Repository containing the code from IMC Prosperity's challenge. Our team got the 91st place out of more than 8000 teams.

The purpose of this competition is to utilize various techniques of data analysis and quantitative finance to trade commodities with diverse behaviors.

The competition comprises five rounds, each involving the introduction of new commodities exhibiting distinct behaviors.

Participants have worked with two assets, namely PEARLS, whose price remains relatively constant over time at a value of 10k seashells, and BANANAS, an asset whose price is highly volatile, fluctuating frequently.

Participants have been provided with data on COCONUTS and PINA_COLADAS. Although the price of COCONUTS and PINA_COLADAS are related, as coconuts are required for the production of pina coladas, the converse is not true.

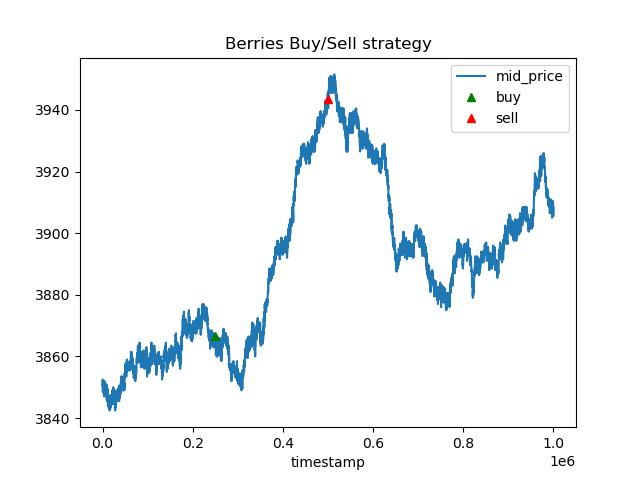

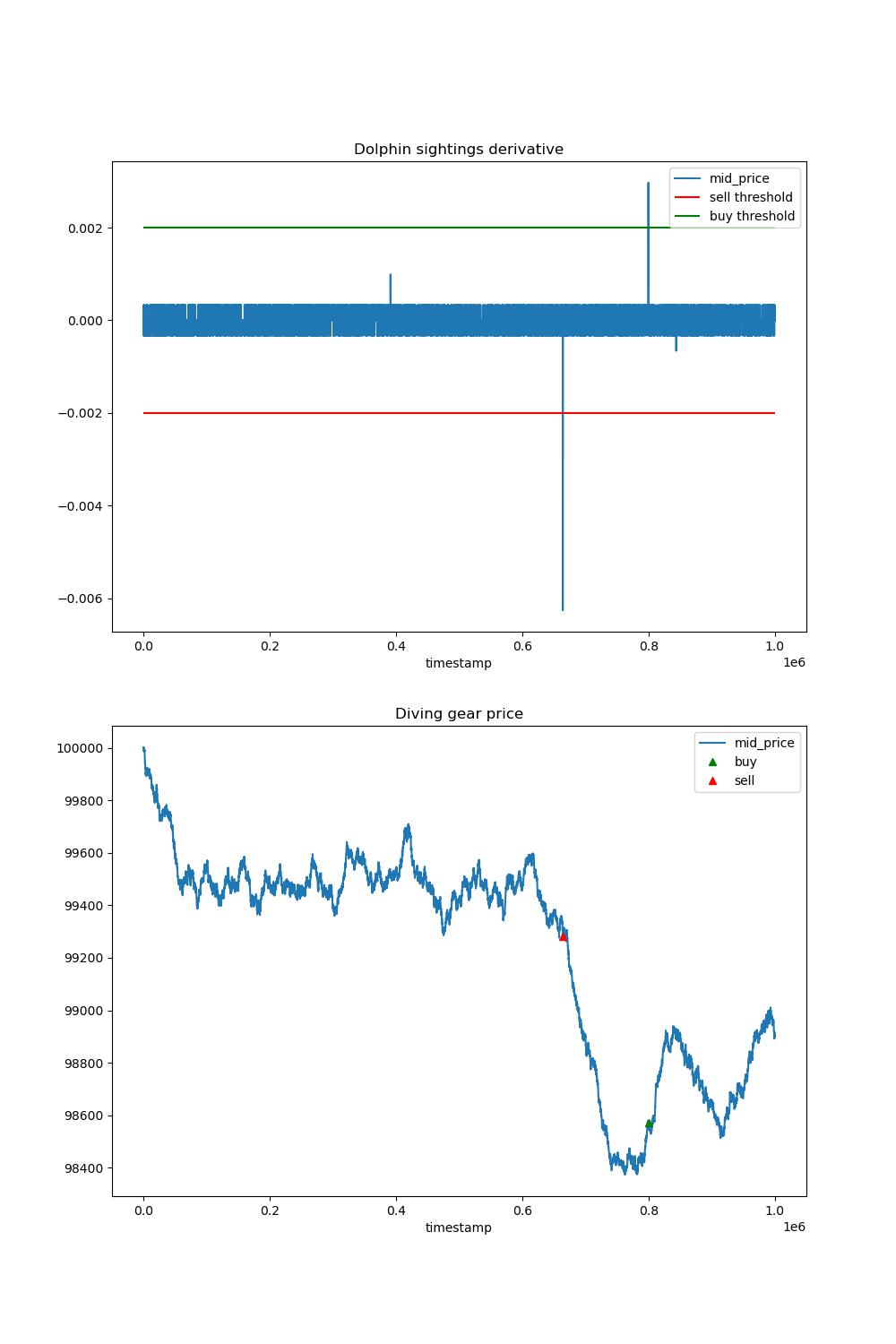

Two additional assets were introduced, BERRIES and DIVING_GEAR. The price of BERRIES is seasonal, while that of DIVING_GEAR is influenced by DOLPHIN_SIGHTINGS, another data set provided by IMC. The latter may serve as a feature for predicting the price of DIVING_GEAR.

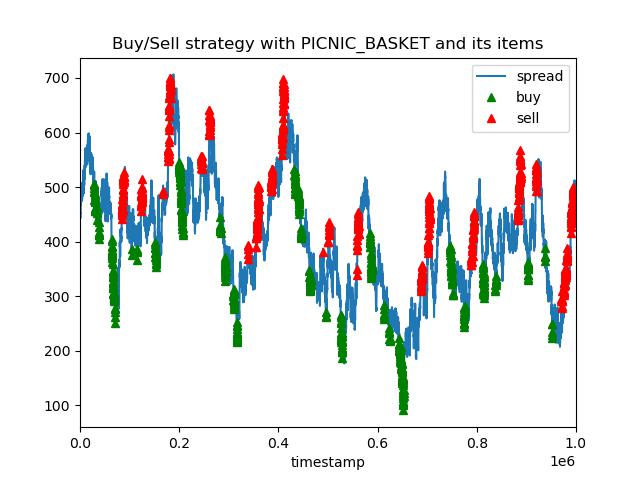

Participants have worked with four assets, namely PICNIC_BASKET, UKULELE, DIP, and BAGUETTE. We have been informed that one PICNIC_BASKET consists of one UKULELE, two BAGUETTEs, and four DIPs. However, the price of PICNIC_BASKET is not equivalent to the sum of the prices of its individual components.

During this round, participants were granted access to IMC trader bots trading history and were given the opportunity to replicate, or take profit from the strategy of the most experienced bots.

