Table of Contents

- About The Project

- Getting Started

- Usage

- Constant Product AMM

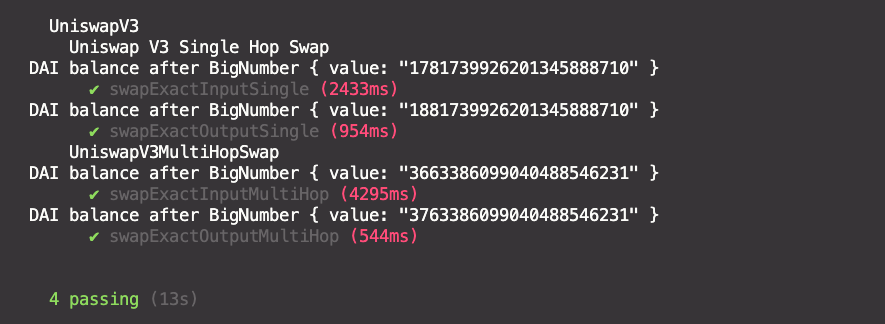

- Test Single and Multi hop swap

- Uniswap V2 Single Hop Swap

- Uniswap V3 Multi Hop Swap

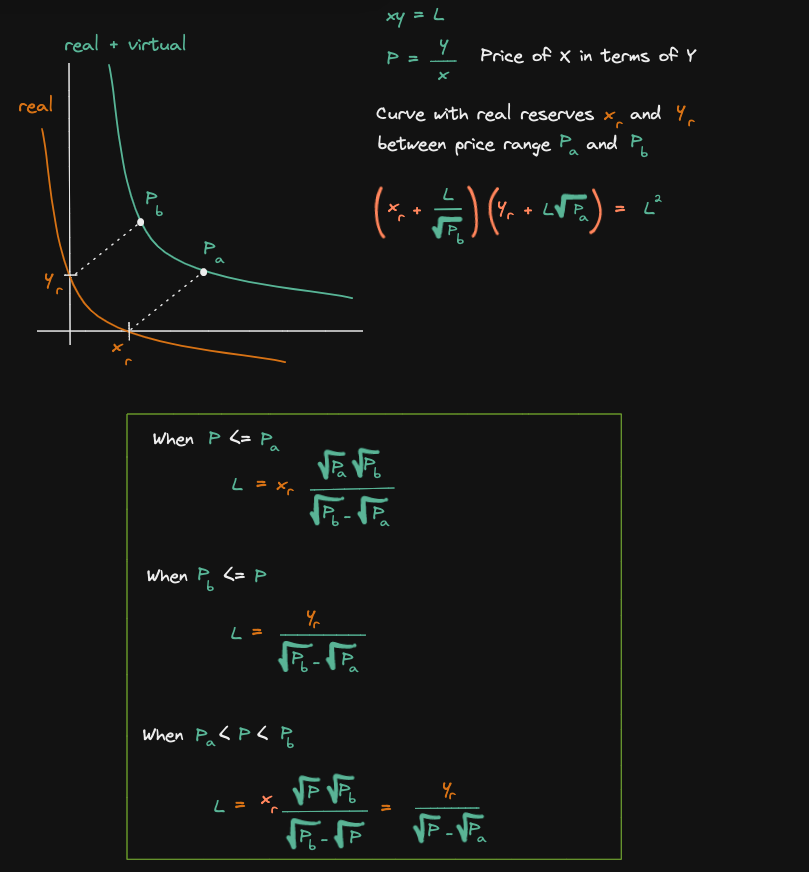

- Uniswap V3 Curve of real reserves

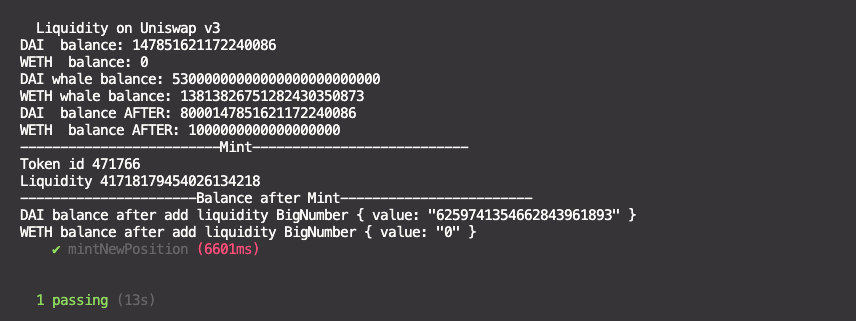

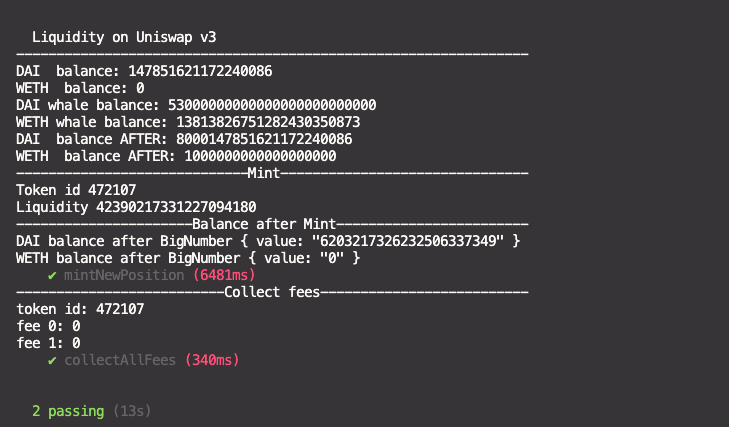

- Test Mint new position

- Uniswap V3 Liquidity of a single position

- Test Collect fees

- Test Increase liquidity

- Test Decrease liquidity

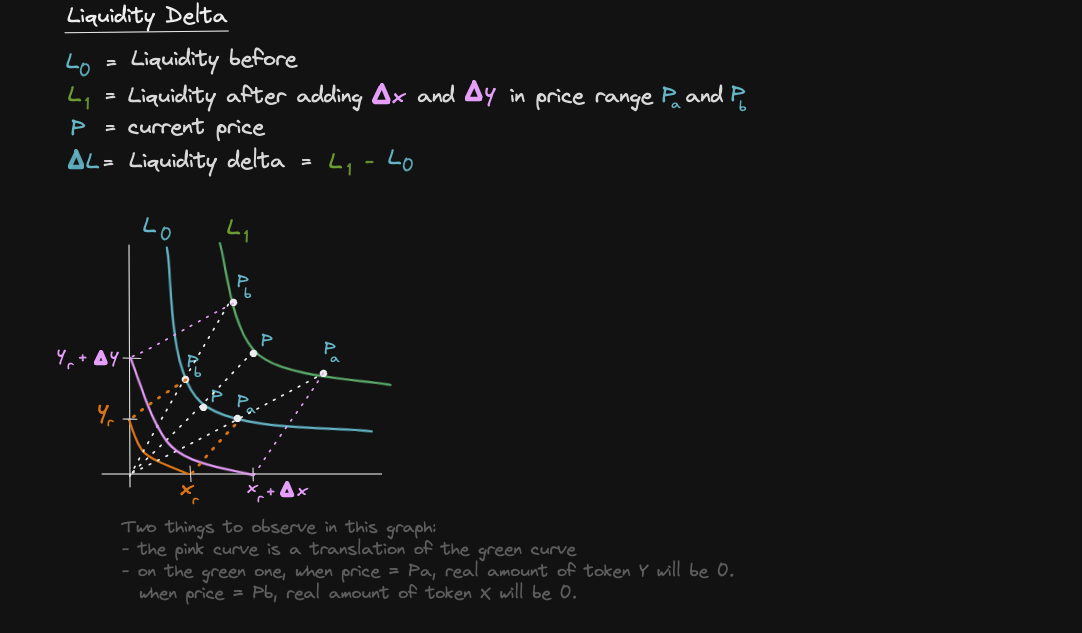

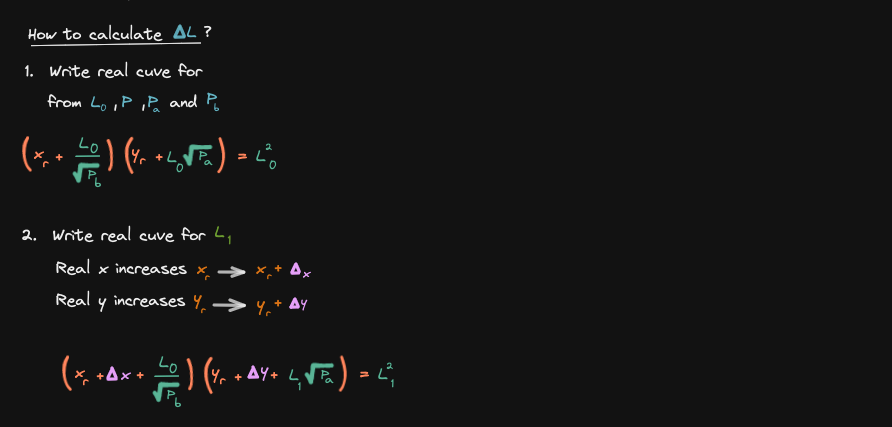

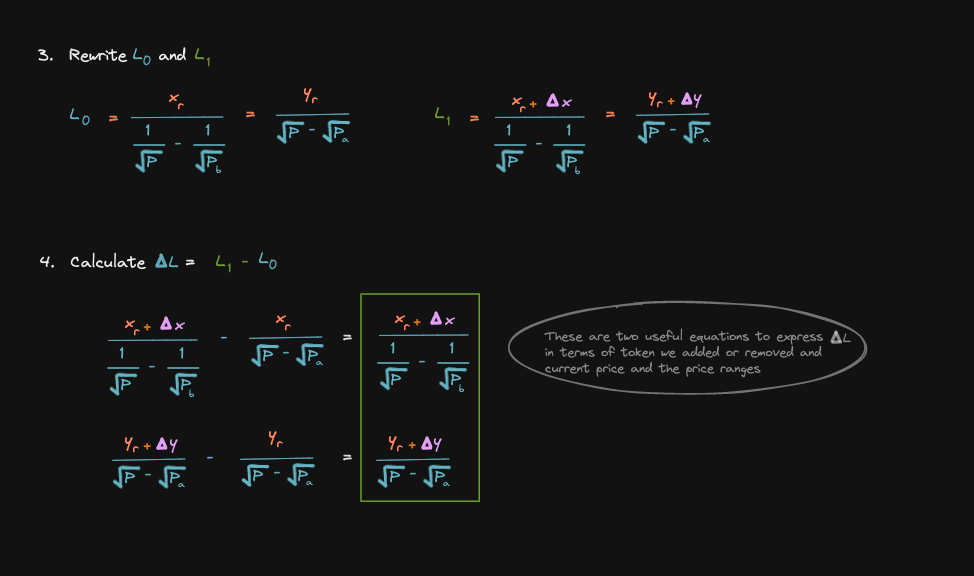

- Uniswap V3 Liquidity Delta

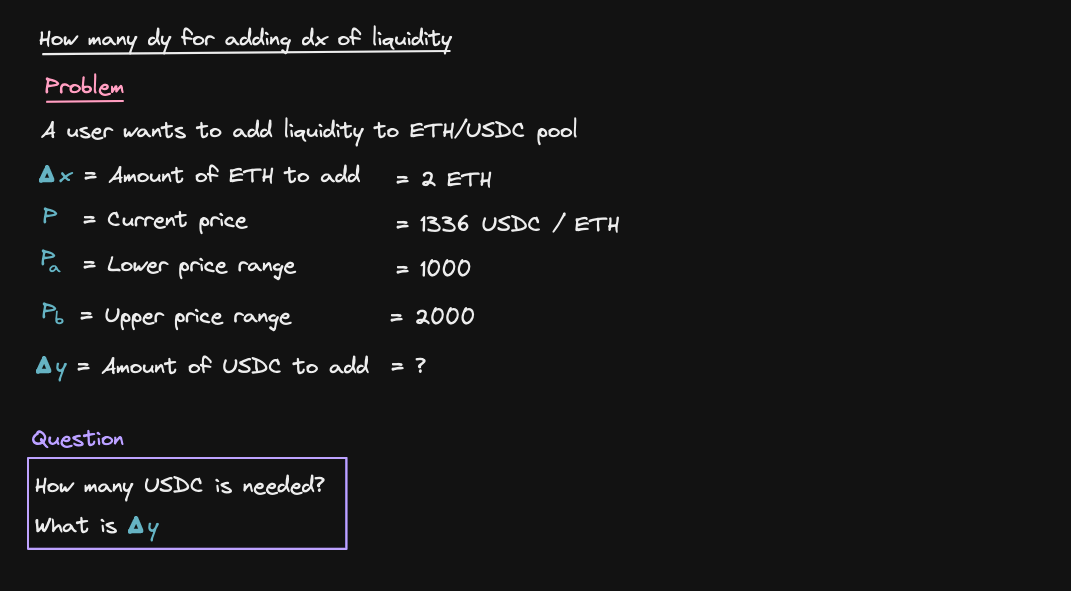

- Uniswap V3 How many tokens to add

- Uniswap V2 Add and Remove Liquidity

- Uniswap V3 Price of ETH from sqrtPriceX96

- Uniswap V3 Tick and sqrtPriceX96

- Uniswap V3 Price Change from a Swap

- Uniswap V3 Liquidity Price Graph

- Uniswap V3 Liquidity Price Graph Example

- Uniswap V3 Flash Swap

- Uniswap V3 Capital Efficiency

- Uniswap V3 Just In Time Liquidity

- Forking mainnet

- Note

- Roadmap

- Contributing

- License

- Contact

- Acknowledgments

This project shows how to interact with the main functions of Uniswap V3 and derive the equations used in the protocol

To get a local copy up and running follow these simple example steps.

-

npm

npm init

-

hardhat

npm install --save-dev hardhat

run:

npx hardhat

verify:

npx hardhat verify --network goerli "contract address" "pair address"

-

Clone the repo

git clone https://github.com/Aboudoc/Uniswap-v3.git

-

Install NPM packages

npm install

-

Dependencies

npm add @uniswap/v3-periphery @uniswap/v3-core

For openzeppelin contract, we'll need to install first

solidity 0.7npm i @openzeppelin/contracts@3.4.2

To fix compiler errors, we'll need to change the compilation settings

If you need testnet funds, use the Alchemy testnet faucet.

This project shows how to swap, add and remove liquidity

Uniswap V3 is a Constant product AMM (automated market maker) <=> a decentralized exchange where 2 tokens are traded. You can find a deep overview of CPAMM in this repo

