Inverted_Yield_Curves

An inverse yield structure exists when long-term interest rates on the capital market are lower than short-term interest rates. Normally, the exact opposite is the case. Inverse yield curves rarely occur and are considered a quite solid signal for an upcoming economic recession.

Import libraries

import pandas as pd

import numpy as np

from matplotlib.dates import MonthLocator, YearLocator

import matplotlib.pyplot as plt

from datetime import date

from dateutil.relativedelta import relativedelta

import requests

from bs4 import BeautifulSoup

import datetime

import matplotlib.dates as mdates

from matplotlib.patches import RectangleDownload Yield data

We obtain the Treasury Par Yield Curve Rates from the official site of the U.S. DEPARTMENT OF THE TREASURY

%%time

yield_ = pd.DataFrame(columns=['1Mo','2Mo','3Mo','6Mo','1Yr','2Yr','3Yr','5Yr','7Yr','10Yr','20Yr','30Yr'])

time_range = range(1990,2023,1)

base_url = "https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value="

for i,year in enumerate(time_range):

url = base_url + str(year)

data = requests.get(url).text

soup = BeautifulSoup(data, 'html.parser')

table = soup.find('table')

df_soup = pd.read_html(str(table))[0]

# rearrange

df_soup = df_soup[['1 Mo','2 Mo','3 Mo','6 Mo','1 Yr','2 Yr','3 Yr','5 Yr','7 Yr','10 Yr','20 Yr','30 Yr']]

df_soup.columns = ['1Mo','2Mo','3Mo','6Mo','1Yr','2Yr','3Yr','5Yr','7Yr','10Yr','20Yr','30Yr']

df_soup.index = pd.to_datetime(pd.read_html(str(table))[0]['Date'])

# append and delete duplicates

yield_ = yield_.append(df_soup, ignore_index=False)

yield_.to_pickle("yield_data.pkl")

yield_.to_csv("yield_data.csv")| 1Mo | 2Mo | 3Mo | 6Mo | 1Yr | 2Yr | 3Yr | 5Yr | 7Yr | 10Yr | 20Yr | 30Yr | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1990-01-02 | nan | nan | 7.83 | 7.89 | 7.81 | 7.87 | 7.9 | 7.87 | 7.98 | 7.94 | nan | 8 |

| 1990-01-03 | nan | nan | 7.89 | 7.94 | 7.85 | 7.94 | 7.96 | 7.92 | 8.04 | 7.99 | nan | 8.04 |

| 1990-01-04 | nan | nan | 7.84 | 7.9 | 7.82 | 7.92 | 7.93 | 7.91 | 8.02 | 7.98 | nan | 8.04 |

| -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- |

| -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- |

| 2022-04-06 | 0.21 | 0.44 | 0.67 | 1.15 | 1.79 | 2.5 | 2.67 | 2.7 | 2.69 | 2.61 | 2.81 | 2.63 |

| 2022-04-07 | 0.21 | 0.5 | 0.68 | 1.15 | 1.78 | 2.47 | 2.66 | 2.7 | 2.73 | 2.66 | 2.87 | 2.69 |

| 2022-04-08 | 0.2 | 0.49 | 0.7 | 1.19 | 1.81 | 2.53 | 2.73 | 2.76 | 2.79 | 2.72 | 2.94 | 2.76 |

Calculation - Proportion how many yield curves are inverted?

def highlight_negative_values(cell):

if type(cell) != str and cell < 0 :

return 'color: red'

else:

return 'color: black'

def time_ft(time):

return str(time.strftime("%Y%m%d"))

def calculate_matrix():

df = pd.DataFrame(np.zeros((len(yield_.columns),len(yield_.columns))))

df.index = considered_yield_data.index

df.columns = df.index

df[:] = np.nan

for hor in range(0,len(df.index)):

for ver in range(0,len(df.index)):

if hor>ver:

df.iloc[hor,ver] = considered_yield_data.iloc[hor]-considered_yield_data.iloc[ver]

available_entries = (len(df))**2 - df.isna().sum().sum()

negative_entries = np.sum((df < 0).values.ravel())

inverted_percentage = round(negative_entries/available_entries*100,1)

return inverted_percentage, df.style.applymap(highlight_negative_values)

def add_patch(startdate,enddate):

