A modular dynamical-systems model of Fei Protocol's Protocol-controlled Value (PCV) Monetary Policy and proposed FEI Savings Rate mechanism, based on the open-source Python library radCAD.

This code repo is based on the CADLabs Ethereum Economic Model radCAD modelling & simulation project template.

See the Ethereum Economic Model README notebook for a good introduction to the radCAD experiment and modelling workflow.

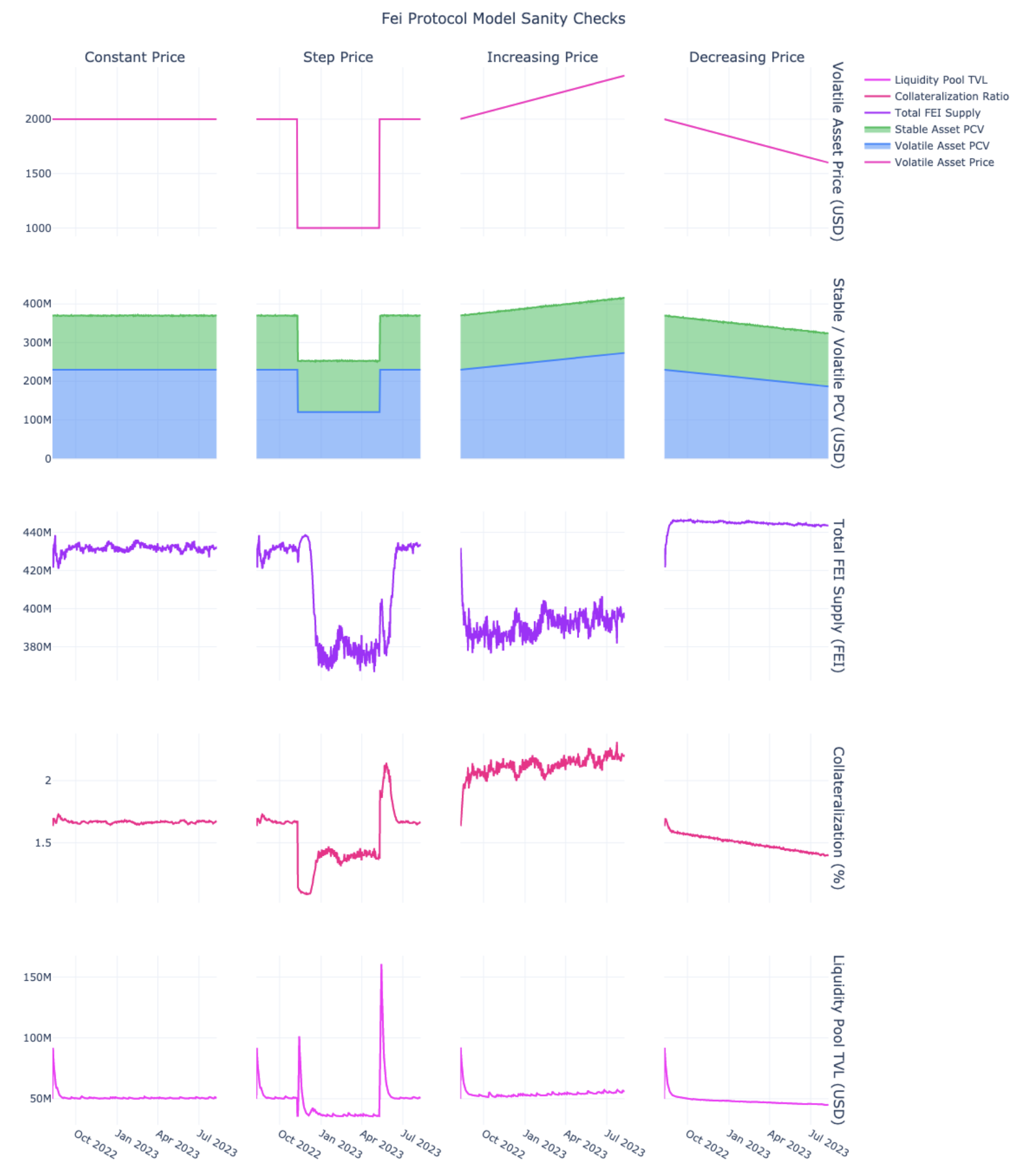

Excerpts from experiments/notebooks/1_sanity_checks.ipynb:

- Introduction

- Environment Setup

- Simulation Experiments

- Model Extension Roadmap

- Tests

- Change Log

- Acknowledgements

- Contributors

- License

The Fei Protocol Model was developed to support public policy making and management of protocol risk and health.

