Welcome to the Expatrio Tax Data Management App! This Flutter application is designed to streamline the process of managing tax residency information for users. It encompasses a set of features including a user-friendly login page, a dedicated screen with a prominent Call-to-Action (CTA) for updating tax data, and a convenient bottom sheet for seamless input and editing of tax-related information.

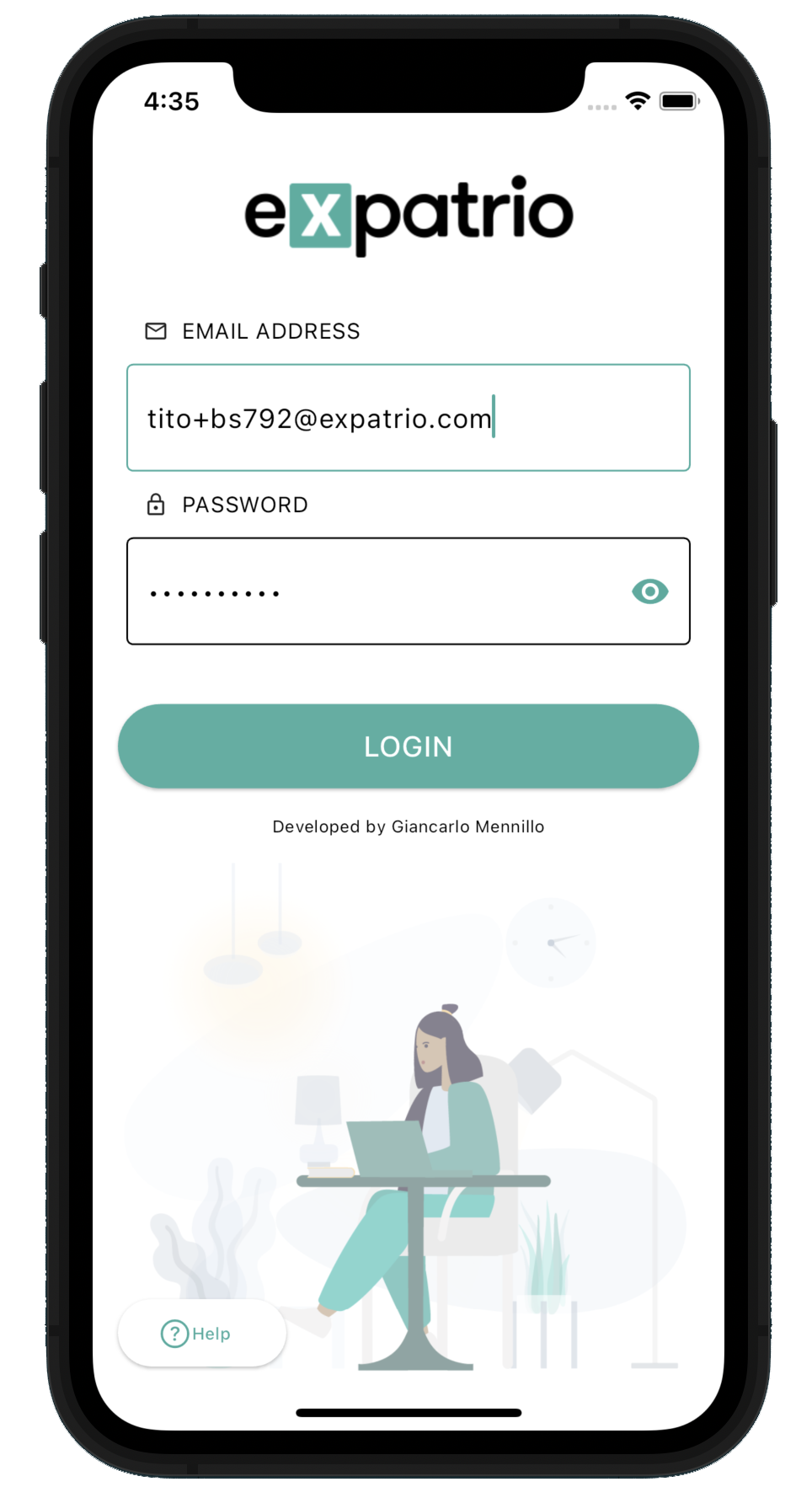

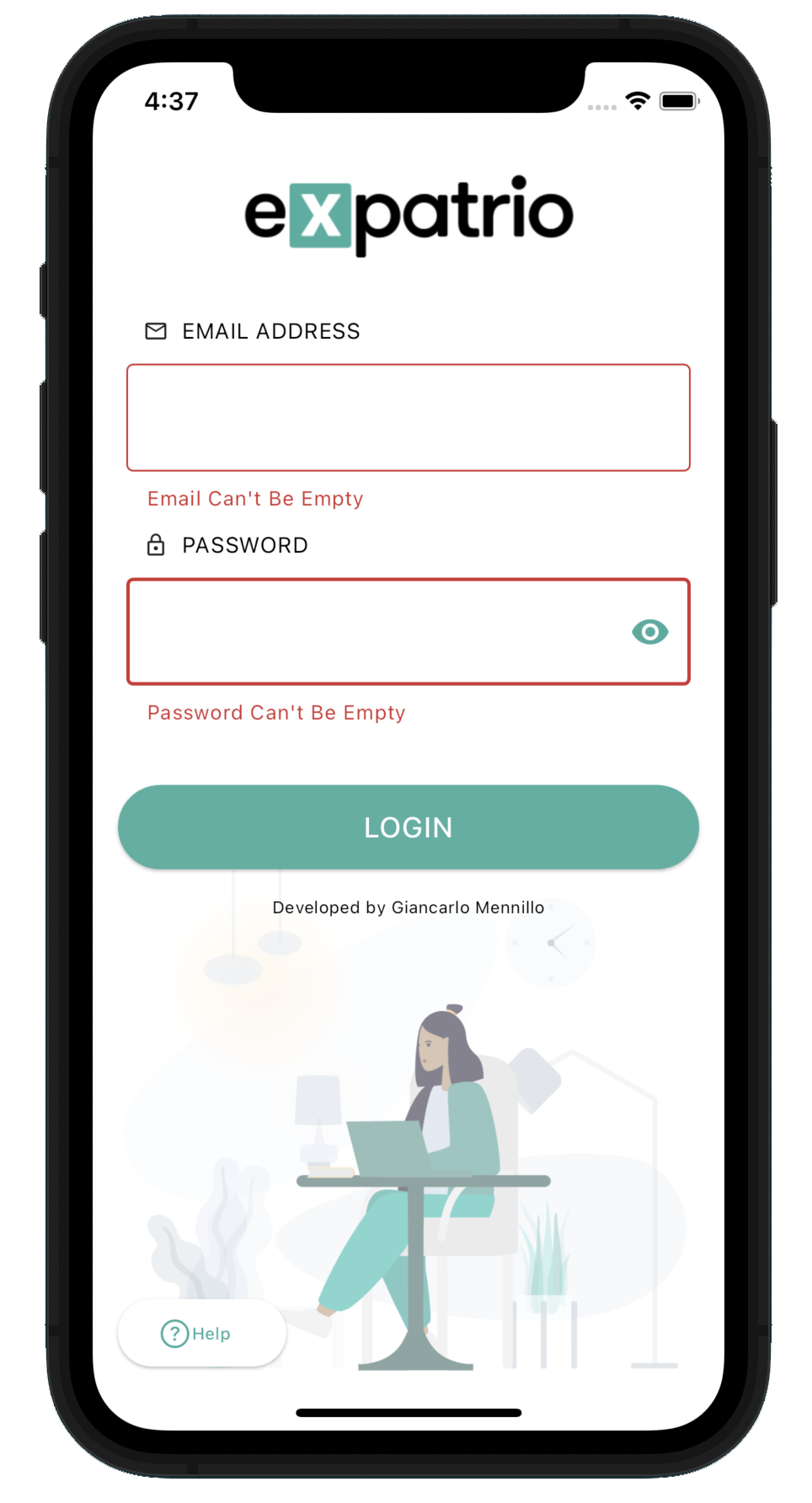

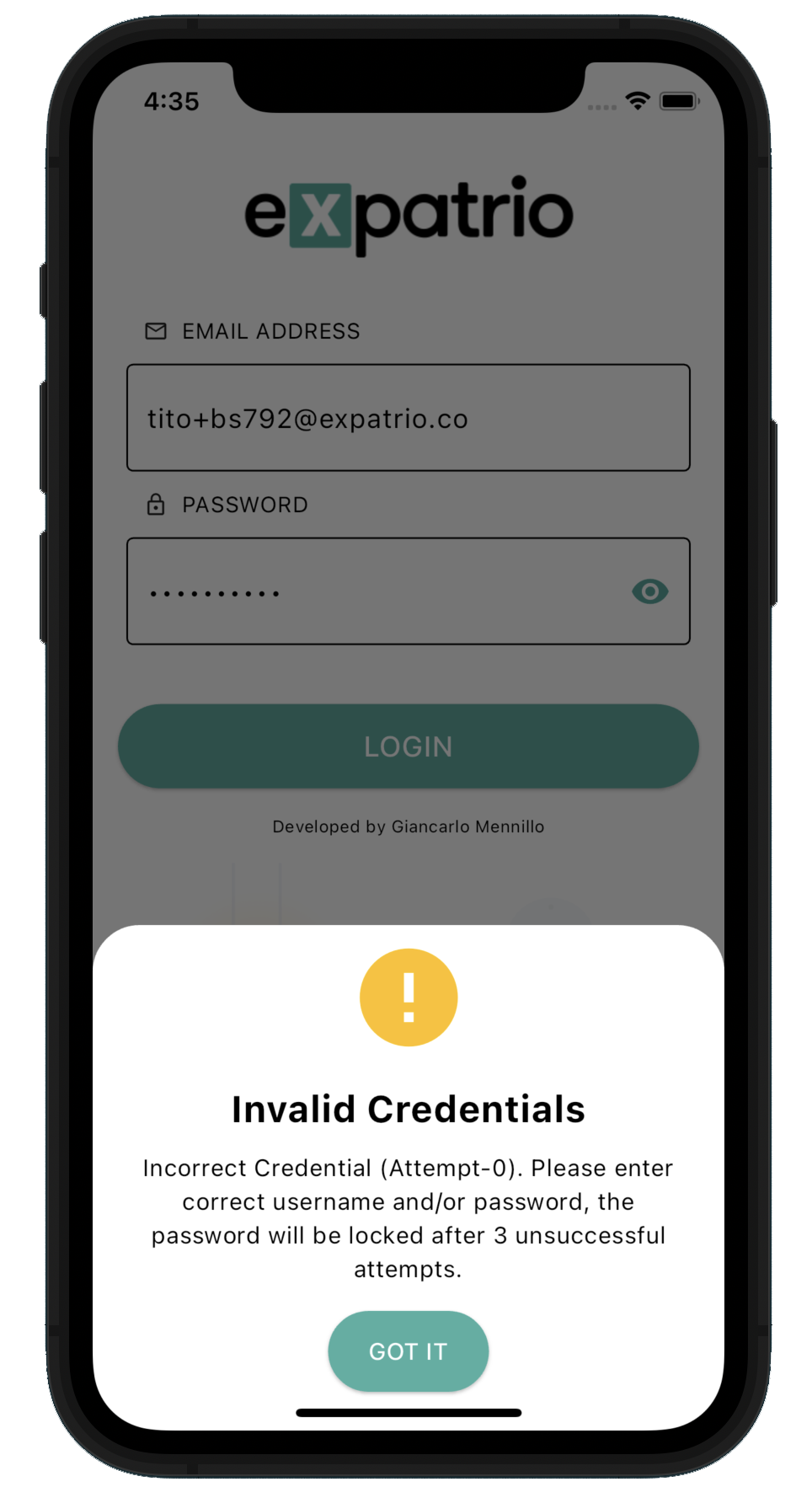

