A framework for analysing financial products in personalized contexts

| Latest Release |

|

financial_life is an opinionated framework written in Python that allows to simulate monetary flows between different types of accounts. These simulations allow a deeper understanding of financial plans and a better comparison of financial products (in particular loan conditions) for personal circumstances. With financial_life you can

- analyse loan conditions and payment strategies

- describe the properties of your financial plans with a few lines of code

- create dynamic monetary flows between accounts for modeling more realistic scenarios

- extend the code by controller functions (e.g. for modeling tax payments)

View documentation for a more detailed introduction.

Say you want to model an account with regular income and payments to a loan

from financial_life.financing import accounts as a

from datetime import timedelta, datetime

# create a private bank account and a loan account

account = a.Bank_Account(amount = 1000, interest = 0.001, name = 'Main account')

loan = a.Loan(amount = 100000, interest = 0.01, name = 'House Credit')

# add these accounts to the simulation

simulation = a.Simulation(account, loan)

# describe monetary flows between accounts

simulation.add_regular('Income', account, 2000, interval = 'monthly')

simulation.add_regular(account, loan, lambda: min(1500, -loan.account), interval = 'monthly')

# simulate for ten years

simulation.simulate(delta = timedelta(days=365*10))

# plot the data

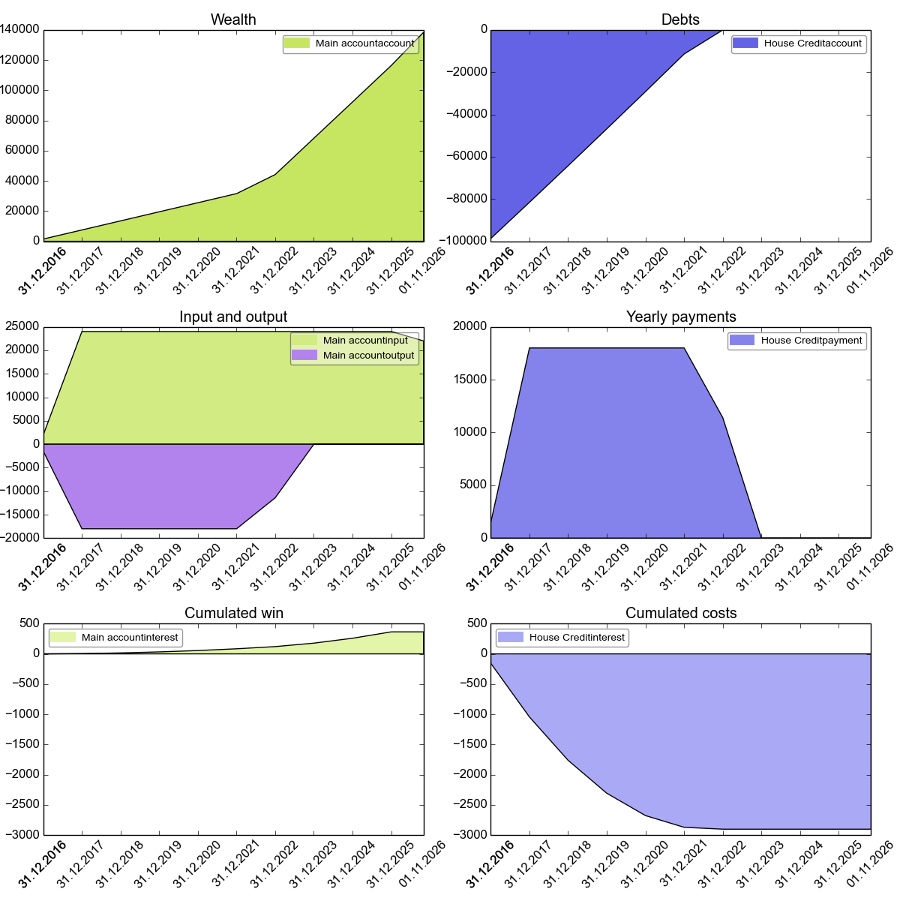

simulation.plt_summary()

