This is an attempt to predict who will default on loans based on existing customer data. This is a kaggle challenge. You can find it here

The first step is do do something about missing values. There is missing data in the columns for salary, experience, delinquency, and credit scores.

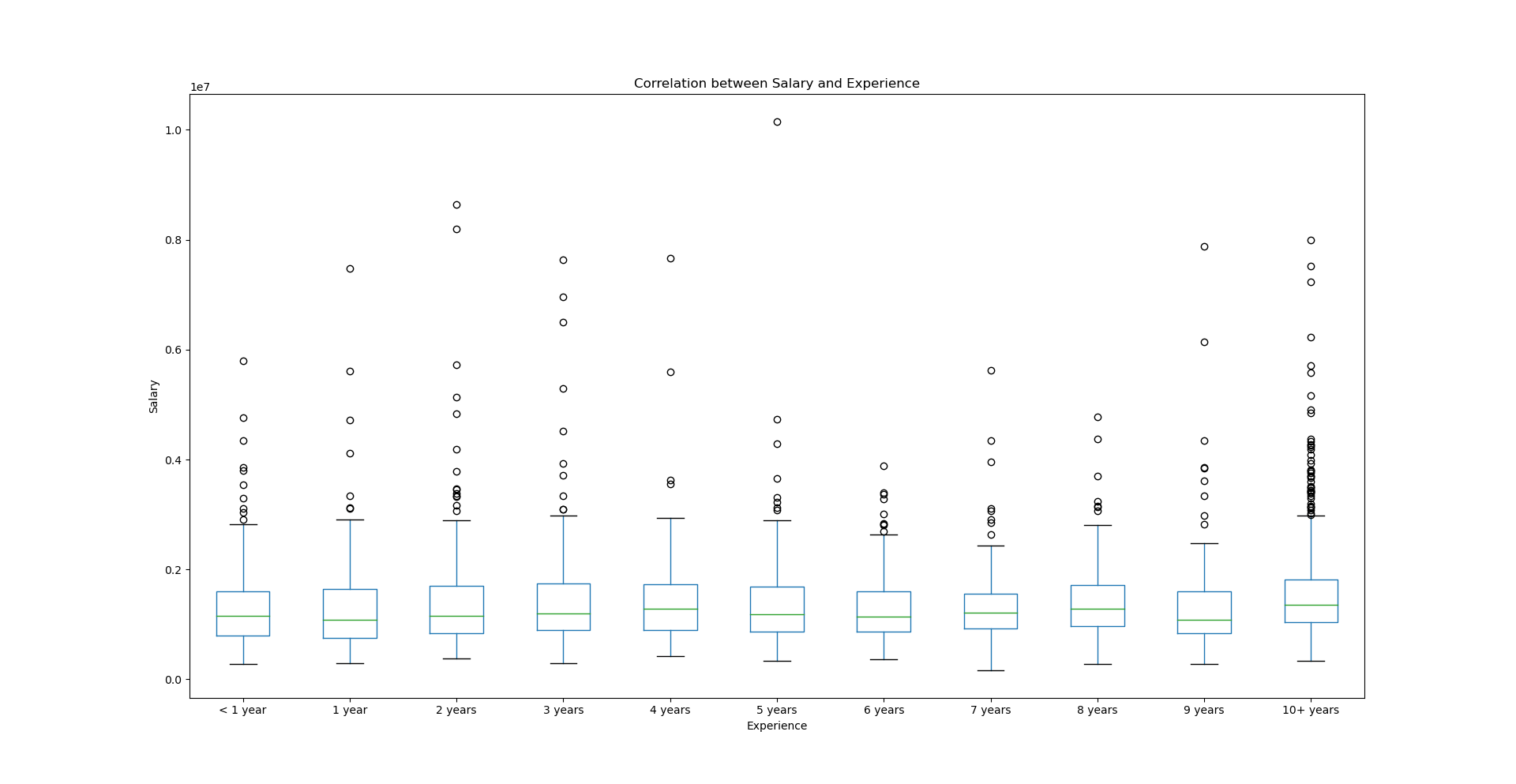

My first intuition was that there may be a correlation between Salary and Experience. If this were true, we could at-least infer values for Salary or Experience where 1 is missing. To test this theory, I removed all records where either was missing and plotted Salary vs Experience in a box plot.

The following was the result:

As can be seen here, it doesn't look like there is any clear enough link between Salary and Experience for us to perform an inference so I investigated other possible correlations.

