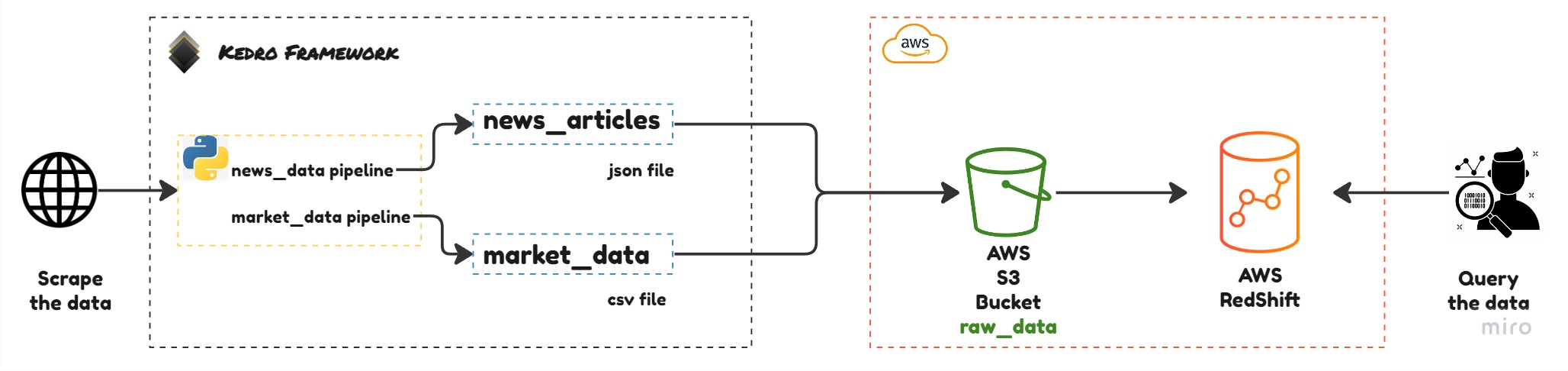

This is a robust data engineering solution focused on streamlining the collection, transformation, and analysis of financial data specific to gold as a commodity. This project aims to empower investment portfolio managers with timely and accurate insights for making informed decisions in the world of precious metals investments, gold against the us dollar.

What I learned

- handling market data (ohlc)

- web scraping using python

- sentiment analysis using LLMs

- text summarization

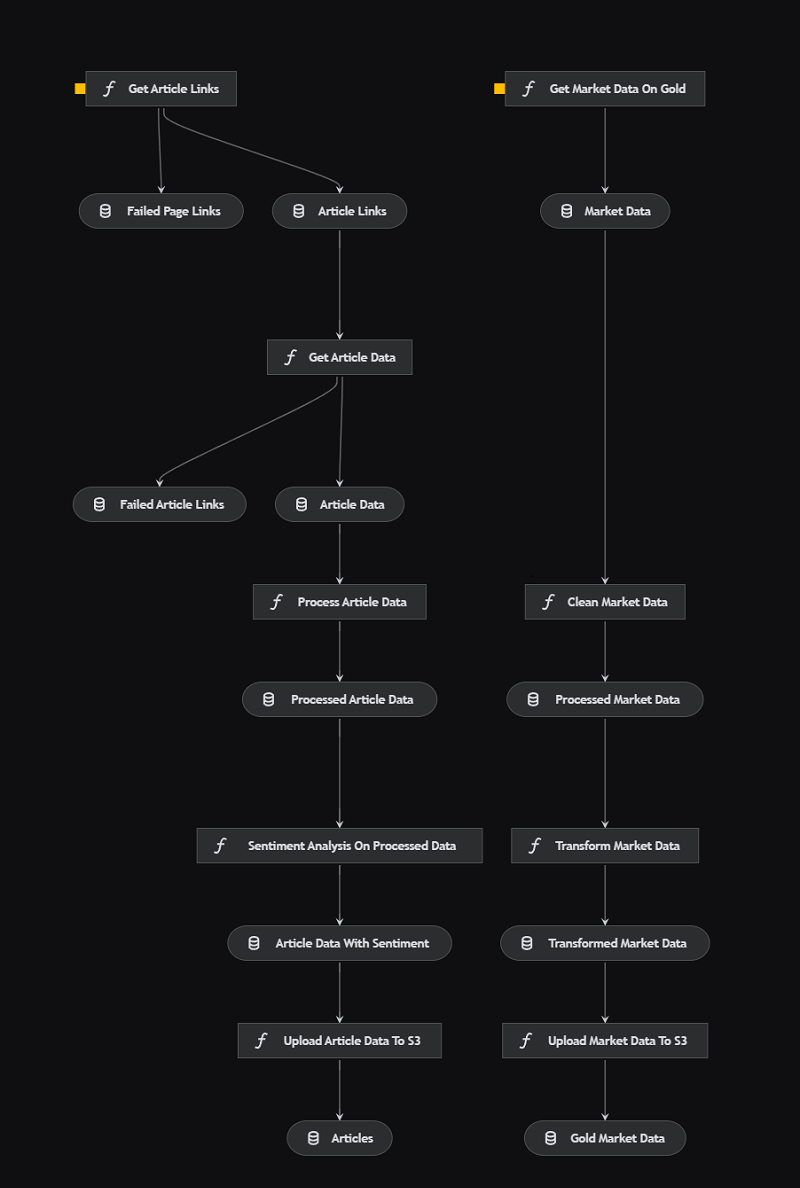

The news data pipeline

- Scrapes news articles from a website.

- Performs sentiment analysis on the articles.

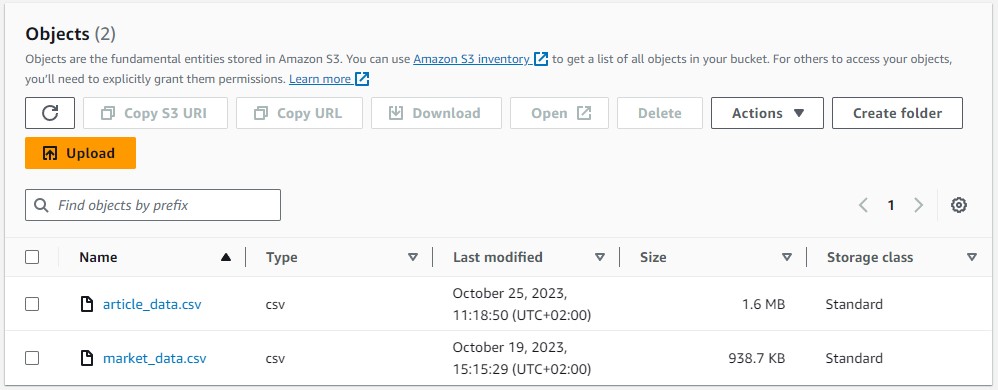

- Uploads the resulting datasets to AWS S3.

The market data pipeline

-

Scrapes ohlc market data via the twelvedata api.

-

Adds a new column based on the difference between the open price and close price.

-

Uploads the resulting datasets to AWS S3.

To get these pipelines up and running you have to run the following command:

kedro run

To learn how to set up a kedro project visit https://docs.kedro.org/en/stable/get_started/install.html

This project is licensed under the MIT License - see the LICENSE file for details.