# print reports summarized by years

print(account.report.yearly())

print(loan.report.yearly())

# analyze data

print("Interests on bank account: %.2f" % sum(account.report.yearly().interest))

print("Interests on loan account: %.2f" % sum(loan.report.yearly().interest))The output will look like this:

Main account

Date account output input interest

---------- --------- --------- -------- ----------

31.12.2016 2000.32 -3000.00 4000.00 0.32

31.12.2017 8005.58 -18000.00 24000.00 5.26

31.12.2018 14016.85 -18000.00 24000.00 11.27

31.12.2019 20034.13 -18000.00 24000.00 17.28

31.12.2020 26057.42 -18000.00 24000.00 23.29

31.12.2021 32086.74 -18000.00 24000.00 29.32

31.12.2022 46271.00 -9853.30 24000.00 37.56

31.12.2023 70330.32 0.00 24000.00 59.32

31.12.2024 94413.68 0.00 24000.00 83.36

31.12.2025 118521.15 0.00 24000.00 107.47

01.10.2026 138521.15 0.00 20000.00 0.00

House Credit

Date account interest payment

---------- --------- ---------- ---------

31.12.2016 -97190.22 -190.22 3000.00

31.12.2017 -80064.23 -874.01 18000.00

31.12.2018 -62766.98 -702.75 18000.00

31.12.2019 -45296.76 -529.78 18000.00

31.12.2020 -27652.02 -355.26 18000.00

31.12.2021 -9830.65 -178.63 18000.00

31.12.2022 0.00 -22.65 9853.30

31.12.2023 0.00 0.00 0.00

31.12.2024 0.00 0.00 0.00

31.12.2025 0.00 0.00 0.00

Interests on bank account: 374.45

Interests on loan account: -2853.30

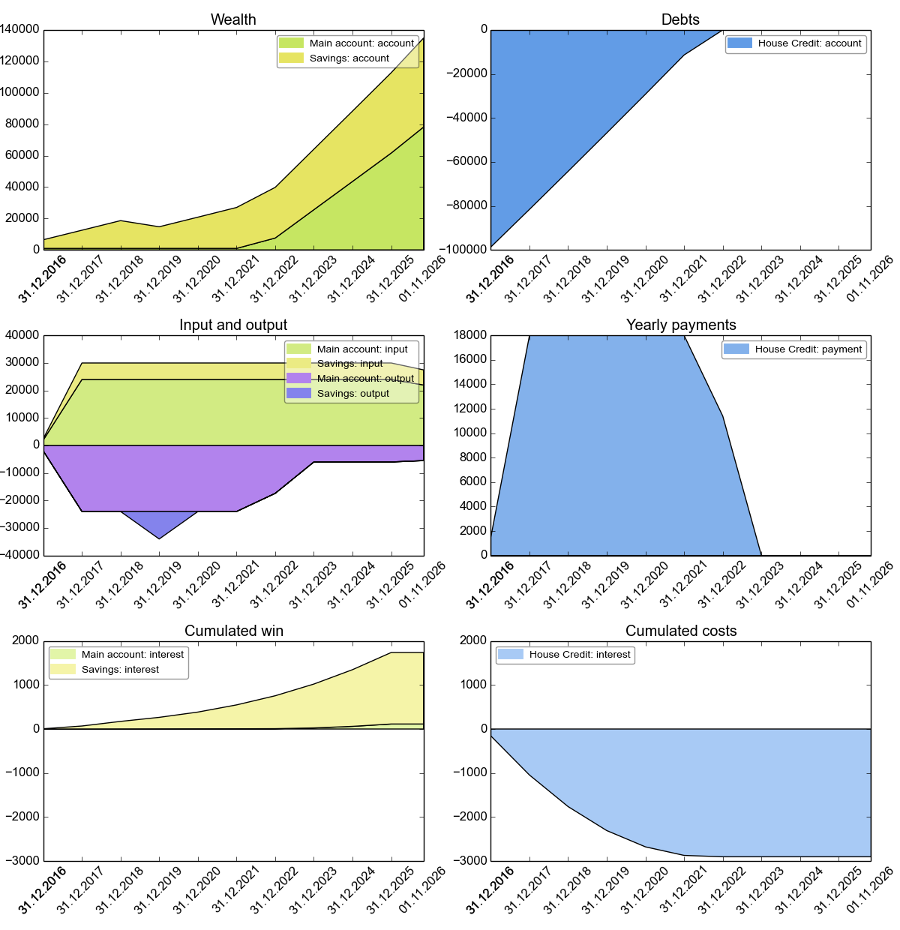

Now let's say, we put some money on a special savings account with better interests, because we want to purchase in two years a car. With financial_life, you just add the necessary changes to your model.

# create new account

savings = a.Bank_Account(amount = 5000, interest = 0.007, name = 'Savings')

# add it to the simulation (or create a new simulation with all three accounts)

simulation.add_account(savings)

# add regular payment to the savings-account

simulation.add_regular(account, savings, 500, interval = 'monthly')

# somewhere in the distant future we will make a payment to

# the vendor of a car

simulation.add_unique(savings, 'Vendor of a car', 10000, '17.03.2019')The plot will now include the savings-account as well.

