Do you work at a digital asset exchange or wallet provider?

Please contact us. We can help guide your integration.

Ripple is a network of computers which use the Ripple consensus algorithm to atomically settle and record transactions on a secure distributed database, the Ripple Consensus Ledger (RCL). Because of its distributed nature, the RCL offers transaction immutability without a central operator. The RCL contains a built-in currency exchange and its path-finding algorithm finds competitive exchange rates across order books and currency pairs.

- Distributed

- Direct account-to-account settlement with no central operator

- Decentralized global market for competitive FX

- Secure

- Transactions are cryptographically signed using ECDSA or Ed25519

- Multi-signing capabilities

- Scalable

- Capacity to process the world’s cross-border payments volume

- Easy access to liquidity through a competitive FX marketplace

Ripple enables banks to settle cross-border payments in real-time, with end-to-end transparency, and at lower costs. Banks can provide liquidity for FX themselves or source it from third parties.

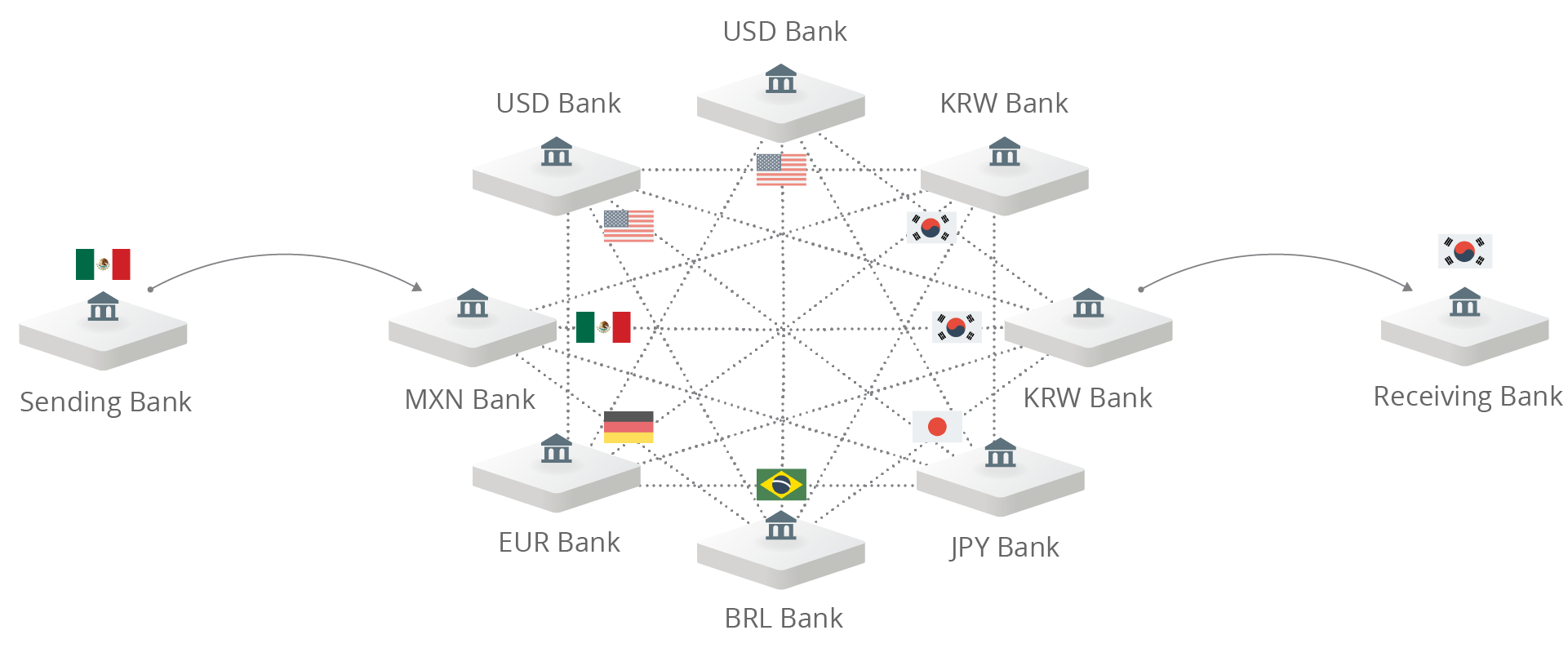

As Ripple adoption grows, so do the number of currencies and counterparties. Liquidity providers need to maintain accounts with each counterparty for each currency – a capital- and time-intensive endeavor that spreads liquidity thin. Further, some transactions, such as exotic currency trades, will require multiple trading parties, who each layer costs to the transaction. Thin liquidity and many intermediary trading parties make competitive pricing challenging.

