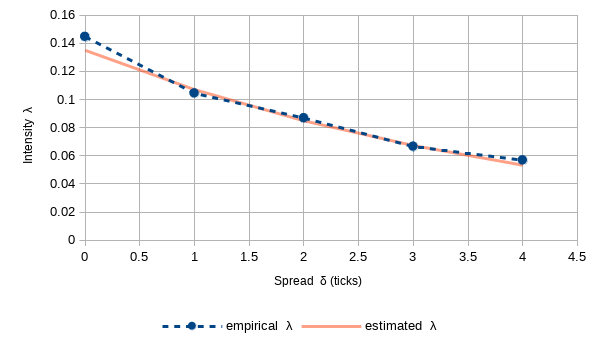

Poisson intensity of limit order execution, calibration of parameters A and k using level 1 tick data

A limit order placed at a price St ± δ, has the instantaneous probability of execution λ(δ)dt where the intensity λ(δ) is given by:

λ(δ) = A e -kδ

λ - Poisson order execution intensity

δ - spread (distance from mid price St)

A - parameter, positively related to trading intensity

k - parameter, positively related to market depth

Package Execution Intensity Estimator (EIE) contains single and multi threaded calibration procedure of A and k parameters.

Methods that calculate intensity λ(δ, A, k) and spread δ(λ, A, k) are provided as well.

Algorithm operates on level 1 tick data, therefore it is suitable in a setting where liquidity is not fully observable (i.e. dark pools).

Calibration is two step procedure performed separately for buy and sell limit orders.

Steps:

- For each spread δk of N predefined spreads (δ0 , δ1 , δ2 , ... δN-1) estimate execution intensity λ(δk) using "waiting time" approach described in [1] 4.4.2.. Result of this step is set of N points (δk , λ(δk)) on empirical Spread Intensity Curve (SIC)

- Estimate A and k based on N points from previous step. This can be achieved by various approaches.

Code implements two approaches described in [2] 3.2:

- LOG_REGRESSION performs OLS regression of log(λk) on δk. Finally k = -slope and A = e intercept

- MULTI_CURVE from set of N points creates Ns = (N*(N-1))/2 unique pairs fo points ((δx , λx) , (δy , λy)).

For each set of points solves the following set of equations for A' and k' :

λx = A' e -k'δx

λy = A' e -k'δy

Final estimates are A = mean(A'1 , A'2 , ... A'Ns) and k = mean(k'1 , k'2 , ... k'Ns)

Once A and k are calibrated, depending on context of usage, user can specify:

- Configuration parameters

double spreadStep = 0.00001; // increment of spread, greater than or equal to tick size

int nSpreads = 10; // number of spread increments, greater than 2

long w = 3600000; // 60 min, width of estimators sliding window

long dt = 10000 // 10 seconds, time scaling

- Create an instance of AkSolverFactory and specify SolverType

- Create an instance of FillRateEstimator

AkSolverFactory sf = new AkSolverFactory(SolverType.MULTI_CURVE);

IntensityEstimator ie = new IntensityEstimator(spreadStep, nSpreads, w, dt, sf);

- Pass an instance of ExecutorService to EstimationExecutor. Ensure minimum number of 5 threads is available. This step is required only for multithreaded estimation.

EstimationExecutor.setExecutor(executorService);

- Pass data (bid, ask, timestamp) to the instance of FillRateEstimator with onTick/onTickAsync call

- Run parameter estimates with estimate/estimateAsync call

while(loop){

...

// pass tick data to estimator

Future<Boolean> tickResult = ie.onTickAsync(bid, ask, timeStamp);

...

if (tickResult.get()) { // check if estimator can be called

Future<IntensityInfo> result = ie.estimateAsync(timeStamp);

...

IntensityInfo intensityInfo =result.get();

...

- Returned IntensityInfo instance gives access to parameters A and k for both buy and sell orders. Intensities λ(δ) and Spreads δ(λ) are returned by corresponding public methods.

Note:

- More details on usage and configuration can be found in IntensityEstimatorTest and javadoc comments

- Detailed test output is saved to target/intensity-log/ folder

- Single threaded outperforms multithreaded execution when less complex configurations are used