Analyzing Profitability on Rentals using AirbnB and Zillow datasets

Problem Statement

Airbnb wants to buy properties in New York from Zillow listings data for short term rentals. We have to help Airbnb decide which zip codes would be most profitable to invest in. One assumption made here is that the occupancy rate of Airbnb is 75% and they are interested in buying properties with 2 bedrooms only.

What this analysis includes:

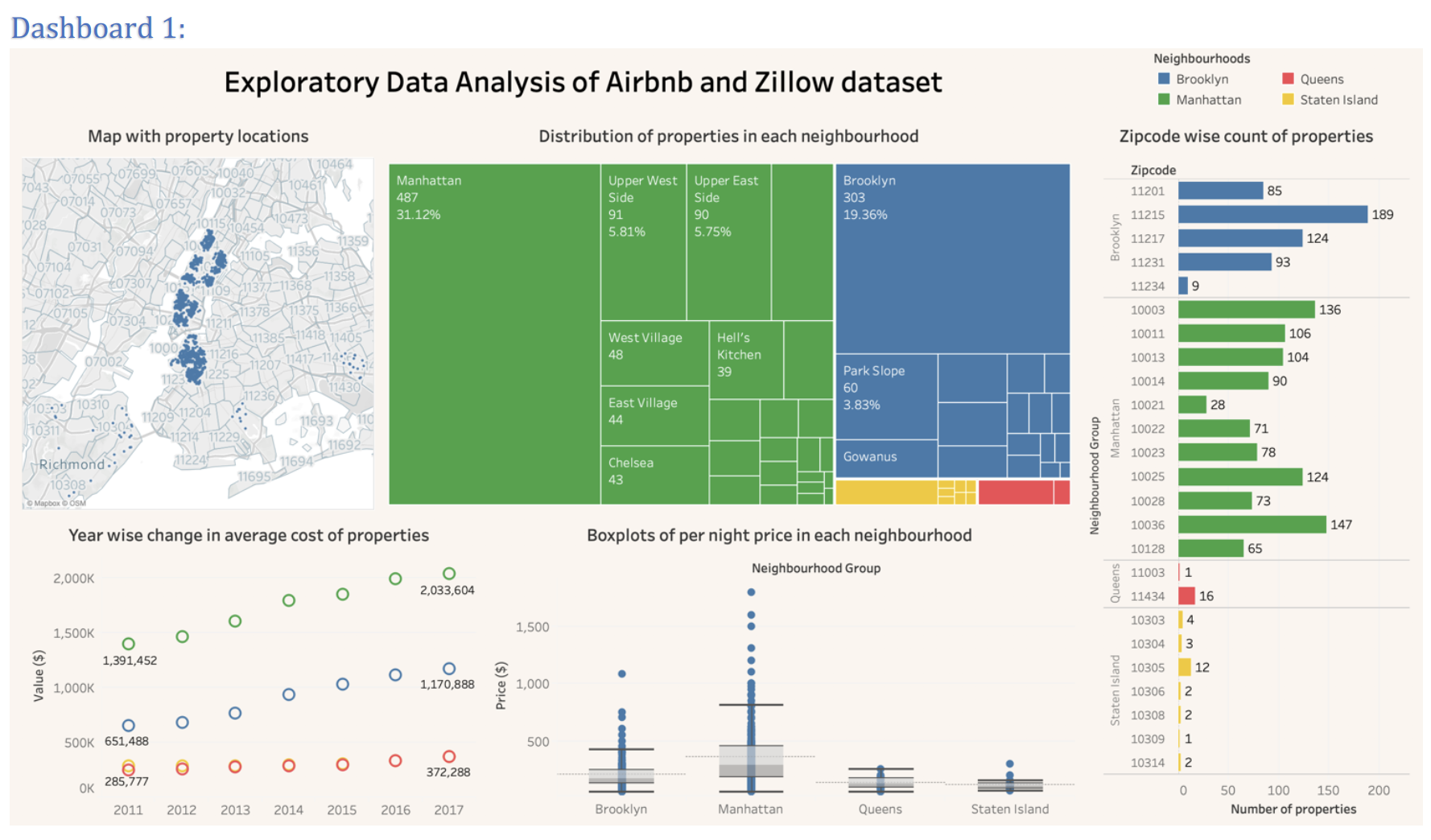

- Analyzing data and comparing Neighbourhoods with data visualizations