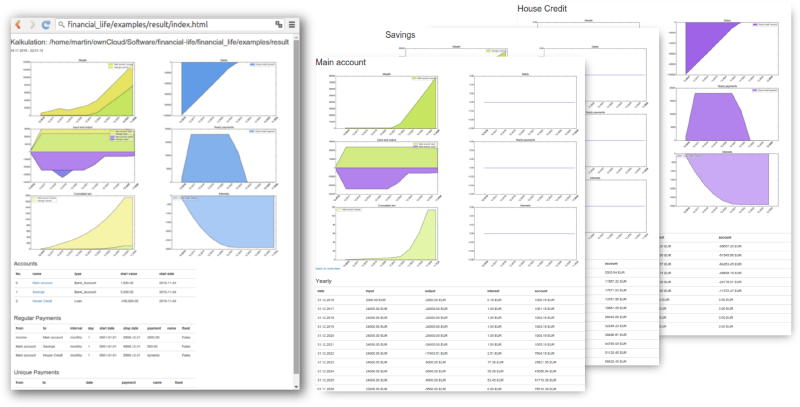

You can also export the simulation to HTML to explore your model in the browser:

from financial_life.reports import html

html.report(simulation, style="standard", output_dir = result_folder)You can analyse the reports as pandas DataFrame as well and export it to excel:

import pandas as pd

from financial_life.reports import excel

account.report.as_df() # Hello pandas

excel.report(simulation, filename='reports.xls') # explore the results in excelHere are more examples. financial_life supports:

- dependencies between accounts, e.g. to model how the ownership of a property rises when the loan decreases

- meta-data, e.g. for writing tax-calculations, which require additional knowledge about your payments

- controller-functions for dynamic changes of the simulation properties during simulation

financial_life is available in version 0.9.2. It is written in Python 3.4 and has not been tested for Python 2.x.

To get a working environment, simply do

git clone https://github.com/MartinPyka/financial_life.git

cd financial_life

virtualenv venv

source venv/bin/activate

pip install -r requirements.txt

# test an example

python financial_life/examples/simple_examples.py

For installing the package:

git clone https://github.com/MartinPyka/financial_life.git

cd financial_life

python setup.py install

Or use pip

pip install financial_life

You can checkout the example with

python financial_life/examples/simple_examples.py

financial_life was designed with the idea in mind that any line of code should contribute to the description of the problem you want to model. In spreadsheets, you would deal with a lot of auxiliary tables to accurately calculate the course of a loan influenced by incoming payments and generated interests. In financial_life, you just create your loan account with the given interests rate and you define the regular payments going into this loan account. That's it. Changes in the model and the exploration of different parameters within this model are therefore way easier to accomplish than in a spreadsheet-based simulation.