The objectives for the model for each stakeholder group identified during requirements specification were:

Stakeholder group 1: Fei Protocol Policy Makers

- Inform public policy and decision making by evaluating simulated protocol health, risk, resilience e.g. Contractionary Monetary Policy

- Inform effective management of PCV under different scenarios and failure modes

- Evaluate and sustainably increase demand for FEI

Stakeholder group 2: Fei Holders

- Obtain transparency and confidence as to the mechanics and resilience of the system behind PCV management

Stakeholder group 3: Tribe DAO

- Better understand the levers impacting PCV management

From these requirements, three System Goals were developed:

- Goal 1: Sustainably increase demand for FEI

- Goal 2: Manage PCV risk

- Goal 3: Optimise PCV capital efficiency

Finally, the model aimed to achieve the following outcomes:

- Ability to make model-informed design decisions, illuminating complex relationships and downstream effects

- Ability to support effective PCV management under different scenarios and failure modes

- Ability to simulate FEI demand with different FEI Savings Rates under different market conditions

A number of assumptions were made in the scoping and development of the model, and any suggested extensions outside the scope of the MVP modelling effort have been proposed in the modelling roadmap. The following is a list of features currently implemented in the model:

- Ability to implement PCV Management policies using a PCV Deposit Class with a familiar interface and standard methods for PCV movement and yield accrual