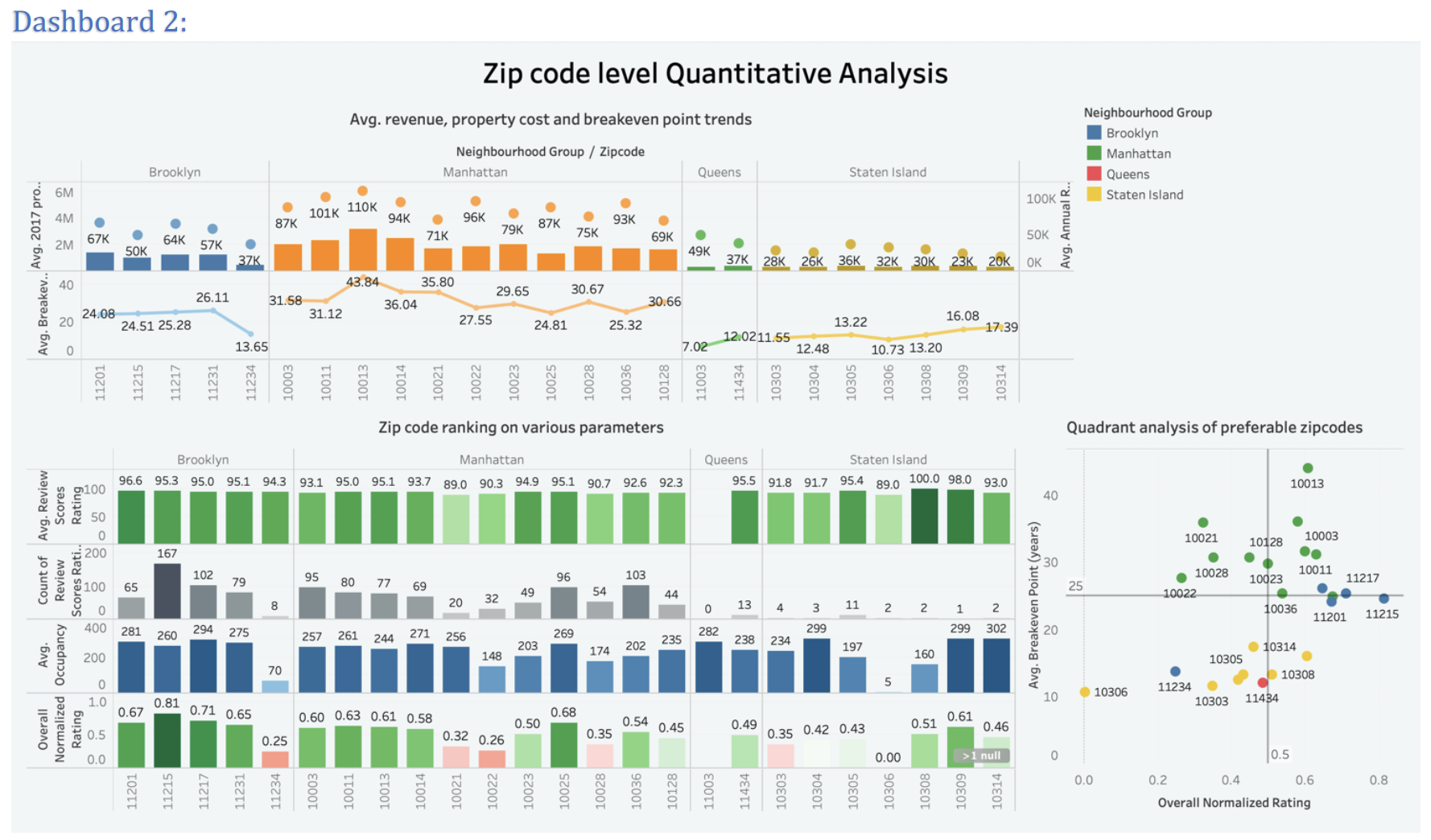

- Comparison of Break-even time and YoY profits for different zipcodes

- NYC Zip codes rankings based on various parameters

- Quadrant analysis of preferable zip codes and recommendations and final Recommendations

Datasets Used

- Zillow Data - Provides the price for two-bedroom properties in NYC

- Airbnb Data - Provides the rent charged for properties in NYC

Content

- Python notebook with data data-preprocessing steps

- Final Report containing the insights and recommendations.

- Tableau Dashboards