start = mdates.date2num(startdate)

end = mdates.date2num(enddate)

width = end - start

range_in_days = (enddate-startdate).days

rect = Rectangle((start, ax.get_ylim()[0]), width, ax.get_ylim()[1] - ax.get_ylim()[0], color='yellow',alpha = 0.15)

ax.add_patch(rect)One specific date

yield_ = pd.read_pickle("yield_data.pkl")

considered_date = "2022-04-08"

considered_yield_data = yield_.loc[considered_date]

print("Proportion how many yield curves are inverted: " + str(calculate_matrix()[0]) + "%")

calculate_matrix()[1]| 1Mo | 2Mo | 3Mo | 6Mo | 1Yr | 2Yr | 3Yr | 5Yr | 7Yr | 10Yr | 20Yr | 30Yr | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1Mo | nan | nan | nan | nan | nan | nan | nan | nan | nan | nan | nan | nan |

| 2Mo | 0.29 | nan | nan | nan | nan | nan | nan | nan | nan | nan | nan | nan |

| 3Mo | 0.5 | 0.21 | nan | nan | nan | nan | nan | nan | nan | nan | nan | nan |

| 6Mo | 0.99 | 0.7 | 0.49 | nan | nan | nan | nan | nan | nan | nan | nan | nan |

| 1Yr | 1.61 | 1.32 | 1.11 | 0.62 | nan | nan | nan | nan | nan | nan | nan | nan |

| 2Yr | 2.33 | 2.04 | 1.83 | 1.34 | 0.72 | nan | nan | nan | nan | nan | nan | nan |

| 3Yr | 2.53 | 2.24 | 2.03 | 1.54 | 0.92 | 0.2 | nan | nan | nan | nan | nan | nan |

| 5Yr | 2.56 | 2.27 | 2.06 | 1.57 | 0.95 | 0.23 | 0.03 | nan | nan | nan | nan | nan |

| 7Yr | 2.59 | 2.3 | 2.09 | 1.6 | 0.98 | 0.26 | 0.06 | 0.03 | nan | nan | nan | nan |

| 10Yr | 2.52 | 2.23 | 2.02 | 1.53 | 0.91 | 0.19 | -0.01 | -0.04 | -0.07 | nan | nan | nan |

| 20Yr | 2.74 | 2.45 | 2.24 | 1.75 | 1.13 | 0.41 | 0.21 | 0.18 | 0.15 | 0.22 | nan | nan |

| 30Yr | 2.56 | 2.27 | 2.06 | 1.57 | 0.95 | 0.23 | 0.03 | 0 | -0.03 | 0.04 | -0.18 | nan |

Time period

%%time

yield_ = pd.read_pickle("yield_data.pkl")

inverted_percentage = []

for u in range(0,(yield_.shape[0])):

considered_yield_data = yield_.iloc[u]

inverted_percentage.append(calculate_matrix()[0])

yield_["inverted_percentage"] = inverted_percentage

yield_| 1Mo | 2Mo | 3Mo | 6Mo | 1Yr | 2Yr | 3Yr | 5Yr | 7Yr | 10Yr | 20Yr | 30Yr | inverted_percentage | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1990-01-02 | nan | nan | 7.83 | 7.89 | 7.81 | 7.87 | 7.9 | 7.87 | 7.98 | 7.94 | nan | 8 | 16.7 |

| 1990-01-03 | nan | nan | 7.89 | 7.94 | 7.85 | 7.94 | 7.96 | 7.92 | 8.04 | 7.99 | nan | 8.04 | 16.7 |

| 1990-01-04 | nan | nan | 7.84 | 7.9 | 7.82 | 7.92 | 7.93 | 7.91 | 8.02 | 7.98 | nan | 8.04 | 13.9 |

| -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- |

| -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- |

| 2022-04-06 | 0.21 | 0.44 | 0.67 | 1.15 | 1.79 | 2.5 | 2.67 | 2.7 | 2.69 | 2.61 | 2.81 | 2.63 | 12.1 |

| 2022-04-07 | 0.21 | 0.5 | 0.68 | 1.15 | 1.78 | 2.47 | 2.66 | 2.7 | 2.73 | 2.66 | 2.87 | 2.69 | 7.6 |

| 2022-04-08 | 0.2 | 0.49 | 0.7 | 1.19 | 1.81 | 2.53 | 2.73 | 2.76 | 2.79 | 2.72 | 2.94 | 2.76 | 7.6 |