npx hardhat test test/unlock-account.test.jsnpx hardhat test test/swapV3.test.jsThis contract introduces 2 functions to perform single hop swaps on Uniswap V3

exactInputSingle - Sell all of input token.

exactOutputSingle - Buy specific amount of output token.

We are interacting with the interface for Uniswap V3 router ISwapRouter

- Address of tokens (2 or 3) and the address of the router

- Set interfaces for tokens and router

- Transfer

amountInfrommsg.sender - Approve

amountIntorouter - Set the

paramsby preparing struct ISwapRouter.ExactInputSingleParams - Call

exactInputSingleon ISwapRouter (router interface)

- Transfer

amountInMaxfrommsg.sender - Approve

amountInMaxtorouter - Set the

paramsby preparing struct ISwapRouter.ExactOutputSingleParams - Call

exactOutputSingleon ISwapRouter and store amount of WETH spent by Uniswap in amountIn (uint) - Refund WETH not spent back to msg.sender

- Reset approvals of WETH for router to 0

Swap WETH for USDC and then USDC for DAI.

exactInput - Sell all of input token.

exactOutput - Buy specific amount of output token.

We are interacting with the interface for Uniswap V3 router ISwapRouter

- Address of tokens and the address of the router

- Set interfaces for tokens and router

This function will swap WETH for maximum amount of DAI.

- Transfer

amountInfrommsg.sender - Approve

amountIntorouter - Setup the swapping

path - Prepare struct ISwapRouter.ExactInputParams

- Execute the trade by calling

router.exactInputwith the parameters prepared above

This function will swap minimum amount of WETH for a specific amount of DAI.

- Transfer

amountInMaxfrommsg.sender - Approve

amountInMaxtorouter - Setup the swapping

path - Call

swapTokensForExactTokenson IUniswapV2Router and store the actual amount of token in swapped for token out in amountSwap (uint) - Refund efund WETH not spent back to msg.sender

- Reset approvals of WETH for router to 0

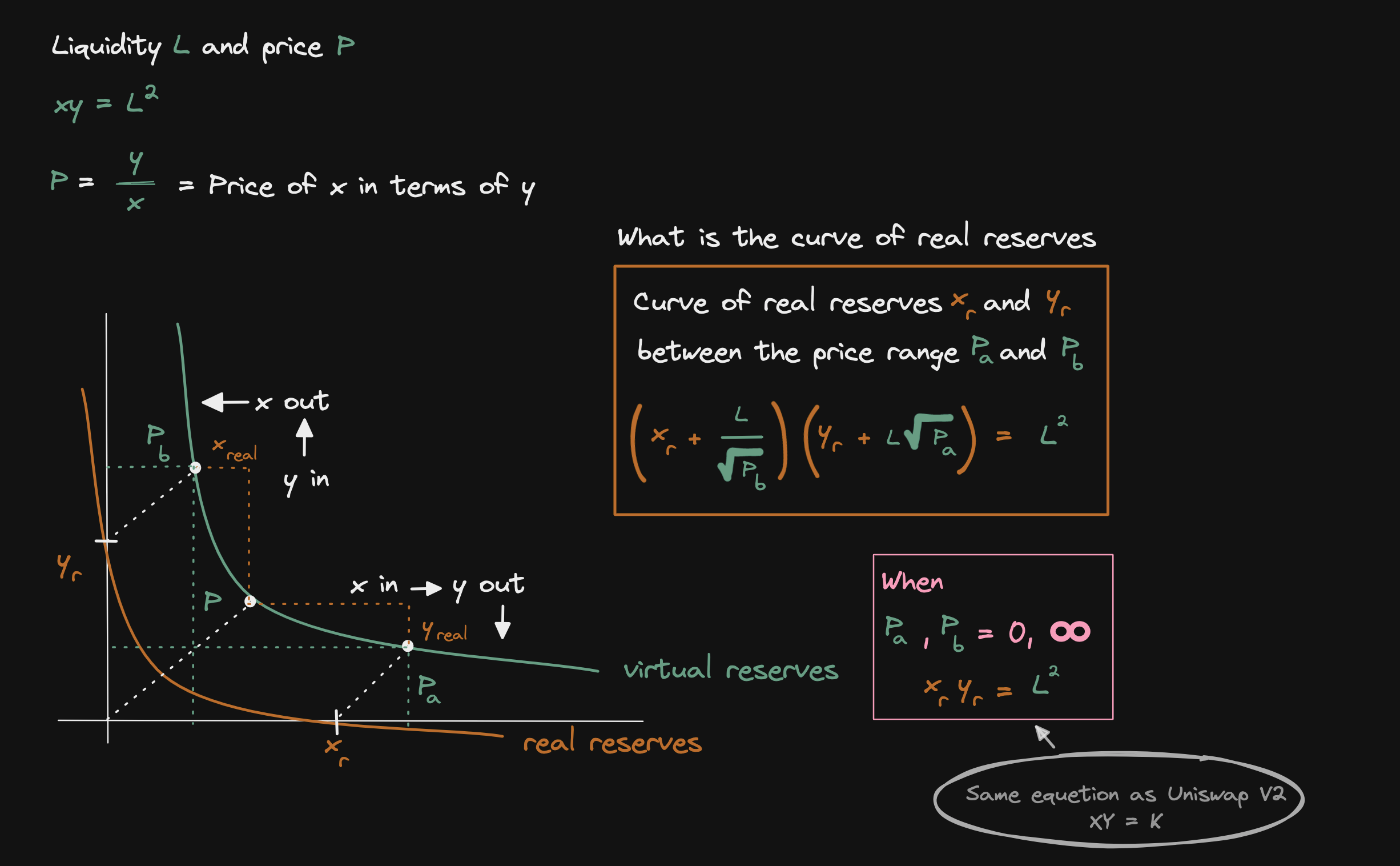

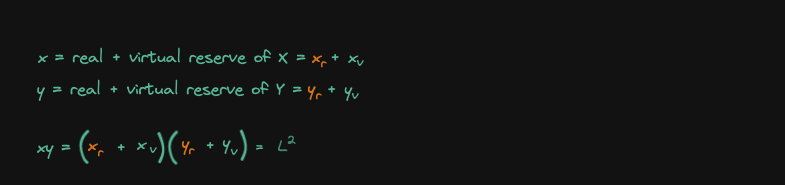

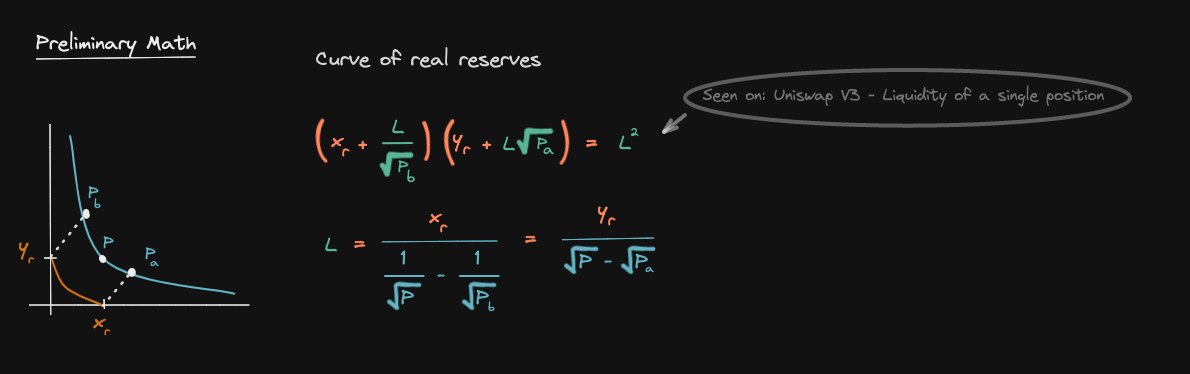

In Uniswap V3 the curve of the real reserve is giving by the formula below (orange square)