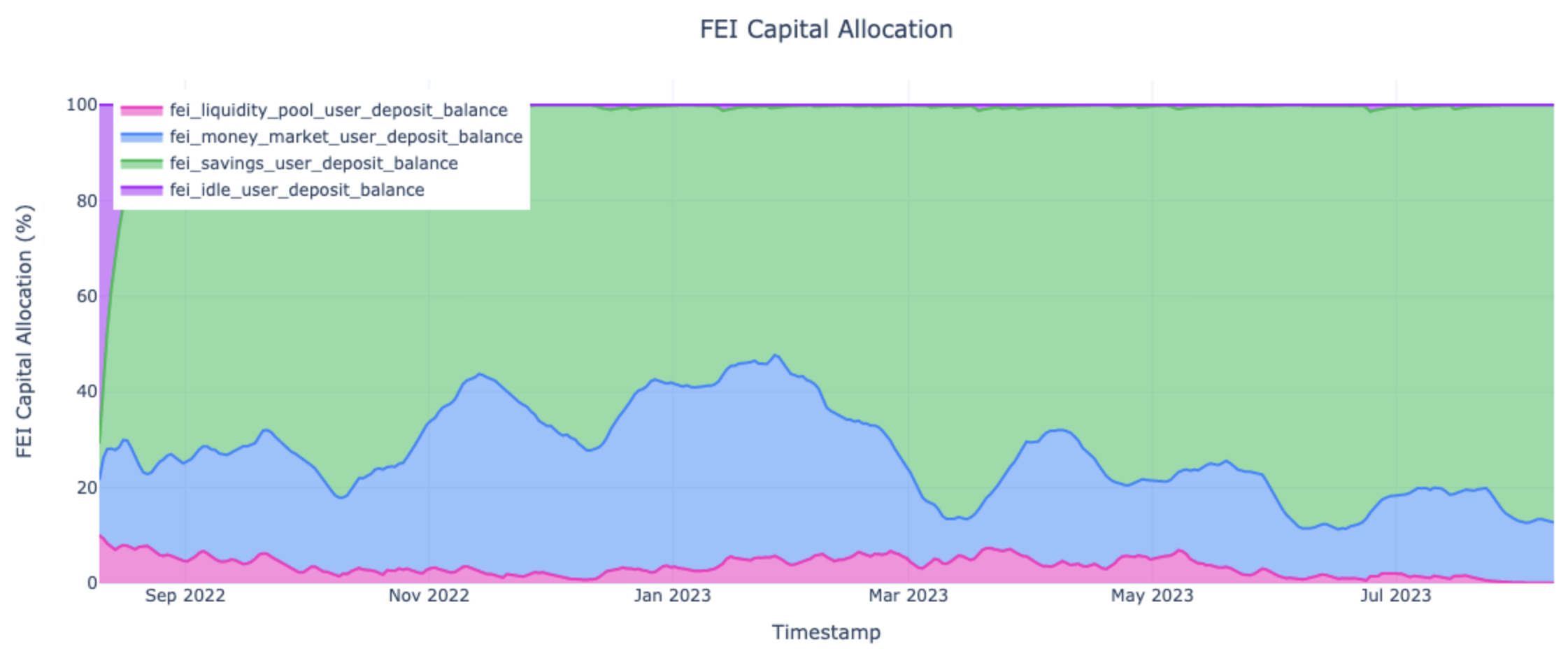

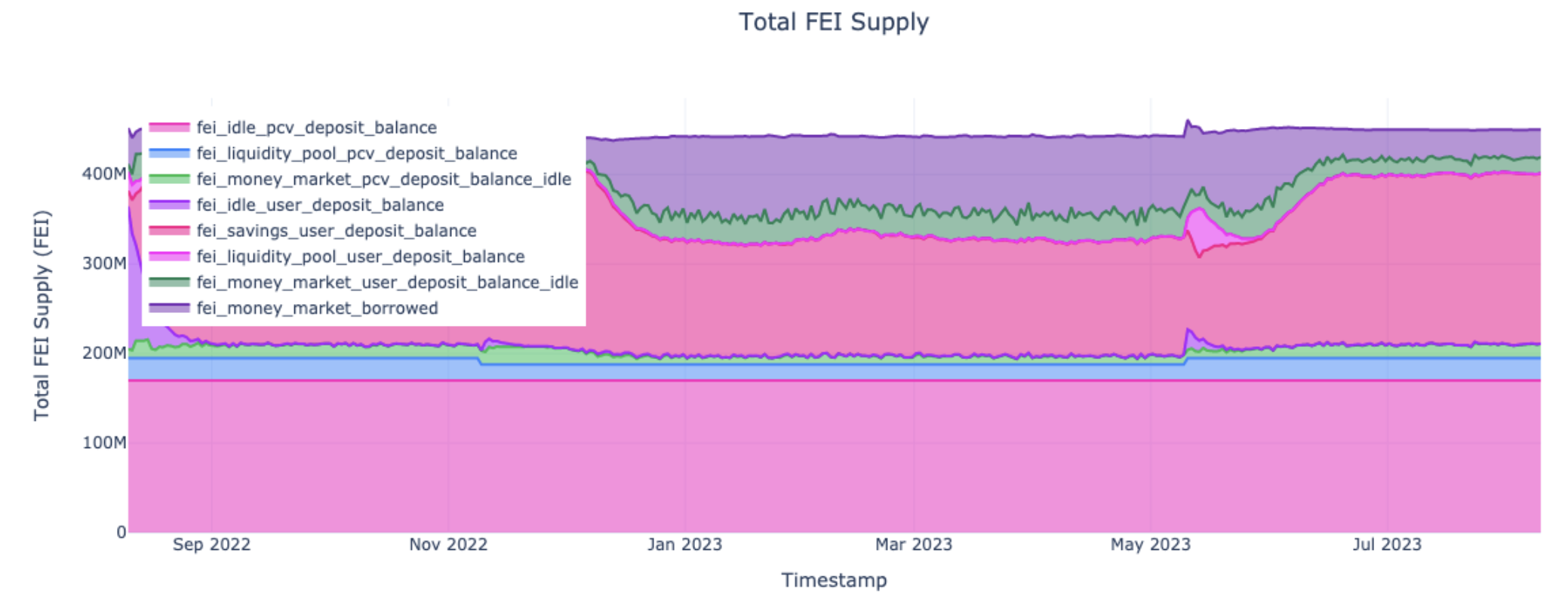

- A model of User-circulating FEI Capital Allocation that describes the aggregate movements of user-circulating FEI within the Fei Protocol ecosystem User Deposits based on yield and risk weighted user preferences

- A generic FEI-Volatile Liquidity Pool to model the dynamic of market condition dependent imbalances causing sourcing and sinking of FEI in the system

- A generic Money Market to model the FEI Savings Rate competing yield opportunity that exists for the FEI token

- Various System Metrics and KPIs including PCV at Risk used to evaluate the performance of the system

- Various Jupyter notebooks exploring relevant FIP monetary policy inspired analyses

- data/: Datasets and API data sources (such as Etherscan.io and Beaconcha.in) used in the model