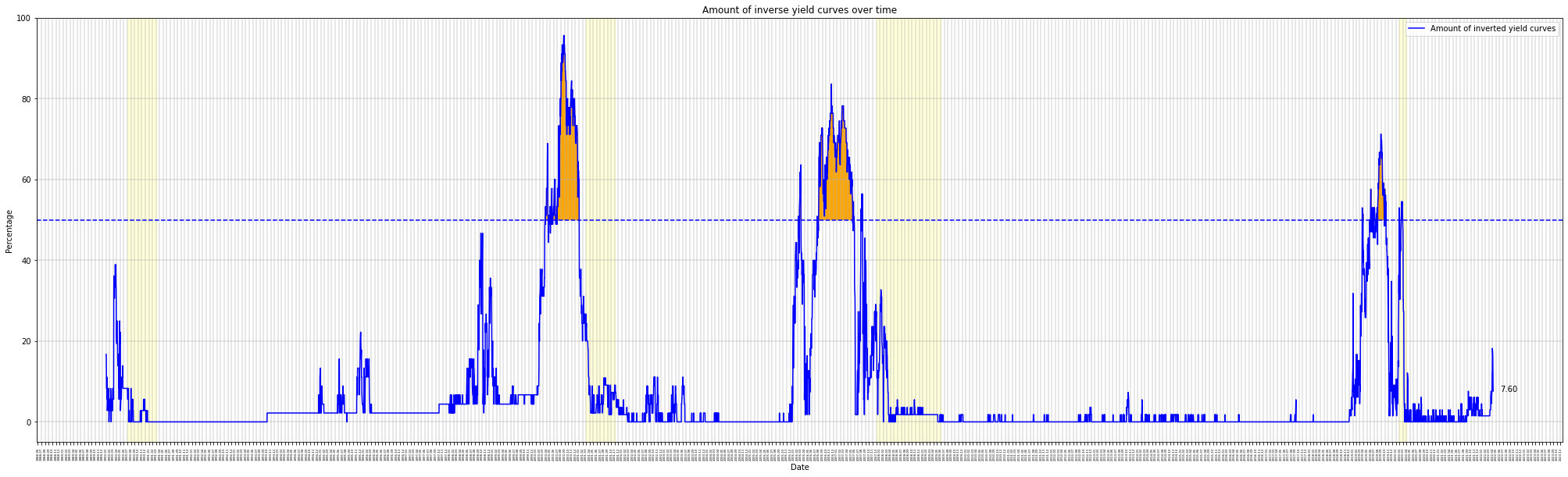

Recessions

When did economic recessions take place

### https://en.wikipedia.org/wiki/List_of_recessions_in_the_United_States

from datetime import date

r1_start,r1_end = date(1990,7,1), date(1991,3,1)

r2_start,r2_end = date(2001,3,1), date(2001,11,1)

r3_start,r3_end = date(2007,12,1), date(2009,6,1)

r4_start,r4_end = date(2020,2,1), date(2020,4,1)

recessions = [[r1_start,r1_end],

[r2_start,r2_end],

[r3_start,r3_end],

[r4_start,r4_end]]fig,ax = plt.subplots(figsize=(35,10))

ax.plot(yield_.index, yield_["inverted_percentage"], label='Amount of inverted yield curves', linewidth=1.5, color = "blue")

ax.axhline(y=50, linewidth = 1.5, linestyle='--', color = "blue")

ax.set_ylim(-5,100)

# add recessions as a rectangle inside the figure

for i,_ in enumerate(recessions):

add_patch(recessions[i][0],recessions[i][1])

# Annotation - current value

ax.annotate('%0.2f' % yield_["inverted_percentage"].iloc[-1], xy=(1, yield_["inverted_percentage"].iloc[-1]), xytext=(-80, 0),

xycoords=('axes fraction', 'data'), textcoords='offset points')

## critical area

treshold = 50

ax.fill_between(yield_.index, yield_["inverted_percentage"], treshold,

where=(treshold < yield_["inverted_percentage"]),

facecolor='orange', edgecolor='orange', alpha=1)

legend = ax.legend(loc='upper right')

mloc = MonthLocator()

ax.xaxis.set_major_locator(mloc)

ax.grid(True,linewidth=2,alpha = 0.3)

