- Introduction:

- Baseline Performance:

- Tuning the Baseline Algorithm:

- Evaluations of the Models:

- Conclusion:

This report details the evaluation of a machine learning trading bot, aiming to improve existing algorithmic trading systems through data-driven decision making. We explored the performance of various configurations including parameter combinations and machine learning models.

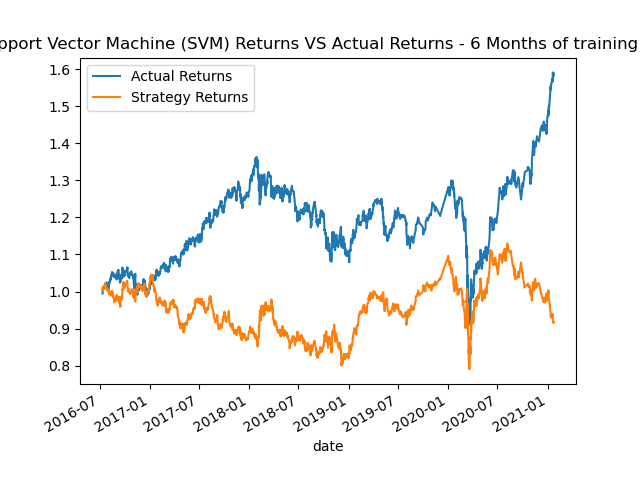

The initial model employed an SVC classifier based on short and long Simple Moving Average (SMA) features. The cumulative return comparison between actual and strategy returns serves as a benchmark for further assessments.

All models are created with 2 senarios.