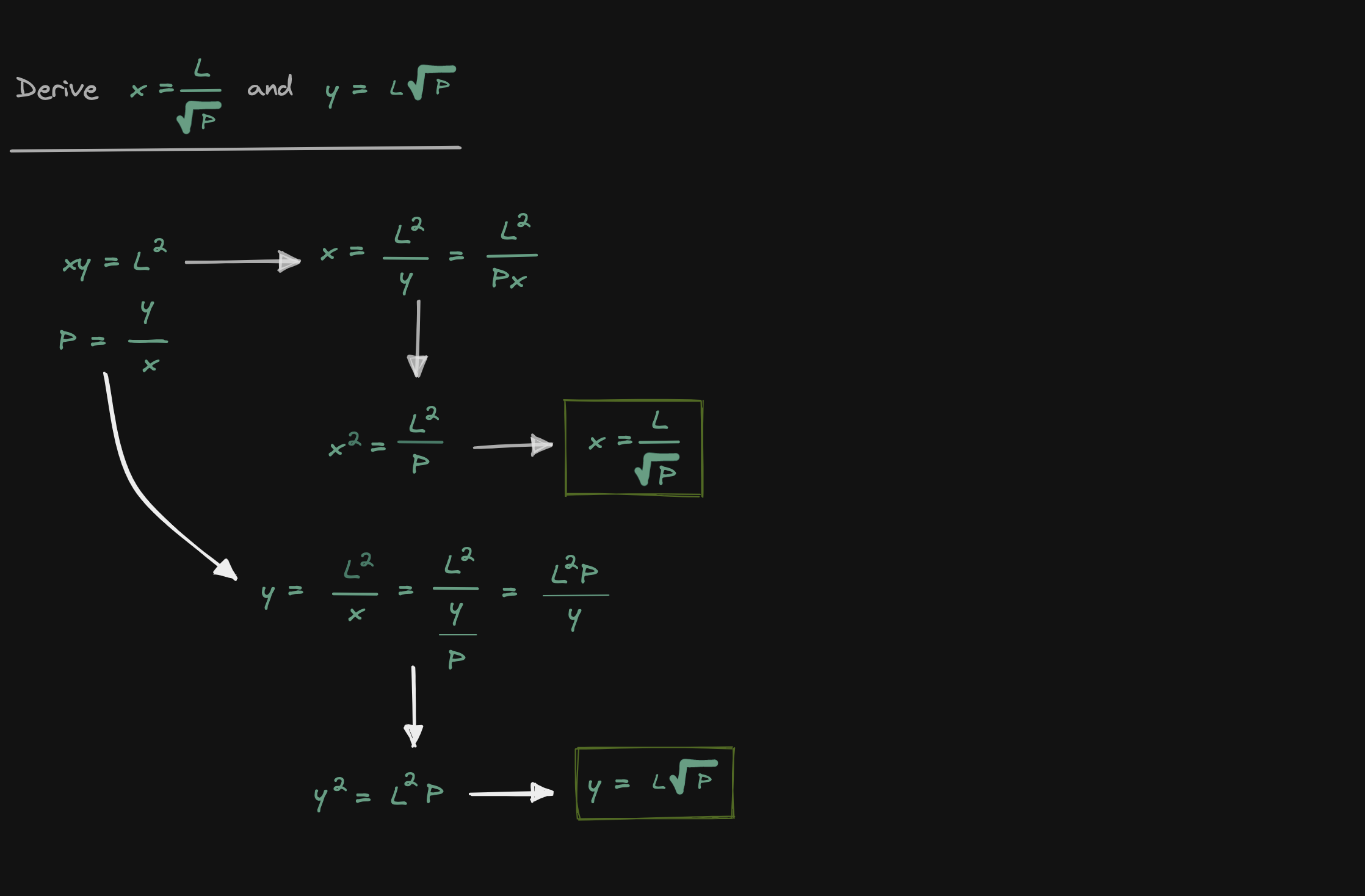

Let's derive this equation starting from the constant product equation XY = K

Let's now derive the equation, the curve for the real reserve

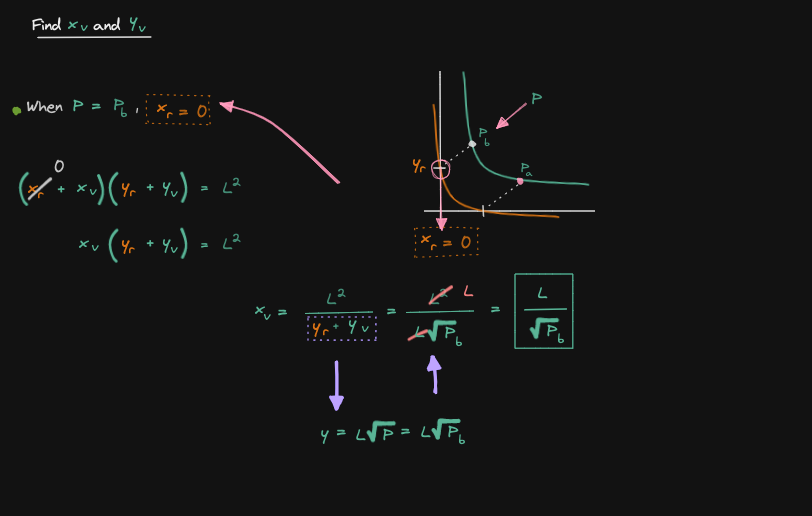

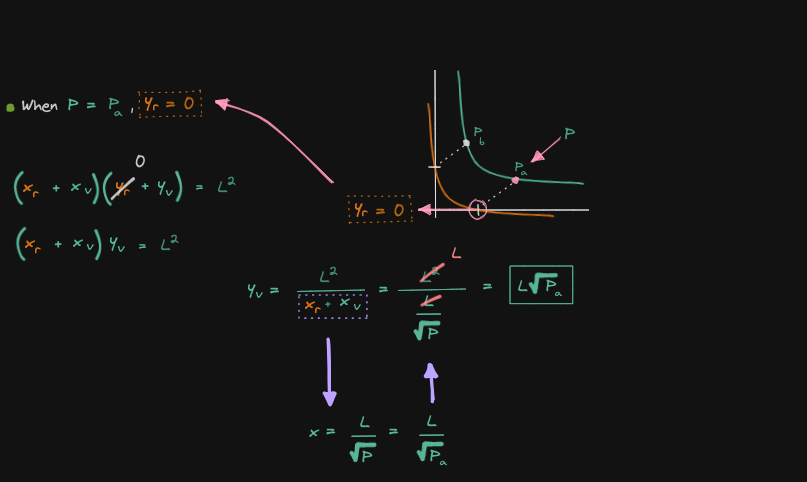

Now that we can rewrite x and y in terms of the liquidity L and the current price P, let's now derive the equation for the real reserves (solve for Xv and Yv)

Let's solve for Xv

Let's solve for Yv

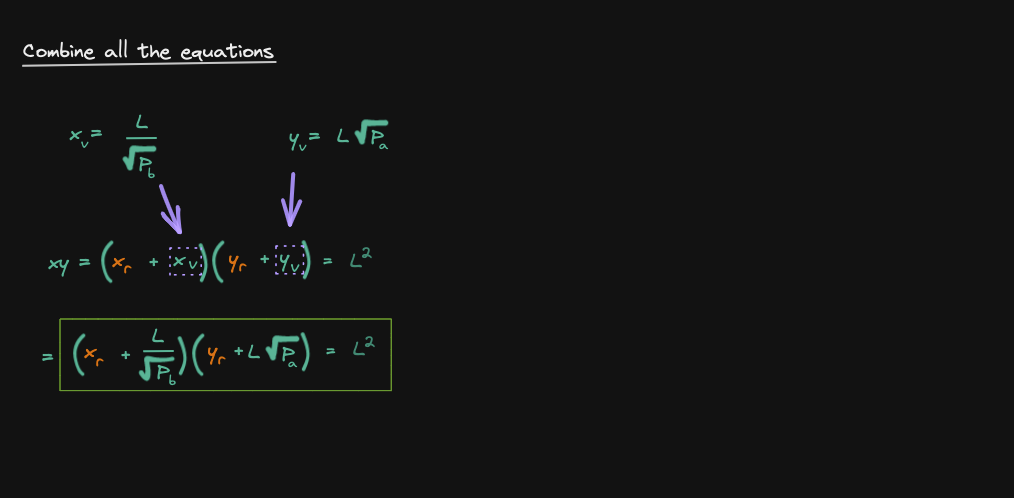

The final step to derive the curve for the real reserve is to combine all of the equations that we have derived so far

Later on, we will use this equation to derive the liquidity delta: changing liquidity when we add some amount of token x and token y

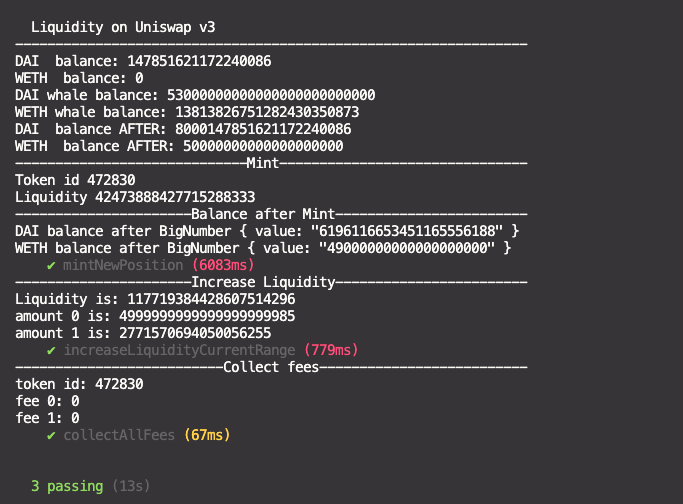

npx hardhat test test/unlock-account.test.jsnpx hardhat test test/liquidityV3.test.jsnpx hardhat test test/liquidityV3.test.jsNo fees in this case

