The product and operations team at Airbnb wants a detailed analysis of their guest host matching system in an attempt to grow bookings at Rio. The team wants to

-

Track a few KPI's that would help them monitor the success of the teams efforts in improving guest host matching.

-

Gain a deeper understanding of what areas to invest. Come up with a few recommendations, business initiative and product changes and demonstrate the rationale behind the recommendations.

-

Conversion rate (%)

- Across different stages of communication between guest & host, from

first interation -> first reply -> acceptance -> booking/abandoned - Across contact channel types (contact_me, book_it, instant_book)

- Across user type (New vs. Returning)

- Across room types (Private room vs. Entire Apt vs. Shared room)

- Across different stages of communication between guest & host, from

-

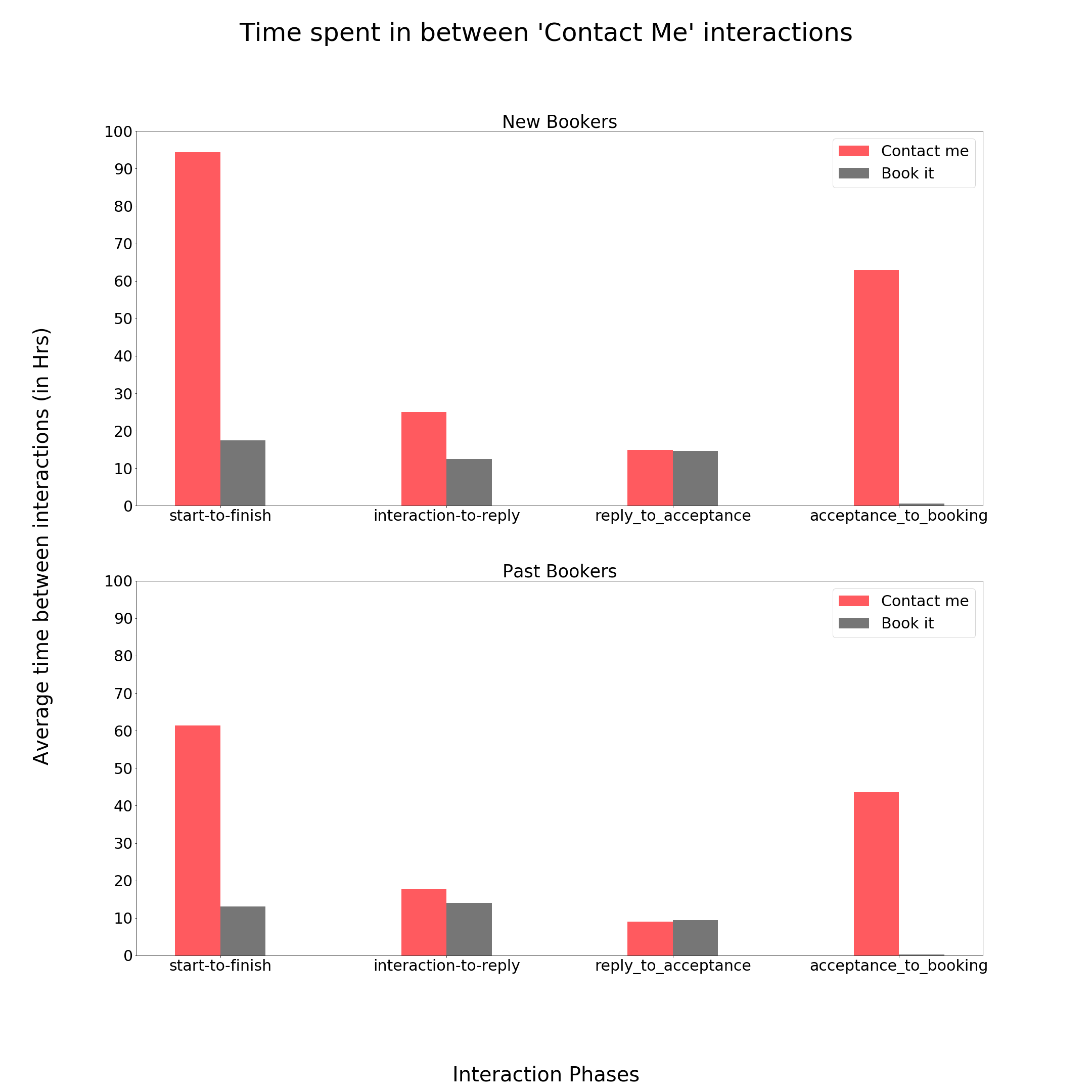

Average time between interactions

- Across user-type and channel-type

-

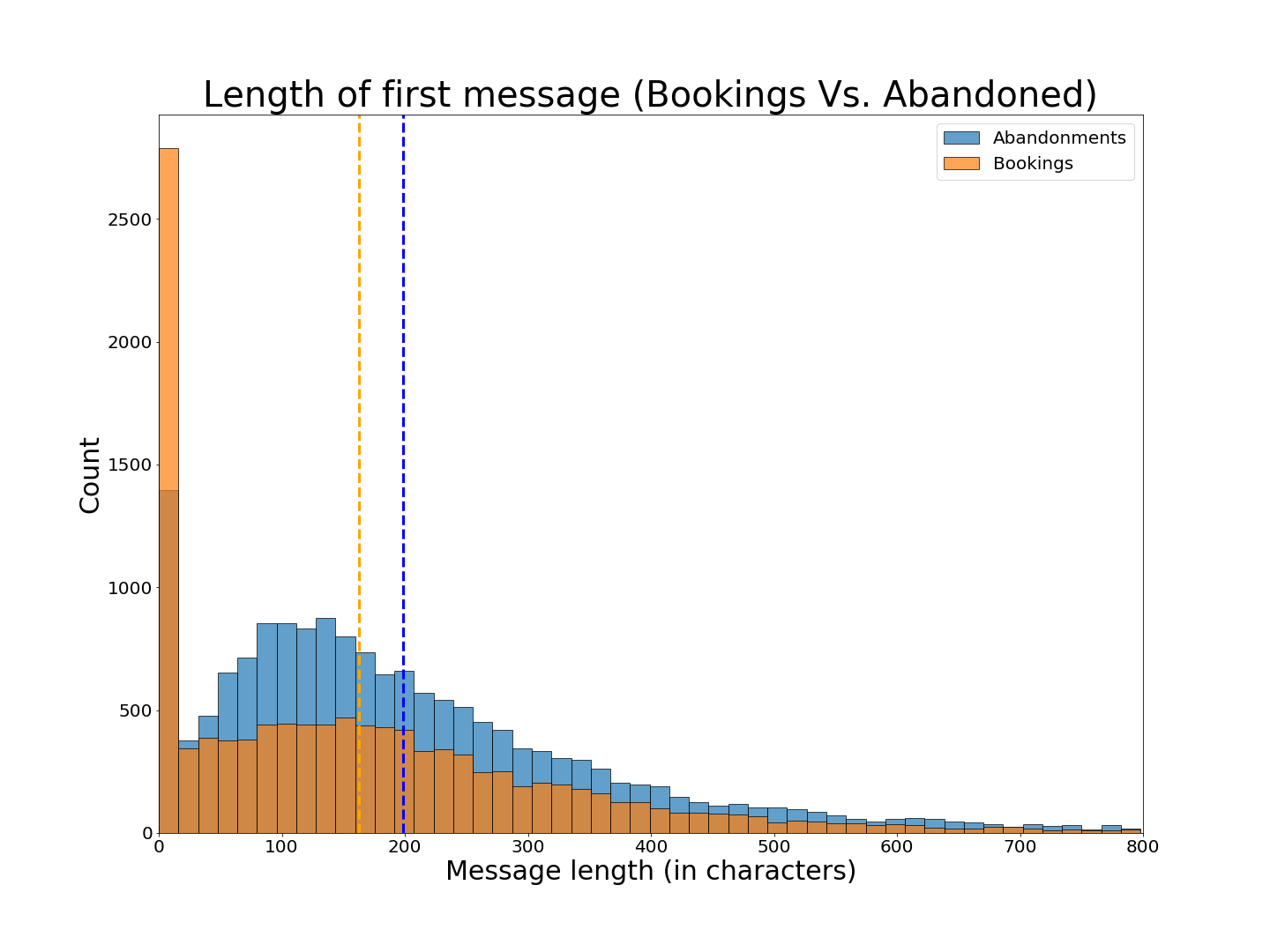

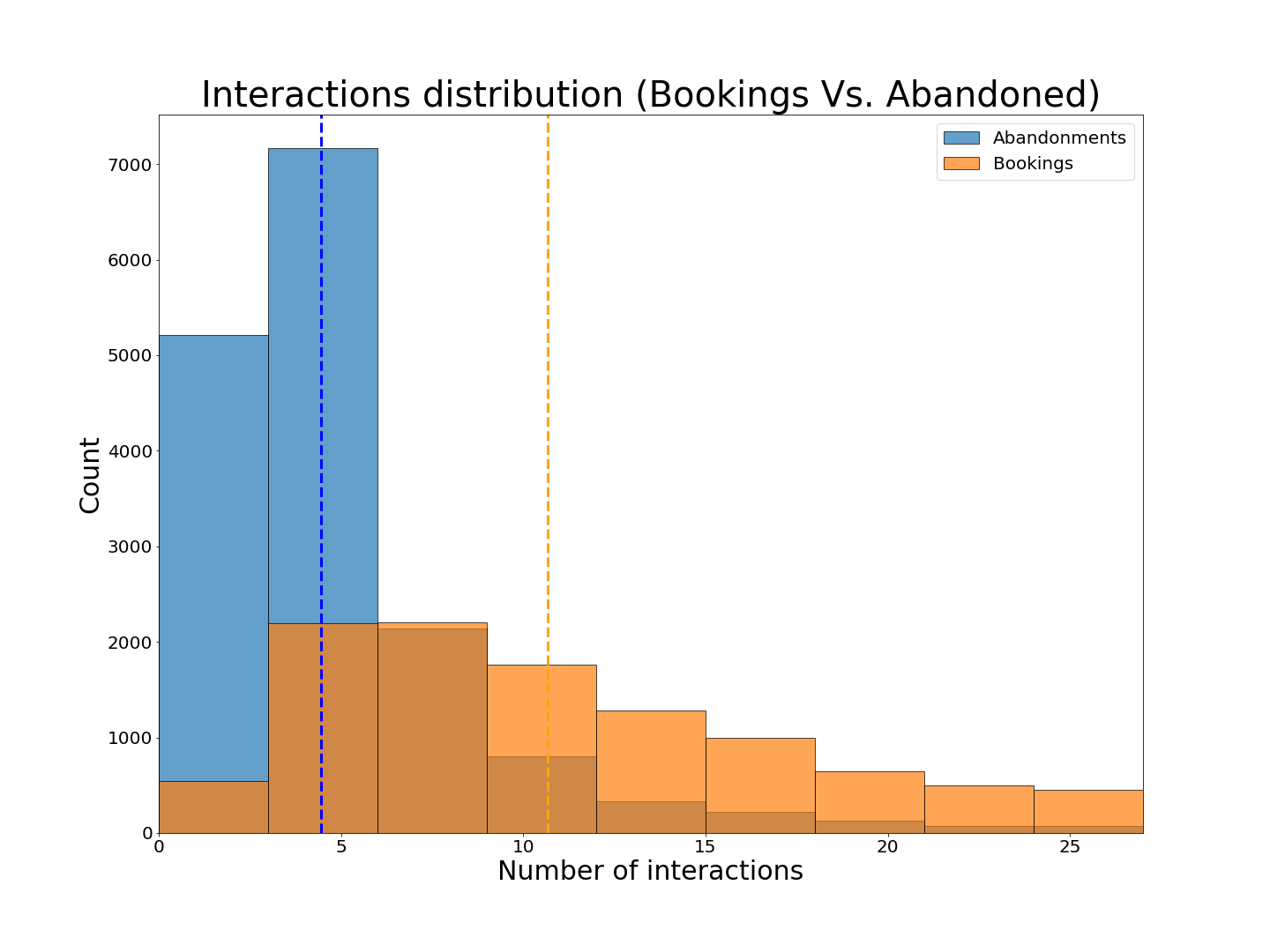

# Interactions and # Characters in guests opening remark (Bookings vs. Abandoned)

-

Make suggestions to keep the interactions engaging

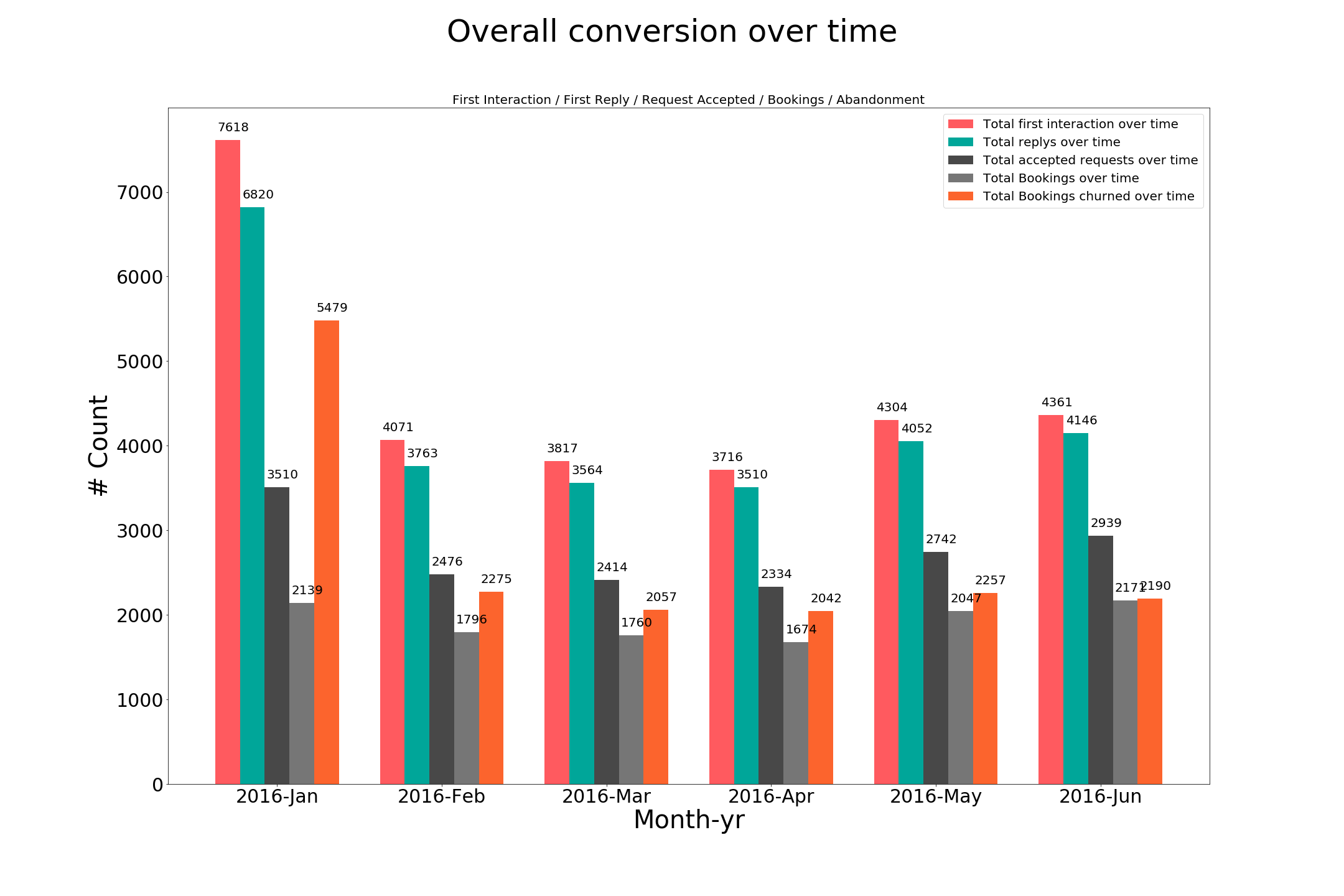

On an overall level, there is a massive drop in the number of accepted requests once we get past the reply phase. Providing sample suggestions to both guest and host could improve the chances of booking.

The following distributions plots provide further evidence to come up with measures to improve engagement.

-

To make a good first impression, the opening message should have no more than ~180 characters.

-

Also all the successful bookings have shown little over 10 interactions.

