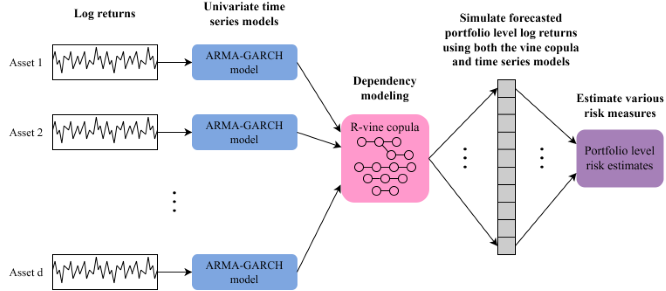

Portfolio level unconditional as well as conditional risk measure estimation for backtesting and stress testing using Vine Copula and ARMA-GARCH models. The package implements the proposed approaches in Sommer (2022) and Sommer et al. (2023).

You can install the released version of portvine from

CRAN with:

install.packages("portvine")You can install the development version of portvine from

GitHub with:

# install.packages("devtools")

devtools::install_github("EmanuelSommer/portvine")The implemented algorithms for the unconditional as well as conditional

portfolio level risk measure estimation are based on my masters thesis

at the chair of Mathematical Statistics at the TUM which you can find

here. The general idea of the

unconditional risk measure estimation approach is summarized in the

flowchart below for a

For the single conditional approach the general idea for a

If you want to get your hands dirty fast the Get Started vignette is a perfect fit for you as it showcases a minimal case study with a lot of code examples and some handy visualization functions that were not incorporated into the package as they are highly opinionated.

In order to grasp what is going on under the hood a look at the Under the hood article on the package website is advised before starting to use the package. There the most important algorithms used during the risk measure estimation are explained. If this doesn’t saturate your hunger for the theory behind the package you should take a look at Sommer (2022).

Moreover the help pages are quite detailed so feel free to have a look at them.

The risk estimation algorithms implemented in this package lend

themselves perfectly for parallel processing. In this package this is

enabled through the in my humble opinion amazing

future framework. For details please

have a look at the detailed section on parallel processing within the

help page of the estimate_risk_roll() function (or function reference

on the package website). Some performance measurements of different

parallel strategies and further information on the implemented

parallelisms are presented in the Parallel processing article on the

package website.

This package is built on the shoulder of giants most importantly the R

packages

rvinecopulib and

rugarch. Thus a big

thanks goes to all the contributors and maintainers! Also I would like

to thank Claudia Czado and Karoline Bax for giving me the opportunity to

work on this project in the first place and their dedicated

collaboration along the way!