- docs/: Misc. documentation such as auto-generated docs from Python docstrings and Markdown docs

- experiments/: Analysis notebooks and experiment workflow (such as configuration and execution)

- logs/: Experiment runtime log files

- model/: Model software architecture (structural and configuration modules)

- tests/: Unit and integration tests for model and notebooks

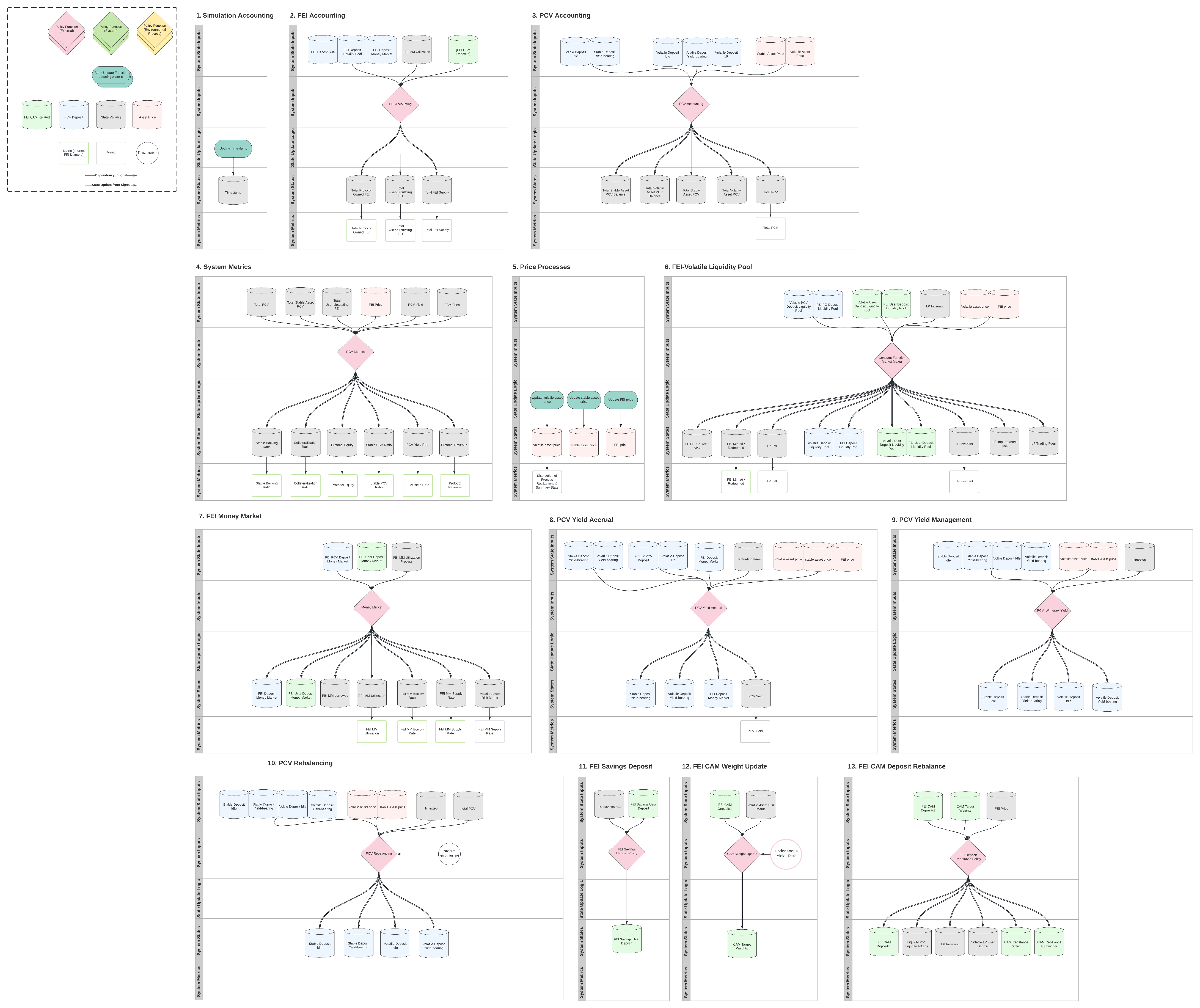

The model/ directory contains the model's software architecture in the form of two categories of modules: structural modules and configuration modules.

