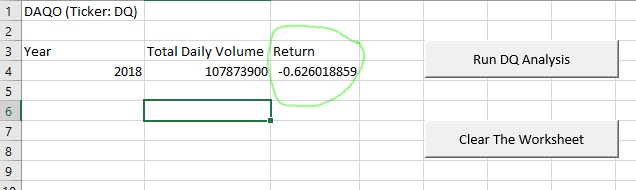

This project is created to analyze green energy stocks, particularly DAQO New Energy Corp (DQ), and determine the most efficient ones based on their performance (amount sold and return) for diversification of investment funds using Excel and VBA.

First I calculated Total Daily Volume (amount of sold DQ stocks) and Return (difference between the stock prices at the end of the year 2018 to the beginning of the year 2018) using code:

Sub DQAnalysis()

Worksheets("DQ Analysis").Activate

Range("A1").Value = "DAQO (Ticker: DQ)"

'Create a header row

Cells(3, 1).Value = "Year"

Cells(3, 2).Value = "Total Daily Volume"

Cells(3, 3).Value = "Return"

Worksheets("2018").Activate

Dim startingPrice As Double

Dim endingPrice As Double

' Establish the number of rows to loop over

rowStart = 2

'DELETE: rowEnd = 3013

'rowEnd code taken from https://stackoverflow.com/questions/18088729/row-count-where-data-exists

rowEnd = Cells(Rows.Count, "A").End(xlUp).Row

'set initial volume to zero

totalVolume = 0

'loop over all the rows

For i = rowStart To rowEnd

If Cells(i, 1).Value = "DQ" Then

'increase totalVolume if ticker is "DQ"

totalVolume = totalVolume + Cells(i, 8).Value

End If

If Cells(i, 1).Value = "DQ" And Cells(i - 1, 1).Value <> "DQ" Then

startingPrice = Cells(i, 6).Value

End If

If Cells(i, 1).Value = "DQ" And Cells(i + 1, 1).Value <> "DQ" Then

endingPrice = Cells(i, 6).Value

End If

Next i

'MsgBox (totalVolume)

Worksheets("DQ Analysis").Activate

Cells(4, 1).Value = 2018

Cells(4, 2).Value = totalVolume

Cells(4, 3).Value = (endingPrice / startingPrice) - 1

End SubIn 2018 DQ showed the negative return -63%. That means that DQ stocks decreased in price about 63%.

To find better stocks to invest in I calculated Total Daily Volume and Return for all other stocks in 2018 and 2017 using code:

Sub AllStocksAnalysis()

Dim startTime As Single

Dim endTime As Single

Worksheets("All Stocks Analysis").Activate

Dim yearValue As String

yearValue = InputBox("What year would you like to run the analysis on?")

startTime = Timer

Range("A1").Value = "All Stocks (" + yearValue + ")"

'Create a header row

Cells(3, 1).Value = "Ticker"

Cells(3, 2).Value = "Total Daily Volume"

Cells(3, 3).Value = "Return"

'2) Initialize array of all tickers

Dim tickers(11) As String

tickers(0) = "AY"

tickers(1) = "CSIQ"

tickers(2) = "DQ"

tickers(3) = "ENPH"

tickers(4) = "FSLR"

tickers(5) = "HASI"

tickers(6) = "JKS"

tickers(7) = "RUN"

tickers(8) = "SEDG"

tickers(9) = "SPWR"

tickers(10) = "TERP"

tickers(11) = "VSLR"