-

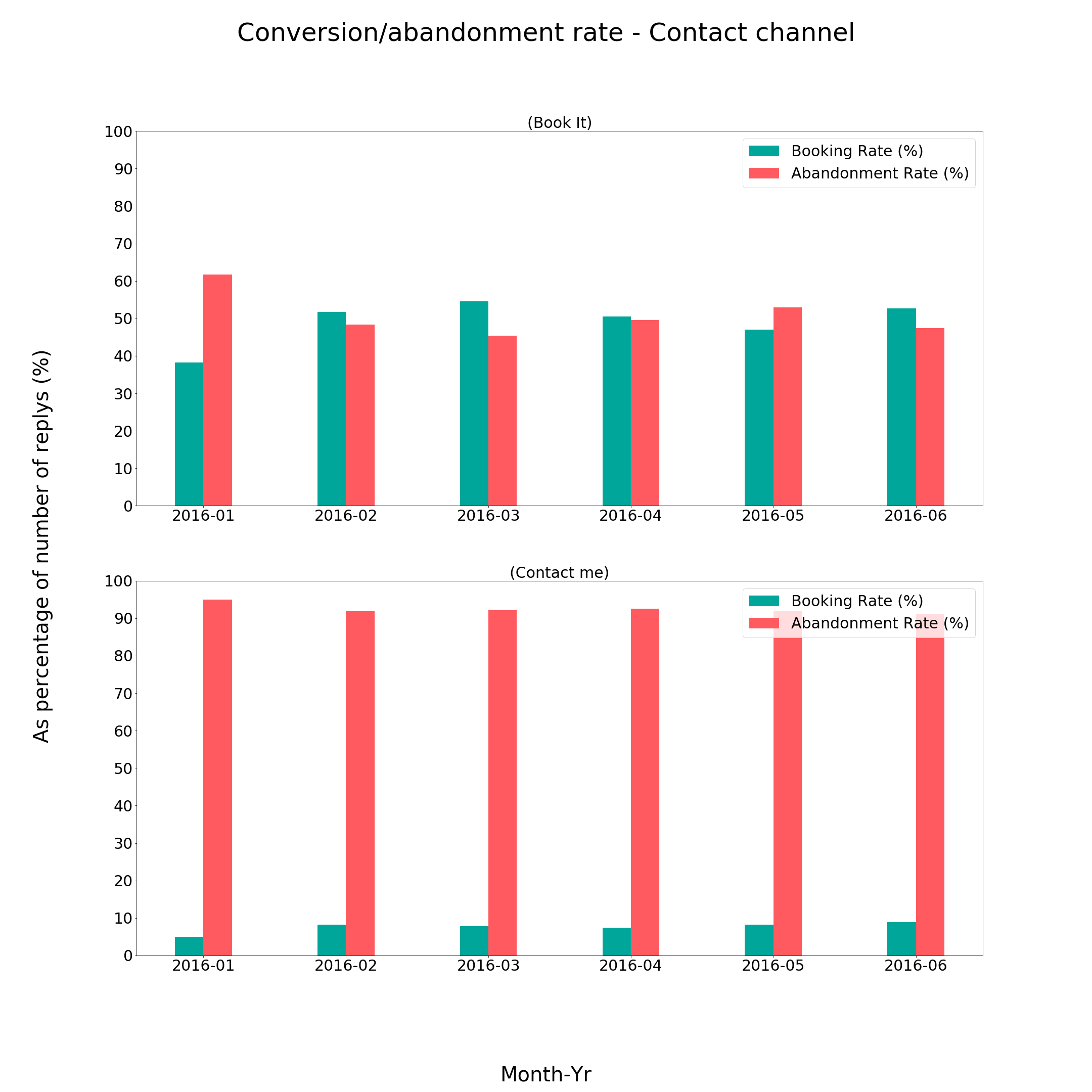

"Contact_me" performs poorly

Looking at the abandonment rate in the figure below, we see that "Contact_me" channel type has 10 times the abandonment rate as compared to "book_it".

Note: The abandonment rate is a percentage of the total number of interactions started.

Digging a bit deeper, the following plot shows the time spent in number of hours between different phases of the interaction for new vs. returning buyers. We clearly see that average time for "Contact_me" between the phases is well over a day for both types of buyers, which provides further evidence against the channel.

2. Buildzoom - Top

Buildzoom gets data on building permits and wants to build a classifier that can correctly identify of the permit. The permit maybe of several types, but Buildzoom, wants a binary classification that can identify if a permit is (ELECTRICAL/NON-ELECTRICAL).

| Data Column | Description |

|---|---|

| License Type | Types of license associated with the property (Electrical contractor license, Speciality contractor license) |

| Business Name | Name of business |

| Legal Description | Legal address/block information |

| Description | describes work that need to be done eg: Install low voltage security system |

| Type (y) | ELECTRICAL/NON-ELECTRICAL |

| Subtype | Commercial/Single Family |

| Job Value | Value associated with the job |

Python libraries: Pandas, NumPy, Scikit-learn, NLTK, XGBoost, Regex

- StatQuest: https://www.youtube.com/watch?v=GrJP9FLV3FE&t=2217s

- Data School: https://www.youtube.com/watch?v=irHhDMbw3xo&t=135s