-

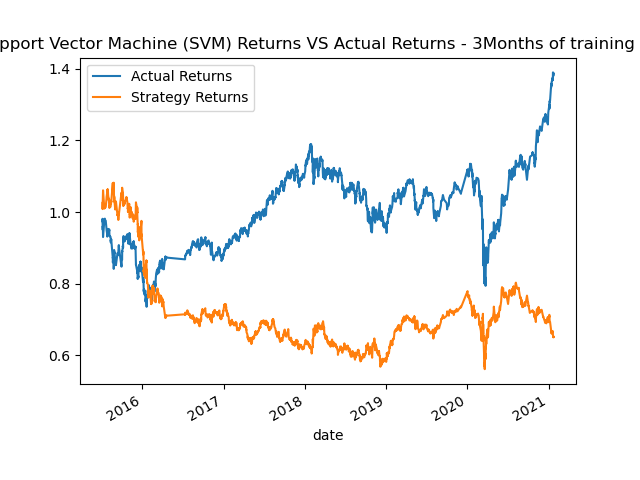

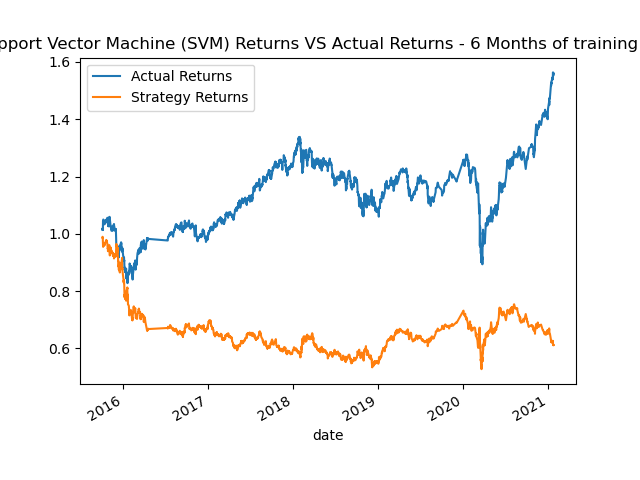

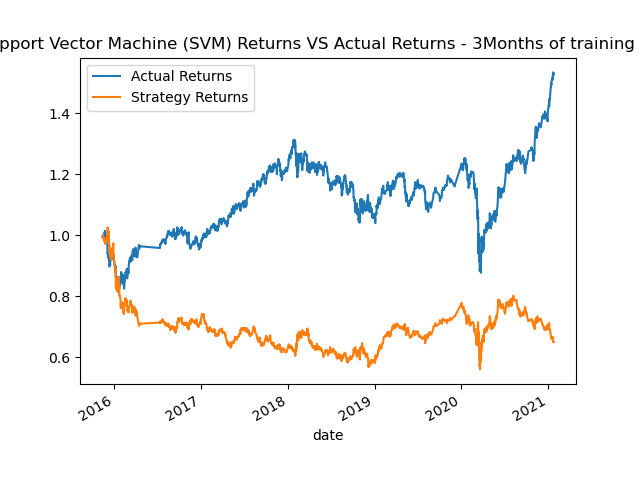

1st Models utilized 3 months of historical data for training and testing data.

-

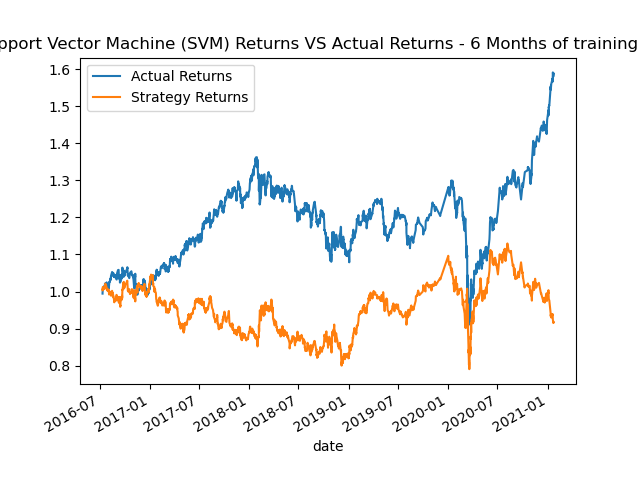

2nd Models utilized 6 months of historical data used for training and testing.

- 4/100 Day Moving Average

- 50/100 Day Moving Average

- 20/50 Day Moving Average

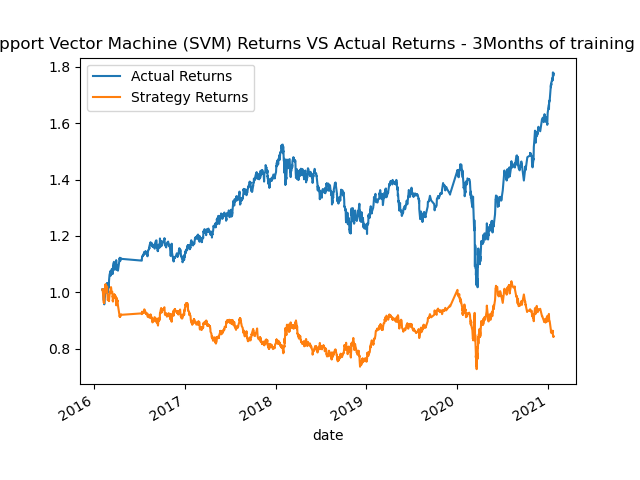

Varying the short and long SMA windows produced diverse results. The combination of 50-day low and 100-day high SMA resulted in the most significant positive impact on strategy returns compared to the baseline. Key Takeaway: Experimenting with SMA windows yielded mixed results, emphasizing the importance of finding the optimal combination for specific datasets.