# Labeling

plt.xticks(fontsize=4, rotation=90)

ax.set_title('Amount of inverse yield curves over time')

plt.ylabel('Percentage')

plt.xlabel("Date")

# save figure

pdf_name = "Yield.pdf"

plt.savefig(pdf_name)Banks Tightening Standards for Commercial and Industrial Loans

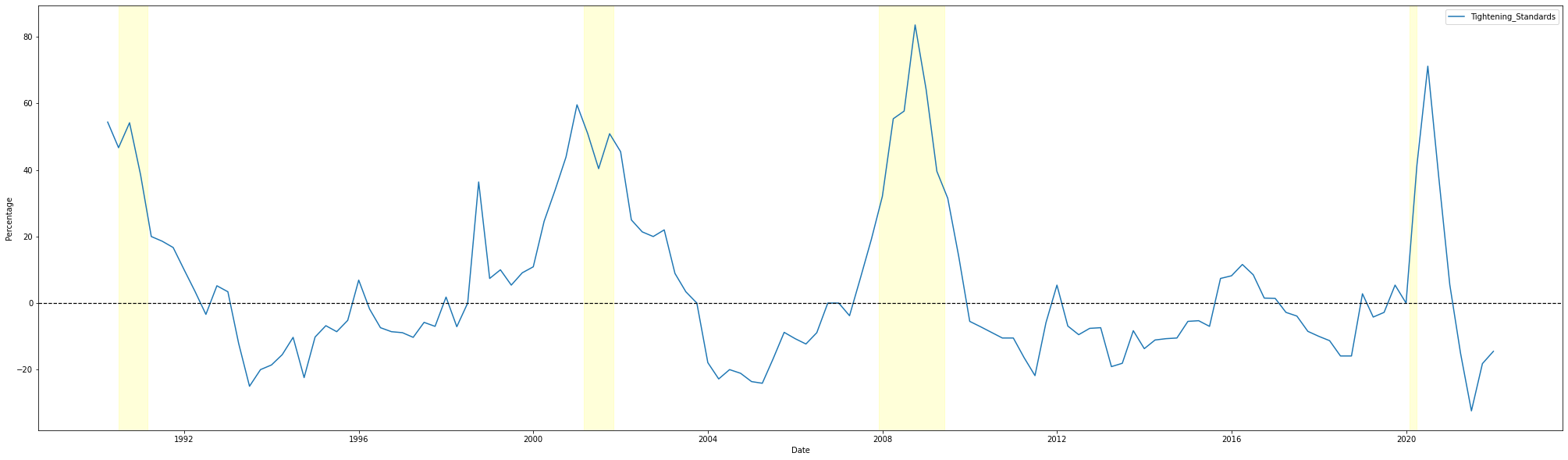

Net Percentage of Domestic Banks Tightening Standards for Commercial and Industrial LoansNet Percentage of Domestic Banks Tightening Standards for Commercial and Industrial Loans

Number of regional banks in the U.S. that stop lending (Thightening Standards). If a bank fears bad times are coming, then it will lend less. If banks hold back to the maximum, then there will potentially a crash

# https://fred.stlouisfed.org/series/DRTSCILM

Tightening_Standards_csv = r"****/DRTSCILM.csv"

Tightening_Standards_df = pd.read_csv(Tightening_Standards_csv, sep=',')

Tightening_Standards_df.index = pd.to_datetime(Tightening_Standards_df["DATE"])

Tightening_Standards_df.drop(['DATE'], axis=1,inplace = True)

fig,ax = plt.subplots(figsize=(35,10))

ax.plot(Tightening_Standards_df.index, Tightening_Standards_df["DRTSCILM"], label='Tightening_Standards', linewidth=1.5)

ax.axhline(y=0, color='k', linewidth = 1.2, linestyle='--')

for i,_ in enumerate(recessions):

add_patch(recessions[i][0],recessions[i][1])

plt.ylabel('Percentage')

plt.xlabel("Date")