3. DataRobot - Top

DataRobot wants to build a classification model to predict if an applicant is going to default on loan or not. Which loan applicants are most profitable and worthy of lending money to?

Following snippet of code shows the data dictionary. is_bad is the binary classification variable we want to predict. Based on some EDA the data set is highly imbalanced, so we need to make sure that we are using evaluation metrics that accounts for it.

import pandas as pd

data_dict = pd.read_csv('/datarobot/data/data_dictionary.csv')

print(data_dict)| Index | Column Name | Type | Description | Category |

|---|---|---|---|---|

| 0 | addr_state | Categorical | Customer State | Customer |

| 1 | annual_inc | Numeric | Annual Income | Customer |

| 2 | collections_12_mths_ex_med | Numeric | (Credit based) | Customer |

| 3 | debt-to-income | Numeric | Ratio of debt to income | Loan |

| 4 | delinq_2yrs | Numeric | Any delinquency in last 2 years | Customer |

| 5 | earliest_cr_line | Date | First credit date | Customer |

| 6 | emp_length | Numeric | Length in current job | Customer |

| 7 | emp_title | Text | Employee Title | Customer |

| 8 | home_ownership | Categorical | Housing Status | Customer |

| 9 | Id | Numeric | Sequential number | Identifier |

| 10 | initial_list_status | Categorical | Loan status | Loan |

| 11 | inq_last_6mths | Numeric | Number of inquiries | Customer |

| 12 | is_bad | Numeric | 1 or 0 | Target |

| 13 | mths_since_last_delinq | Numeric | Months since last delinquency | Customer |

