Optimizing Joint Posts on the Income Tax Returns in the Netherlands for 2022 by Analyzing its Gradient

This algorithm sends over a thousand requests to the belastingdienst servers over a timespan of ~1h30m. Please note that using this algorithm is at your own risk and the author takes no responsibility for any consequences resulting from the use of this algorithm.

I recommend reducing the number of samples to minimize the load on the servers. While 1000 samples allow for more detailed analysis of the gradient, in reality the algorithm can converge to a good local minima with ~100 samples for most cases.

Furthermore, please be aware that the algorithm may not find the global minimum and it may be necessary to run the algorithm multiple times with different random seeds or adjust the number of samples.

If someone wishes to develop this algorithm into a tool, please contact the author, Sikerdebaard, who is available on a freelance basis.

This program is licensed under the MIT License with a “Commons Clause” License Condition v1.0 added on top to prevent commercial use. Please refer to the LICENSE file for more details.

In this document, we will describe an algorithm to optimize tax savings in the Dutch tax system. The algorithm makes use of a Python script that automates the process of optimizing tax savings by perturbing input parameters for box1 and box3 and calculating the gradient of the function with respect to each input parameter. The script generates a random vector of values that are sampled from a uniform distribution to perturb the input parameters.

The algorithm tests a total of 1000 random permutations to calculate the gradient by interpolating the random samples. While the algorithm is good at finding local minima, there is no guarantee that these minima are the global minima. The algorithm should be run multiple times with different random seeds or adjust the number of samples if the algorithm fails to converge or if the gradient looks flawed or incomplete.

In the following chapters, we will describe the algorithm in more detail, including the configuration parameters, the steps to run the algorithm, and the interpretation of the output.

Before we can start using the algorithm, we need to set up the environment. This chapter will guide you through the steps required to configure your system to run the Python code.

- Python 3.8 or higher

- Required Python packages: numpy, matplotlib, selenium, tqdm, and scipy.

- Firefox browser

Python is a popular high-level programming language used for a wide variety of applications. The first step in setting up the environment is to install Python 3.8 or higher on your system. The Python installation process varies depending on your operating system. You can download the latest version of Python from the official Python website.

After installing Python, you need to install the required Python packages. The required packages are numpy, matplotlib, selenium, tqdm, and scipy. You can install these packages using pip, which is the package installer for Python. Run the following command to install the required packages:

pip3 install numpy matplotlib selenium tqdm scipyThe algorithm uses the Firefox browser to interact with the Belastingdienst website. You can download and install the latest version of Firefox from the official Firefox website.

The algorithm to sample the gradient aims to calculate the gradient of the function with respect to each input parameter for box1 and box3 by randomly perturbing their values. The algorithm generates a random vector of values that are sampled from a uniform distribution to perturb the input parameters. The algorithm then tests a total of 1000 random permutations to calculate the gradient by interpolating the random samples.

Although there are many methods to achieve a similar result for this problem, the random sampling method was selected because manual joint posts optimization on the website feels like spinning the wheel of fortune. It's not feasible to check every possible permutation to find the optimal result, so the random sampling method provides a good balance between accuracy and feasibility while also staying close to how the website originally is intended to work.

It's important to note that there is still a risk that the algorithm may not find the global minimum. In such cases, it may be necessary to run the algorithm multiple times with different random seeds or adjust the number of samples to find the optimal solution. This algorithm is good at finding local minima, but there's no guarantee that these minima are the global minima. Therefore, it's recommended to run the algorithm more than once if it fails to converge or if the gradient looks flawed or incomplete.

Now that we have covered the details of the algorithm, we can discuss how to use it to optimize your tax savings.

You will need to set the input parameters for box1 and box3. These can be found on the website of the Belastingdienst, which you will need to navigate to manually. Once you have reached the "Verdeel de bedragen" page, you can open the developer tools in your browser to inspect the input fields for box1 and box3.

Next you will need to enter these input parameters in the config dictionary located in the Python script. Specifically, you will need to update the input_params dictionary with the correct IDs for each input field. You can do this by inspecting the HTML source code for the input fields.

Below you will find the correct values for the 2022 tax returns.