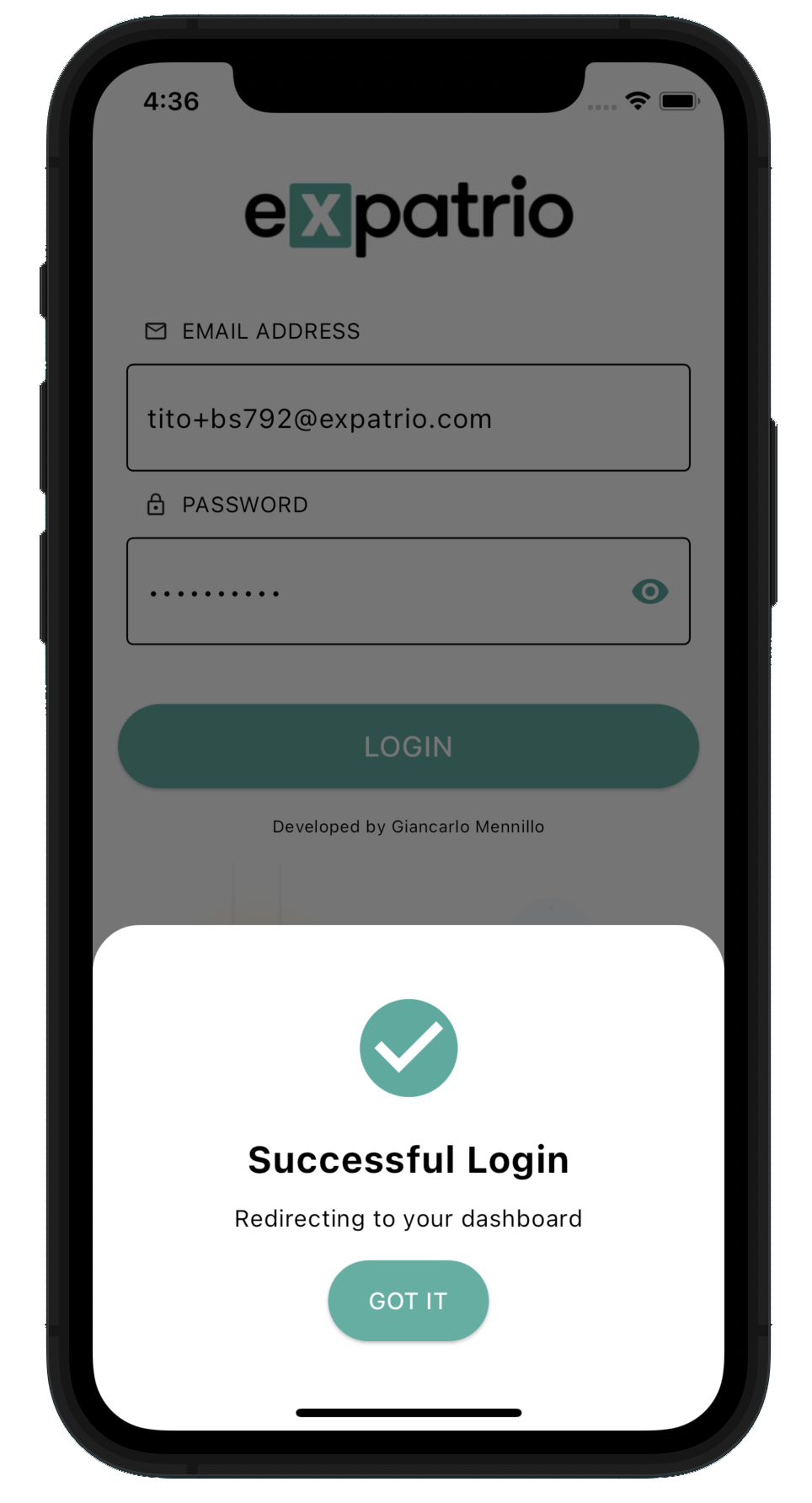

- Login Screen: A secure login page (with Expatrio authentication) that ensures users can access their tax-related information with confidence.