| 14 | mths_since_last_major_derog | Numeric | (Credit based) | Customer |

| 15 | mths_since_last_record | Numeric | Months since last record | Customer |

| 16 | Notes | Text | Notes taken by the administrator | Loan |

| 17 | open_acc | Numeric | (Credit based) | Customer |

| 18 | pymnt_plan | Categorical | Current Payment Plans | Customer |

| 19 | policy_code | Categorical | Loan type | Loan |

| 20 | pub_rec | Numeric | (Credit based) | Customer |

| 21 | purpose | Text | Purpose for the loan | Loan |

| 22 | purpose_cat | Categorical | Purpose category for the loan | Loan |

| 23 | revol_bal | Numeric | (Credit based) | Customer |

| 24 | revol_util | Numeric | (Credit based) | Customer |

| 25 | total_acc | Numeric | (Credit based) | Customer |

| 26 | verification_status | Categorical | Income Verified | Loan |

| 27 | zip_code | Categorical | Customer zip code | Customer |

For numeric data the missing values were replaced/imputed by the most occurring value or the mean() if the count of missing value was <1% and feature scaling was performed using the minmaxscaler() method of sklearn library.

For categorical data missing values were replaced by "None". If a particular feature had too many categories, they were grouped together into broader categories. For eg: emp_title or Employer title feature had names of employers appering in different patterns.

Following are different patterns in which the US Army, the US Navy and Walmart appeared in. These varied appearence were replace with the more common 'U.S. Army', 'U.S. Navy', 'Walmart'

US Army patterns: ['U.S. Army', 'US Army', 'US ARMY', 'United States Army', 'us army', 'US Army', 'United States Army', 'US military army', 'united states army', 'U.S. Army', 'united States Army', 'US Army', 'U.S army', 'Us Army', 'U.S Army', 'U. S. Army', 'Us army']

US Navy patterns: ['US Navy', 'U.S. Navy', 'US Navy', 'US NAVY', 'Us Navy', 'United States Navy']

Walmart patterns: ['Wal-Mart', 'WAL-MART', 'Walmart', 'WalMart', 'wal-mart', 'walmart']

Some categorical features were biased towards one category 99:1 so they were dropped, because they weren't predictive of is_bad the target variable.

Date variable had information dated as early as 1960's. So they were replaced with quarter and year as two separate variables.

For text data i.e. Notes in the feature engineering stage, NLTK was used to remove stop words and special characters from the notes from potential loan applicants. Stemming and Lemmatizers were applied, but the results with the ML model weren't great so they were skipped.

Further tfidf_vectorizer() from sklearn was used to encode text features into numeric one's. Following were the keywords that were more important in categorizing the target variable is_bad:

Important keywords: bills, borrower, business, card, credit, current, currently, help, job, like, loan, need, pay, rate

XGBoost model was trained to maximize sensitivity/recall for prediction, because of all the one's that defaulted we want the capacity to predict most of them ~70% or higher prediction accuracy.

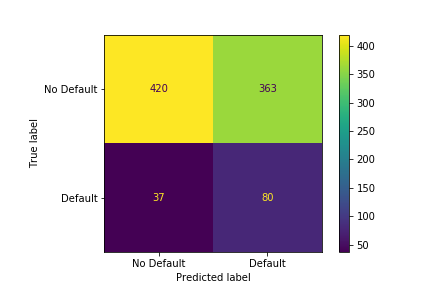

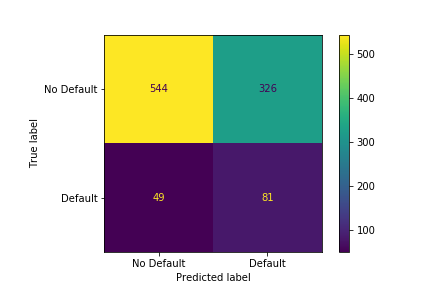

After performing Grid search for hyper-parameter tuning and some amount of manual tuning, we get the following confusion matrix for our validation and test set.

