python 2.7 or 3.x

pandas >= 0.18

numpy

matplotlib

selenium and PhantomJS

requests

plotly >= 1.9 (optional)

ipywidgets (optional)

bqplot (optional)

colour (optional)

git clone https://github.com/Yvictor/IVtws.git

cd IVtws

jupyter Notebook from IVtws import IVstream

form IPython .display import display

import matplotlib .pyplot as plt #with plotly interactive plot

from plotly .tools import mpl_to_plotly

from plotly .offline import iplot ,iplot_mpl ,init_notebook_mode

init_notebook_mode ()IVtw = IVstream ((8 ,45 ),(13 ,45 ))

IVtw .init_table (select_settled = 0 )#select_settled is the selectbox of option qoute's settlement date default is the first week option

買進

賣出

成交

成交價

漲跌

內含價值

時間價值

隱含波動率

組合價

總量

時間

TCUL

履約價

15

270.000

272.000

272.000

272.0

-37.000

268.3

3.7

13.84

9168.3

300

2016-10-14 13:44:29

3.001722

8900

17

178.000

179.000

178.000

178.0

-34.000

167.5

10.5

13.51

9167.5

988

2016-10-14 13:44:36

3.001333

9000

18

134.000

136.000

135.000

135.0

-36.000

117.0

18.0

13.24

9167.0

1142

2016-10-14 13:44:51

3.000500

9050

19

95.000

96.000

96.000

96.0

-34.000

68.0

28.0

12.54

9168.0

8657

2016-10-14 13:44:52

3.000444

9100

20

62.000

63.000

63.000

63.0

-33.000

17.0

46.0

12.26

9167.0

16032

2016-10-14 13:44:53

3.000389

9150

21

39.000

39.500

39.000

39.0

-26.000

0.0

39.0

12.05

9169.0

49552

2016-10-14 13:44:52

3.000444

9200

22

20.500

21.000

20.500

20.5

-20.500

0.0

20.5

11.72

9167.5

47770

2016-10-14 13:44:53

3.000389

9250

23

10.000

10.500

10.000

10.0

-13.000

0.0

10.0

11.58

9168.0

43563

2016-10-14 13:44:53

3.000389

9300

24

4.100

4.200

4.100

4.1

-7.400

0.0

4.1

11.29

9169.1

21033

2016-10-14 13:44:52

3.000444

9350

25

1.600

1.700

1.700

1.7

-2.800

0.0

1.7

11.57

9165.7

21693

2016-10-14 13:44:53

3.000389

9400

履約價

買進

賣出

成交價

成交

內含價值

時間價值

隱含波動率

組合價

漲跌

總量

TCUL

時間

11

8500

0.500

0.600

0.6

0.600

0.0

0.6

29.08

9189.4

-0.300

1926

3.001111

2016-10-14 13:44:40

12

8600

0.800

0.900

0.8

0.800

0.0

0.8

26.08