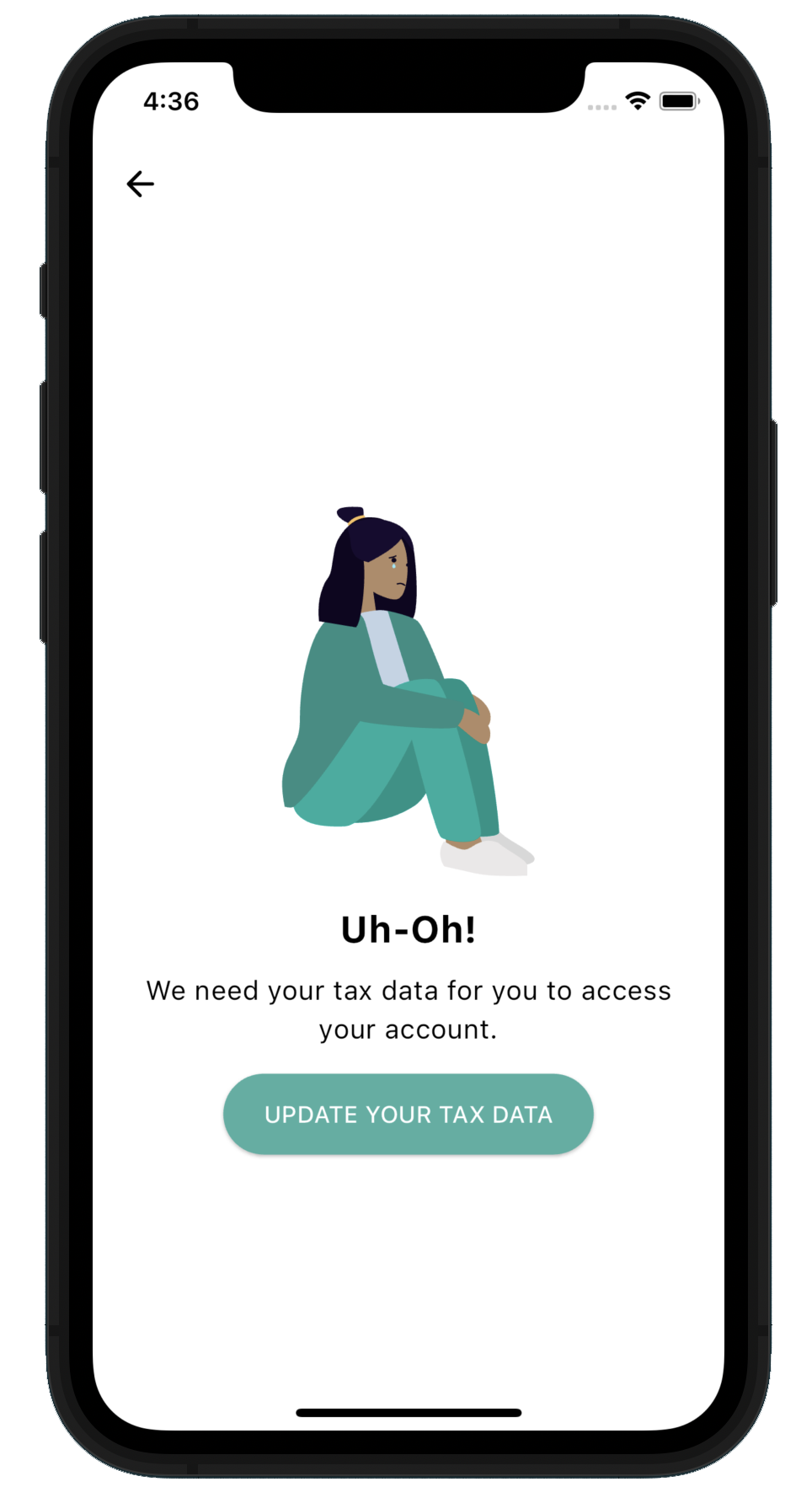

- Tax Data Screen: After a successful login, the user is redirect in the Tax Data Screen, a screen with a prominent CTA to update his TAX DATA. When the user clicks on the "UPDATE YOUR TAX DATA" button, a bottom sheet open, prompting the user to input their tax data.