|

|---|

| Figure 1: Validation set - Confusion matrix |

|

|---|

| Figure 2: Test set - Confusion matrix |

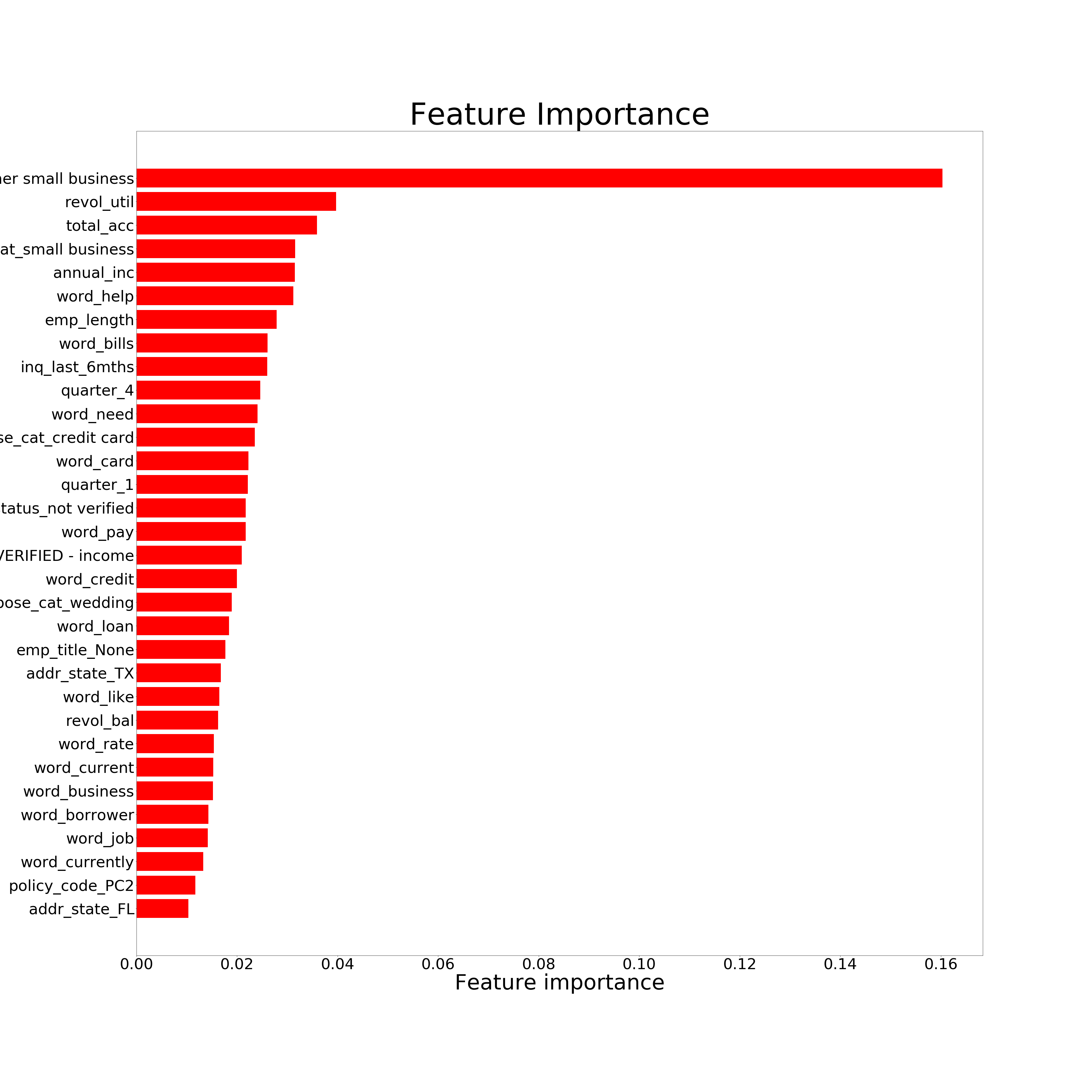

We also need to figure out the set of features that are predictive of our target variable i.e is_bad.

|

|---|

| Figure 3: Feature Importance |