The model is composed of several structural modules in the model/parts/ directory:

| Module | Description |

|---|---|

| accounting.py | Assorted accounting of aggregate State Variables such as Protocol Owned FEI, User-circulating FEI, etc. |

| fei_capital_allocation.py | Implementation of a model enconding user-circulating FEI movements |

| fei_savings_deposit.py | Implementation of the FEI Savings Deposit |

| liquidity_pools.py | Implementation of a generic Uniswap style FEI-Volatile Liquidity Pool |

| money_markets.py | Implementation of a generic Aave/Compound style Money Market |

| pcv_management.py | Implementation of PCV management processes and strategies |

| pcv_yield.py | Implementation of PCV yield processes and strategies |

| peg_stability_module.py | Implementation of a Fei Peg Stability Module for minting and redemption |

| price_processes.py | State update functions for drawing samples from misc. projected or stochastic asset price processes |

| system_metrics.py | Assorted system metrics |

| uniswap.py | Uniswap style Constant Function Market Maker functions |

The model is configured using several configuration modules in the model/ directory:

| Module | Description |

|---|---|

| constants.py | Constants used in the model, e.g. number of epochs in a year, Gwei in 1 Ether |

| initialization.py | Code used to set up the Initial State of the model before each subset from the System Parameters |

| state_update_blocks.py | cadCAD model State Update Block structure, composed of Policy and State Update Functions |

| state_variables.py | Model State Variable definition, configuration, and defaults |

| stochastic_processes.py | Helper functions to generate stochastic environmental processes |

| system_parameters.py | Model System Parameter definition, configuration, and defaults |

| types.py | Various Python types used in the model, such as the PCVDeposit Class and calculation units |

| utils.py | Misc. utility and helper functions |

For a comprehensive list of modelling assumptions made see ASSUMPTIONS.md.

The Differential Model Specification depicts the model's overall structure across System States, System Inputs, System Parameters, State Update Logic and System Metrics.

In addition to the LucidChart link above, a copy of the diagram has been included below, and there is a PDF version.

The following steps guide you through how to set up a custom development environment using Python 3 and Jupyter.

Please note the following prerequisites before getting started:

- Python: tested with versions 3.8, 3.9

- NodeJS might be needed if using Plotly with Jupyter Lab (Plotly works out the box when using the Anaconda/Conda package manager with Jupyter Lab or Jupyter Notebook)

First, set up a Python 3 virtualenv development environment (or use the equivalent Anaconda step):

# Create a virtual environment using Python 3 venv module

python3 -m venv venv

# Activate virtual environment

source venv/bin/activateMake sure to activate the virtual environment before each of the following steps.

Secondly, install the Python 3 dependencies using Pip, from the requirements.txt file within your new virtual environment:

# Install Python 3 dependencies inside virtual environment

pip install -r requirements.txtTo create a new Jupyter Kernel specifically for this environment, execute the following command:

python3 -m ipykernel install --user --name python-cadlabs-fei --display-name "Python (CADLabs Fei Model)"You'll then be able to select the kernel with display name Python (CADLabs Fei Model) to use for your notebook from within Jupyter.

To start Jupyter Notebook or Lab (see notes about issues with using Plotly with Jupyter Lab):

jupyter notebook

# Or:

jupyter labFor more advanced Unix/macOS users, a Makefile is also included for convenience that simply executes all the setup steps. For example, to setup your environment and start Jupyter Lab:

# Setup environment

make setup

# Start Jupyter Lab

make start-labTo install and use Plotly with Jupyter Lab, you might need NodeJS installed to build Node dependencies, unless you're using the Anaconda/Conda package manager to manage your environment. Alternatively, use Jupyter Notebook which works out the box with Plotly.

See https://plotly.com/python/getting-started/

You might need to install the following "lab extension":

jupyter labextension install jupyterlab-plotly@4.14.3If you receive the following error and you use Anaconda, try: conda install -c anaconda pywin32

DLL load failed while importing win32api: The specified procedure could not be found.

The experiments/ directory contains modules for configuring and executing simulation experiments, as well as performing post-processing of the results.

The experiments/notebooks/ directory contains Jupyter notebooks exploring each part of the model as well as generic data analysis and model validation.

See experiments/notebooks/1_sanity_checks.ipynb

The purpose of this notebook is to perform a set of sanity checks that validate the expected key system dynamics, as well as the relationships between different key state variables. These analyses should also serve as an educational explanatory tool for less intuitive system dynamics and as an introduction to the model.