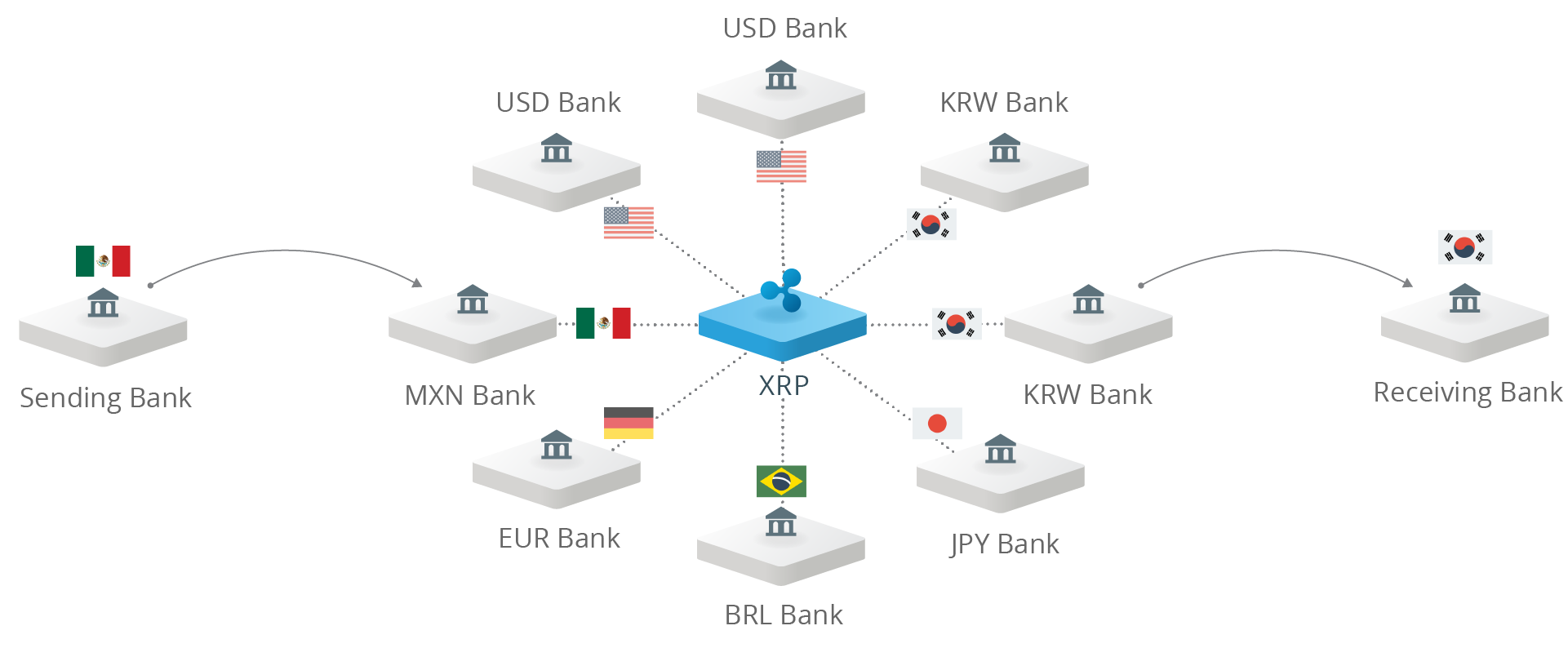

Ripple can bridge even exotic currency pairs directly through XRP. Similar to USD in today’s currency market, XRP allows liquidity providers to focus on offering competitive FX rates on fewer pairs and adding depth to order books. Unlike USD, trading through XRP does not require bank accounts, service fees, counterparty risk, or additional operational costs. By using XRP, liquidity providers can specialize in certain currency corridors, reduce operational costs, and ultimately, offer more competitive FX pricing.

rippled is the reference server implementation of the Ripple

protocol. To learn more about how to build and run a rippled

server, visit https://ripple.com/build/rippled-setup/

rippled is open source and permissively licensed under the

ISC license. See the LICENSE file for more details.

| Folder | Contents |

|---|---|

| ./bin | Scripts and data files for Ripple integrators. |

| ./build | Intermediate and final build outputs. |

| ./Builds | Platform or IDE-specific project files. |

| ./doc | Documentation and example configuration files. |

| ./src | Source code. |

Some of the directories under src are external repositories inlined via

git-subtree. See the corresponding README for more details.

- Ripple Knowledge Center

- Ripple Developer Center

- Ripple Whitepapers & Reports

To learn about how Ripple is transforming global payments visit https://ripple.com/contact/

Copyright © 2017, Ripple Labs. All rights reserved.

Portions of this document, including but not limited to the Ripple logo, images and image templates are the property of Ripple Labs and cannot be copied or used without permission.