This codebase is based on the paper: Frazzini, A. & Pedersen, L. (2014). Betting Against Beta, available online here. It seeks to implement the work discussed in the paper. Namely:

- Since constrained investors bid up high-beta assets, high beta is associated with low alpha.

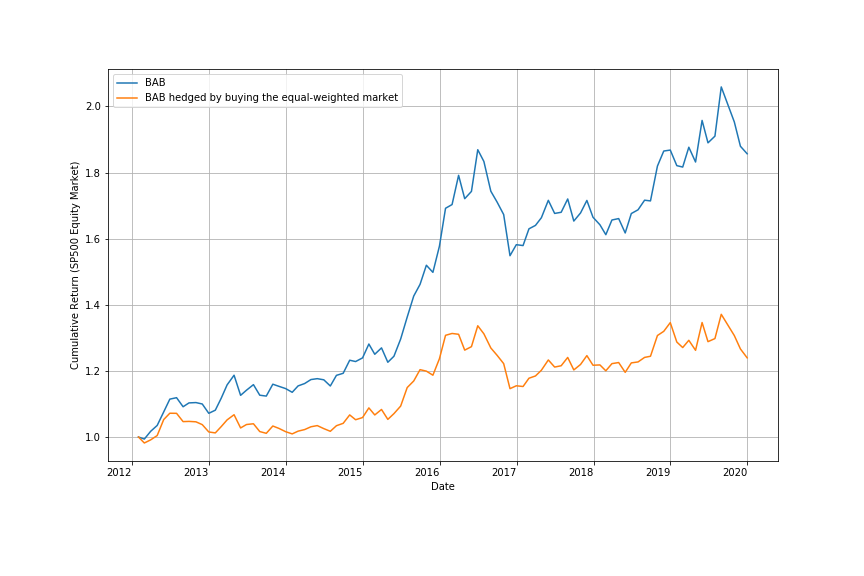

- A betting-against-beta (BAB) factor, which is long leveraged lowbeta assets and short high-beta assets, produces significant positive risk-adjusted returns.

- When funding constraints tighten, the return of the BAB factor is low.

- Increased funding liquidity risk compresses betas toward one.

- More constrained investors hold riskier assets.

-

Datafolder stores the fetched data andData.py. -

Data.pyconsists of 2 parts: save tickers, get data. Tickers are processed through website information, data are fetched using 'pandas-datareader'.

-

main.pycontains all the functions. -

figure.pyis for drawing plots.