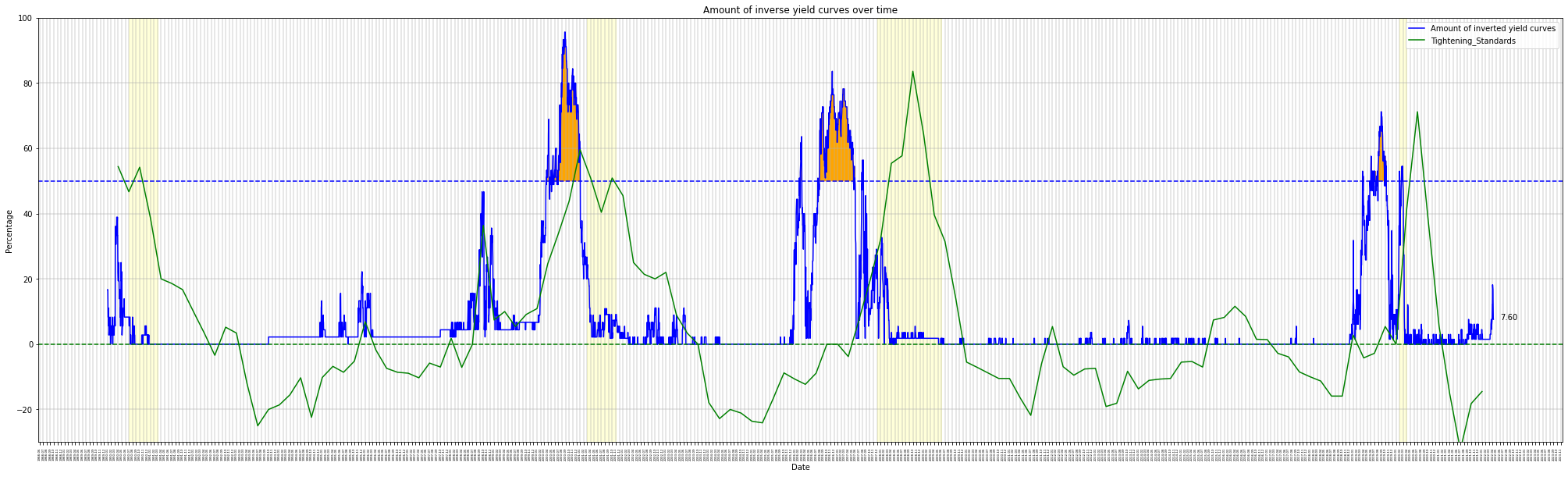

legend = ax.legend(loc='upper right')Combination of Yields and Banks Tightening Standards for Commercial and Industrial Loans

yield_part = pd.read_pickle("yield_data.pkl")

fig,ax = plt.subplots(figsize=(35,10))

ax.plot(yield_.index, yield_["inverted_percentage"], label='Amount of inverted yield curves', linewidth=1.5, color = "blue")

ax.axhline(y=50, linewidth = 1.5, linestyle='--', color = "blue")

ax.set_ylim(-30,100)

# add recessions as a rectangle inside the figure

for i,_ in enumerate(recessions):

add_patch(recessions[i][0],recessions[i][1])

# Annotation - current value

ax.annotate('%0.2f' % yield_["inverted_percentage"].iloc[-1], xy=(1, yield_["inverted_percentage"].iloc[-1]), xytext=(-80, 0),

xycoords=('axes fraction', 'data'), textcoords='offset points')

ax.plot(Tightening_Standards_df.index, Tightening_Standards_df["DRTSCILM"], label='Tightening_Standards', linewidth=1.5,color = "green")

ax.axhline(y=0, linewidth = 1.5, linestyle='--',color = "green")

## critical area

treshold = 50

ax.fill_between(yield_.index, yield_["inverted_percentage"], treshold,

where=(treshold < yield_["inverted_percentage"]),

facecolor='orange', edgecolor='orange', alpha=1)

legend = ax.legend(loc='upper right')

mloc = MonthLocator()

ax.xaxis.set_major_locator(mloc)

ax.grid(True,linewidth=2,alpha = 0.3)

# Labeling

plt.xticks(fontsize=4, rotation=90)

ax.set_title('Amount of inverse yield curves over time')

plt.ylabel('Percentage')

plt.xlabel("Date")

# save figure

pdf_name = "Yield.pdf"

plt.savefig(pdf_name)