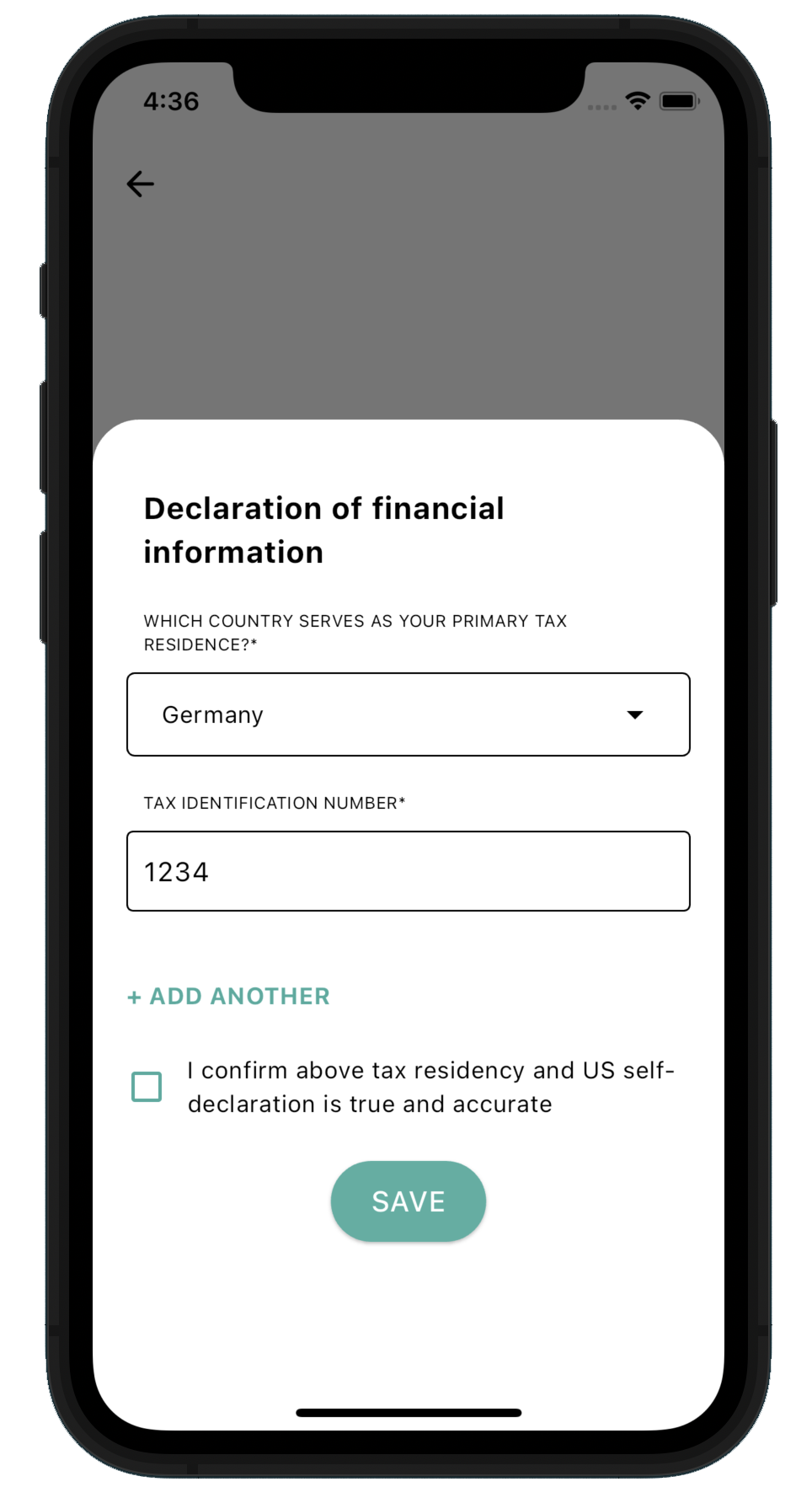

- Tax Form Widget: A flexible widget that facilitates the input of tax residency information, allowing users to efficiently manage their primary and secondary tax residences.