'3a) Initialize variables for starting price and ending price

Dim startingPrice As Double

Dim endingPrice As Double

'3b) Activate data worksheet

Sheets(yearValue).Activate

'3c) Get the number of rows to loop over

RowCount = Cells(Rows.Count, "A").End(xlUp).Row

'4) Loop through tickers

For i = 0 To 11

ticker = tickers(i)

totalVolume = 0

'5) loop through rows in the data

Worksheets(yearValue).Activate

For j = 2 To RowCount

'5a) Get total volume for current ticker

If Cells(j, 1).Value = ticker Then

'increase totalVolume

totalVolume = totalVolume + Cells(j, 8).Value

End If

'5b) get starting price for current ticker

If Cells(j, 1).Value = ticker And Cells(j - 1, 1).Value <> ticker Then

startingPrice = Cells(j, 6).Value

End If

'5c) get ending price for current ticker

If Cells(j, 1).Value = ticker And Cells(j + 1, 1).Value <> ticker Then

endingPrice = Cells(j, 6).Value

End If

Next j

'6) Output data for current ticker

Worksheets("All Stocks Analysis").Activate

Cells(4 + i, 1).Value = ticker

Cells(4 + i, 2).Value = totalVolume

Cells(4 + i, 3).Value = (endingPrice / startingPrice) - 1

Next i

endTime = Timer

MsgBox ("This code ran in " & (endTime - startTime) & " seconds for the year " & (yearValue))

End SubI also added buttons and formatted the table to make it easier to understand for users using code:

Sub ClearWorksheet()

Cells.Clear

End Subfor "Clear the table" button and code:

Sub formatAllStocksAnalysisTable()

Worksheets("All Stocks Analysis").Activate

Range("A3:C3").Font.Bold = True

Range("A3:C3").Borders(xlEdgeBottom).LineStyle = xlContinuous

Range("A1").Font.Size = 14

Range("A1").Font.Color = vbBlue

Range("A1").Font.Bold = True

Range("B4:B15").NumberFormat = "#,##0"

Range("C4:C15").NumberFormat = "0.00%"

Columns("B").AutoFit

dataRowStart = 4

dataRowEnd = 15

For i = dataRowStart To dataRowEnd

If Cells(i, 3) > 0 Then

'Color the cell green

Cells(i, 3).Interior.Color = vbGreen

ElseIf Cells(i, 3) < 0 Then

'Color the cell red

Cells(i, 3).Interior.Color = vbRed

Else

'Clear the cell color

Cells(i, 3).Interior.Color = xlNone

End If

Next i

End Subfor "Format the table " button.

