Yupana Protocol is a decentralized lending protocol for individuals and protocols to access financial services. The protocol is permissionless, transparent, and non-custodial.

Yupana Protocol contracts are under development. In this repository, you can follow the development and changes.

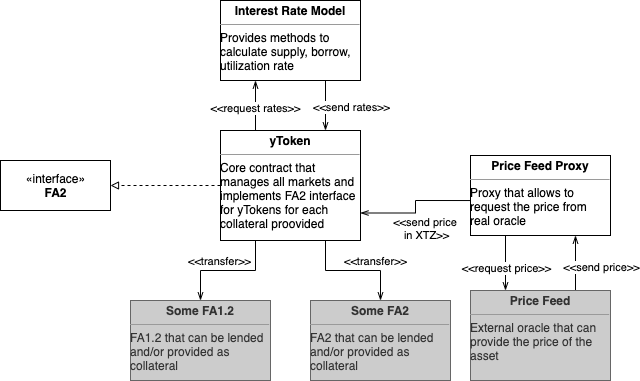

YToken- Core contract than manages all markets and implements FA2 interface for yToken for each collateral provided;PriceFeedProxy- Proxy that allows to request the price from real oracle;InterestRate- Providers methods to calculate supply, borrow, utilization rate.

.

.

├── contracts/ # contracts

├────────── main/ # the contracts to be compiled

├─────────────────── yToken

├─────────────────── interestRate

├─────────────────── priceFeed

├────────── partial/ # the code parts imported by main contracts

├─────────────────── interestRate/

├───────────────────────── interestRateMethods

├───────────────────────── interestRateTypes

├─────────────────── proxy/

├───────────────────────── priceFeedMethods

├───────────────────────── priceFeedTypes

├─────────────────── yToken/

├───────────────────────── adminMethods

├───────────────────────── fa2Methods

├───────────────────────── fa2Types

├───────────────────────── lendingMethods

├─────────────────────────lendingTypes

├───────────────────────── wrapTransfer

├─────────────────── mainTypes

├── migrations/

├── scripts/ # cli for account actions

├── storage/ # initial storage for contract originations

├── test/ # test cases

├── README.md # current file

└── .gitignore

Underlying asset is the real asset that is provided to the lending protocol.

yToken token is the single token with the specific token id inside of the core Yupana FA2; represents specific underlying asset locked in the protocol.

Collateral is the yToken token that can be used as the collateral to take the loan.

Borrow is the amount of the underlying asset borrowed by the user(loan).

Cash is the amount of the underlying asset present on the contract(not borrowed).

Reserves is the amount of the underlying asset stored in the protocol.

Collateral Factor is the rate represents by which the borrow limit increases if the yToken is minted.

Close Factor is the max portion of the loan that can be liquidated per single transaction.

Reserve Factor is the rate that represents what part of the interest goes to the protocol reserves.

Liquidation discount is the rate that the liquidator will earn if liquidate the asset.

- The

getPrice(asset_name):- can only be called by the yToken and otherwise, the transaction fails

- requests the price from the Price Feed and expects the response on the

receivePriceentrypoint.

- The

receivePrice:- can only be called by the Price Feed.

- the response is processed and the price is sent to the yToken contract.

- The

receivePricecan only be called if thegetPricehas been called just before in the same operation(prevent unexpected entrance and reentrancy); theenteredflag can be used.

- getPrice - asks for a price from Oracle.

- receivePrice - sends the price from Oracle to the

yTokencontract.

- The contract has the followed 3 entrypoints that can be called by anyone with the result send to arbitrary contract:

getBorrowRate(borrows, cash, reserves),getSupplyRate(borrows, cash, reserves),getUtilizationRate(borrows, cash, reserves).

- getBorrowRate - sends a callback with the counted BorrowRate.

- getSupplyRate - sends a callback with the counted SupplyRate.

- getUtilizationRate - sends a callback with the counted UtilizationRate.

- mint - is a function to add a token as a collateral. It allows you to add a token to our system.

- redeem - the function is designed to withdraw tokens from the platform.

- borrow - a function for borrowing a token. Implemented the logic of freezing collateral tokens when borrowing a token.

- repay - a function designed to repay debt.

- liquidate - the function allows another user to liquidate someone's debt.

- enterMarket - allows you to designate that this token will be used as collateral.

- exitMarket - allows you to indicate that this token is no longer used as collateral.

To compile and deploy contracts to network:

0. run yarn

- compile contract

yarn compile - deploy contract to chain

- mainnet:

yarn migrate - hangzhounet:

yarn migrate-hang - granadanet:

yarn migrate-gra

- mainnet:

Run: yarn test