- Support Vector Machine: Base model used

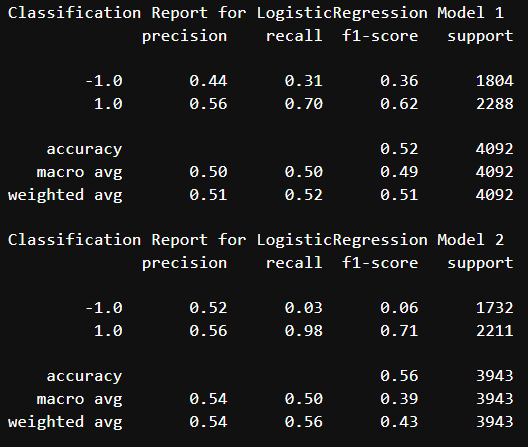

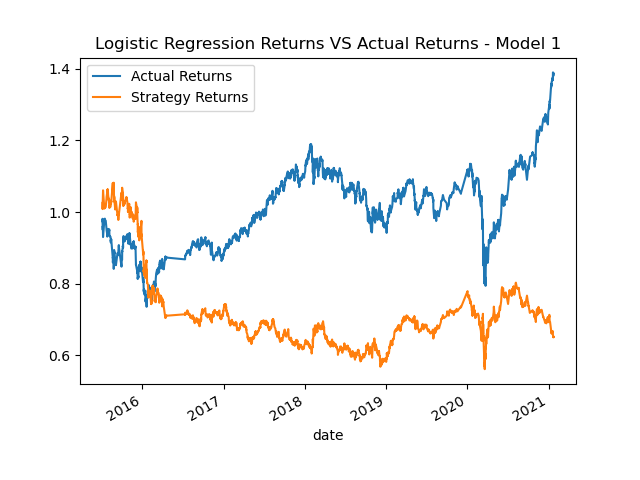

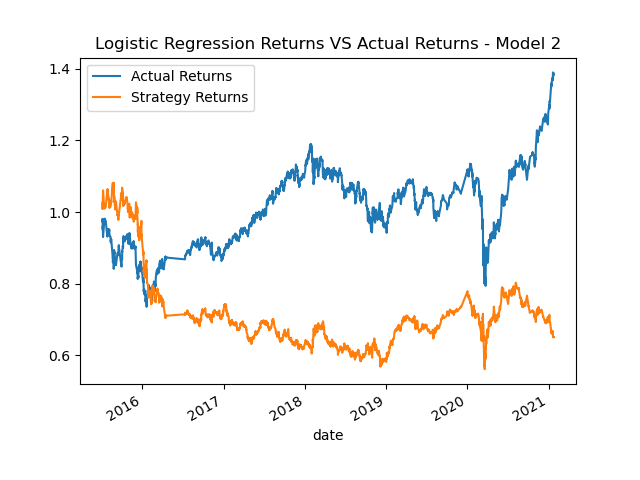

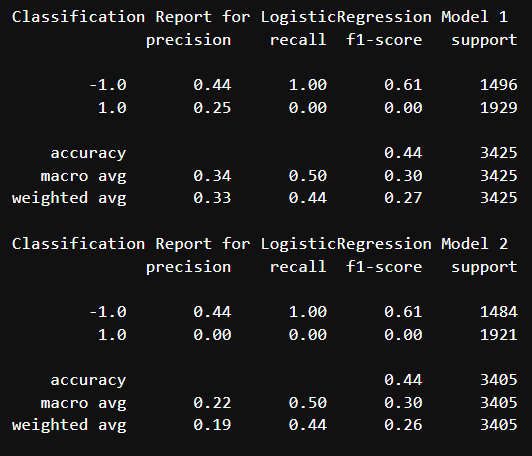

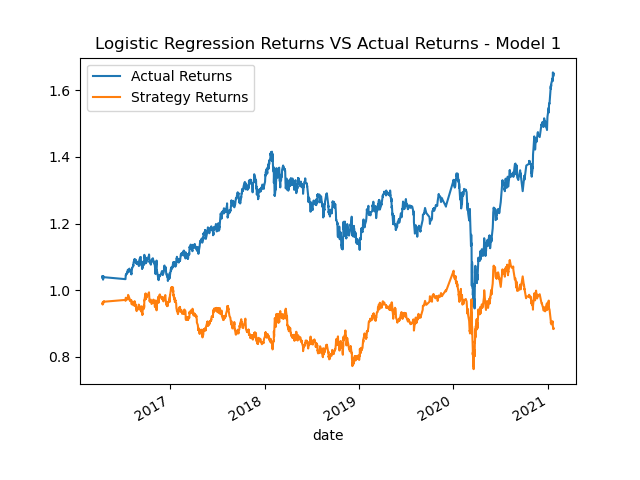