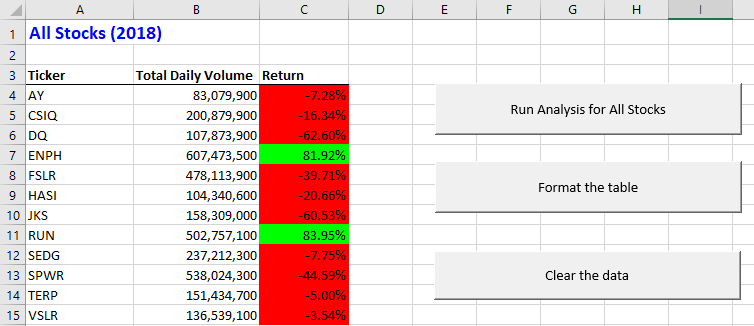

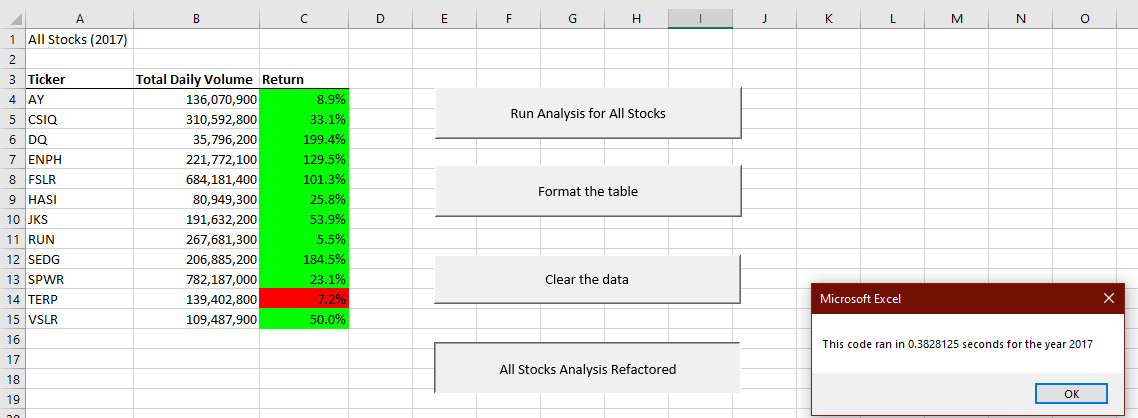

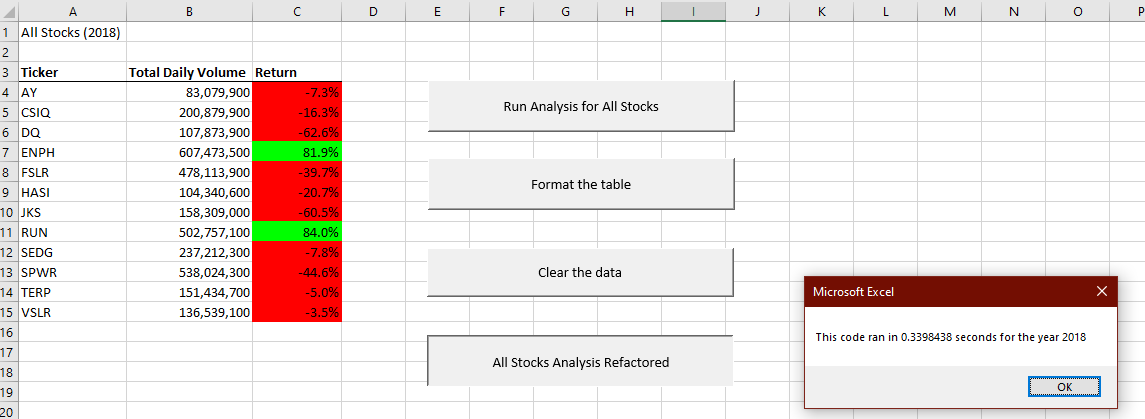

As a result of this analysis we can see that only two of twelve stocks showed positive dynamics in 2018: "ENPH" and "RUN":

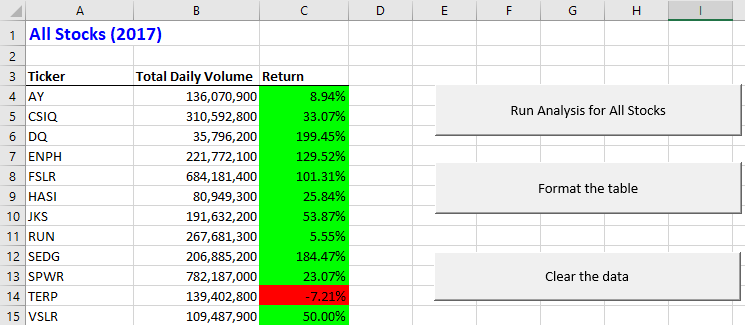

2017 though was a pretty successful year for almost all the stocks including "DQ":

Stocks "ENPH" show good results for two years in a row what makes them attractive to invest in. "RUN" increased in price in 2017 less than others did but the dynamics is still positive. "DQ" raised well in 2017 (by almost 200%) but dropped in 2018 by 63%.

If calculate the approximate two-years-term outcome we get

(x+2x) -- (x+2x)*0.63 = 3x -- 1.89x = 1.11x

what means that "DQ" stocks raised by 11% - still positive result but pretty risky.

This script works well for twelve stocks but might be a little slow for a bigger amount of stocks because it performs all the operations (activation the right worksheet, calculations and output) inside of one for-loop. To make it work faster we can separate parts that can work independently and don't need to be repeated for every step of the for-loop like

- Making tikerVolume = 0 for every ticker

- Activation the right worksheet

- Output the values into All Stocks Analysis worksheet using new arrays (tickerVolumes(), tickerStartingPrice() and tickerEndingPrice()).