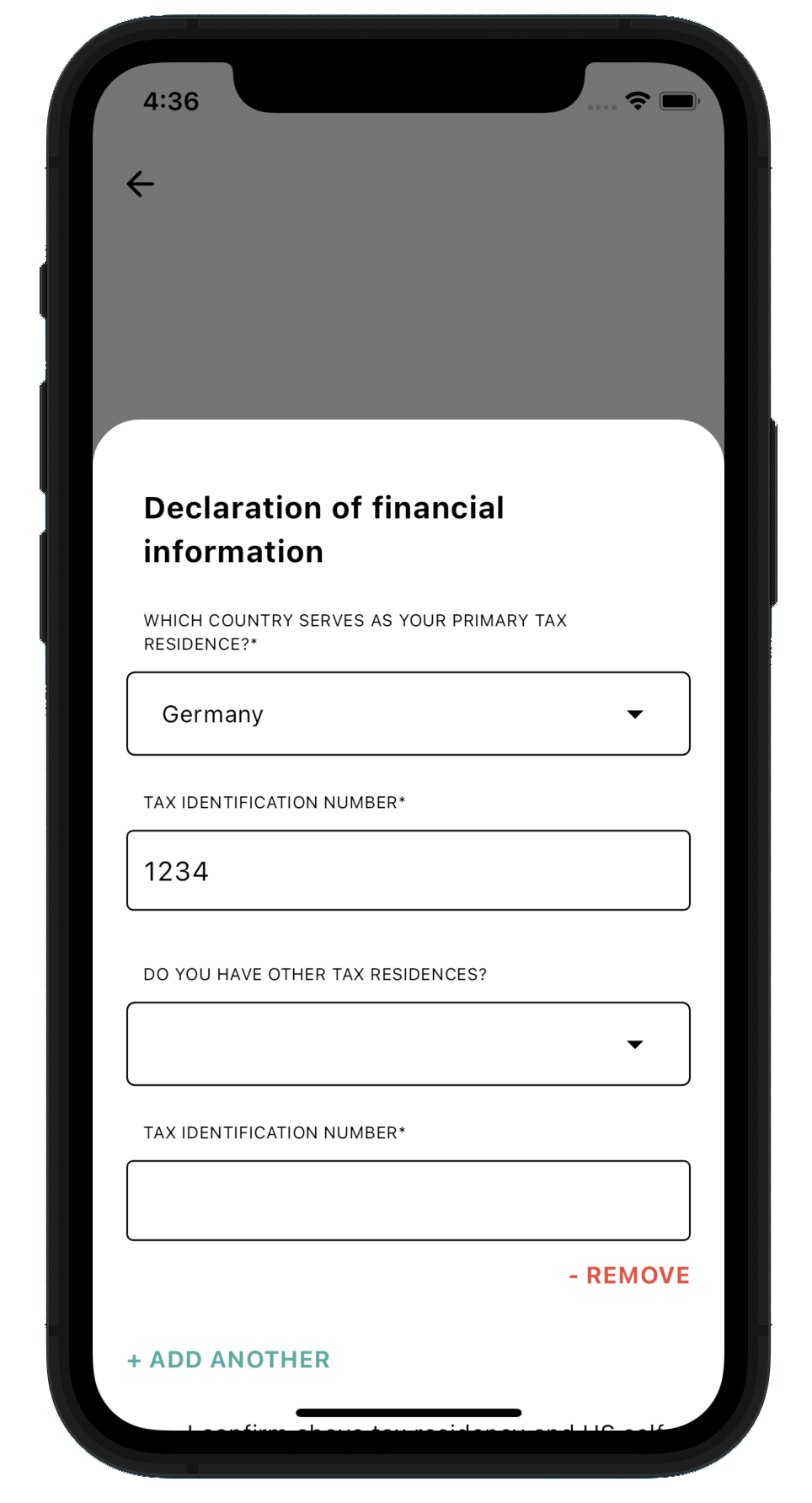

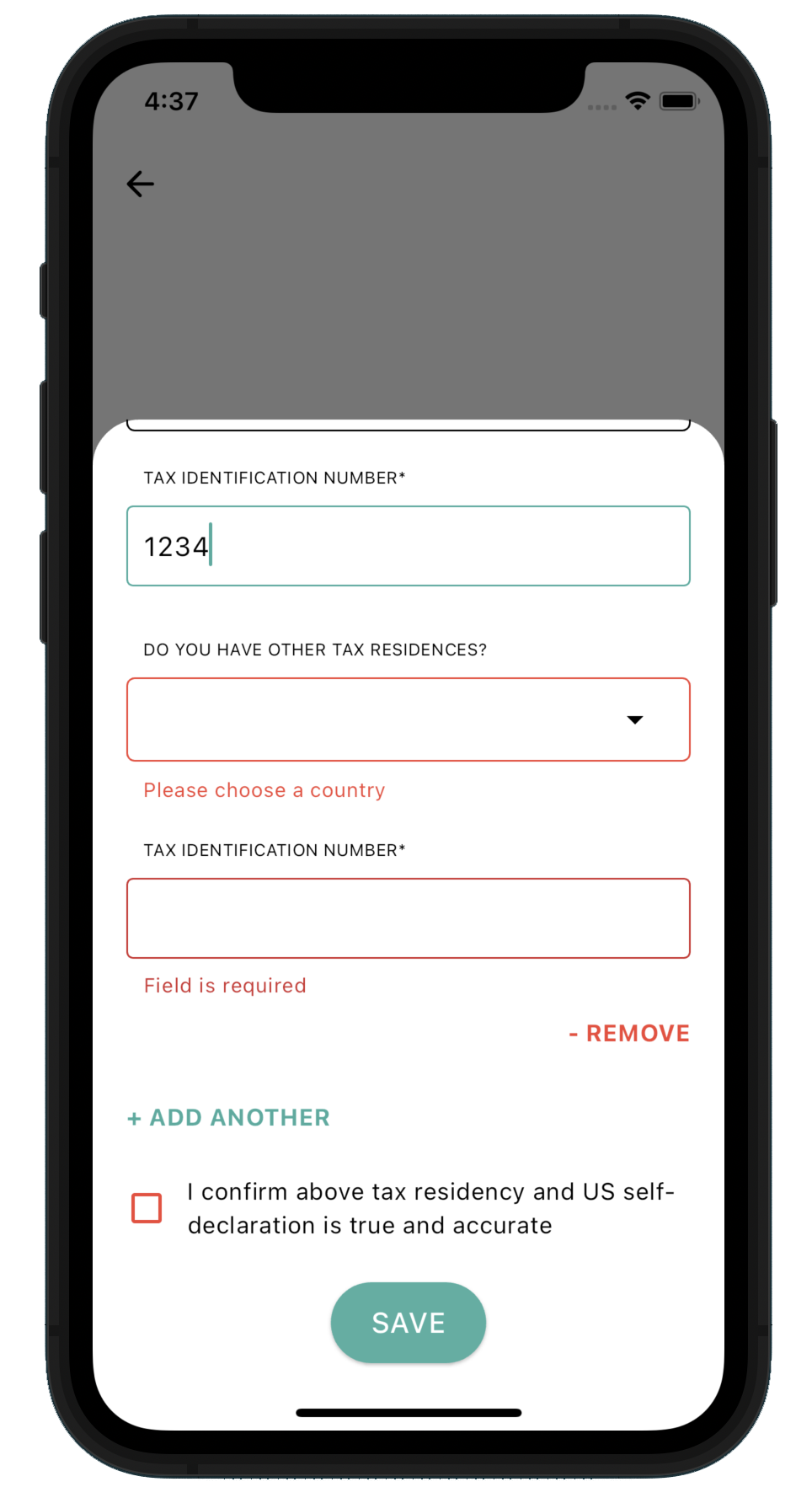

- Via API call data is received and to pre-populate existing fields. Here the user can select a country from a list and also allow the user to input a TAX ID number for the field. A user can select multiple taxation countries by clicking the "ADD ANOTHER" button.

- A verification is applied so that the user is not able to choose a previously selected country.

- The user can also remove any additional countries by clicking on the "REMOVE" button. A verification is made so that by default, the user must have at least one country/tax pair available.

- The user is forced to check a checkbox verifying the accuracy of their information before being able to submit their tax data.

- The tax data is stored locally for the user’s ID and pushed to the backend via API call.

- Country Dropdown Widget: A reusable widget for searching and selecting countries, ensuring a standardized and user-friendly approach across the application.

- Search Box Widget: A search box that enhances the user's ability to find specific information quickly, improving overall usability.

- Flutter: A powerful UI toolkit for building natively compiled applications for mobile, web, and desktop from a single codebase.

- Lottie: An animation library for Flutter that enables the use of After Effects animations in the app.

- URL Launcher: A Flutter plugin for launching URLs, providing a convenient way to open links in the default web browser.

- HTTP: A Dart package for making HTTP requests, facilitating communication with remote APIs.

- Flutter Secure Storage: A Flutter plugin for securely storing key-value pairs, ensuring sensitive data is stored safely.

- Flutter SVG: A Flutter plugin for rendering SVG images, offering scalable and resolution-independent graphics.

- Flutter Lints: A set of recommended lint rules for Flutter projects, ensuring good coding practices.

