Nifty Bank Data Analysis and Supertrend Indicator Backtesting: Exploring Trend Patterns and Performance Across Multiple Time Frames

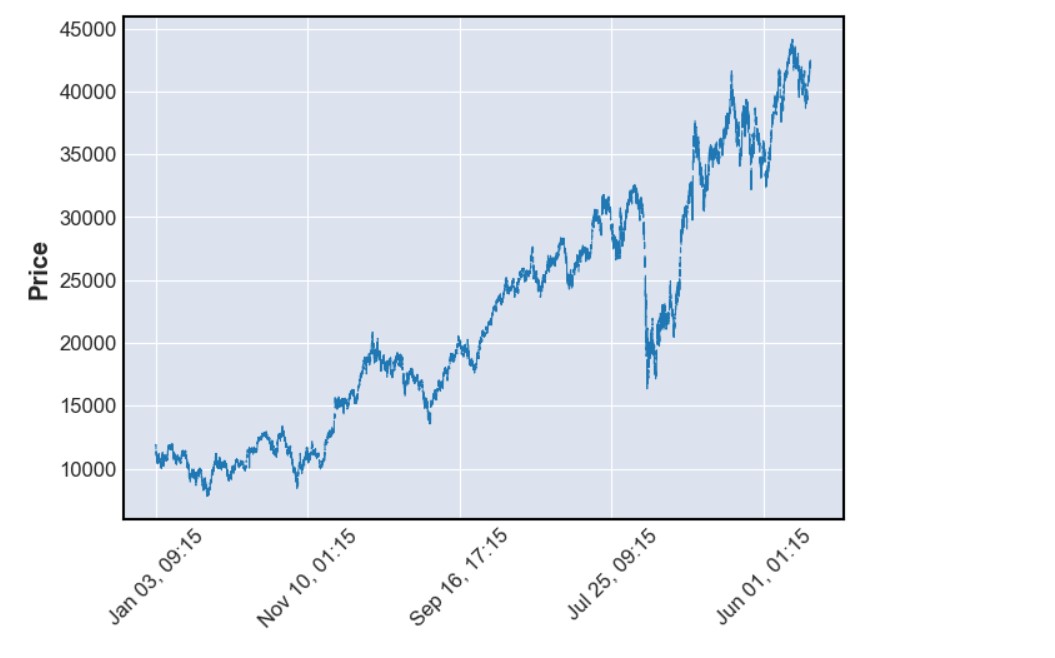

This project focuses on analyzing Nifty Bank data spanning from 2007 to May 2023. The data is resampled into various time frames, such as 5 minutes, 15 minutes, 1 hour, 1 week, and 1 month, in order to observe trends and patterns at different levels of detail.The Supertrend indicator, a popular technical analysis tool combining volatility and moving averages, is then applied to the resampled data to generate potential buy or short signals based on trend direction.Backtesting is performed on the different time frame data, comparing it with the Supertrend signals. Backtesting involves simulating trades using historical data to evaluate the performance and accuracy of a trading strategy. The results of the backtesting process provide insights into the effectiveness of the Supertrend indicator across different time frames. These findings will inform future trading strategies. However, it is important to acknowledge that past performance does not guarantee future results, and the success of a trading strategy can be influenced by market conditions and other factors. Consequently, thorough research and analysis will continue to be conducted before making any investment decisions