Regarding PEARLS, we will put bid orders at 10k - 1 and ask orders at 10k + 1, since the price is consistently stable at 10k.

For BANANAS we put bid orders at EMA - 1 and ask orders at EMA + 1, where EMA is the exponential moving average:

Where

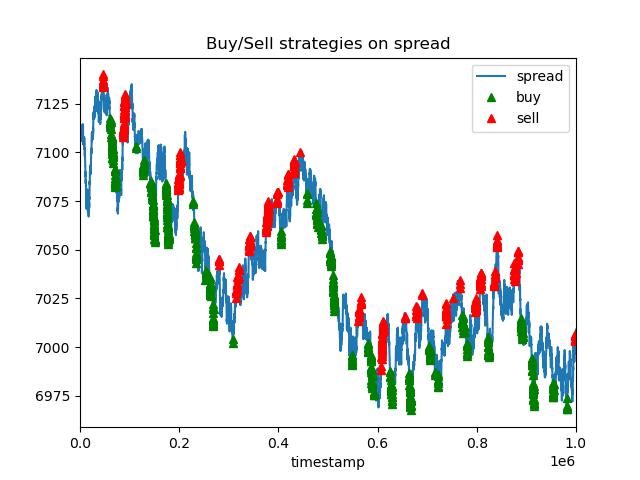

In this round, since COCONUT and PINA_COLADAS prices are have correlation over 90%, we created a pair trading strategy between COCONUT and PINA_COLADAS. Then we traded on the spread:

-

When the z-score of the spread is higher than 1.5, we shorted the spread (i.e we buy COCONUTS and sell PINA_COLADAS)

-

When the z-score of the spread is lower than -1.5, we bought the spread (i.e., we buy PINA_COLADAS and sell COCONUTS)

For BERRIES, we verified that the price starts rising at $ t_{long} = 2e5 $ and after $ t_{short} = 5e5 $, it starts falling. Then, we buy at $ t_{long} $ and sell at $ t_{short} $

For DIVING_GEARs we traded based on a signal from the DOLPHIN_SIGHTINGS observations. The signal was based on a sufficiently elevated derivative of these observations, both for buying and selling (see figure below). Therefore, when the derivative of dolphin sightings reaches a buying threshold (set at 0.002) or a selling threshold (set at -0.002), our algorithm trades in the appropriate direction.

In this round, we traded on the SPREAD between PICNIC_BASKET and its components, when the z-scores passes $ \pm $ 1.5

In the last round, we verified that our strategy performed consistently better than all IMC bots in all commodities. Then we decided to keep the same strategy as before.