mfbvar

Overview

The mfbvar package implements a steady-state prior and a Minnesota prior for state space-based mixed-frequency VAR models.

Installation

The package can be installed with the help of devtools:

devtools::install_github("ankargren/mfbvar")Usage

To illustrate the functionality of the package, first load some data stored in the package.

library(mfbvar)

Y <- mfbvar::mf_sweden

head(Y)

#> unemp infl ip eti gdp

#> 1996-08-31 9.9 -0.44997116 0.5941788 0.19536978 NA

#> 1996-09-30 9.8 0.56804886 -1.5522700 0.08309475 0.4704331

#> 1996-10-31 9.8 0.03539614 -0.4825100 0.26642772 NA

#> 1996-11-30 9.9 -0.20074400 1.3213405 0.07019829 NA

#> 1996-12-31 10.1 -0.15378249 2.7076404 -0.06840048 0.7567702

#> 1997-01-31 10.0 -0.01183922 0.3478264 0.31459737 NA

tail(Y)

#> unemp infl ip eti gdp

#> 2015-07-31 7.3 0.02895613 -3.1285137 0.09746577 NA

#> 2015-08-31 7.0 -0.19319944 3.8446293 0.16136658 NA

#> 2015-09-30 7.3 0.39565793 0.9132484 0.23165768 0.843138

#> 2015-10-31 7.2 0.07701935 NA 0.16152144 NA

#> 2015-11-30 NA NA NA -0.17872172 NA

#> 2015-12-31 NA NA NA 0.33933697 NAPrior specification

Next, we create a minimal prior object. We must specify: 1) data, 2) the frequency of the data, 3) the number of lags, 4) the length of burn-in and main chains, respectively. This is done by calling the set_prior() function and giving named arguments. The resulting object is of class mfbvar_prior and has a basic print method.

prior_obj <- set_prior(Y = Y, freq = c(rep("m", 4), "q"),

n_lags = 4, n_burnin = 1000, n_reps = 1000)

#> Warning: prior_Pi_AR1: 0 used as prior mean for AR(1) coefficients.

#> Warning: lambda1: 0.2 used as the value for the overall tightness hyperparameter.

#> Warning: lambda2: 1 used as the value for the lag decay hyperparameter.

#> Warning: lambda3: 10000 used for the constant's prior variance.

#> Warning: n_fcst: 0 used for the number of forecasts to compute.Warnings are produced because we haven't specified values for some of the prior elements and instead the function uses default values.

There is a print method for the prior object, showing some basic information:

prior_obj

#> The following elements of the prior have not been set:

#> d d_fcst prior_psi_mean prior_psi_Omega

#>

#> Checking if steady-state prior can be run... FALSE

#> Missing elements: d prior_psi_mean prior_psi_Omega

#> Checking if Minnesota prior can be run... TRUEThe message tells us what elements of the prior have not yet been set, and if each of the two priors can be run with the current specification. The check is very minimal; the steady-state prior cannot be used to make forecasts (which it will attempt to if n_fcst is greater than 0) unless also d_fcst is given, but to run the model with no forecasts only the three indicated elements are missing.

The summary method provides a little bit more detail:

summary(prior_obj)

#> PRIOR SUMMARY

#> ----------------------------

#> Required elements:

#> Y: 5 variables, 233 time points

#> freq: m m m m q

#> prior_Pi_AR1: 0 0 0 0 0

#> lambda1: 0.2

#> lambda2: 1

#> n_lags: 4

#> n_fcst: 0

#> n_burnin: 1000

#> n_reps: 1000

#> ----------------------------

#> Steady-state-specific elements:

#> d: <missing>

#> d_fcst: <missing>

#> prior_psi_mean: <missing>

#> prior_psi_Omega: <missing>

#> ----------------------------

#> Minnesota-specific elements:

#> lambda3: 10000

#> ----------------------------

#> Other:

#> verbose: FALSE

#> smooth_state: FALSE

#> check_roots: TRUEModel estimation

As the print method told us before, we can run the Minnesota prior, but not the steady-state prior with the current prior specification. The model is estimated by calling estimate_mfbvar().

mod_minn <- estimate_mfbvar(mfbvar_prior = prior_obj, prior_type = "minn")To use the steady-state prior, we need to specify d, prior_psi_mean and prior_psi_Omega. We specify the prior moments for ψ using the helper function interval_to_moments() which converts 95 % prior probability intervals to prior moments, assuming independence.