9189.2

-0.400

2605

3.000778

2016-10-14 13:44:46

13

8700

1.300

1.400

1.4

1.400

0.0

1.4

23.51

9181.6

-0.800

5801

3.000944

2016-10-14 13:44:43

14

8800

2.100

2.200

2.1

2.100

0.0

2.1

19.87

9167.9

-0.900

6778

3.000389

2016-10-14 13:44:53

15

8900

3.700

3.800

3.7

3.700

0.0

3.7

17.00

9168.3

-1.400

19534

3.000389

2016-10-14 13:44:53

16

8950

6.000

6.100

6.0

6.000

0.0

6.0

16.88

9182.0

-2.400

9207

3.000722

2016-10-14 13:44:47

17

9000

10.000

10.500

10.5

10.500

0.0

10.5

15.57

9167.5

-3.000

21161

3.000389

2016-10-14 13:44:53

18

9050

17.500

18.000

18.0

18.000

0.0

18.0

15.05

9167.0

-2.000

18981

3.000444

2016-10-14 13:44:52

19

9100

27.500

28.000

28.0

28.000

0.0

28.0

14.17

9168.0

-1.000

40078

3.000444

2016-10-14 13:44:52

20

9150

45.500

46.000

46.0

46.000

0.0

46.0

13.81

9167.0

2.500

37940

3.000444

2016-10-14 13:44:52

21

9200

70.000

71.000

70.0

70.000

31.0

39.0

13.57

9169.0

7.000

36969

3.000389

2016-10-14 13:44:53

22

9250

103.000

104.000

103.0

103.000

82.5

20.5

13.28

9167.5

13.000

12599

3.000500

2016-10-14 13:44:51

23

9300

141.000

142.000

142.0

142.000

132.0

10.0

13.28

9168.0

21.000

7654

3.000611

2016-10-14 13:44:49

24

9350

181.000

188.000

185.0

185.000

180.9

4.1

13.33

9169.1

24.000

1206

3.000389

2016-10-14 13:44:53

25

9400

232.000

239.000

236.0

236.000

234.3

1.7

14.29

9165.7

36.000

668

3.001722

2016-10-14 13:44:29

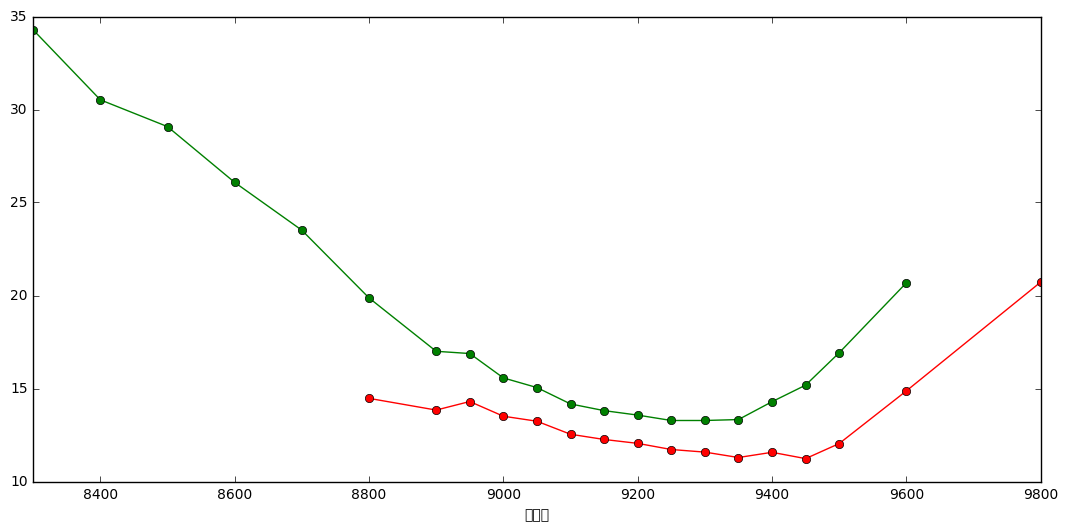

fig ,ax = plt .subplots (1 )

Call = IVtw .Call [IVtw .Call ['內含價值' ]< 450 ].set_index ('履約價' ,drop = False )

Put = IVtw .Put [IVtw .Put ['內含價值' ]< 450 ].set_index ('履約價' ,drop = False )

Call ['隱含波動率' ].plot (ax = ax ,figsize = (13 ,6 ),c = 'r' ,label = 'CallIV' ,marker = 'o' )

Put ['隱含波動率' ].plot (ax = ax ,figsize = (13 ,6 ),c = 'g' ,label = 'PutIV' ,marker = 'o' )

fig ,ax = plt .subplots (1 )

Call = IVtw .Call [IVtw .Call ['內含價值' ]< 500 ].set_index ('履約價' ,drop = False )

Put = IVtw .Put [IVtw .Put ['內含價值' ]< 500 ].set_index ('履約價' ,drop = False )