# config params to change when the belastingdienst page is changed

config = {

'input_params': {

'box1': {

'eltotal': ['id', 'verdeeloptimaalinvoer_verdeeloptimaalinvoer1_invfmbx1ewtotafteigenwongez'],

'elinput': ['id', 'verdeeloptimaalinvoer_verdeeloptimaalinvoer1_verdeelewaang'],

},

'box3': {

'eltotal': ['id', 'verdeeloptimaalinvoer_verdeeloptimaalinvoer1_invfmbx3gezgrdslgez'],

'elinput': ['id', 'verdeeloptimaalinvoer_verdeeloptimaalinvoer1_verdeelbox3aang'],

},

},

'berekenbutton': ['xpath', '//button[@title="Belasting berekenen"]'],

'resultfield': ['xpath', "//*[contains(text(), 'Te betalen')]"],

'num_samples': 1_000,

}# imports

import numpy as np

import matplotlib.pyplot as plt

from selenium.webdriver import Firefox

from selenium.webdriver.firefox.options import Options

from selenium.webdriver.common.by import By

from selenium.common.exceptions import NoSuchElementException

from selenium.webdriver.common.keys import Keys

from tqdm.auto import tqdm

from scipy.interpolate import NearestNDInterpolator, RBFInterpolator

from scipy.stats import zscore

from scipy.optimize import minimize

import time# util functions

def toint(s):

return int(s.replace('.', '').replace(',','.'))

def set_input(el, inp):

el.send_keys(Keys.CONTROL + "a")

el.send_keys(inp)

el.send_keys(Keys.TAB)

time.sleep(1)Once you have set the input parameters, you can run the algorithm by executing the following code. The code will open a Firefox browser window and navigate to the belastingdienst website where you will have to login and navigate to the "verdeel" page of the Belastingdienst website.

# initialize an instance of Firefox with selenium

# and wait for the user to go to the verdelen page

options = Options()

driver = Firefox(options=options)

driver.get('https://mijn.belastingdienst.nl/mbd-pmb/pmb.html')

is_aangifte_page = lambda driver: 'aangifte' in driver.current_url and '2022' in driver.current_url and 'olaib.html' in driver.current_url

while not is_aangifte_page(driver):

time.sleep(1)

time.sleep(1)

while 'Verdeel de bedragen' not in driver.page_source:

time.sleep(1)

time.sleep(1)

# retrieve the box1/box3 parameters that we need to optimize

enabled_params = []

totparams = {}

for k, v in config['input_params'].items():

try:

el = driver.find_element(*v['eltotal'])

totparams[k] = toint(el.get_attribute('innerText'))

enabled_params.append(k)

except NoSuchElementException as e:

print(f'WARN: Element not found: {k} {v["eltotal"]}')

print(f"Found the following params on page: {', '.join(enabled_params)}")Found the following params on page: box1, box3