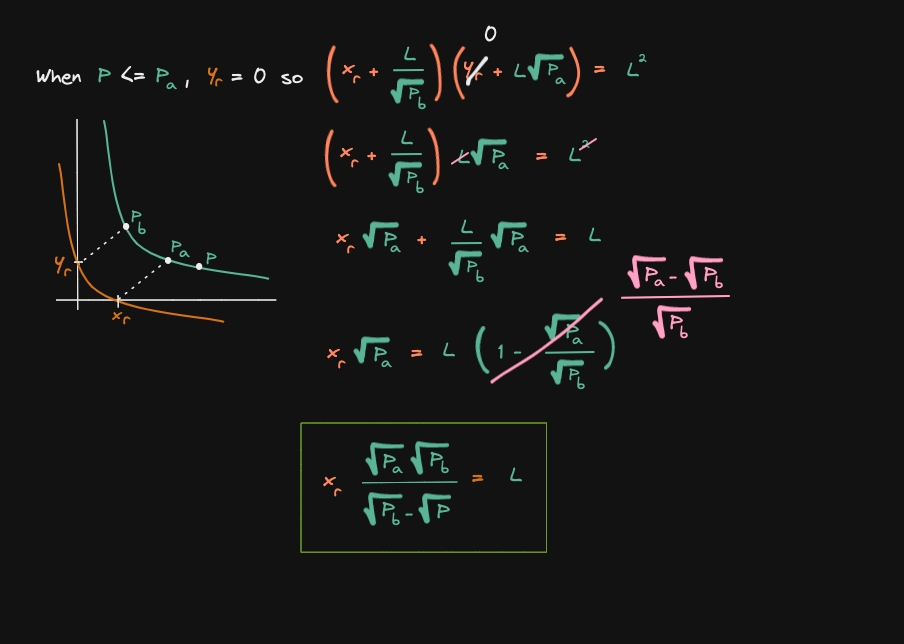

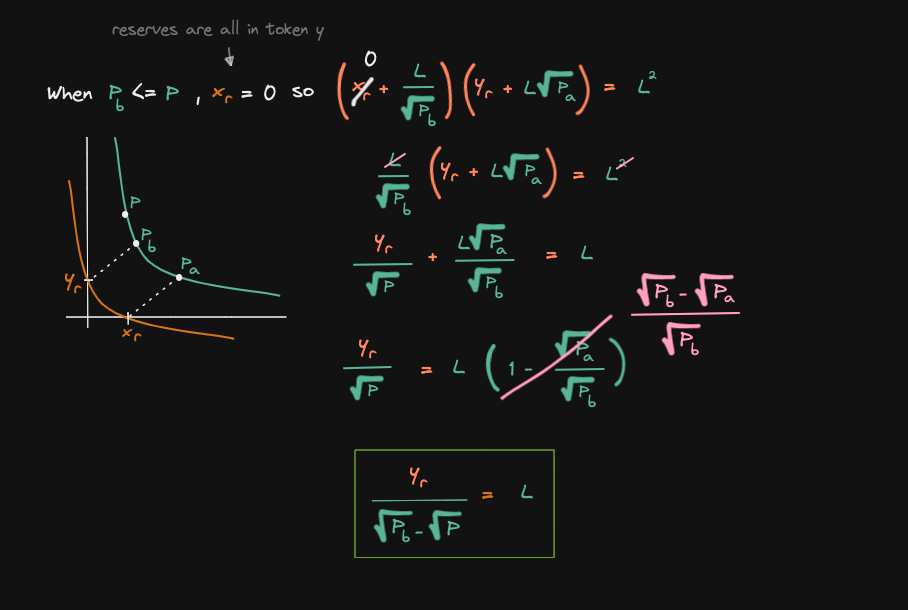

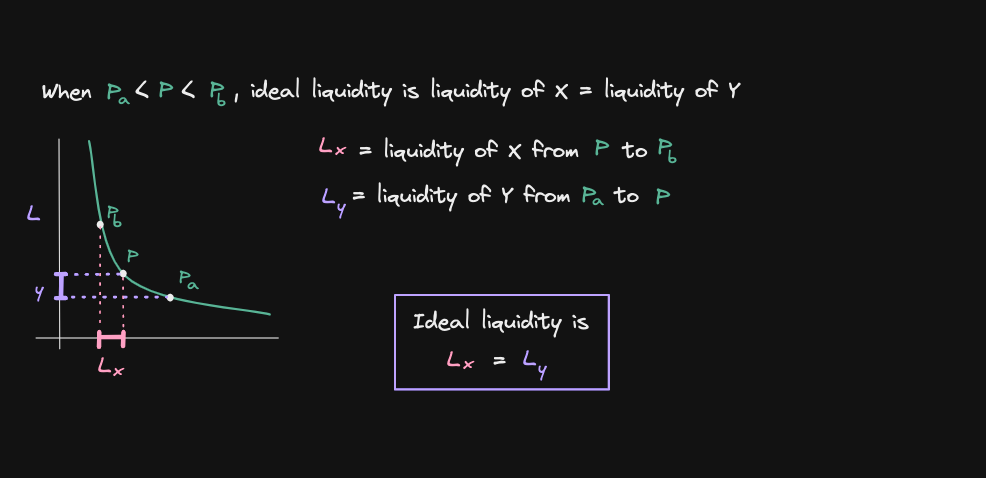

We previously derived the curve for the real reserves.

Let's use this equation to derive the equation for the liquidity(this equation has 3 parts):

Let's start with the first case

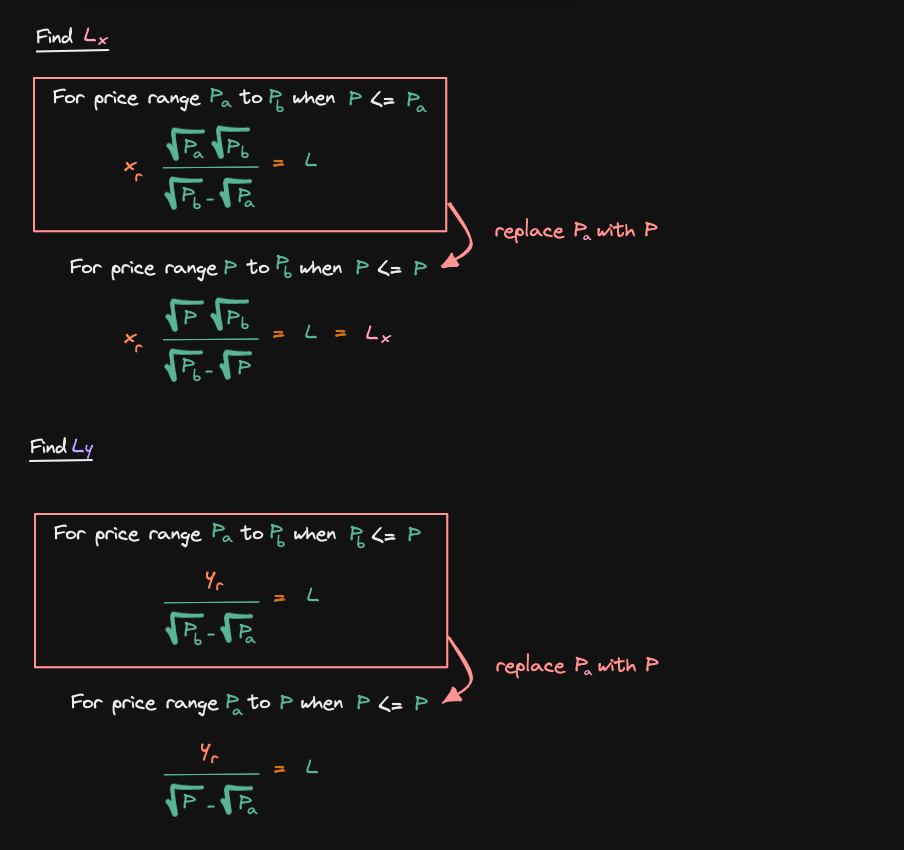

Let's derive the equation for liquidity when the current price >= Pb

Let's apply the same technique to find Ly

Find Lx and Ly

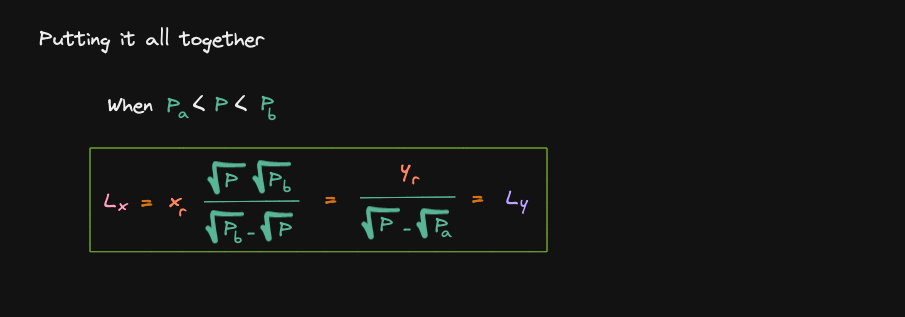

Finally let's put the two equations that we derived earlier

npx hardhat test test/liquidityV3.test.js5000 DAI and 2,77 WETH added

Amounts specified in liquidityV3.test.js:

const daiAmount = 5000n * 10n ** 18n;

const wethAmount = 10n * 10n ** 18n;Learn more about Add liquidity - How many dx, dy to add? in this repo about Constant Product AMM

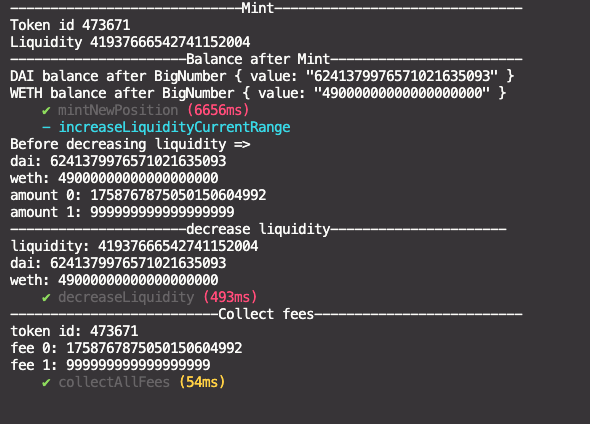

npx hardhat test test/liquidityV3.test.jsWhen we call the function decreaseLiquidity, it doesn't transfer the tokens back to contract

To actually withdraw the tokens from Uniswap V3, after calling the function decreaseLiquidity(), we'll have to call the function collect()

Note that after calling decreaseLiquidity, DAI balance and WETH balance remain the same