prior_intervals <- matrix(c( 6, 7,

0.1, 0.2,

0, 0.5,

-0.5, 0.5,

0.4, 0.6), ncol = 2, byrow = TRUE)

psi_moments <- interval_to_moments(prior_intervals)

prior_psi_mean <- psi_moments$prior_psi_mean

prior_psi_Omega <- psi_moments$prior_psi_OmegaInstead of creating a new prior object, we can update the old by use of the update_prior() function. Note also that it is possible to specify "intercept" for d rather than a matrix containing a constant for the deterministic term.

prior_obj <- update_prior(prior_obj, d = "intercept", prior_psi_mean = prior_psi_mean,

prior_psi_Omega = prior_psi_Omega)

prior_obj

#> The following elements of the prior have not been set:

#>

#>

#> Checking if steady-state prior can be run... TRUE

#>

#> Checking if Minnesota prior can be run... TRUEIt is now possible to estimate the model using the steady-state prior.

mod_ss <- estimate_mfbvar(prior_obj, "ss")It is also allowed to temporarily override elements in the prior object by adding them as separate arguments to the estimate_mfbvar() function. Thus, to get forecasts eight steps ahead we would use:

mod_minn <- estimate_mfbvar(prior_obj, "minn", n_fcst = 8)

mod_ss <- estimate_mfbvar(prior_obj, "ss", n_fcst = 8)Processing results

The resulting objects contain all of the posterior information. The returned objects from estimate_mfbvar() are of class mfbvar and mfbvar_ss or mfbvar_minn.

class(mod_minn)

#> [1] "mfbvar" "mfbvar_minn"

class(mod_ss)

#> [1] "mfbvar" "mfbvar_ss"For forecasts, there is a predict method for class mfbvar which computes forecasts for selected quantiles. By default, it returns the 10%, 50% and 90% quantiles.

predict(mod_minn, pred_quantiles = 0.5)

#> $quantile_50

#> unemp infl ip eti gdp

#> 2015-10-31 7.200000 0.07701935 0.15937929 0.161521443 0.9532468

#> 2015-11-30 7.133971 0.06294611 0.22159661 -0.178721720 1.2583549

#> 2015-12-31 7.144809 0.14946118 0.41239687 0.339336970 0.7827024

#> fcst_1 7.071454 0.10820970 0.61760986 0.039354282 1.0709753

#> fcst_2 7.063182 0.05068836 0.33710755 0.013616411 0.7690866

#> fcst_3 7.061058 0.13085761 0.02997096 0.034041795 0.7069756

#> fcst_4 7.002702 0.09072667 0.27579304 0.012184009 0.7835469

#> fcst_5 7.004394 0.11209962 0.14695194 0.014447554 0.6775694

#> fcst_6 7.026714 0.05772676 0.14264816 -0.015879097 0.6082434

#> fcst_7 6.989170 0.08354229 -0.01363007 -0.018254112 0.5807203

#> fcst_8 6.988067 0.09529331 -0.02175004 -0.005380111 0.5294131If desired, it can be requested in a tidy format.

head(predict(mod_minn, pred_quantiles = 0.5, tidy = TRUE))

#> value fcst_date time variable quantile

#> 1 7.200000 2015-10-31 231 unemp 0.5

#> 2 7.133971 2015-11-30 232 unemp 0.5

#> 3 7.144809 2015-12-31 233 unemp 0.5

#> 4 7.071454 fcst_1 234 unemp 0.5

#> 5 7.063182 fcst_2 235 unemp 0.5

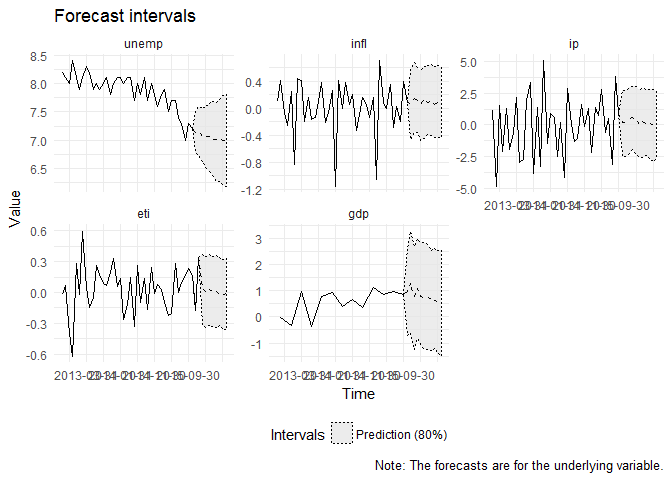

#> 6 7.061058 fcst_3 236 unemp 0.5Calling plot on mfbvar_ss or mfbvar_minn objects produces plots of the forecasts and, by default, 5*n_fcst of the preceding values.

plot(mod_minn)The axis tick labels are too long and overlap. The plot() method returns a ggplot. Hence, modifying the plot simply amounts to adding layers in the usual ggplot2 way. The method also allows for changing where the plot should begin.