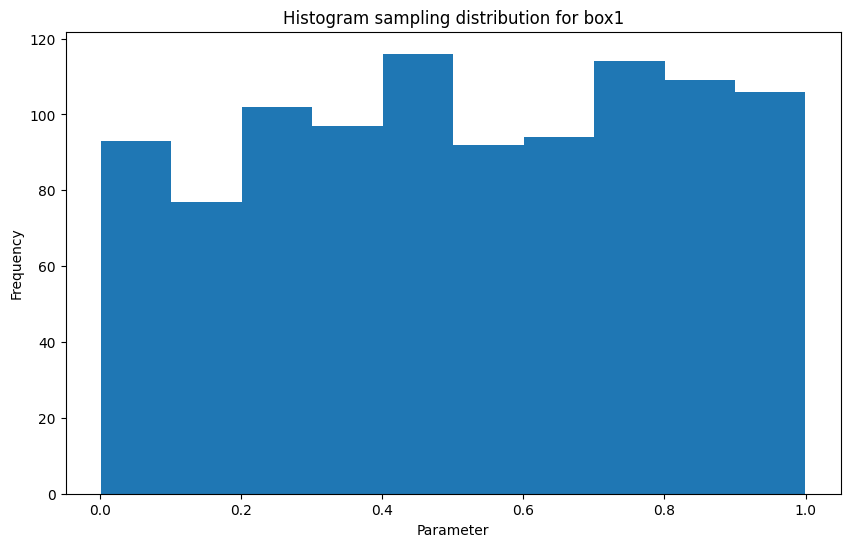

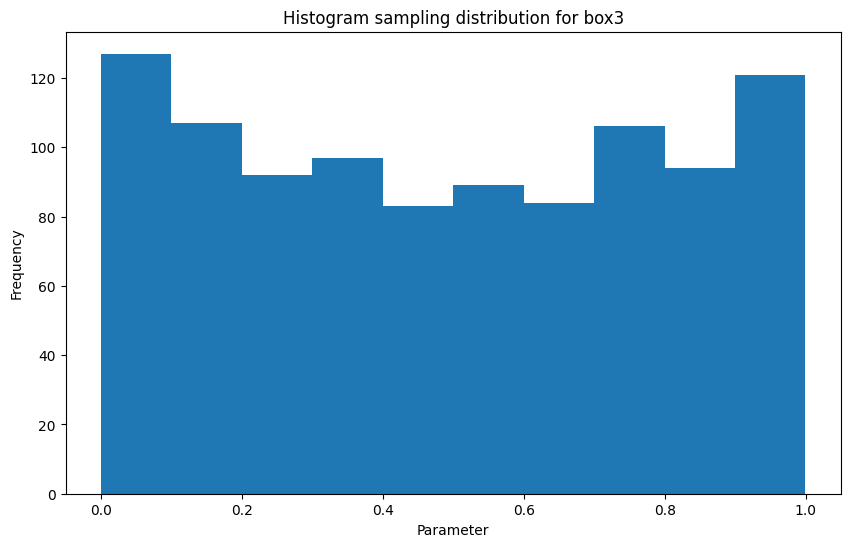

The algorithm will then generate 1000 random permutations of the input parameters for box1 and box3, and calculate the tax savings for each permutation. The algorithm will output the best permutation and the corresponding tax savings. Running this step will take around 1h so be patient.

num_params = len(enabled_params)

num_samples = config['num_samples']

samples = np.random.uniform(0, 1, (num_samples, num_params))

print('Distribution parameters')

for idx in range(samples.shape[1]):

plt.figure(figsize=(10, 6))

plt.hist(samples[:, idx], bins=10)

plt.title(f'Histogram sampling distribution for {enabled_params[idx]}')

plt.ylabel('Frequency')

plt.xlabel('Parameter')Distribution parameters

def calc(samples):

for param_idx, param in zip(range(len(enabled_params)), enabled_params):

elinp = driver.find_element(*config['input_params'][param]['elinput'])

perc = samples[param_idx]

set_input(elinp, f'{int(totparams[param] * perc)}')

driver.find_element(*config['berekenbutton']).click()

time.sleep(1)

betalen = toint(driver.find_element(*config['resultfield']).get_attribute('innerText').split('€')[-1].strip())

return betalen

results = []

for idx in tqdm(range(samples.shape[0])):

betalen = calc(samples[idx, :])

results.append(betalen) 0%| | 0/1000 [00:00<?, ?it/s]

# visualize the gradient based on the random samples

def visgrad(xy, z, interpolator, title, labels, interparams=None):

if interparams is None:

interparams = {}

edges = np.linspace(0., 1., 101)

centers = edges[:-1] + np.diff(edges[:2])[0] / 2.

x_i, y_i = np.meshgrid(centers, centers)

x_i = x_i.reshape(-1, 1)

y_i = y_i.reshape(-1, 1)

xy_i = np.concatenate([x_i, y_i], axis=1)

interp = interpolator(xy, z, **interparams)

z_i = interp(xy_i)

# plot the result

fig, ax = plt.subplots()

X_edges, Y_edges = np.meshgrid(edges, edges)

# Use red-white-blue colorpallet

# Because they resemble the colors of the Dutch flag

lims = dict(cmap='RdBu_r', vmin=z.min(), vmax=z.max())

mapping = ax.pcolormesh(

X_edges, Y_edges, z_i.reshape(100, 100),

shading='flat', **lims

)

ax.scatter(xy[:, 0], xy[:, 1], 10, z, edgecolor='w', lw=0.1, **lims)

ax.set(

title=title,

xlim=(0., 1.),

ylim=(0., 1.),

)

plt.xlabel(labels[0])

plt.ylabel(labels[1])

cbar = fig.colorbar(mapping)

cbar.ax.set_ylabel('Gradient (lower = better)', rotation=270)

# convert the amount to pay into zscore

# because I do not feel comfortable putting

# my box1/box3 numbers out in public

zresults = zscore(results)

# sort in descending order - this improves

# the matplotlib render because the lowest

# values are drawn last

sortidx = np.argsort(-np.array(zresults))

sorted_samples = samples.copy()[sortidx, :]

sorted_results = np.array(zresults)[sortidx]

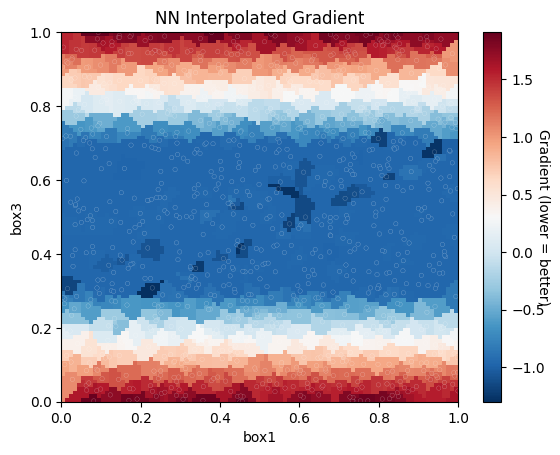

# Visualize the found gradient using a NN and RBF Interpolator

visgrad(sorted_samples, sorted_results, NearestNDInterpolator, 'NN Interpolated Gradient', enabled_params)