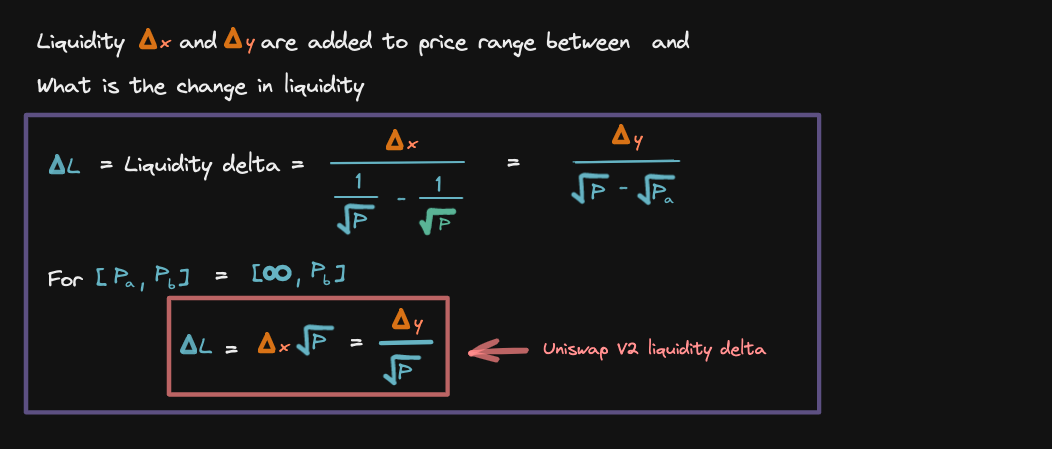

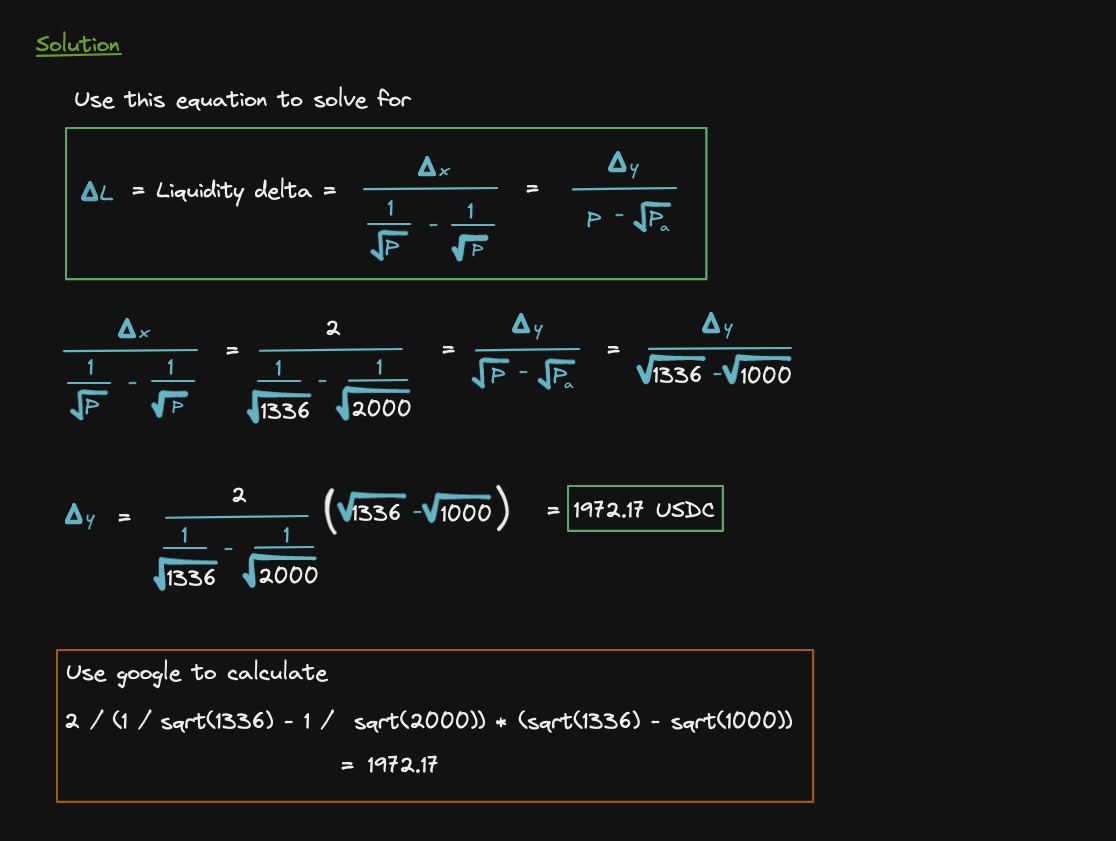

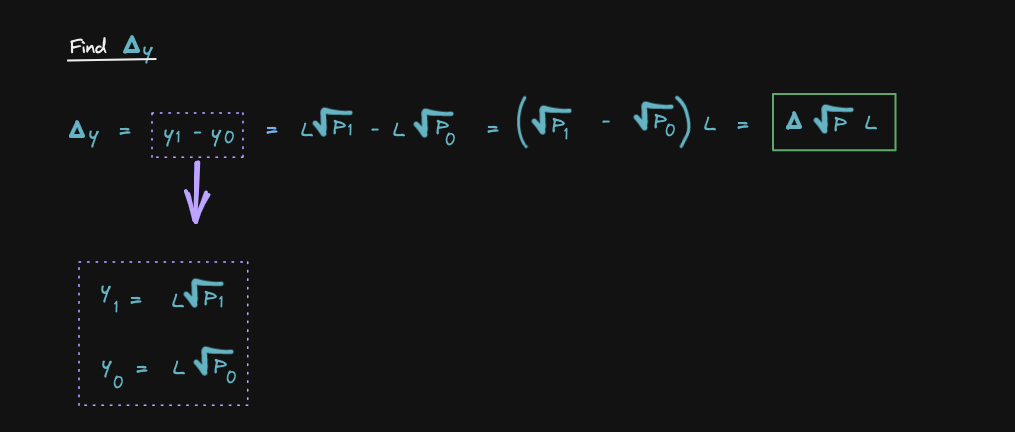

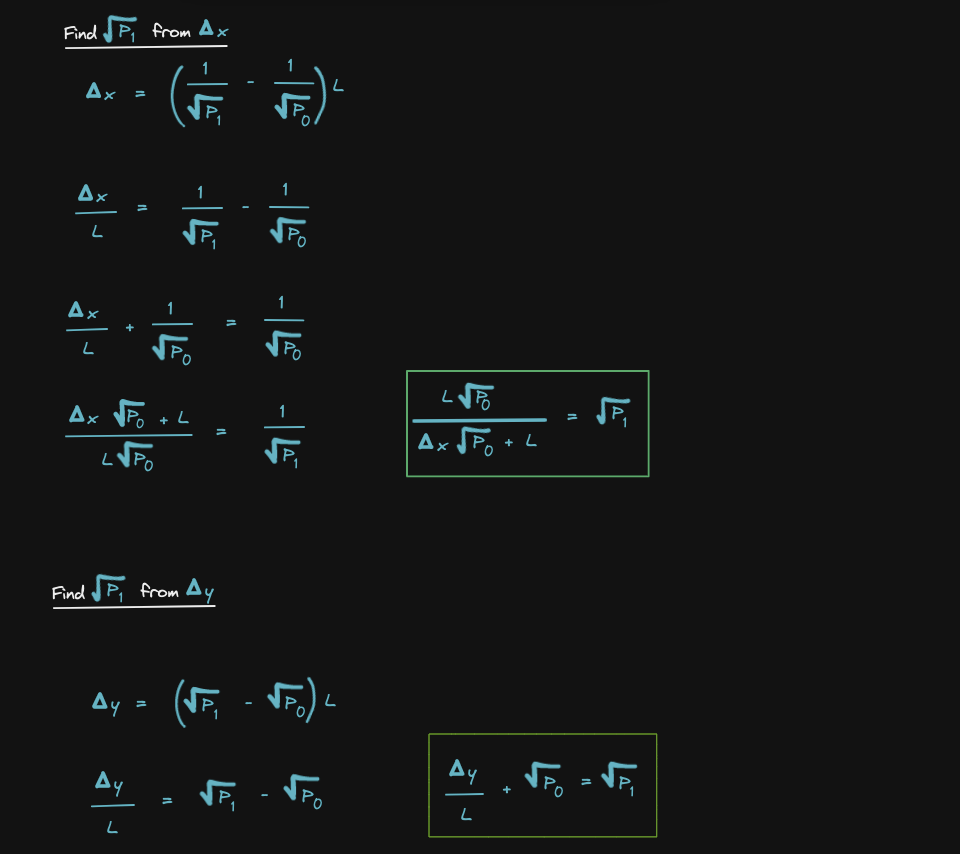

let's derive these two equations

First, preliminary math:

Let's define liquidity delta

Four steps to calculate liquidity delta:

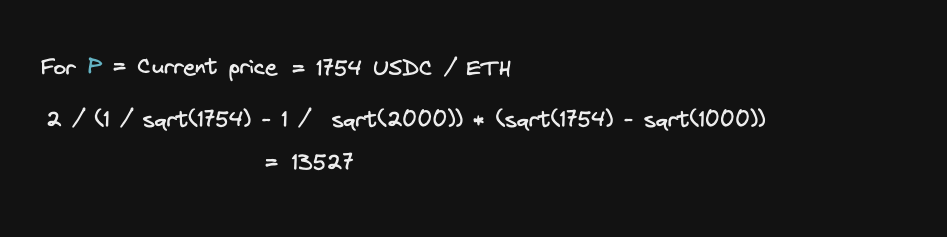

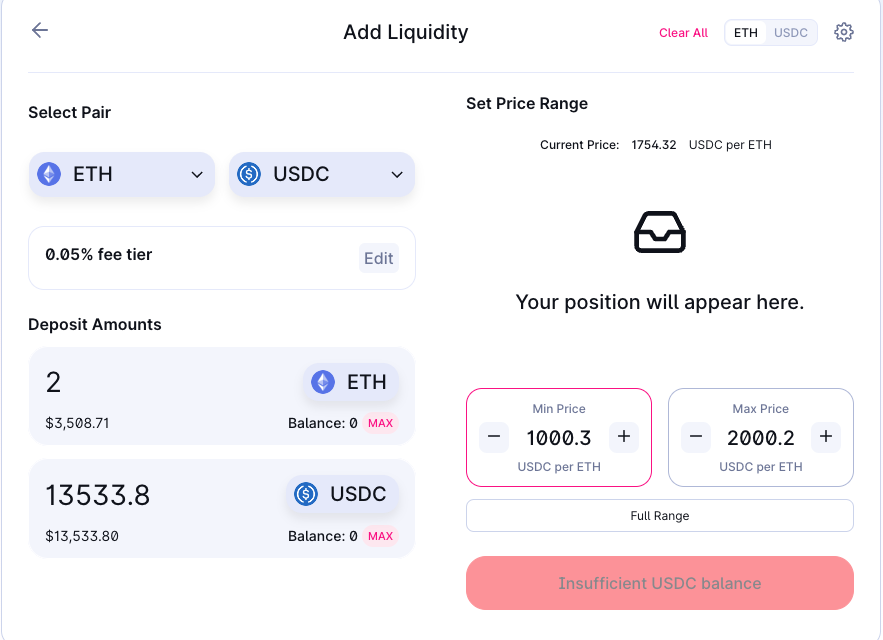

Let's see a real example of how to calculate the amount of tokens needed when we add liquidity to Uniswap V3

How much USDC will we need to add with the following parameters?

How do we compute delta Y? We'll use the previous equation (Uniswap V3 Liquidity Delta)

You can access the uniswap app to compare the amount of USDC that we will need to put in when the price of ETH is $1754

If we compare with the UI, the result is very close

Manage liquidity in Uniswap V3

Mint new position Increase liquidity Decrease liquidity Collect fees and withdraw tokens

Contract inherits from IERC721Receiver

- Address of tokens. Set MIN_TICK, MAX_TICK, TICK_SPACING

- Set interfaces for tokens and manager with the

INonfungiblePositionManagerinterface

This function is called when safeTransferFrom is called on INonFungiblePositionManager.

- Transfer

wethAmountDesiredanddaiAmountDesiredfrommsg.sender - Approve

amountwethAmountDesiredanddaiAmountDesiredtorouter - Call

addLiqiuidity()onrouterand storewethAmount,daiAmountandliquidityreturned from the function call - Refund to msg.sender, excess WETH and DAI that were not added to liquidity

This function removes liquidity from the Uniswap WETH - DAI pool.

- Transfer DAI and WETH from

msg.senderinto this contract.amount0ToAddis DAI amount,amount1ToAddis WETH - Approve

managerto spend DAI and WETH from this contract - Set

tickLowerandtickUpper, price range to add liquidity. Both ticks must be a multiple ofTICK_SPACING. - Prepare parameter to add new liquidity and mint new position

- Add liquidity by calling

manager.mintwith the parameters prepared above - manager.mint returns 4 outputs. Refund tokens not added to liquidity back to msg.sender. We pulled in amount0ToAdd and amount1ToAdd. Actual amount added to Uniswap V3 are amount0 and amount1.

- Reset approvals of DAI and WETH for manager to 0

- Emit Mint with tokenId.