After doing all these steps and adding the formatting part into the code I got:

Sub AllStocksAnalysisRefactored()

Dim startTime As Single

Dim endTime As Single

Dim yearValue As String

Dim ticker As String

yearValue = InputBox("What year would you like to run the analysis on?")

startTime = Timer

'Format the output sheet on All Stocks Analysis worksheet

Worksheets("All Stocks Analysis").Activate

Range("A1").Value = "All Stocks (" + yearValue + ")"

'Create a header row

Cells(3, 1).Value = "Ticker"

Cells(3, 2).Value = "Total Daily Volume"

Cells(3, 3).Value = "Return"

'Initialize array of all tickers

Dim tickers(12) As String

tickers(0) = "AY"

tickers(1) = "CSIQ"

tickers(2) = "DQ"

tickers(3) = "ENPH"

tickers(4) = "FSLR"

tickers(5) = "HASI"

tickers(6) = "JKS"

tickers(7) = "RUN"

tickers(8) = "SEDG"

tickers(9) = "SPWR"

tickers(10) = "TERP"

tickers(11) = "VSLR"

'Activate data worksheet

Worksheets(yearValue).Activate

'Get the number of rows to loop over

RowCount = Cells(Rows.Count, "A").End(xlUp).Row

'1a) Create a ticker Index

Dim tickerIndex As Integer

tickerIndex = 0

'1b) Create three output arrays

Dim tickerVolumes(12) As Long

Dim tickerStartingPrices(12) As Single

Dim tickerEndingPrices(12) As Single

''2a) Create a for loop to initialize the tickerVolumes to zero.

For tickerIndex = 0 To 11

tickerVolumes(tickerIndex) = 0

Next tickerIndex

For tickerIndex = 0 To 11

ticker = tickers(tickerIndex)

''2b) Loop over all the rows in the spreadsheet.

Worksheets(yearValue).Activate

For i = 2 To RowCount

If Cells(i, 1).Value = ticker Then

'3a) Increase volume for current ticker

tickerVolumes(tickerIndex) = tickerVolumes(tickerIndex) + Cells(i, 8).Value

End If

'3b) Check if the current row is the first row with the selected tickerIndex.

'If Then

If Cells(i, 1).Value = ticker And Cells(i - 1, 1).Value <> ticker Then

tickerStartingPrices(tickerIndex) = Cells(i, 6).Value

'End If

End If

'3c) check if the current row is the last row with the selected ticker

If Cells(i, 1).Value = ticker And Cells(i + 1, 1).Value <> ticker Then

tickerEndingPrices(tickerIndex) = Cells(i, 6).Value

End If

'If the next row’s ticker doesn’t match, increase the tickerIndex.

'If Then

'DELETE If Cells(i, 1).Value = ticker And Cells(i + 1, 1).Value <> ticker Then

'3d Increase the tickerIndex.

'DELETE tickerIndex = tickerIndex + 1

'End If

'DELETE End If Othewise it doesn't work

Next i

Next tickerIndex

'4) Loop through your arrays to output the Ticker, Total Daily Volume, and Return.

For i = 0 To 11

Worksheets("All Stocks Analysis").Activate

Cells(4 + i, 1).Value = tickers(i)

Cells(4 + i, 2).Value = tickerVolumes(i)

Cells(4 + i, 3).Value = (tickerEndingPrices(i) / tickerStartingPrices(i)) - 1

Next i

'Formatting

Worksheets("All Stocks Analysis").Activate

Range("A3:C3").Font.FontStyle = "Bold"

Range("A3:C3").Borders(xlEdgeBottom).LineStyle = xlContinuous

Range("B4:B15").NumberFormat = "#,##0"

Range("C4:C15").NumberFormat = "0.0%"

Columns("B").AutoFit

dataRowStart = 4

dataRowEnd = 15

For i = dataRowStart To dataRowEnd

If Cells(i, 3) > 0 Then

Cells(i, 3).Interior.Color = vbGreen

Else

Cells(i, 3).Interior.Color = vbRed

End If

Next i

endTime = Timer

MsgBox "This code ran in " & (endTime - startTime) & " seconds for the year " & (yearValue)