The purpose of this analysis is to illustrate and validate the driving influence of the Volatile Asset price on key system dynamics.

The purpose of this analysis is to illustrate and validate the relationships between and distribution of key system state variables using the model's default experiment initial state and system parameters.

The purpose of this analysis is to illustrate and validate the correlation between key system state variables.

The purpose of this analysis is to illustrate and validate the effect of a step change in the Volatile Asset price on the liquidity pool imbalance, resulting minting and redemption, and capital allocation.

See experiments/notebooks/2_fei_savings_rate.ipynb

The purpose of this notebook is to showcase how the radCAD Fei Protocol Model can leverage large-scale simulations to provide data-driven insights into monetary policy setting. Specifically, we’ll consider the development of a FEI Savings Rate according to existing FIPs, with relevant qualitative and probabilistic conclusions.

See experiments/notebooks/3_protocol_controlled_value.ipynb

The purpose of this notebook is to illustrate and evaluate the effect of a target Stable Backing Ratio and Contractionary Monetary Policy applied to Liquidity Pool protocol-owned liquidity on key system dynamics and KPIs.

This analysis serves to answer the what-if question: What leverage effect does protocol-owned liquidity have on total FEI supply and collateralization of the protocol in different market trends?

The analysis serves to answer the what-if question: What effect does a PCV management strategy targetting a Stable Backing Ratio have on PCV at Risk and collateralization of the protocol? We'll statistically evaluate the efficacy of different policy settings.

See experiments/notebooks/historical_datasets.ipynb

The purpose of this notebook is to perform Exploratory Data Analysis of real Fei Protocol datasets using checkthechain.

See experiments/notebooks/liquidity_pools_notebook.ipynb

The purpose of this notebook is to illustrate the operation of the generic FEI-Volatile Liquidity Pool subsystem.

See experiments/notebooks/money_markets_notebook.ipynb

The purpose of this notebook is to illustrate the operation of the generic Money Market subsystem.

See experiments/notebooks/pcv_management_notebook.ipynb

The purpose of this notebook is to illustrate PCV management strategies.

See experiments/notebooks/pcv_yield_notebook.ipynb

The purpose of this notebook is to illustrate PCV yield accrual and management.

The modular nature of the model makes structural and experiment-level extensions straightforward. The Model Extension Roadmap provides some inspiration.

We use Pytest to test the model module code, as well as the notebooks.

To execute the Pytest tests:

source venv/bin/activate

python3 -m pytest testsTo run the full GitHub Actions CI Workflow (see .github/workflows):

source venv/bin/activate

make testA notebook exists to perform simulation time profiling of individual State Update Blocks of the model, see [experiments/notebooks/simulation_profiling/simulation_timestep_substep_profiling.ipynb]. Simulation time profiling of PRs is also performed in the GitHub Action pipeline, and included in each PR by a bot. See the Makefile and GitHub Action file for more details.

Memory profiling can also be performed using the memory-profiler Python package:

make profile-memory target="tests/test_notebook_memory.py 1_sanity_checks.ipynb"See CHANGELOG.md for notable changes and versions.

Storm and the rest of the Fei Protocol team for their close collaboration and guidance in creating this model.

Thanks goes to these wonderful contributors (see emoji key):

cadlabsgt 💻 📖 🤔 🔬 👀 ✅ |

Benjamin Scholtz 📆 💻 📖 🤔 🔬 👀 |

vmeylan 💻 🤔 🔬 👀 |

Danilo Lessa Bernardineli 💻 🤔 🔬 |

sslivkoff 🤔 🔬 👀 🧑🏫 |

This project follows the all-contributors specification. Contributions of any kind welcome!

The code repository CADLabs/fei-protocol-model is licensed under the GNU General Public License v3.0.

Permissions of this strong copyleft license are conditioned on making available complete source code of licensed works and modifications, which include larger works using a licensed work under the same license. Copyright and license notices must be preserved. Contributors provide an express grant of patent rights.

If you'd like to cite this code and/or research, we suggest the following format:

CADLabs, Fei Protocol Model, (2023), GitHub repository, https://github.com/CADLabs/fei-protocol-model

@misc{CADLabs2023,

author = {CADLabs},

title = {Fei Protocol Model},

year = {2023},

publisher = {GitHub},

journal = {GitHub repository},

howpublished = {\url{https://github.com/CADLabs/fei-protocol-model}},

version = {v0.1.1}

}