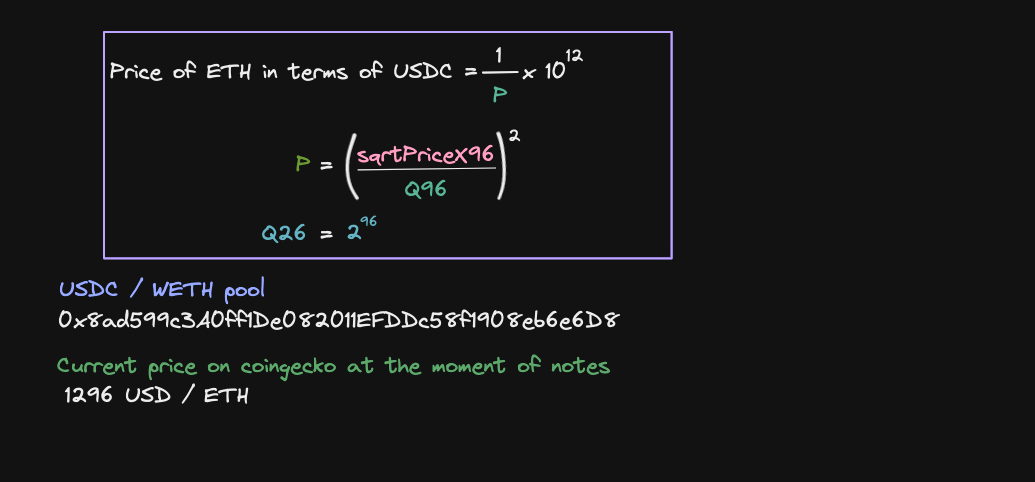

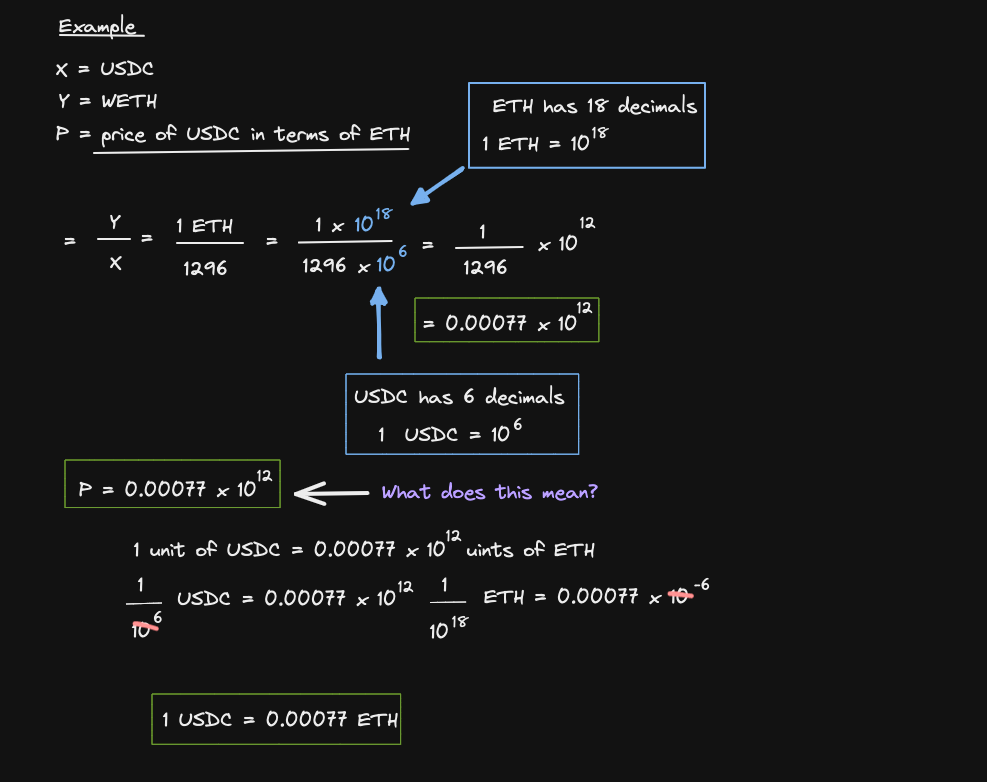

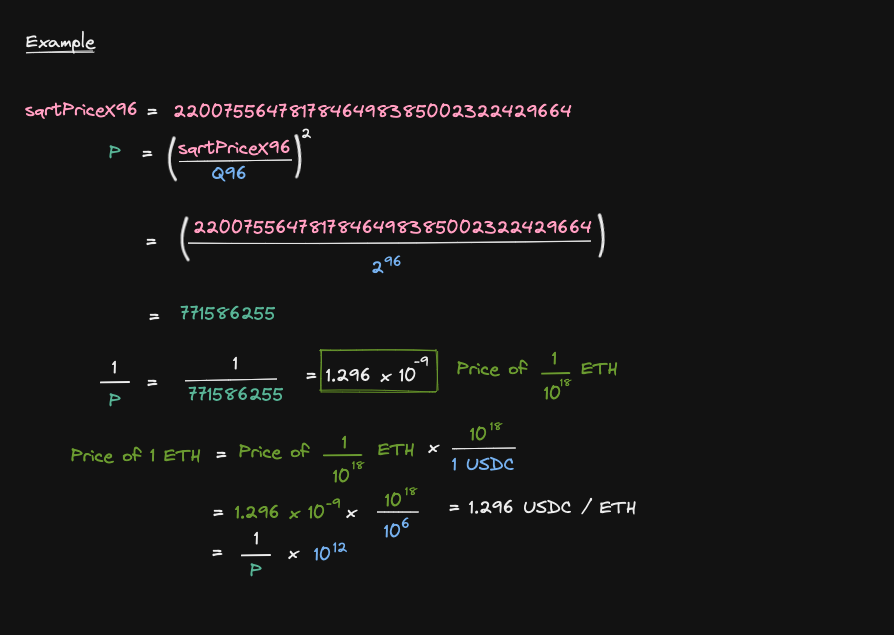

Let's find out where the 10**12 comes from

First, let's find P through an example

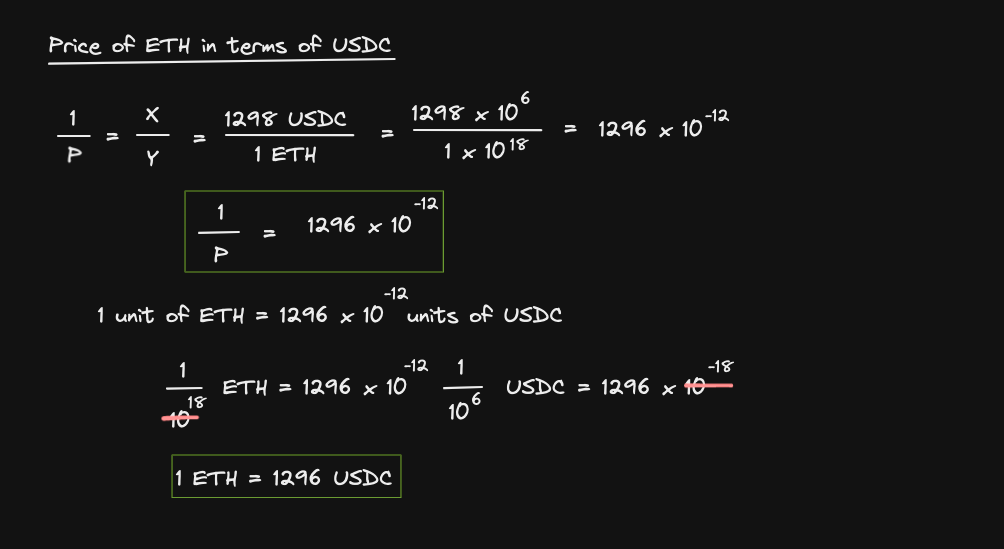

But we are interested in the price of ETH in terms of USDC

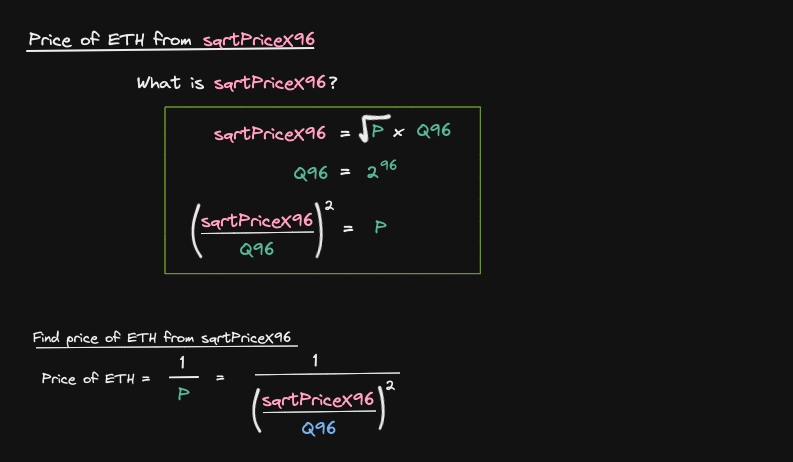

But how we calculate the price of ETH starting from sqrtPriceX96?

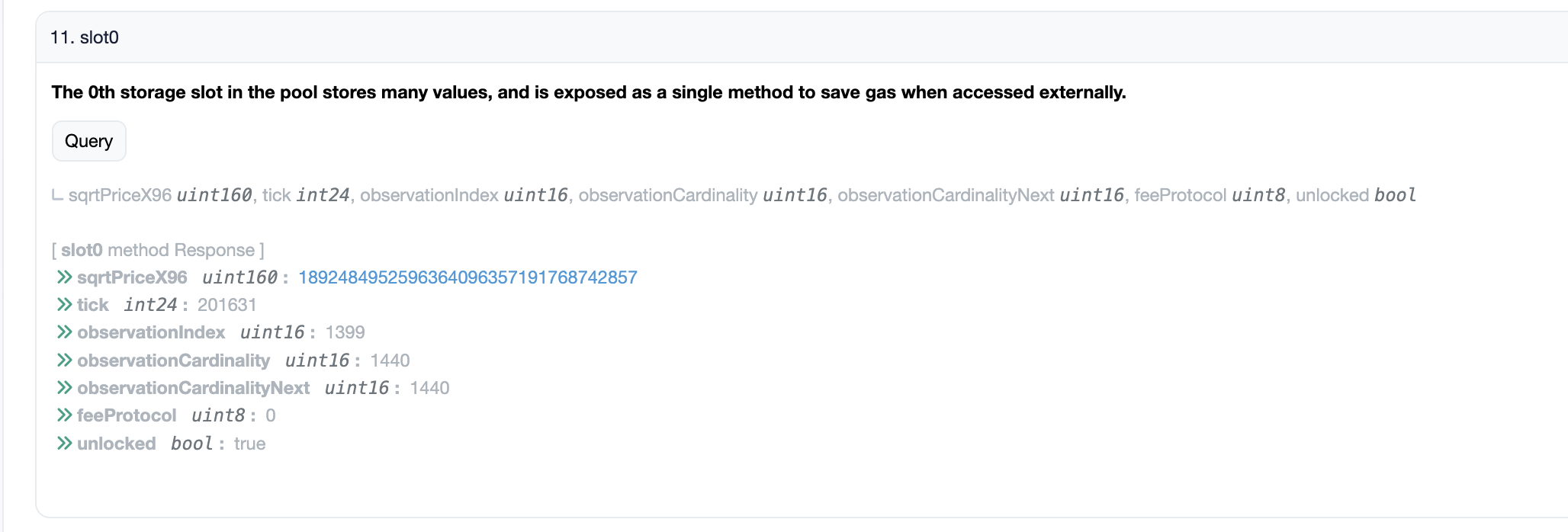

This is the variable related to the price of tokens, stored in Uniswap V3 contract

Find sqrtPriceX96 variable on Uniswap USDC / ETH pool contract

Let's consider sqrtPriceX96 = 2200755647817846498385002322429664. The same can be done with the actual sqrtPriceX95

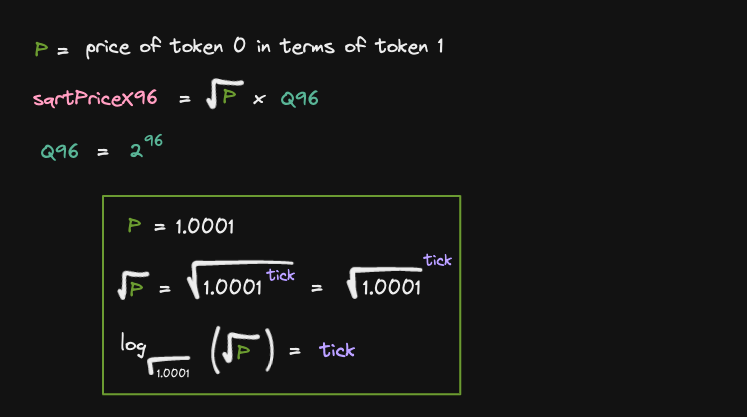

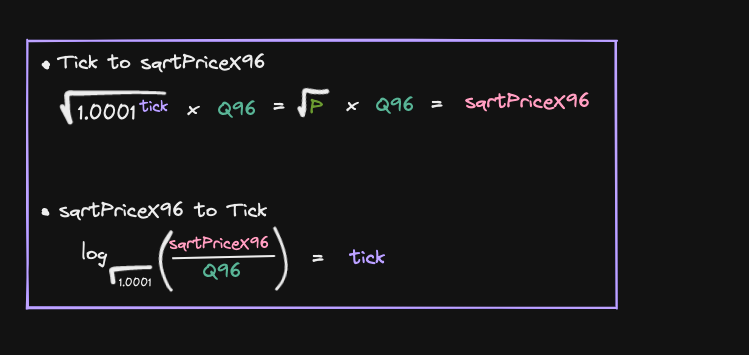

let's see how to convert from tick to sqrtPriceX96 and from sqrtPriceX96 to tick

First, let's start by reviewing some of the variables

We're gonna need these two equations to calculate from tick to sqrtPriceX96 and from sqrtPriceX96 back to tick

For the first example, we'll say tht we know what the tick is and we'll try to compute the sqrtPriceX96