Call ['隱含波動率' ].plot (ax = ax ,figsize = (13 ,6 ),c = 'r' ,label = 'CallIV' )#,marker='o')

Put ['隱含波動率' ].plot (ax = ax ,figsize = (13 ,6 ),c = 'g' ,label = 'PutIV' )#,marker='o')

Call .plot .scatter (ax = ax , x = '履約價' ,y = '隱含波動率' ,s = Call ['時間價值' ]* 5 ,c = (0.7 ,0.3 ,0.3 ),edgecolor = (0.7 ,0.3 ,0.3 ))

Put .plot .scatter (ax = ax , x = '履約價' ,y = '隱含波動率' ,s = Put ['時間價值' ]* 5 ,c = (0.3 ,0.7 ,0.3 ),edgecolor = (0.3 ,0.7 ,0.3 ))

Call .plot .scatter (ax = ax , x = '履約價' ,y = '隱含波動率' ,s = Call ['內含價值' ],c = (0.7 ,0.7 ,0.9 ),edgecolor = (0.7 ,0.3 ,0.3 ))

Put .plot .scatter (ax = ax , x = '履約價' ,y = '隱含波動率' ,s = Put ['內含價值' ],c = (0.7 ,0.7 ,0.9 ),edgecolor = (0.3 ,0.7 ,0.3 ))

plotly_fig = mpl_to_plotly (fig )

plotly_fig ['layout' ]['showlegend' ] = True

iplot (plotly_fig )

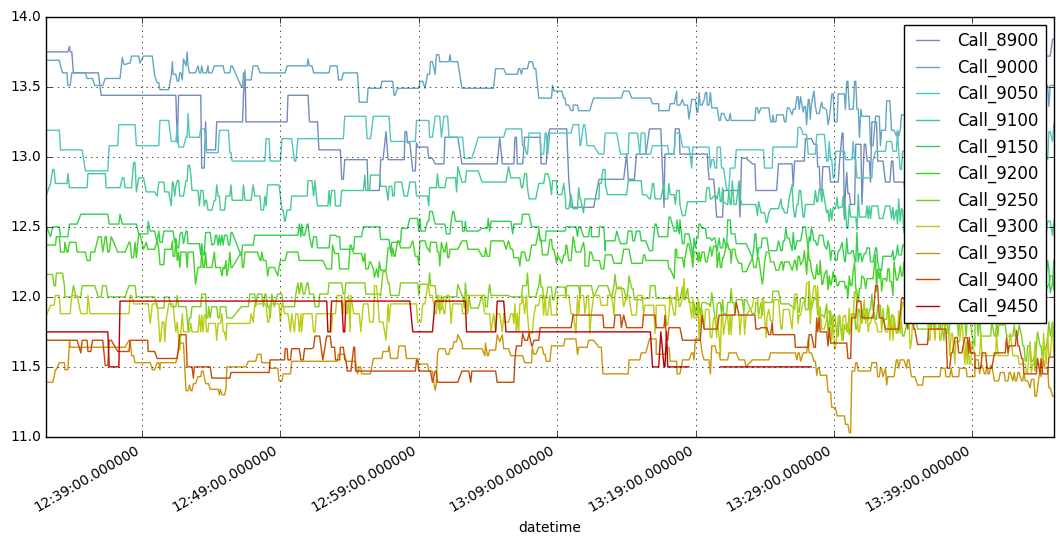

IVtw .CallIVtable .drop_duplicates ().plot (figsize = (13 ,6 ),grid = True ,

color = [i .hex for i in list (Color (rgb = (0.45 ,0.55 ,0.75 )).range_to (Color (rgb = (0.75 ,0 ,0 )), len (IVtw .CallIVtable .columns .tolist ())))])