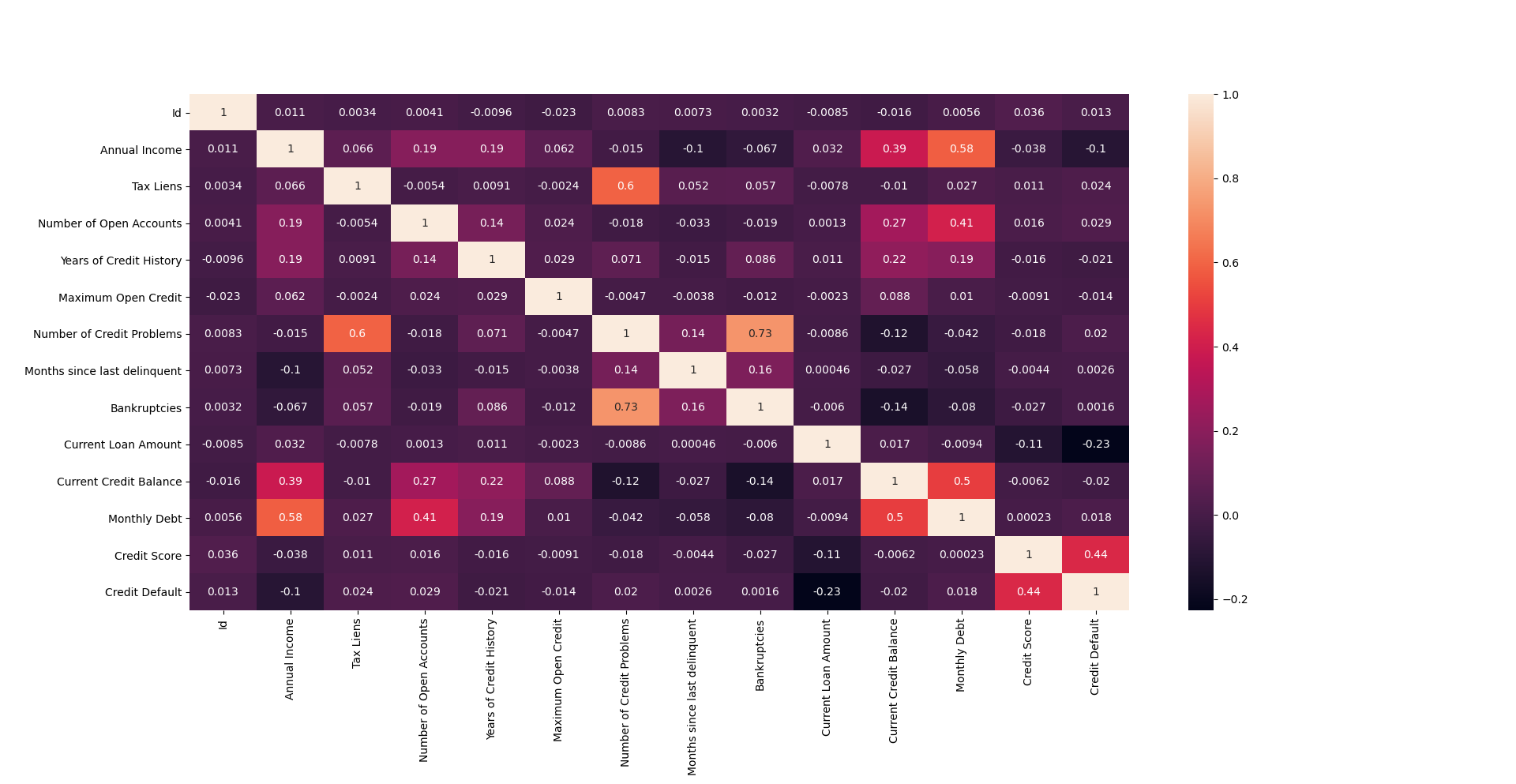

I generated a correlation matrix. This is what I got:

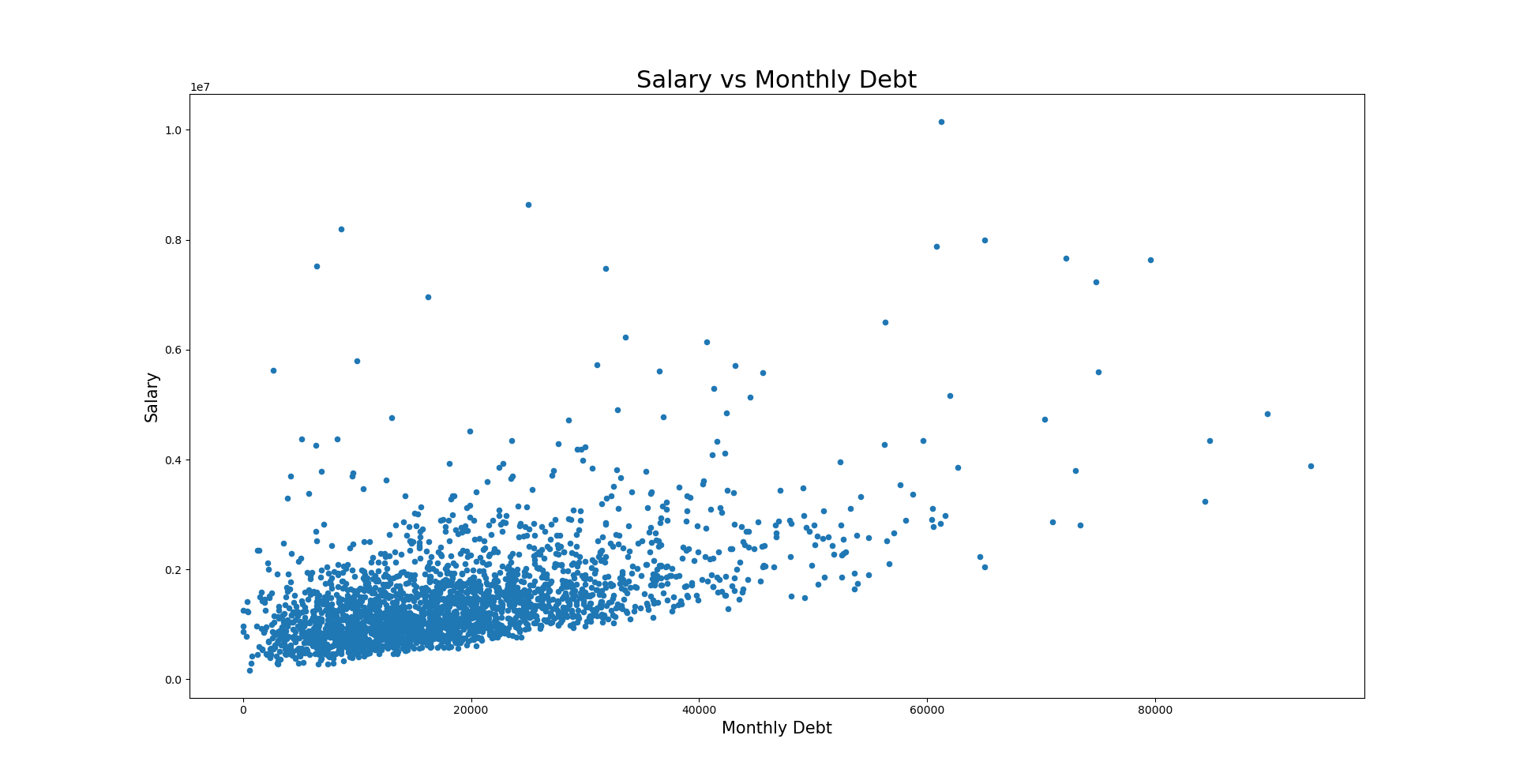

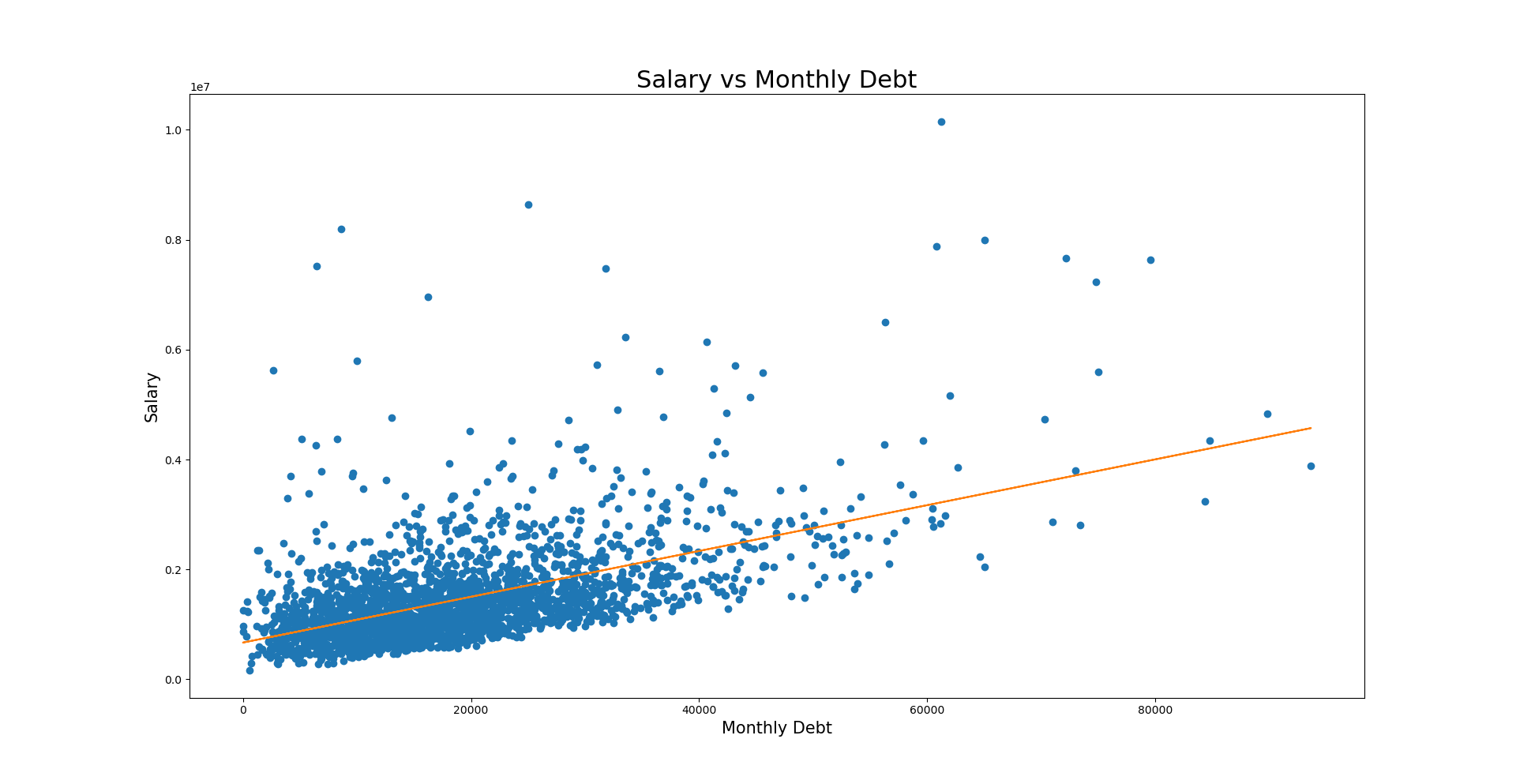

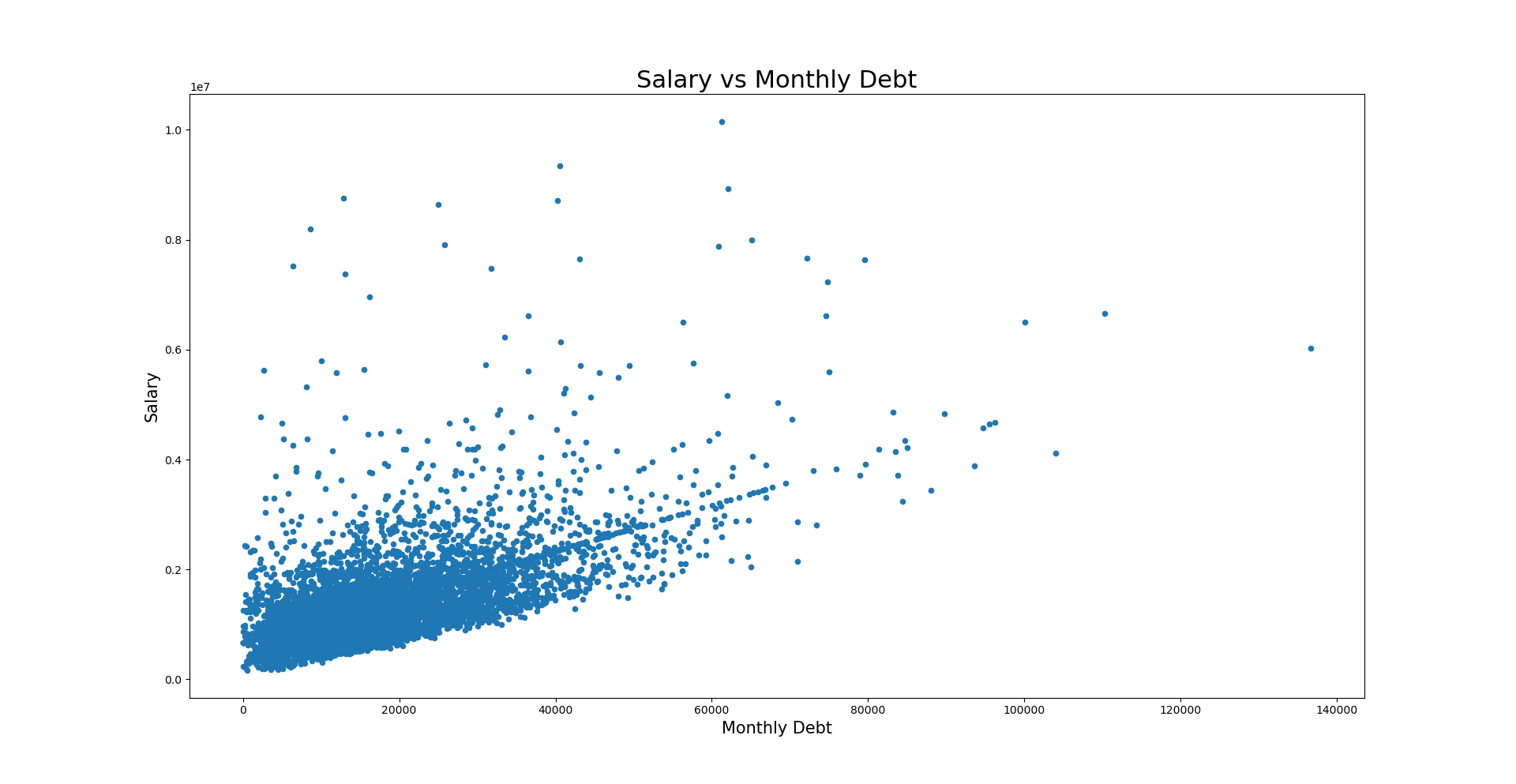

The following is the scatter plot for Salary vs Monthly Debt

This plot reveals a remarkable correlation. It looks like a simple linear regression model should be good enough to infer Salary from Monthly Debt. Also we can see that this plot is flat at the bottom which seems to indicate that for any given monthly debt, there must be a minimum salary.

