio

- Decided on targeting the safest portfolio

-

Read a .csv file containing a finite number of stock tickers

-

Only target US listed stocks

-

Stocks in the portfolio must have an average daily volume of at least 10 000 shares

-

Minimum of 10 - Maximum of 20 stocks

- No individual stock can make up more than 35% of the portfolio

- Must spend all $100 000 USD

-

Purchase stocks at the closing prices on November 26

-

Create a DataFrame called "FinalPortfolio"

- Index starts at 1 and ends at the number of stocks the code chose

- Have the following headings: Ticker, Price, Shares, Value, Weight

- Show the total adds to $100 000 and weight is 100%

- Second last output

-

Create final DataFrame "Stocks"

- Same index as "FinalPortfolio" but only has Ticker and Shares

- Must output DataFrame to a CSV file titled “Stocks_Group_18.csv”

-

At the end of the assignment, provide a declaration of contribution from each team member

- Code should be well commented

- Write and call functions when appropriate

- Avoid hardcoding

- Use loops where appropriate

- Why are the stocks picked those specific stocks?