- Flutter Test: The Flutter testing package for writing unit and widget tests, ensuring the reliability of the codebase.

- Flutter Shake My Widget: A Flutter package for adding shake animations to widgets, enhancing the user interface with visual feedback.

- Path: A Dart package providing common operations for manipulating file paths.

This project follows the best practices and coding standards outlined by the lint rules, ensuring clean, maintainable, and efficient code.

The project is organized following best practices to enhance maintainability and readability:

- lib/src/screens: Contains screen implementations (e.g.,

login.dart,tax_data_screen.dart). - lib/widgets: Holds various reusable widgets used across the application (e.g.,

country_dropdown.dart,search_box.dart). - lib/models: Houses data models (e.g.,

tax_residence.dart,item_dropdown.dart). - lib/services: Includes service classes responsible for handling data retrieval and manipulation (e.g.,

tax_data_service.dart). - lib/shared: Consists of shared constants and configurations (e.g.,

constants.dart,countries_constants.dart). - lib/main.dart: The entry point of the application.

The app is designed to work seamlessly across various screen sizes, providing a consistent and enjoyable experience on both small and large devices.

Follow these steps to run the application locally:

-

Clone this repository to your local machine.

git clone https://github.com/GianMen91/expatrio_coding_challenge.git

-

Navigate to the project directory.

cd expatrio_coding_challenge -

Run the application.

flutter run

- Localization: Implement localization to support multiple languages.

- Testing: Add more tests for robust and reliable code.

- Error Handling: Strengthen error handling mechanisms to provide users with meaningful feedback in case of unexpected scenarios.

- Firebase Integration: Explore integrating tools like Crashlytics for proactive crash reporting and real-time monitoring, enhancing overall app stability and user experience.