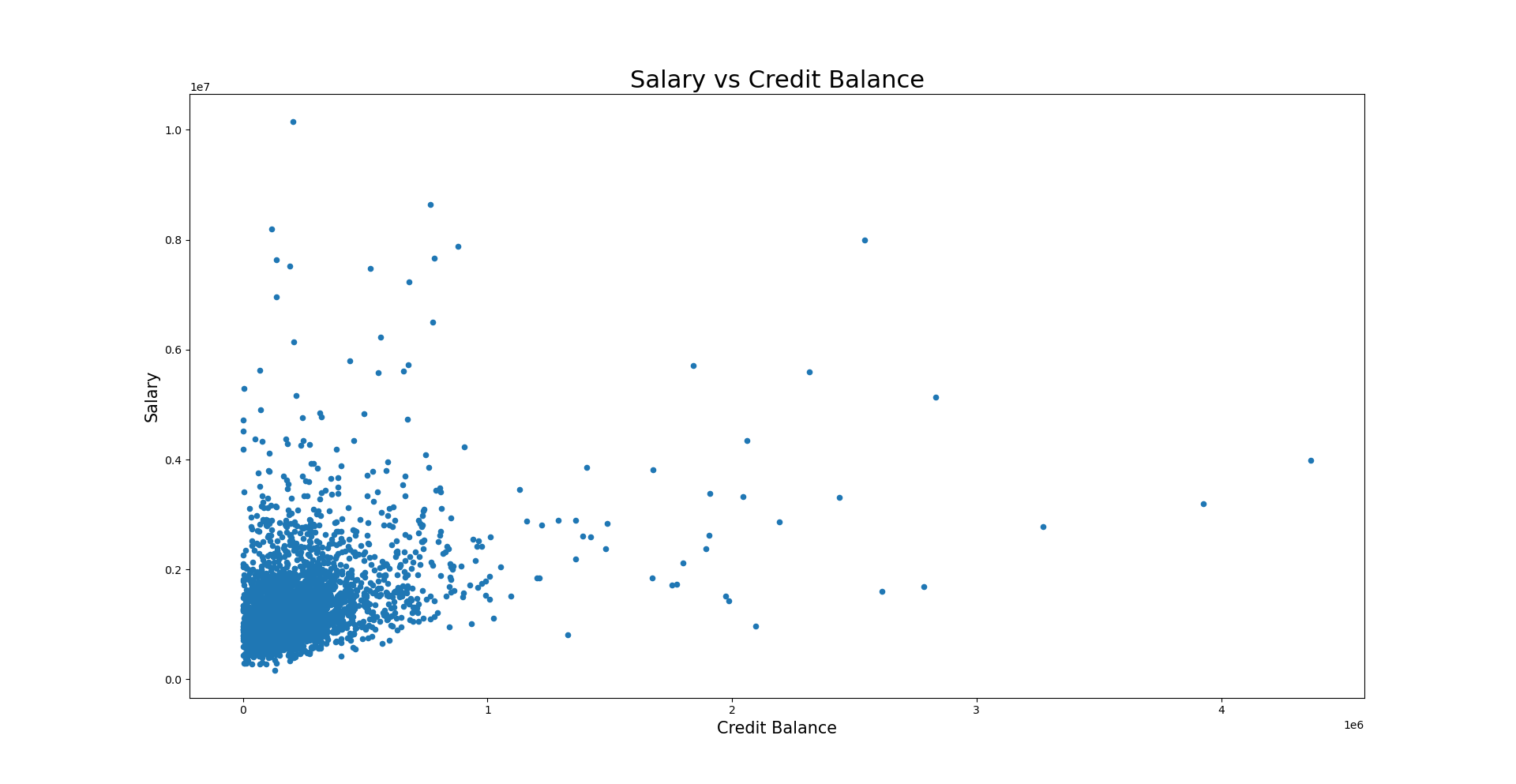

The following is the scatter plot of Salary vs Credit Balance

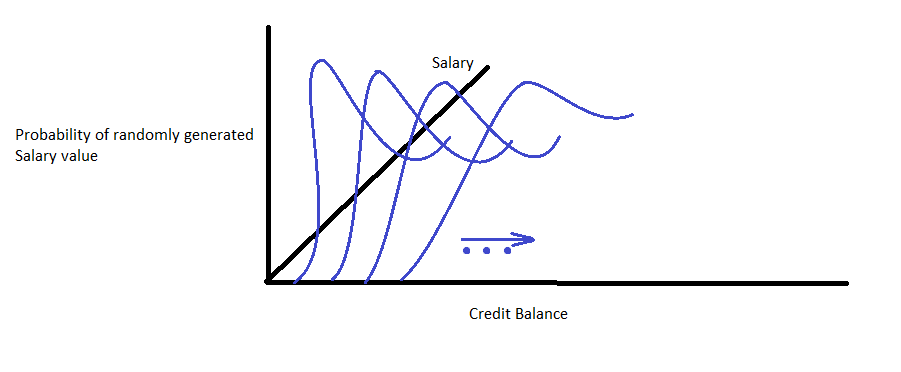

The correlation is less clear cut. The monthly debt seems to be a better indicator of Salary but there could still be a cool way to infer Salary from Credit Balance. As we can see, most of the dots are concentrated at the origin. Intuitively, this means that if the credit balance is lower then it means that the salary is more likely lower than higher. Mathematically we can model this is as a log-normal distribution. So for every point on the Credit Balance axis, we can take the Salary points and fit a Gaussian curve to their density. Then given a Credit Balance value, we could generate a random number for the Salary where the probability of getting each value is given by the Gaussian we have fitted.

The model would end up looking something like this:

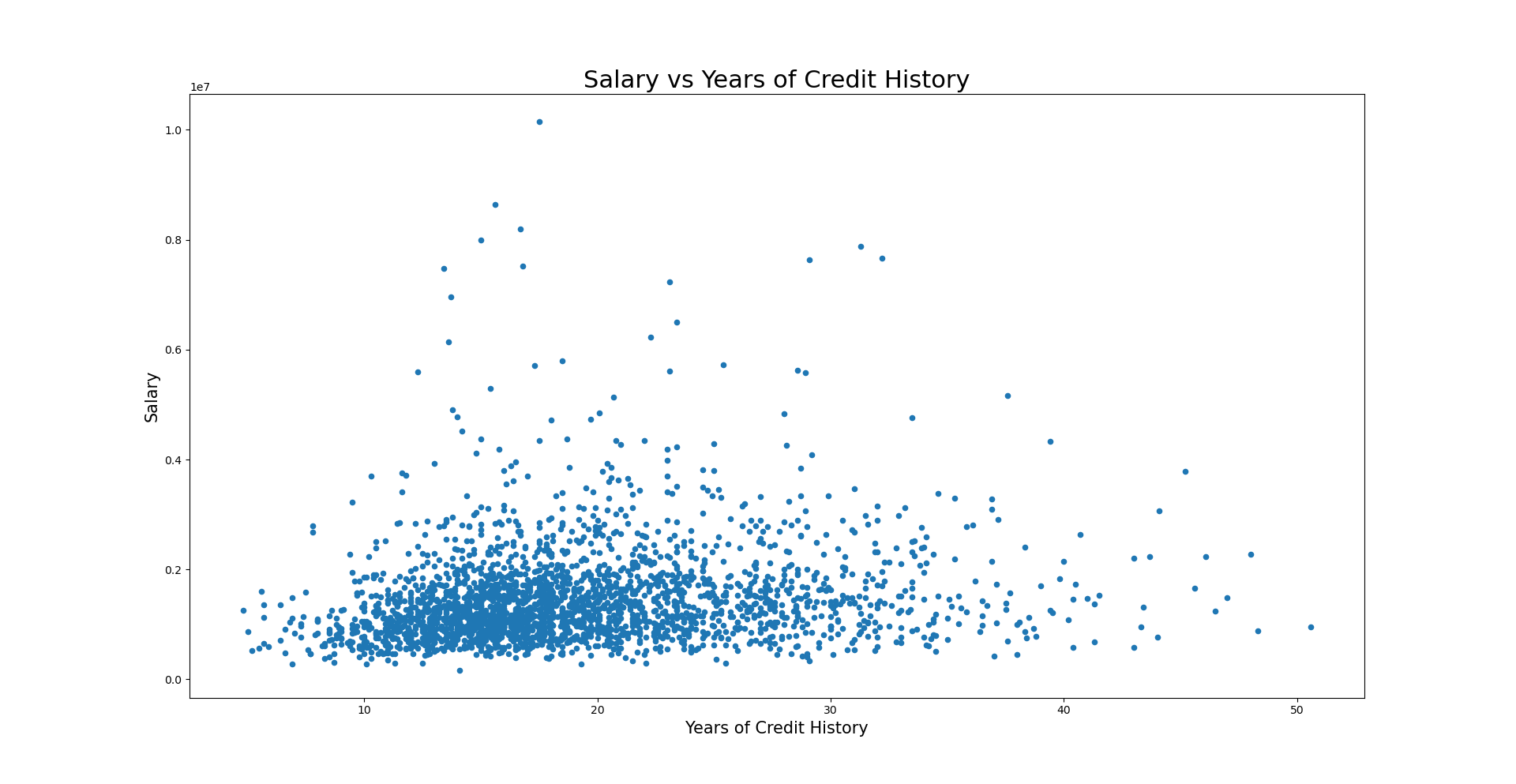

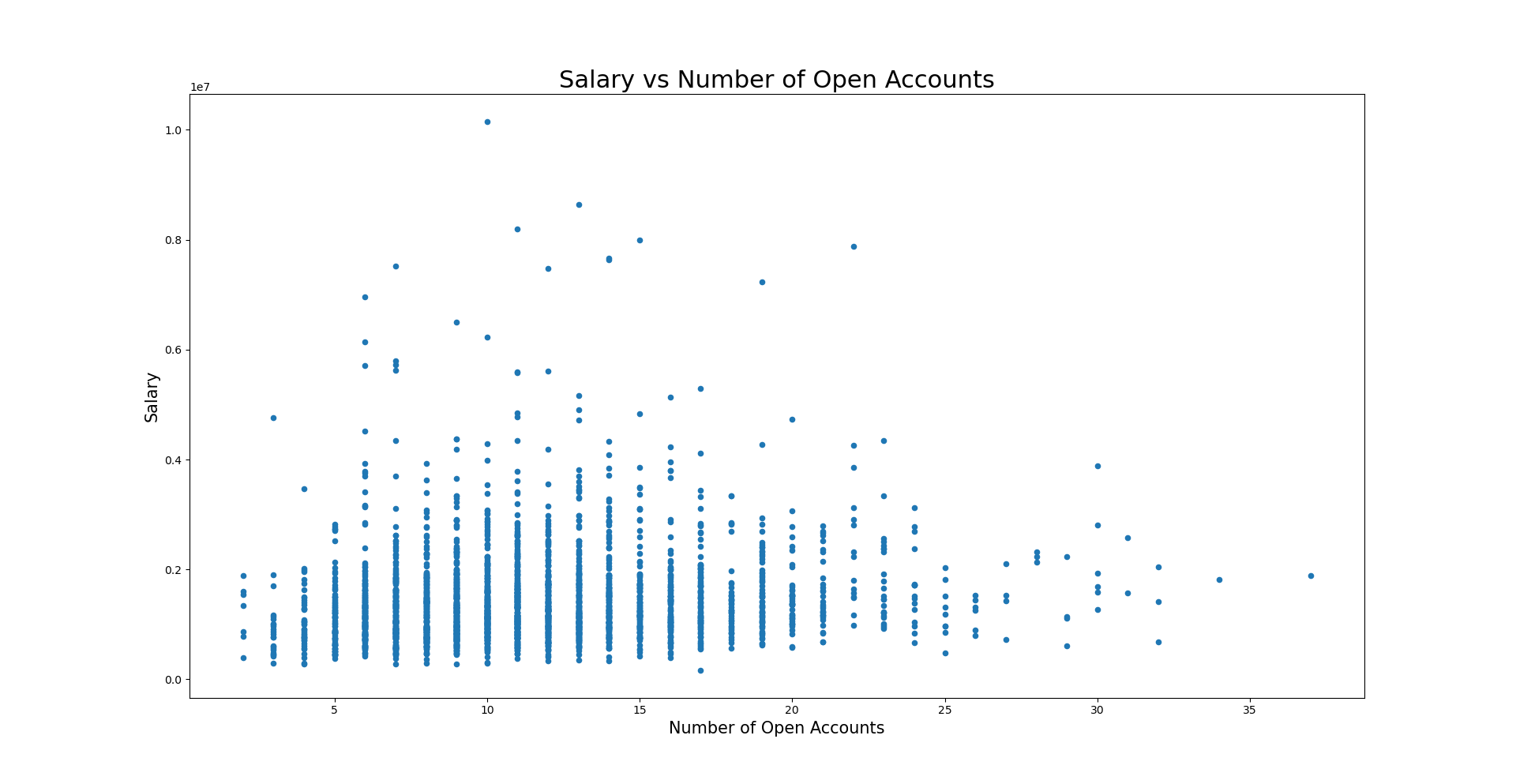

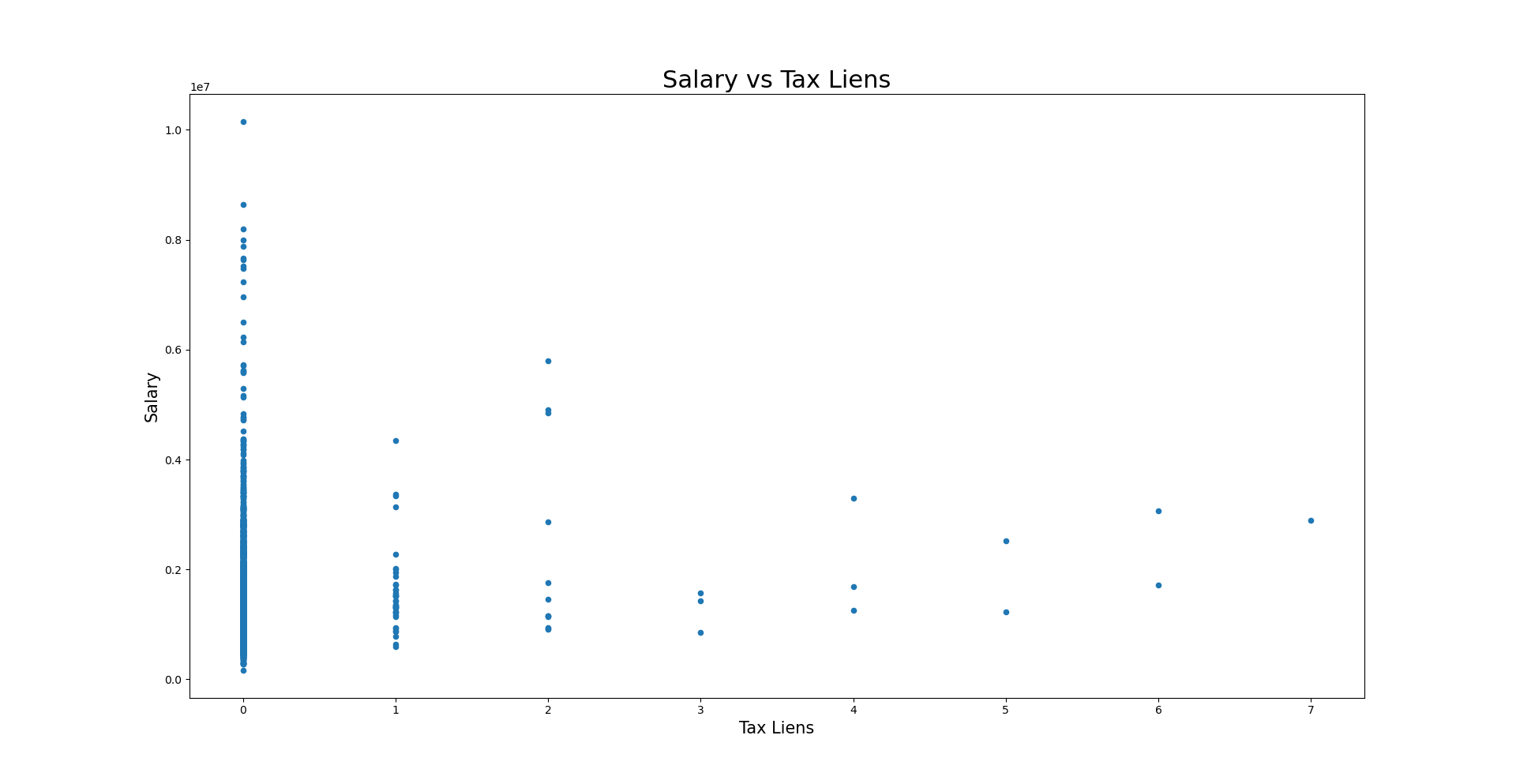

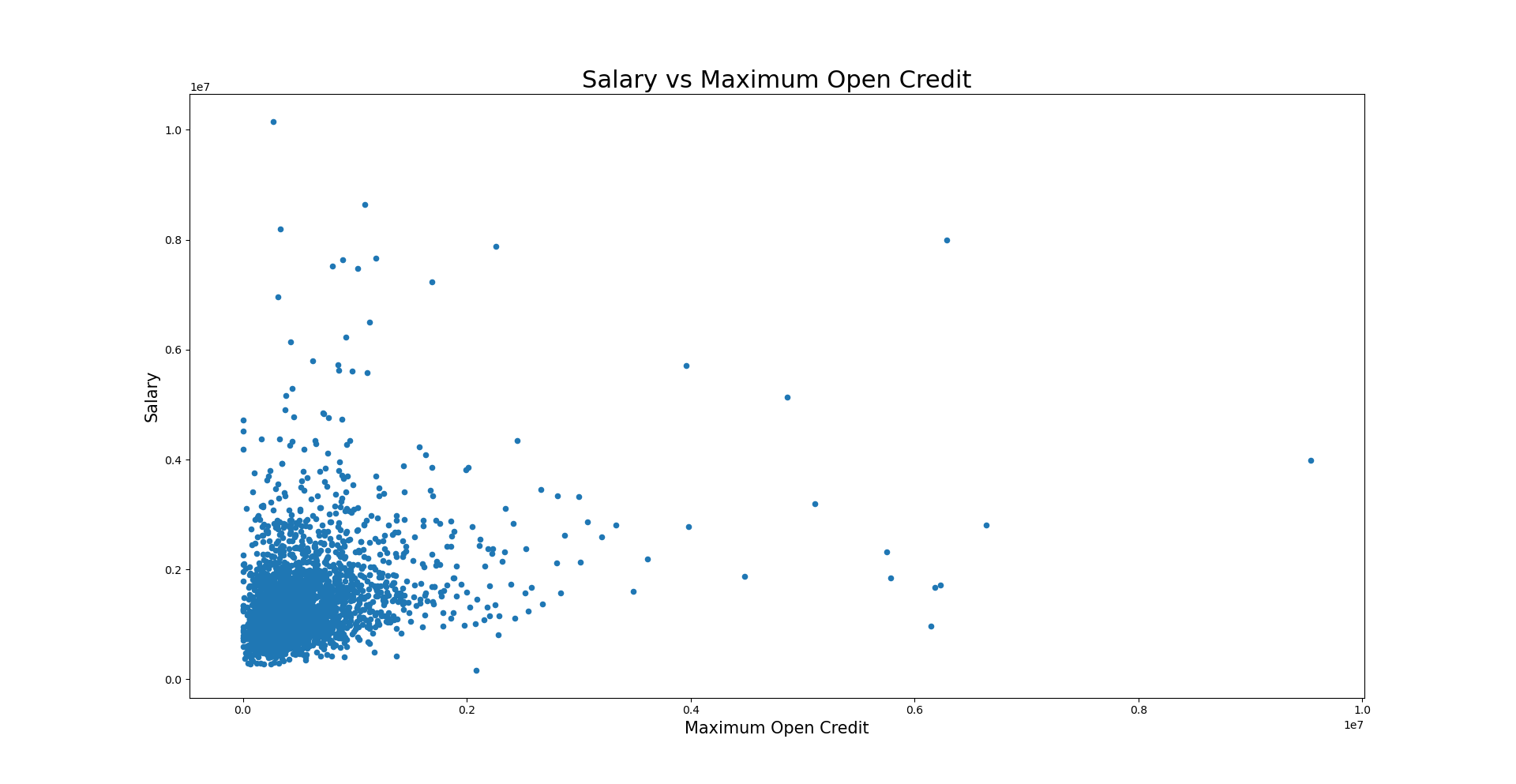

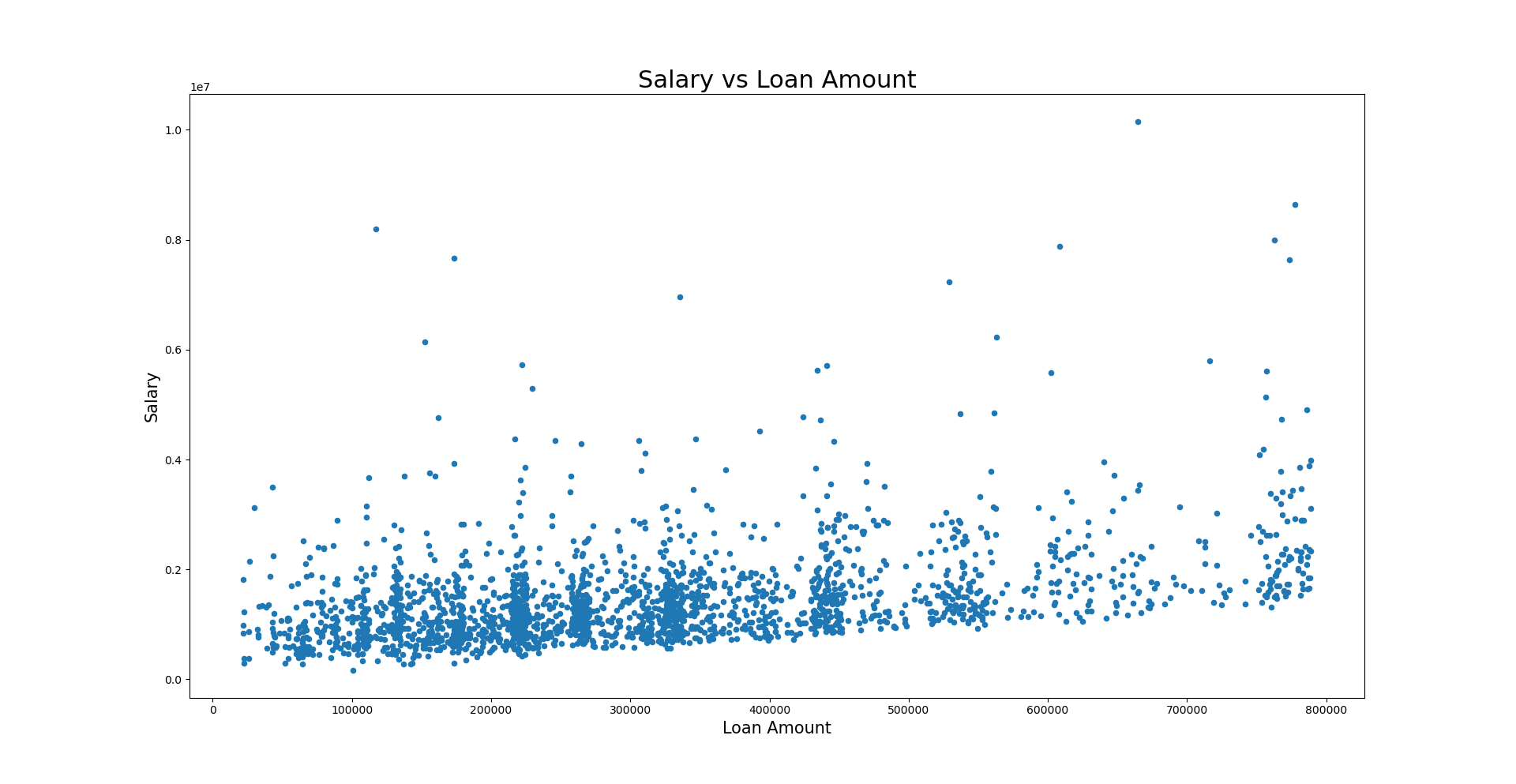

Some more scatter plots to reveal the correlation between Salary and other fields:

|

|

|

|

|

The Salary vs Loan Amount looks interesting. It is flat at the bottom. This indicates that in order to qualify for a loan of a specific amount you need to have a minimum salary.

Numpy was used to do a linear regression on Salary vs Monthly Debt. Result:

- Slope: 41.6727

- y-intercept: 669394

This was used to then infer the missing values for Salary and we get the following plot:

TBC...