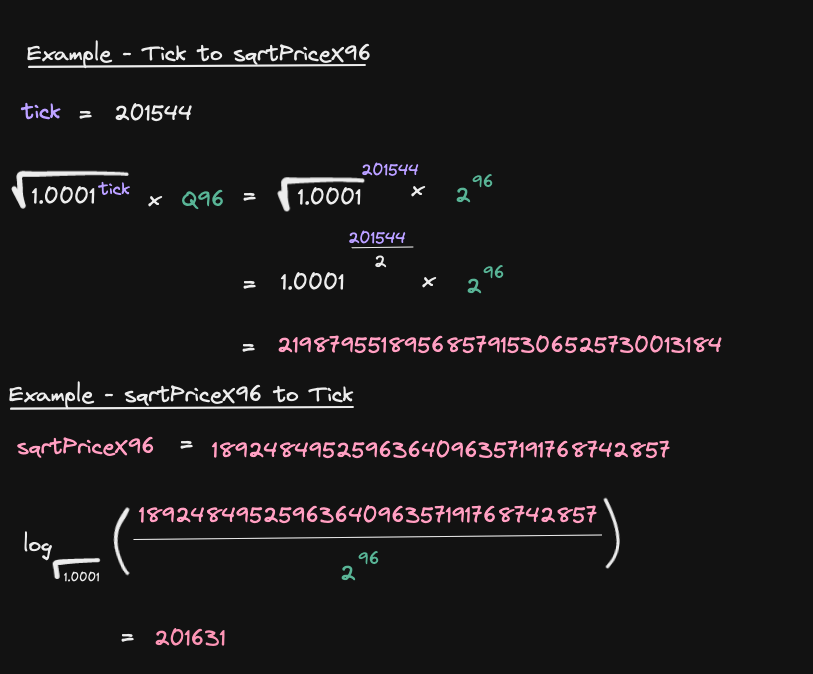

Let's use python to compute sqrtPriceX96 and tick

import math

Q96 = 2 ** 96

def tick_to_sqrt_price_x_96(tick):

return int(1.0001 ** (tick / 2) * Q96)

def sqrt_price_x_96_to_tick(sqrt_price_x_96):

base = math.sqrt(1.0001)

p = sqrt_price_x_96 / Q96

return math.floor(math.log(p, base))

tick = 204632

tick_to_sqrt_price_x_96(tick)

sqrt_price_x_96 = 1892484952596364096357191768742857

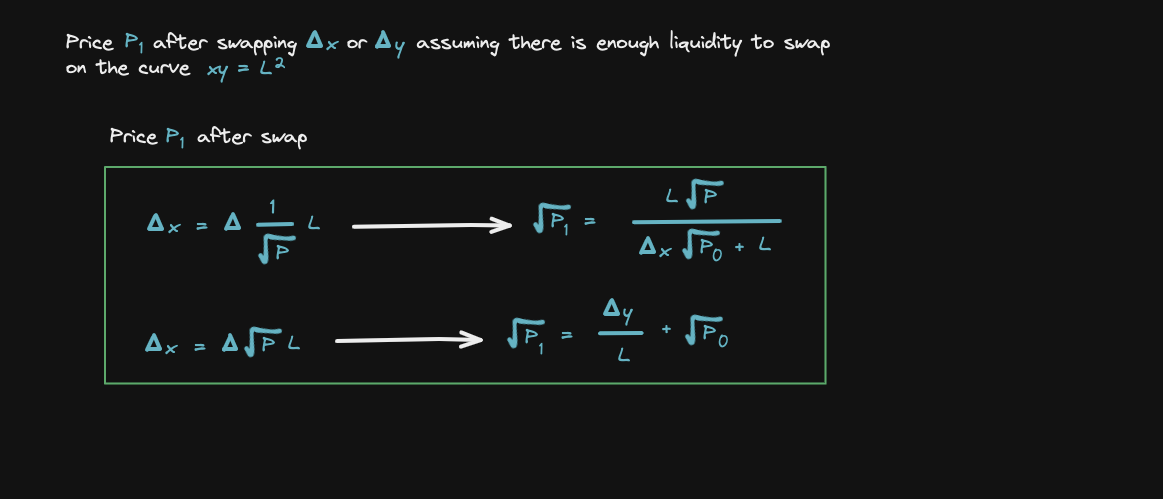

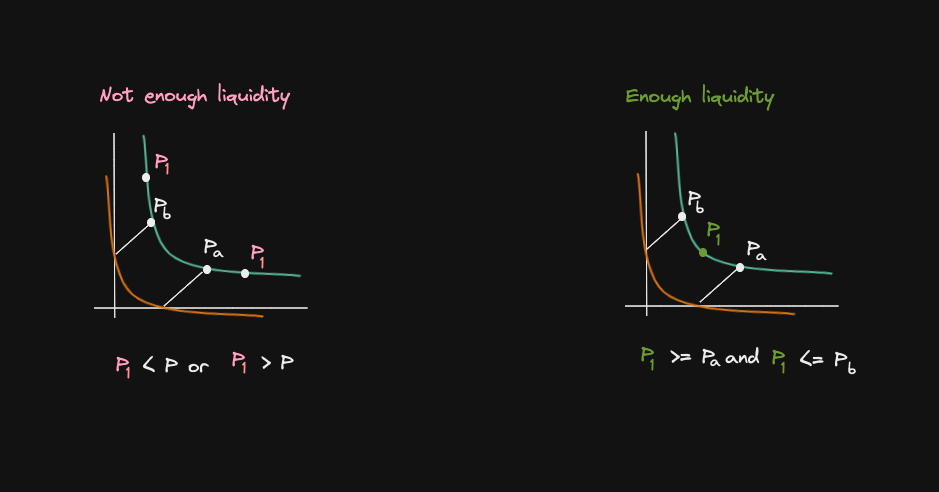

sqrt_price_x_96_to_tick(sqrt_price_x_96)First, let's explain what we mean by "we are assuming there is enough liquidity to swap on the curve"

- Liquidity is only supported between the price range

PaandPb, and the price after the swap falls outside of the price range range - In the second case, the price P1 after the swap remains in the range

PaandPb

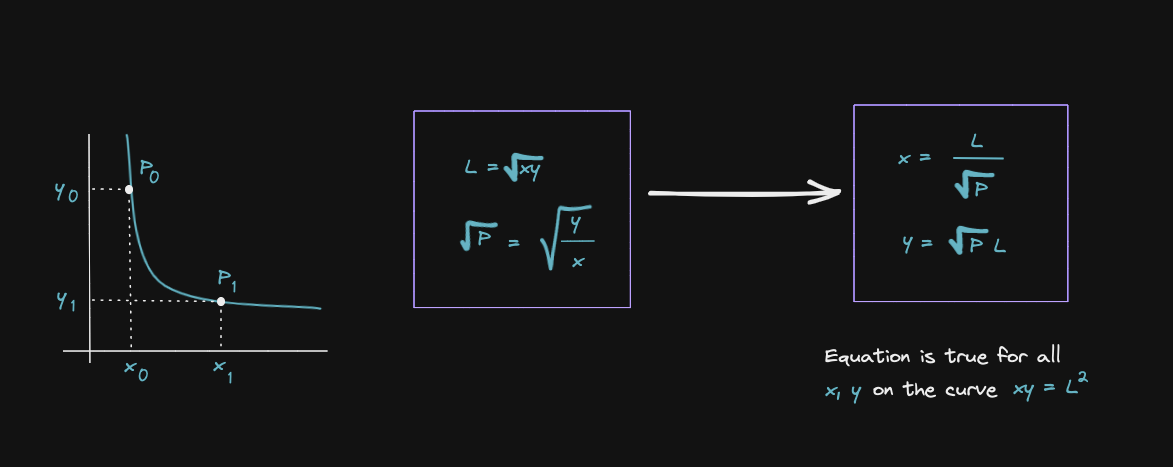

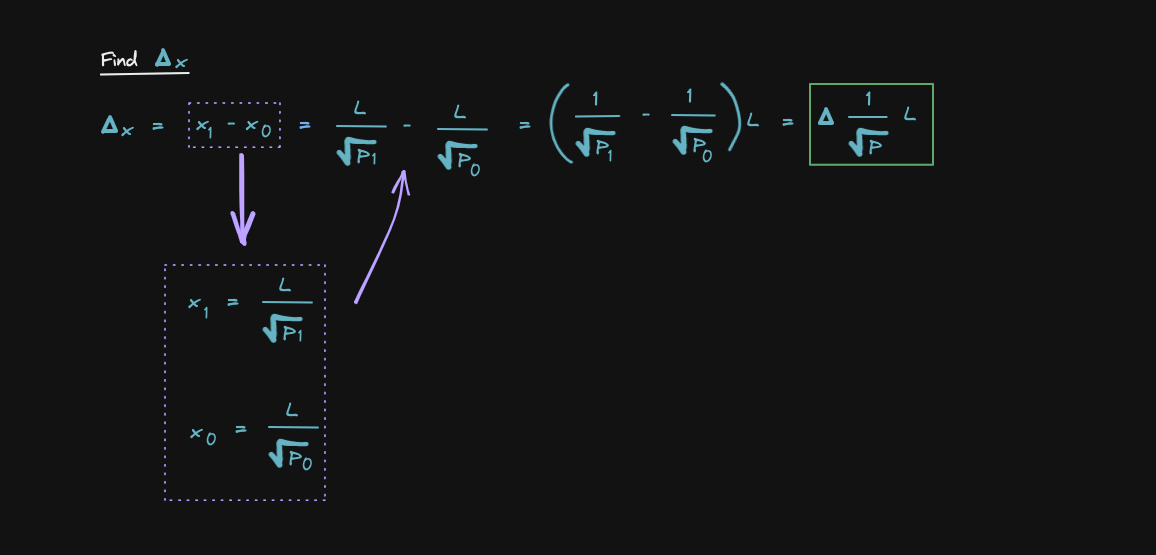

Let's go over the math, let's derive the equations

=> These equations can be applied to Y0, Y1, X0 and X1 since all of these points are on the curve XY = L2

This is a important fact to remember as we will derive the equations for delta x and delta y

We'll do the same trick to find delta y

Finally, let's derive the equations for sqrt(P1) and sqrt(P2)