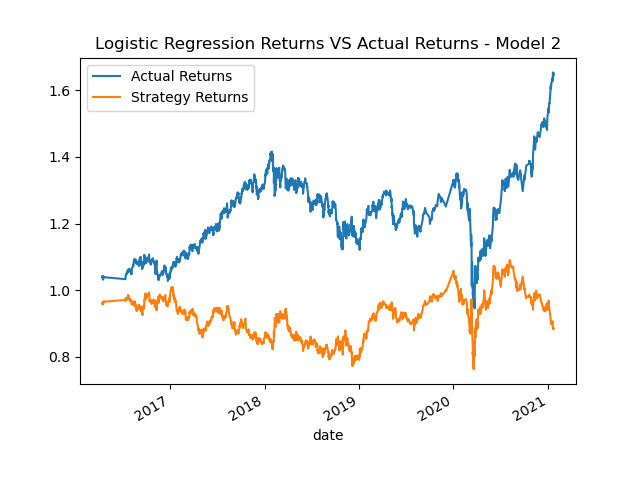

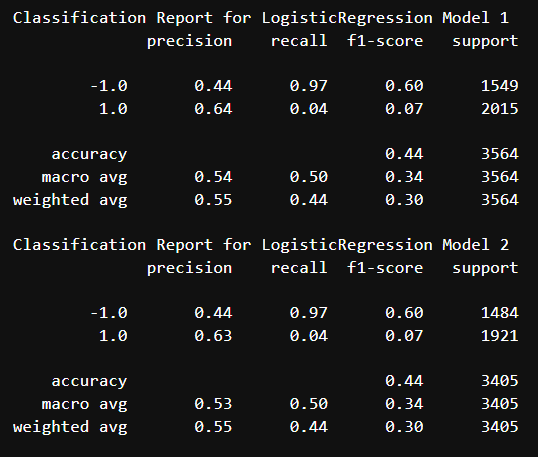

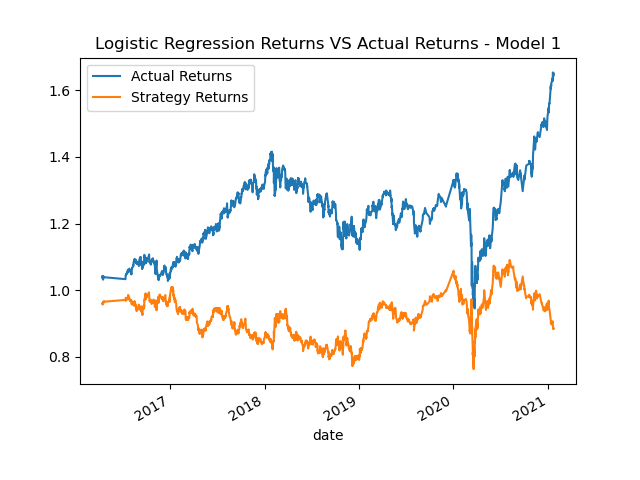

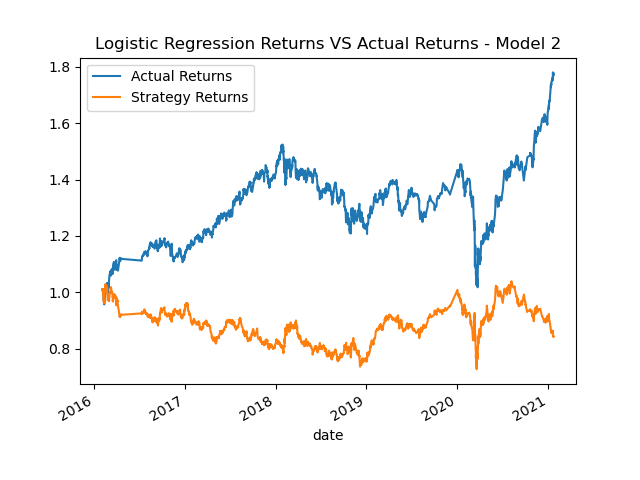

- LogisticRegression: underperformed both the baseline and tuned models.