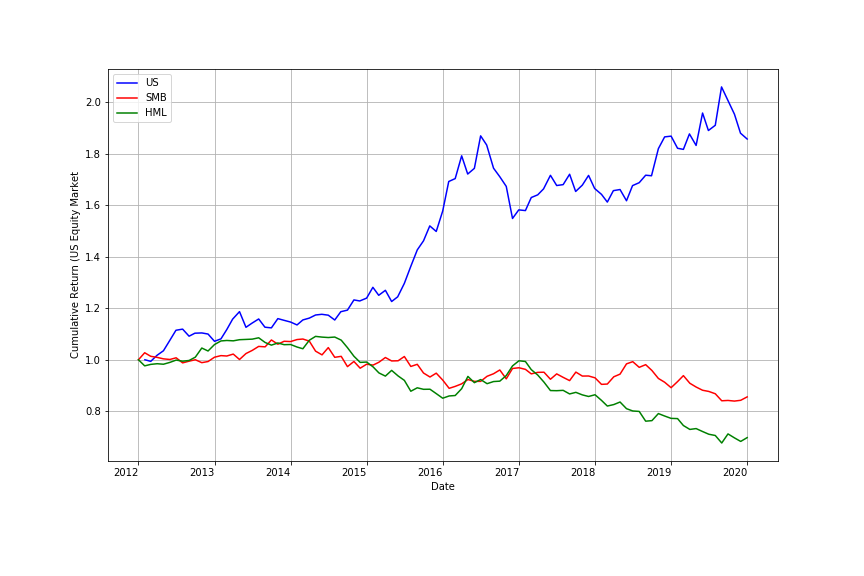

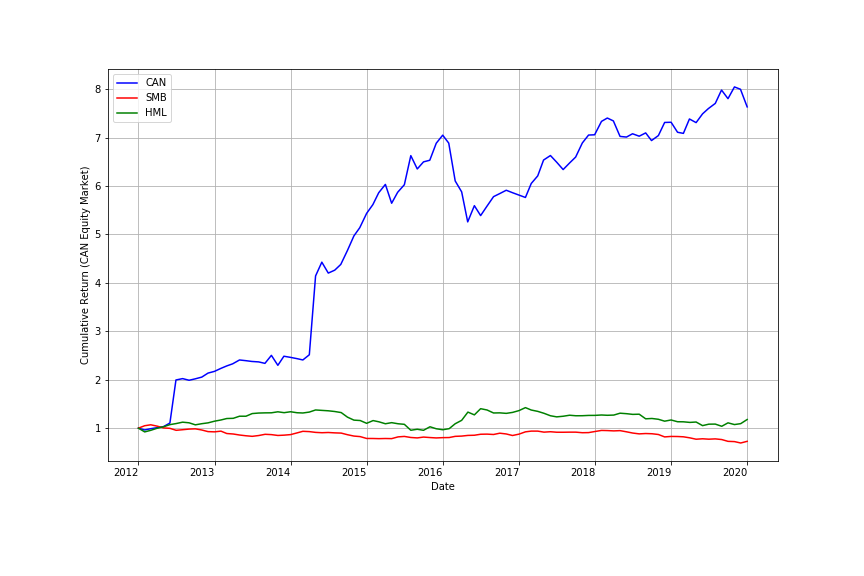

This strategy was back-tested on SP500 stocks and TSX (Toronto Stock Exchange) stocks and compared with two other similar factors presented in the Fama French 3-factor model: one is the SMB (small minus big), the other is the HML (high minus low). SMB and HML data were obtained from Ken French’s data library

Cumulative Return with $1 invested in the beginning in the SP500 (shown as US) equity market (in comparison with the SMB and HML factors)

Cumulative Return with $1 invested in the beginning in the TSX (shown as CAN) equity market (in comparison with the SMB and HML factors)

-

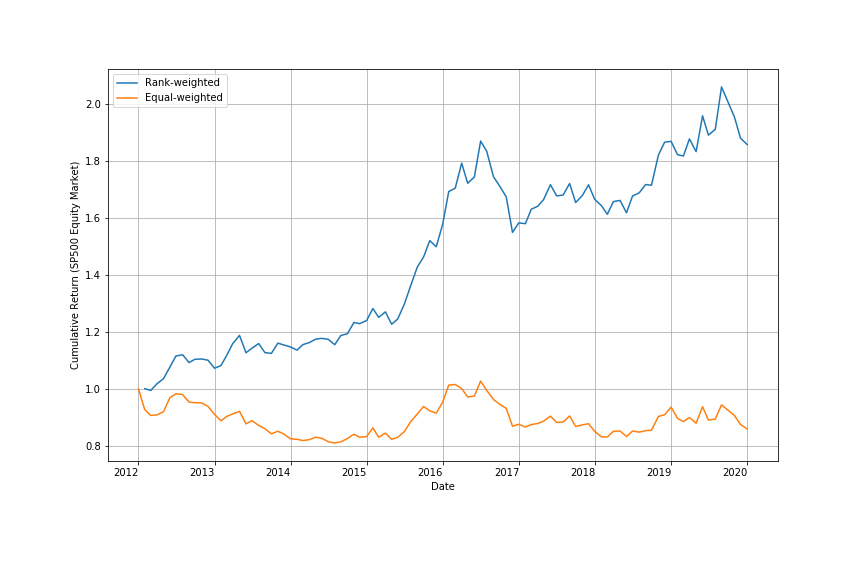

Trading cost: Looking at the actual weights the strategy puts on stocks with different market cap, we find out small-cap stocks are overweighted, causing significant implementation issues because the smallest stocks usually have limited capacity and are expensive to trade.

-

Set some threshold regarding the market capitalization when assigning weights

-

Mitigate risk using diversification

-

Explore the relationship between the strategy and market states, and refine it by incorporating the judgment of market trends into the strategy

- Andrea Frazzini and Lasse Heje Pedersen. Betting against beta. Journal of Financial Economics, 111(1):1–25, 2014