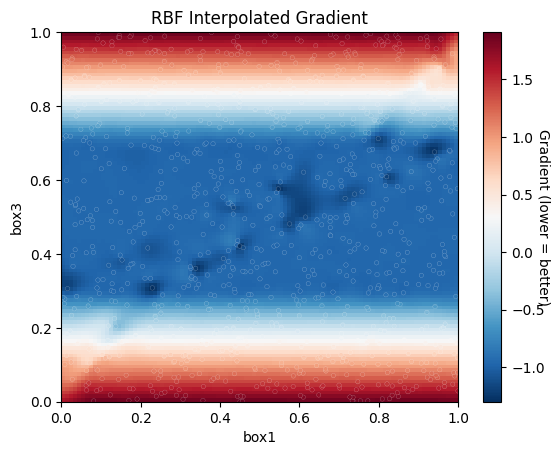

visgrad(sorted_samples, sorted_results, RBFInterpolator, 'RBF Interpolated Gradient', enabled_params, {'epsilon': 2})Below we can see the gradient resulting from the random sampling after interpolation. The heatmap shows the gradient in different areas of the parameter space, with blue indicating lower values and red indicating higher values. We can clearly see some local minima in what appears to be two dark blue lines forming. However, we should keep in mind that this is only an approximation and there may be other minima in the parameter space that were not discovered by the algorithm. Additionally, we can also see that some areas might be undersampled and the interpolation might not be accurate in those regions. Therefore, caution should be exercised when interpreting the gradient heatmap.

If the algorithm does not converge or the results seem incomplete, it may be necessary to run the algorithm again with different random seeds or adjust the number of samples. Additionally, since the algorithm only finds local minima, it is possible that running the algorithm multiple times may lead to finding better local minima.

To achieve even better results, we can run the scipy.optimizer.minimize function with the Nelder-Mead method, using the top-10 results of the random search as the starting parameters. This method can potentially find a slightly better local minimum, resulting in a slightly more favorable tax return. However, it should be noted that the improvement in tax return is usually only a few euros as compared to the random search.

Running this optimizer may take around 30 minutes to complete.

topx = 10

topx_samples = sorted_samples[-topx:]

topx_samplesarray([[0.61531882, 0.49957794],

[0.01576227, 0.3059304 ],

[0.8202811 , 0.60858487],

[0.57517845, 0.48116082],

[0.79867884, 0.71192341],

[0.33883943, 0.36108678],

[0.94054974, 0.67566831],

[0.54706741, 0.57575385],

[0.44949658, 0.42126156],

[0.22953166, 0.30790854]])

# Run the scipy minimizer

method = 'Nelder-Mead'

options = {

#'disp': True,

'return_all': True,

}

minimizer_results = []

bounds = [

(0, 1) for i in range(2)

]

for sample in tqdm(topx_samples[::-1]):

res = minimize(calc, np.array(sample), method=method, bounds=bounds, options=options)

minimizer_results.append(res) 0%| | 0/10 [00:00<?, ?it/s]

In the final step, the results from the successful optimizers are printed. The optimizers should have converged to a local minima. The printed result is the value of the lowest found minima that saves the most money.

success = [x for x in minimizer_results if x.success]

fun = [x.fun for x in success]

idxmin = fun.index(min(fun))

winning_sample = success[idxmin].x

for idx, param in zip(range(len(enabled_params)), enabled_params):

perc = winning_sample[idx]

left = int(totparams[param] * perc)

right = int(totparams[param] - left)

print(f'{param} Uw deel: {left} Partner: {right}')

print(f'Te betalen: €{int(fun[idxmin])}')

print(f'Verschil tussen min en max: €{max(results) - int(fun[idxmin])} max: {max(results)} min: {int(fun[idxmin])}')box1 Uw deel: xxx Partner: yyy

box3 Uw deel: xxx Partner: yyy

Te betalen: €xxx

Verschil tussen min en max: €xxx max: yyy min: zzz

In this project, we have presented an algorithm to optimize tax savings by perturbing the input parameters for box1 and box3 of the Dutch tax system. The algorithm uses random sampling to approximate the gradient of the tax function with respect to each input parameter.

We have demonstrated that this approach can find good local minima, but there is no guarantee that the algorithm will find the global minimum. We recommend running the algorithm multiple times with different random seeds or adjusting the number of samples to improve the chances of finding a good solution.

Future work could include improving the sampling method, exploring other optimization algorithms, or expanding the scope of the problem to include other tax categories. Additionally, the algorithm could be integrated into a web application to provide a user-friendly interface for taxpayers to optimize their tax savings.

In summary, this project presents an effective and efficient method for optimizing tax savings in the Dutch tax system. The algorithm can provide significant benefits for taxpayers, and we look forward to further developments in this field.