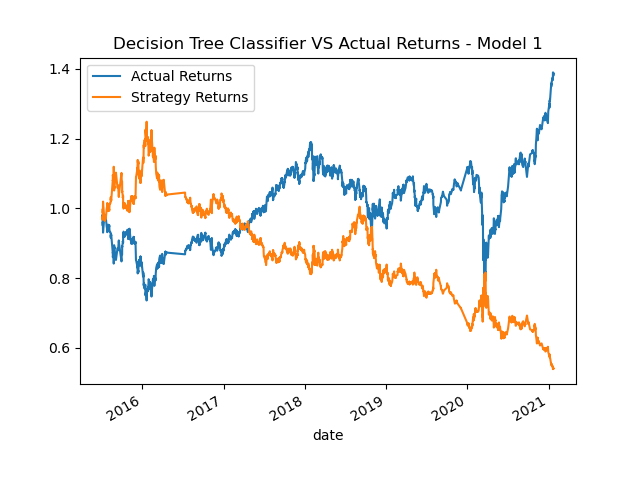

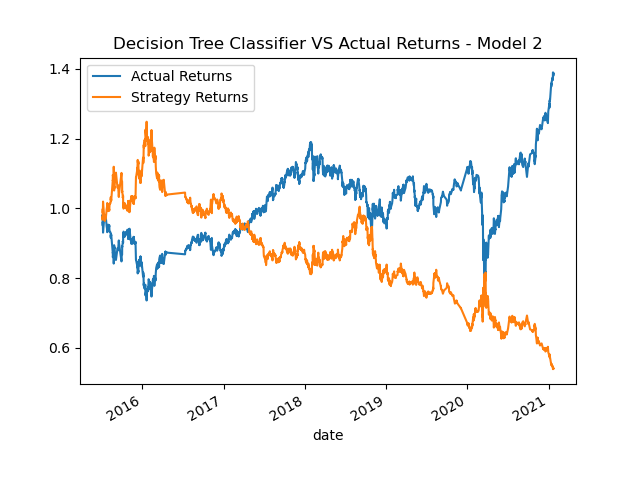

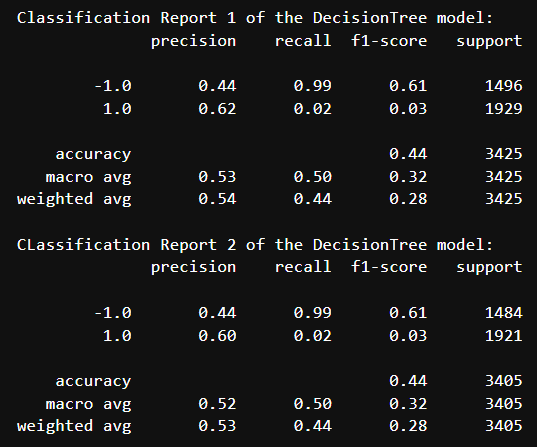

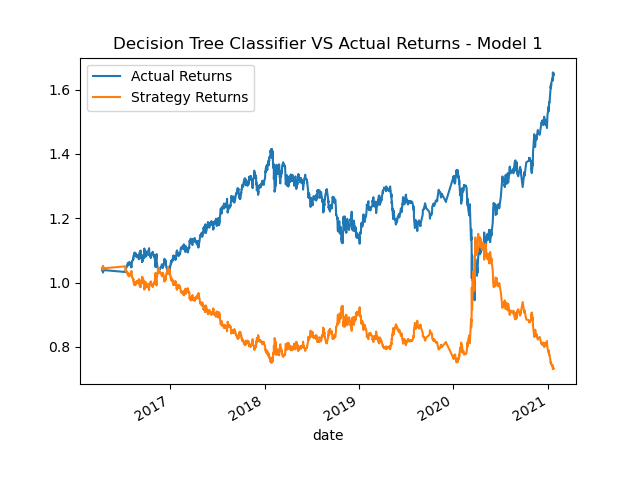

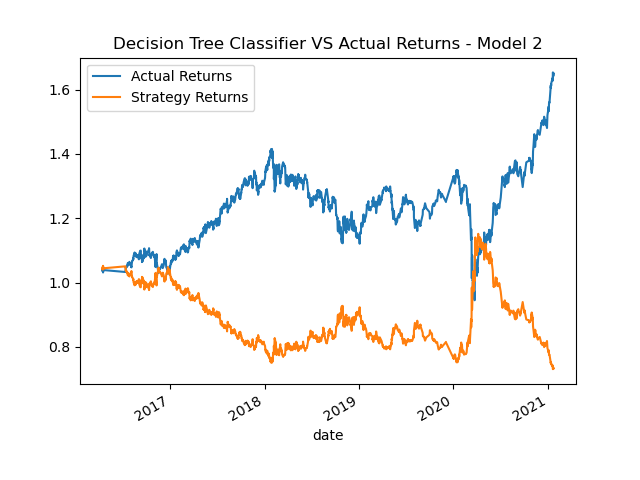