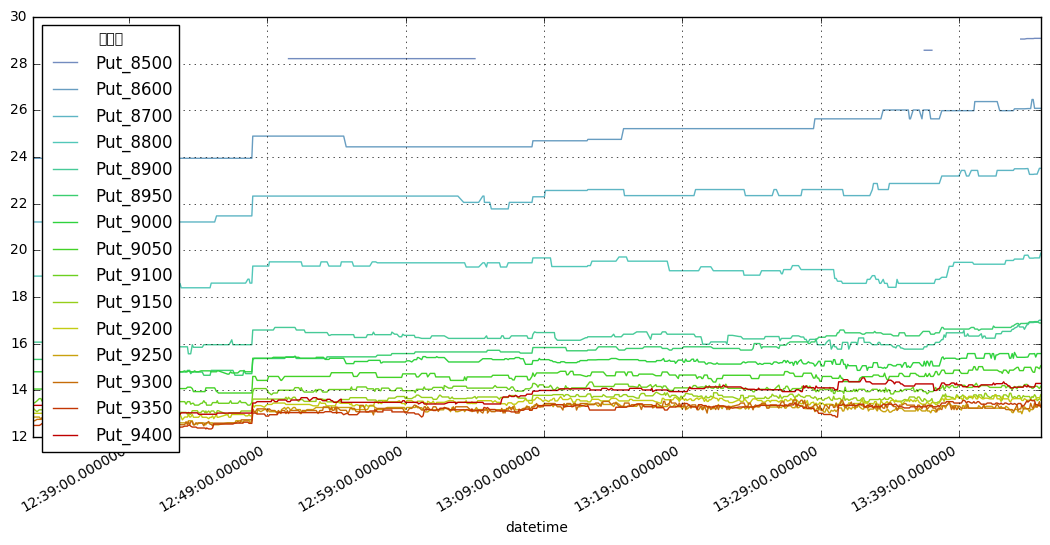

IVtw .PutIVtable .drop_duplicates ().plot (figsize = (13 ,6 ),grid = True ,

color = [i .hex for i in list (Color (rgb = (0.45 ,0.55 ,0.75 )).range_to (Color (rgb = (0.75 ,0 ,0 )), len (IVtw .PutIVtable .columns .tolist ())))])

from ipywidgets import interactive ,IntSlider ,FloatSlider ,Dropdown ,Button ,fixed ,HBox ,VBox ,Layout widg = interactive (IVtw .creatSTwithPlot ,futshare = IntSlider (min = - 5 ,max = 5 ,step = 1 ),

Cal1 = IVtw .Callless ['履約價' ].tolist (),c1share = IntSlider (min = - 5 ,max = 5 ,step = 1 ),

Cal2 = IVtw .Callless ['履約價' ].tolist (),c2share = IntSlider (min = - 5 ,max = 5 ,step = 1 ),

Put1 = IVtw .Putless ['履約價' ].tolist (),p1share = IntSlider (min = - 5 ,max = 5 ,step = 1 ),

Put2 = IVtw .Putless ['履約價' ].tolist (),p2share = IntSlider (min = - 5 ,max = 5 ,step = 1 ),

showrange = IntSlider (min = 200 , max = 500 ,step = 50 ,value = 320 ),

up = IntSlider (min = 100 ,max = 500 ,step = 50 ),

down = IntSlider (min = 100 ,max = 500 ,step = 50 ),

customcur = FloatSlider (min = 0.1 ,max = 0.9 ,step = 0.1 ,value = 0.5 ),

risk_free_rate = FloatSlider (min = 0.010 ,max = 0.050 ,step = 0.005 ,value = 0.0136 ))#,__manual=True)#0.0136

#.layout = Layout(display='display', justify_content= 'space-between', align_items='center', width='100%')

HBox ([VBox (widg .children [:5 ]),VBox (widg .children [5 :10 ]),VBox (widg .children [10 :])])[['Call', 9400, 1.7, 9165.7000000000007, 1], ['Put', 9050, 18.0, 9167.0, -1]]