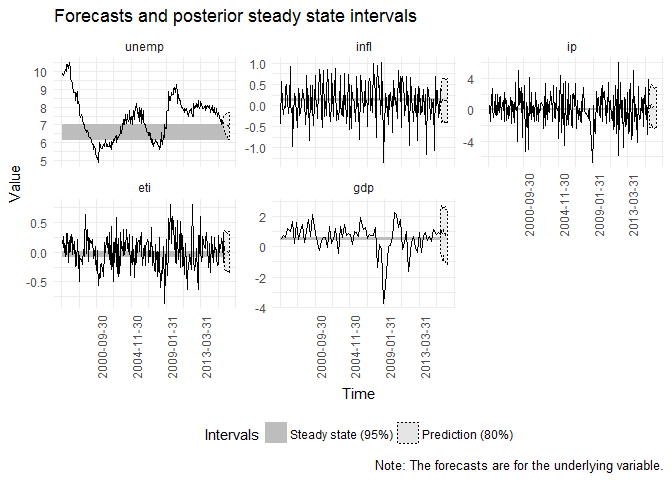

library(ggplot2)

plot(mod_ss, plot_start = 1) +

theme(axis.text.x = element_text(angle = 90))There are also some basic print and summary methods for the two classes implemented.

mod_minn

#> Mixed-frequency Minnesota BVAR with:

#> 5 variables (unemp, infl, ip, eti, gdp)

#> 4 lags

#> 233 time periods (1996-08-31 - 2015-12-31)

#> 8 periods forecasted

#> 1000 draws used in main chain

mod_ss

#> Mixed-frequency steady-state BVAR with:

#> 5 variables (unemp, infl, ip, eti, gdp)

#> 4 lags

#> 233 time periods (1996-08-31 - 2015-12-31)

#> 8 periods forecasted

#> 1000 draws used in main chain

summary(mod_minn)

#> Mixed-frequency Minnesota BVAR with:

#> 5 variables (unemp, infl, ip, eti, gdp)

#> 4 lags

#> 233 time periods (1996-08-31 - 2015-12-31)

#> 8 periods forecasted

#> 1000 draws used in main chain

#>

#> #########################

#> Posterior means computed

#>

#> Pi:

#> indep

#> dep unemp.1 infl.1 ip.1 eti.1 gdp.1

#> unemp 0.57374475 -0.059666359 -0.009725344 -0.06143760 0.006146794

#> infl -0.06984886 0.002022346 0.010754882 0.07097111 0.014382233

#> ip -0.28026095 0.373048568 -0.324879157 1.28380761 0.046542786

#> eti 0.01050189 -0.106675765 -0.010801383 0.12754578 0.040666585

#> gdp -0.14696300 0.213991024 0.014547391 1.13724644 0.041164095

#> indep

#> dep unemp.2 infl.2 ip.2 eti.2 gdp.2

#> unemp 0.2244127962 0.03356854 -0.015902327 0.06713901 -0.0127318401

#> infl 0.0007198677 -0.10438354 0.008958532 -0.10579849 -0.0257301594

#> ip 0.0379167035 -0.02420588 -0.106269928 0.51158351 0.1165583383

#> eti 0.0579525147 -0.06100234 0.003753267 0.03489051 -0.0008739203

#> gdp 0.0746023155 -0.13749131 0.053161687 0.11346517 0.0191243192

#> indep

#> dep unemp.3 infl.3 ip.3 eti.3 gdp.3

#> unemp 0.180207956 -0.0114850007 -0.001508907 0.02592424 -0.041120556

#> infl 0.007807395 -0.0708573306 0.013163578 0.04482953 -0.016255266

#> ip 0.057385158 -0.1363831049 -0.021944661 0.12187429 0.088945671

#> eti -0.017849315 -0.0009358978 -0.001677266 0.07604319 -0.009111746

#> gdp -0.032142196 -0.3113726809 0.036196309 0.31889298 0.053109505

#> indep

#> dep unemp.4 infl.4 ip.4 eti.4 gdp.4

#> unemp -0.01408621 0.008131893 0.002628882 0.005924449 -0.019056511

#> infl 0.01576549 -0.089161854 0.001888369 -0.006608489 -0.011180306

#> ip 0.23290153 -0.020399438 0.037653856 0.288592311 0.106793025

#> eti -0.01859433 0.002372733 0.004739475 0.024390984 -0.004189443

#> gdp 0.14376710 -0.283877282 0.017936840 0.206197468 0.021997354

#>

#>

#> Sigma:

#>

#> unemp infl ip eti gdp

#> unemp 0.073875070 -0.01507315 0.01497214 -0.003623481 -0.092901512

#> infl -0.015073150 0.15106145 0.08214672 0.011032287 0.244597985

#> ip 0.014972144 0.08214672 3.44281563 0.039709454 1.196231322

#> eti -0.003623481 0.01103229 0.03970945 0.061596980 0.009206275

#> gdp -0.092901512 0.24459799 1.19623132 0.009206275 1.949578823

#>

#>

#> Intercept:

#> const

#> unemp 0.2891893

#> infl 0.4700659

#> ip -0.5041606

#> eti -0.2305289

#> gdp 0.2735818

summary(mod_ss)

#> Mixed-frequency steady-state BVAR with:

#> 5 variables (unemp, infl, ip, eti, gdp)

#> 4 lags

#> 233 time periods (1996-08-31 - 2015-12-31)

#> 8 periods forecasted

#> 1000 draws used in main chain

#>

#> #########################

#> Posterior means computed

#>

#> Pi:

#> indep

#> dep unemp.1 infl.1 ip.1 eti.1 gdp.1

#> unemp 0.565601021 -0.0501664015 -0.008066323 -0.05900102 -0.0007952872

#> infl -0.074308112 -0.0007645842 0.009610393 0.07430790 0.0202526049

#> ip -0.292356043 0.3809592812 -0.311388254 1.27143261 0.0273369800

#> eti 0.005474905 -0.1043835489 -0.010273813 0.12866117 0.0401244127

#> gdp -0.086955522 0.1303419397 -0.004154454 0.93475266 0.2006896126

#> indep

#> dep unemp.2 infl.2 ip.2 eti.2 gdp.2

#> unemp 0.2272407402 0.03003094 -0.015271721 0.06977185 -0.011801016

#> infl -0.0005859319 -0.10423933 0.008107247 -0.10627777 -0.026221590

#> ip 0.0230012865 -0.04416975 -0.105170620 0.51452143 0.130369410

#> eti 0.0603574544 -0.06187126 0.004178602 0.04128857 -0.002430807

#> gdp 0.0281931404 -0.21188665 0.039575709 0.09325510 0.018345264

#> indep

#> dep unemp.3 infl.3 ip.3 eti.3 gdp.3

#> unemp 0.192855517 -0.01277139 -0.002135726 0.02822116 -0.038509233

#> infl 0.003961296 -0.06653470 0.013711116 0.04528497 -0.020365545

#> ip 0.048791472 -0.15263152 -0.017387847 0.11410916 0.088923592

#> eti -0.018663976 0.00117084 -0.001842802 0.08064725 -0.007882617

#> gdp -0.048661001 -0.30248337 0.031722774 0.28184597 0.006087828

#> indep

#> dep unemp.4 infl.4 ip.4 eti.4 gdp.4

#> unemp -0.01671768 0.008880352 0.002886700 0.006653569 -0.020834549

#> infl 0.01883941 -0.085232793 0.001704578 -0.011254046 -0.010258549

#> ip 0.21395374 -0.014386281 0.039623469 0.277043607 0.100948317

#> eti -0.01861225 0.005324372 0.005419283 0.022077091 -0.005266916

#> gdp 0.13001238 -0.232934626 0.018196798 0.174806053 0.028511508

#>

#>

#> Sigma:

#>

#> unemp infl ip eti gdp

#> unemp 0.071486945 -0.01446027 0.01217137 -0.003060791 -0.07739934

#> infl -0.014460268 0.14545293 0.08448546 0.010415174 0.22662945

#> ip 0.012171371 0.08448546 3.34777514 0.039130525 1.12270508

#> eti -0.003060791 0.01041517 0.03913053 0.059837815 0.01561569

#> gdp -0.077399337 0.22662945 1.12270508 0.015615690 1.51667808

#>

#>

#> Psi:

#> d1

#> unemp 6.56635166

#> infl 0.13596181

#> ip 0.07535510

#> eti -0.02896786

#> gdp 0.52704781Marginal data density estimation

To estimate the marginal data density, there is a generic function mdd() for which there are methods for classes mfbvar_ss and mfbvar_minn.

mdd_minn <- mdd(mod_minn, p_trunc = 0.5)

mdd_ss_1 <- mdd(mod_ss)

mdd_ss_2 <- mdd(mod_ss, p_trunc = 0.5)

mdd_minn

#> [1] -867.5615

mdd_ss_1

#> [1] -802.3645

mdd_ss_2

#> [1] -803.4983