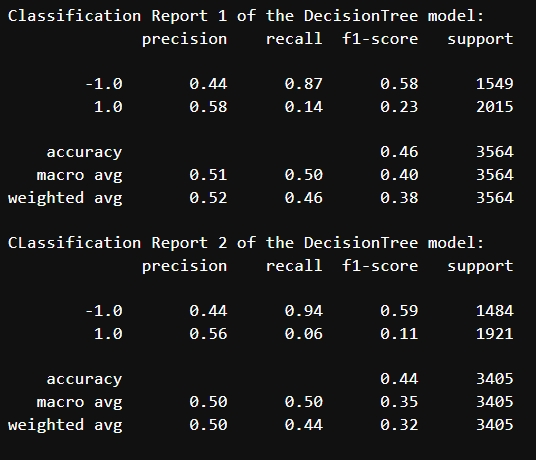

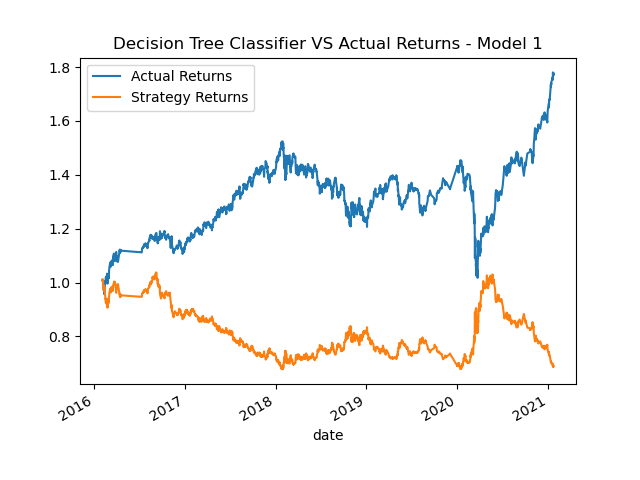

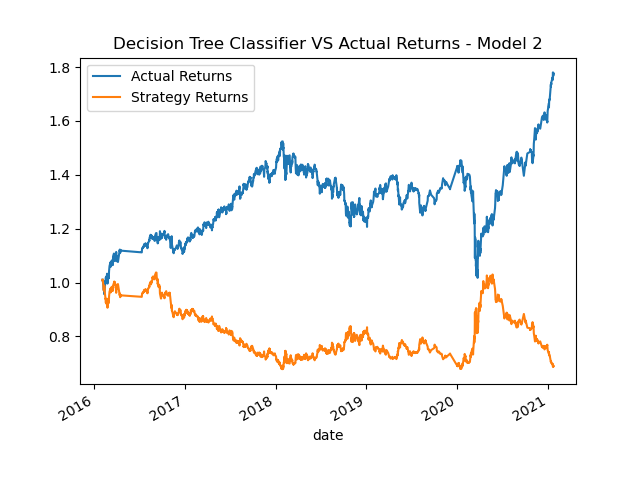

- DecisionTreeClassifier achieved results comparable to the baseline.