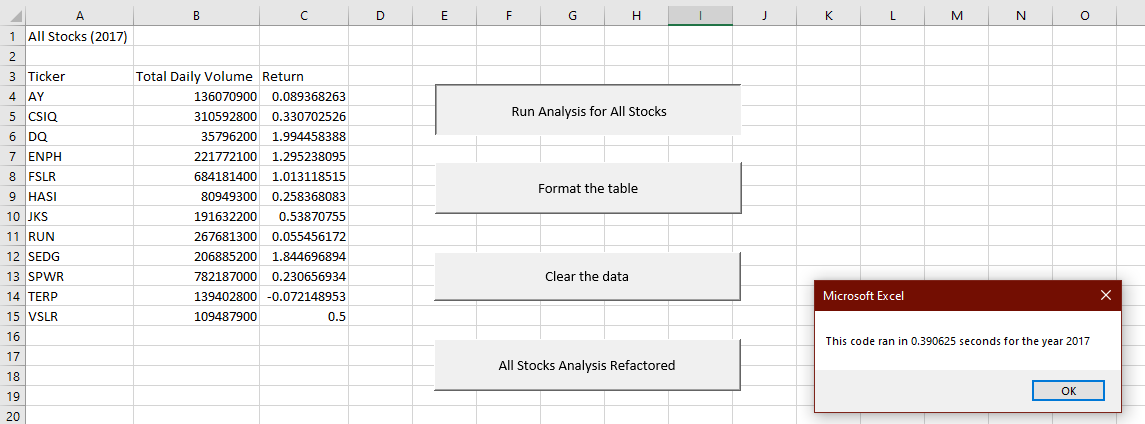

End SubLet's compare the execution time of these two codes.

For 2017 year

Original code:

Refactored one:

Even though in second code we calculated the time needed to make all the calculations and formatting it is still 0.01 seconds less than for executing first one for just calculations.

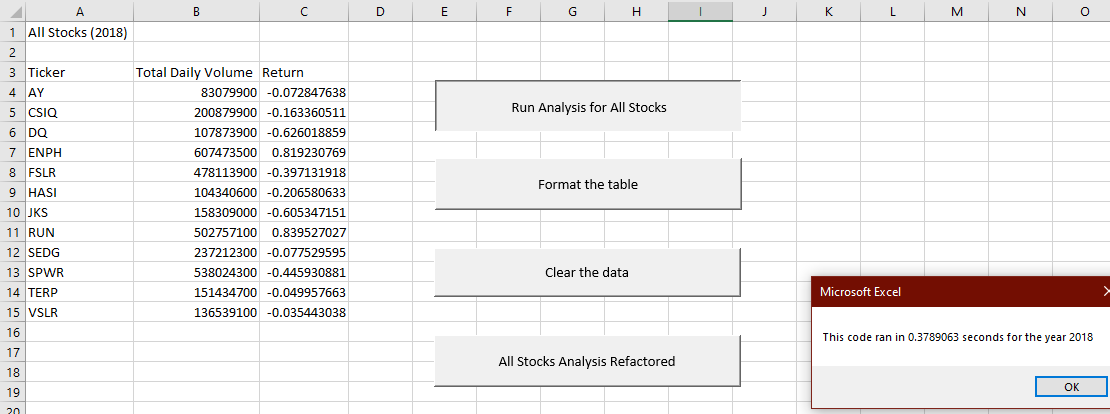

Same for the 2018 year:

Original code:

Refactored one:

Again the refactored code is 0.04 seconds faster than original one.

-

It makes the calculations faster

-

The code is less logically complex, easier to understand

-

Less steps are taken to get results

-

Less memory is used

-

Simplifies support and code updates

-

Saves time and money in future

-

Maintainability and scalability

-

Finding hidden bugs and fixing them.

- Refactoring is time-consuming.

- Made the code work faster

- The code looks less complex, easier to understand

- Less steps are taken to get results.

- Refactoring is time-consuming

- Had to create new and rename some old variables and arrays which can be confusing.