| description |

|---|

Everything you need to know to get started in under 5 minutes |

Overview

Introduction

The Numerai Data Science tournament is where data scientists from around the world build machine learning models on Numerai's obfuscated financial dataset to predict the stock market.

If you are just getting started, this is the overview for you!

Data

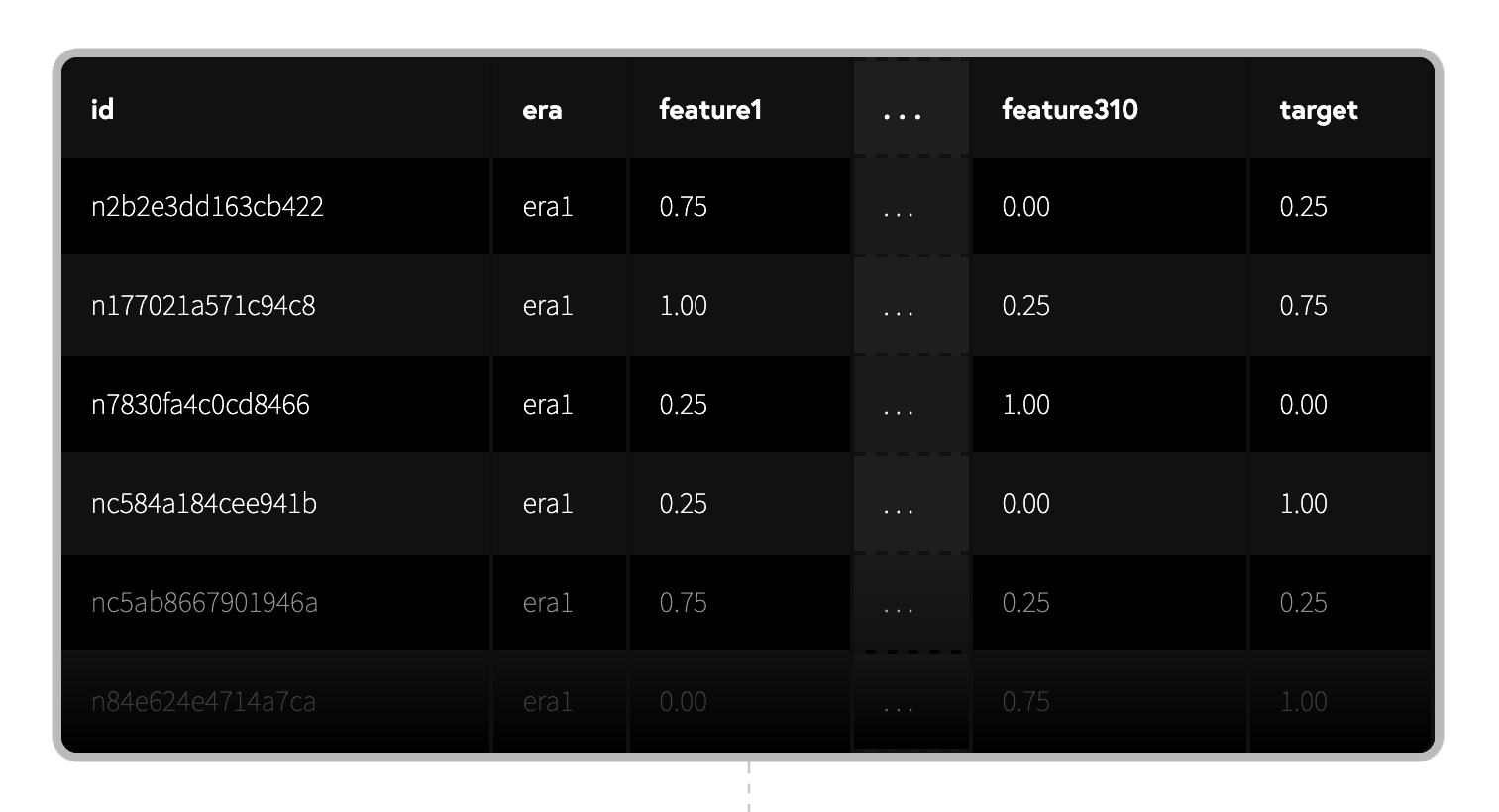

The Numerai dataset is a tabular dataset that describes the global stock market over time.

Each row represents a stock at a specific point in time, where id is the stock id and the era is the date. The features describe the known attributes of the stock at the time (eg. P/E ratio) and the target represents a measure of future returns (eg. after 20 days).

Here is how to download the data in Python using NumerAPI:

{% code lineNumbers="true" %}

# NumerAPI is the official Python client

from numerapi import NumerAPI

napi = NumerAPI()

# Download training data

napi.download_dataset("v4.1/train.parquet")

training_data = pd.read_parquet("v4.1/train.parquet"){% endcode %}

See the Data section for more details and examples.

Modeling

Your objective is to build machine learnings models to predict the target.

Here is an example model in Python using LightGBM:

import lightgbm as lgb

model = lgb.LGBMRegressor(

n_estimators=2000,

learning_rate=0.01,

max_depth=5,

num_leaves=2 ** 5,

colsample_bytree=0.1

)

model.fit(

training_data[[f for f in training_data.columns if "feature" in f]],

training_data["target"]

)See the Models section for more advanced example models.

Submissions

The tournament is organized into rounds starting Saturday, Tuesday, Wednesday, Thursday and Friday every week. Each round goes through 4 stages over the span of a month:

- Open: live features released and submission window open

- Closed: submission window closed

- Scoring: submissions begin scoring

- Resolved: scoring complete and payouts resolved

To compete in the tournament you must submit live predictions in every round. Here is an example in Python using NumerAPI:

# Authenticate

napi = numerapi.NumerAPI("api-public-id", "api-secret-key")

# Get current round

current_round = napi.get_current_round()

# Download latest live features

napi.download_dataset(f"v4.1/live_{current_round}.parquet")

live_data = pd.read_parquet(f"v4.1/live_{current_round}.parquet")

live_features = live_data[[f for f in live_data.columns if "feature" in f]]

# Generate live predictions

live_predictions = model.predict(live_features)

live_predictions.to_csv(f"prediction_{current_round}.csv")

# Submit predictions

napi.upload_predictions(f"prediction_{current_round}.csv", model_id="your-model-id")See the Submissions section for more details and examples.

Scoring

There are two main scores:

- Correlation (

CORR): Your prediction's correlation to the target - True contribution (

TC): Your prediction's contribution to the hedge fund's returns

Here are the CORR and TC scores of our example model over the past 1 year of submissions.

https://numer.ai/integration_test

See the Scoring section for more details.

Staking

You can stake NMR on your model to earn payouts based on performance.

Your payout is a primarily a function of your scores. If you have a positive score you will get a payout. If you have a negative score a portion of your stake will burn.

The maximum payout or burn per round is capped at ±5%

payout = stake * clip(payout_factor * (corr * corr_mult + tc * tc_mult), -0.05, 0.05) stakeis the your model's stake value at thecloseof the roundpayout_factoris a dynamic value that scales inversely with total NMR stakedcorr_multandtc_multare configured by you to control your exposure to each score

See the Staking section for more details.

Leaderboard

The 1 year average score is also called reputation and your rank on the leaderboard is based on your model's 1 year average TC score.

numer.ai/leaderboard

Support

Find us on Discord for questions, support, and feedback!

.png)

(1) (1).png)