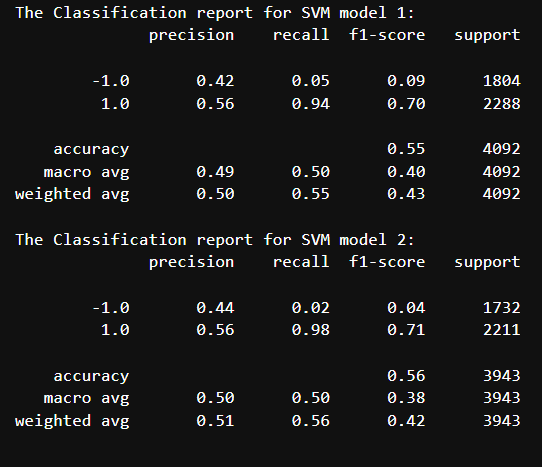

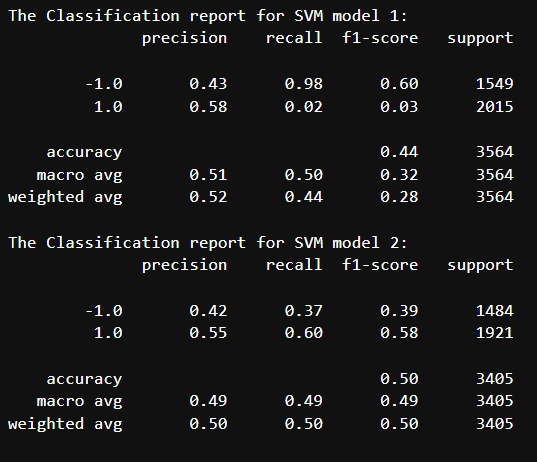

- Classification Reports for 4/100 SMA:

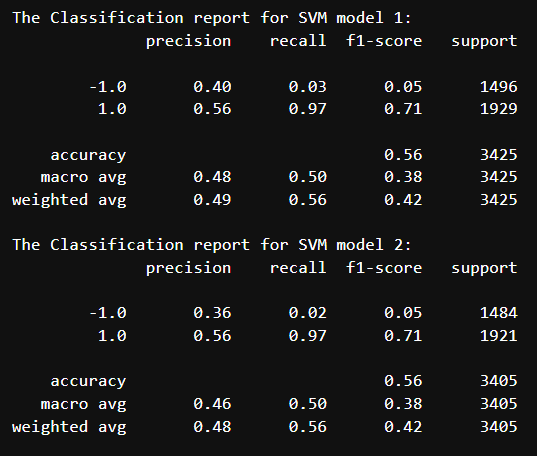

- Classification Reports for 50/100 SMA:

- Classification Reports for 20/50 SMA:

- Classification Reports for 4/100 SMA:

- Classification Reports for 50/100 SMA:

- Classification Reports for 20/50 SMA:

- Classification Reports for 4/100 SMA:

- Classification Reports for 50/100 SMA:

- Classification Reports for 50/50 SMA:

Question: What impact resulted from increasing or decreasing the training window?

Answer: I made two SVM models... One with a training window with 3 months(SVM1) and one with 6 months (SVM2). The second model was slightly better after reviewing the classification report under precision and accuracy. However, not enough to be called successful. I will do the same with all the models to see what comes out better.

Question: What impact resulted from increasing or decreasing either or both of the SMA windows?

Answer: The shorter the duration of simple moving average's the less accurate it seemed to be when compared to the longer duration. In other words the sma with a 50 day and 100 day moving average performed better than both the other SMA I used.

The tuned model utilizing a 50-day low/100-day high SMA strategy and a 3-month training window demonstrated the most promising performance amongst all configurations. Additionally, the SVC classifier remained the most effective model for this specific dataset.

Disclaimer: This report is for informational purposes only and should not be considered financial advice. Always conduct your own research and due diligence before making any investment decisions.

Link to code Module 14 challenge