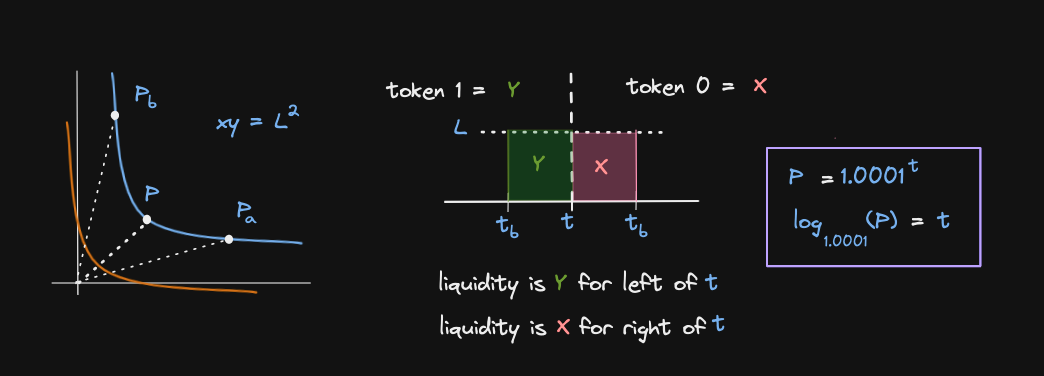

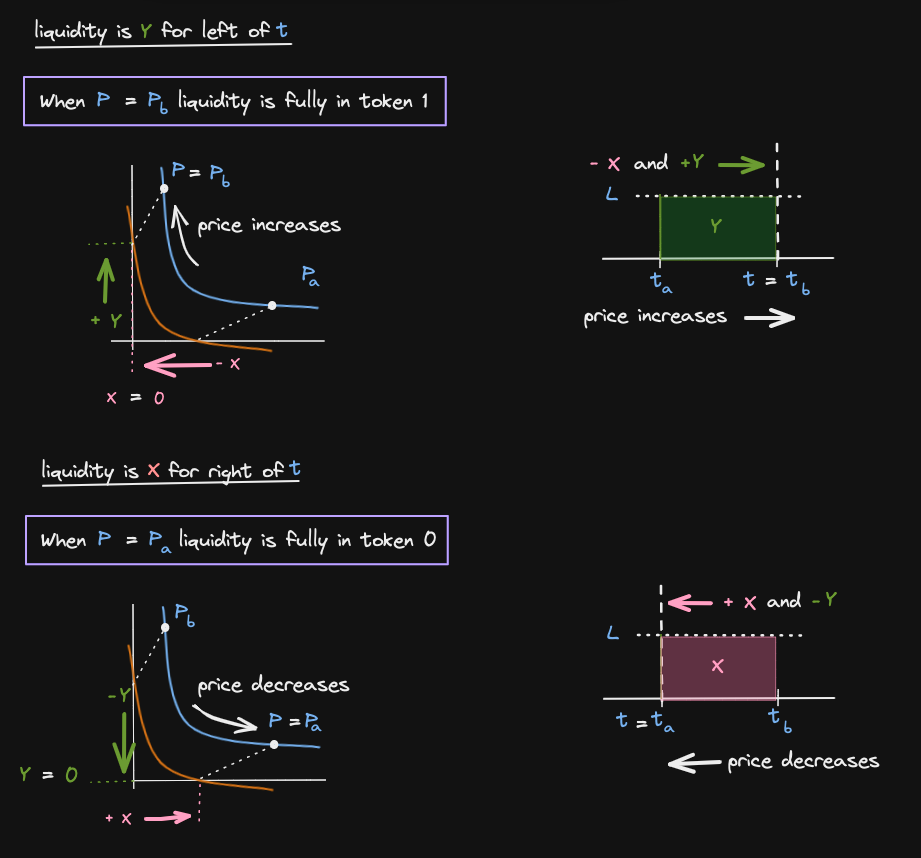

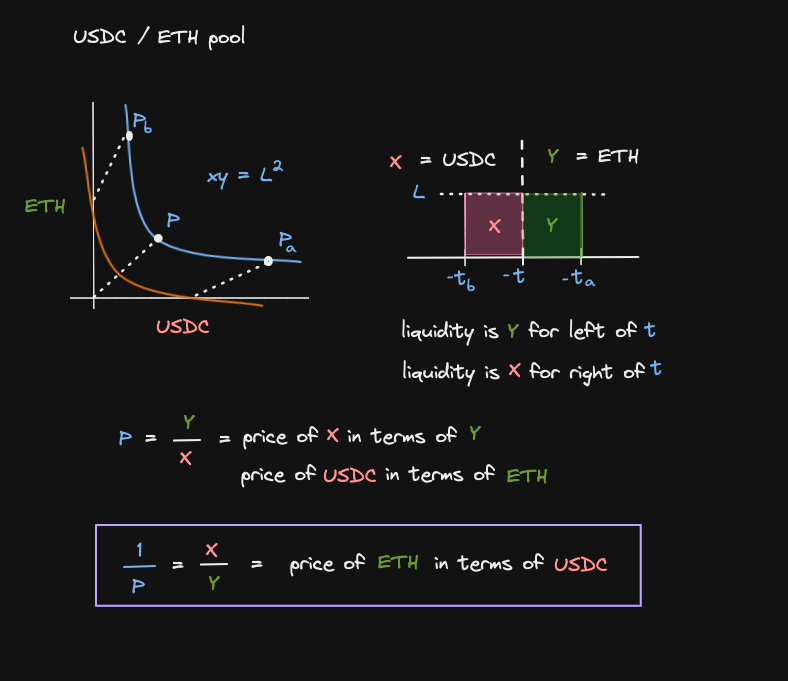

Let's see how to read liquidity price graph

The current liquidity on Uniswap v3 is L and we are trading on the curve XY = L2

There is a single position supporting this liquidity from the price range [Pa - Pb]

From Pa, Pb and the current price P, let's convert to ticks (equations inside the square) and let's map it horizontally.

The vertical axis represents liquidity

=> To the left of the current tick t, all the tokens will be in token 1 (Y)

=> To the right of the current tick t, all the tokens will be in token 0 (X)

Let's see why this is:

When the current price is equal to Pb, then the liquidity is fully in token Y

When the price P is equal to Pa, then the liquidity is fully in token X

=> Combinng these two observations, we know that liquidity is in Y for the left of the current tick t, and liquidity is X for the right of t

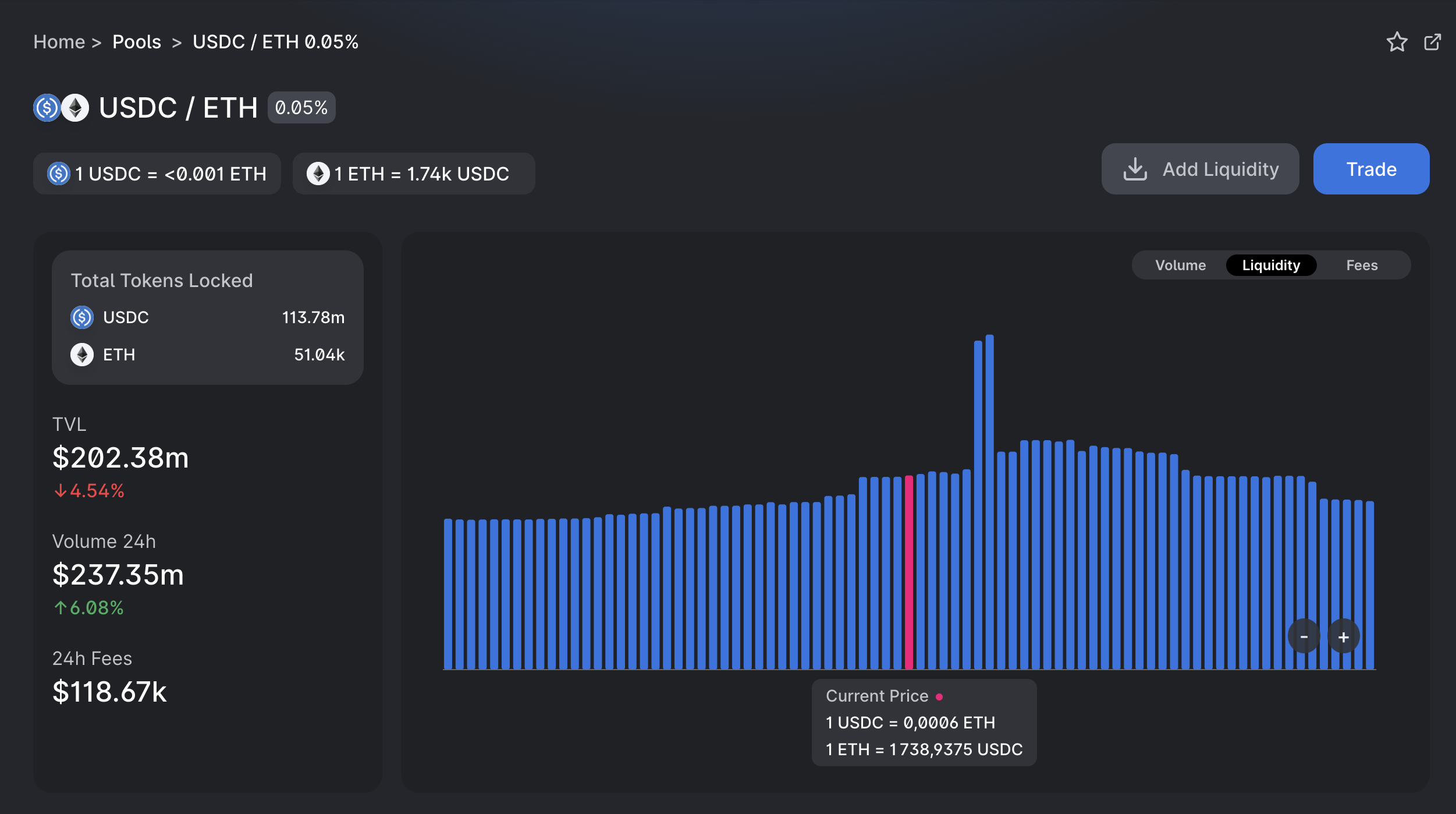

In the following Liquidity Price Graph of the ETH / USDC pool, in pink you can see the current price

To the left of the current price all of the tokens are in USDC

And to the right of the current price, all of the liquidity are in ETH

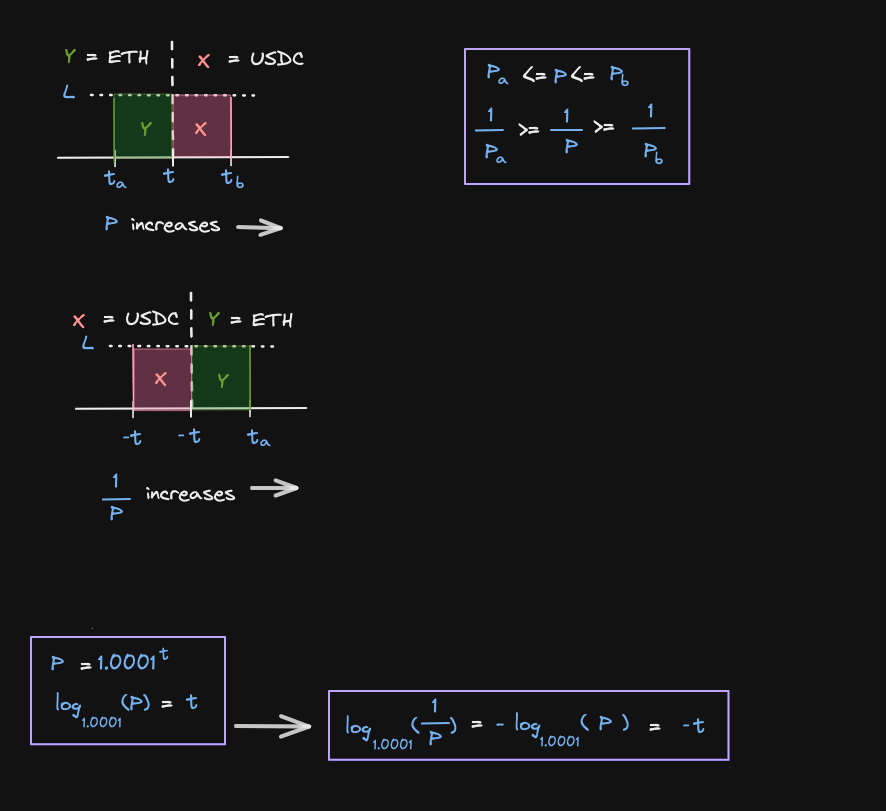

Let's see why

Notice that in the graph below:

- X is on the left and Y is on the right

- ticks are negative

Instead of P increasing to the right, we want to convert this into a graph where 1 / P increases to the right

Inside the first purple rectangle below, we start by mapping the ticks to this new graph (we flip the inequality before mapping into the graph), then we convert 1 / P to ticks inside the second purple rectangle

Here is the link to the ETH / USDC pool on Uniswap v3

npx hardhat test test/unlock-account.test.jsnpx hardhat test test/flashSwapV3.test.jsnpx hardhat test test/flashSwapArbV3.test.jsBorrow tokens from Uniswap V3 pool and then repay with fee in a single transaction. This is called flash loan.

We'll call flash on Uniswap V3 pool to borrow WETH.

- Address of tokens and the address of the factory

- Set WETH interface and declare pool (IUniswapV3Pool)

- Set

POOL_FEEto 3000 because we'll call DAI / WETH pool with 0.3% fee - Declare struct

FlashDatawithwethAmountandcaller

- The variable pool is immutable, so initialize it inside the constructor.

- Address of the pool can be obtained by calling

PoolAddress.computeAddress. - PoolKey can be obtained by calling

PoolAddress.getPoolKey

This function will initialize the flash loan on Uniswap V3 pool by calling pool.flash

Below is an overview of what will happen after pool.flash is called.

- The pool sends tokens to the borrower.

- The pool calls uniswapV3FlashCallback on the borrower.

- Inside the uniswapV3FlashCallback our customm code is executed. At the end of the code, we must pay back the borrowed amount plus fees.

- Prepare data to be passed to

pool.flash. Any bytes can be passed, but we will encode our custom structFlashData. - Call

pool.flash

interface IUniswapV3Pool {

function flash(

address recipient,

uint amount0,

uint amount1,

bytes calldata data

) external;

}This is the function called by pool, after we call pool.flash.

Here we have the requested borrow amount of WETH. Our custom code logic goes here. In this case, we will simply repay the borrowed amount plus fee.

- Require that msg.sender is the pool.

- Decode the data into FlashData

- Caller stored in FlashData will pay for the fee on borrow. Transfer WETH from decoded.caller into this contract for the amount fee1.

- Repay WETH back to the pool. Transfer borrowed amount + fee1.

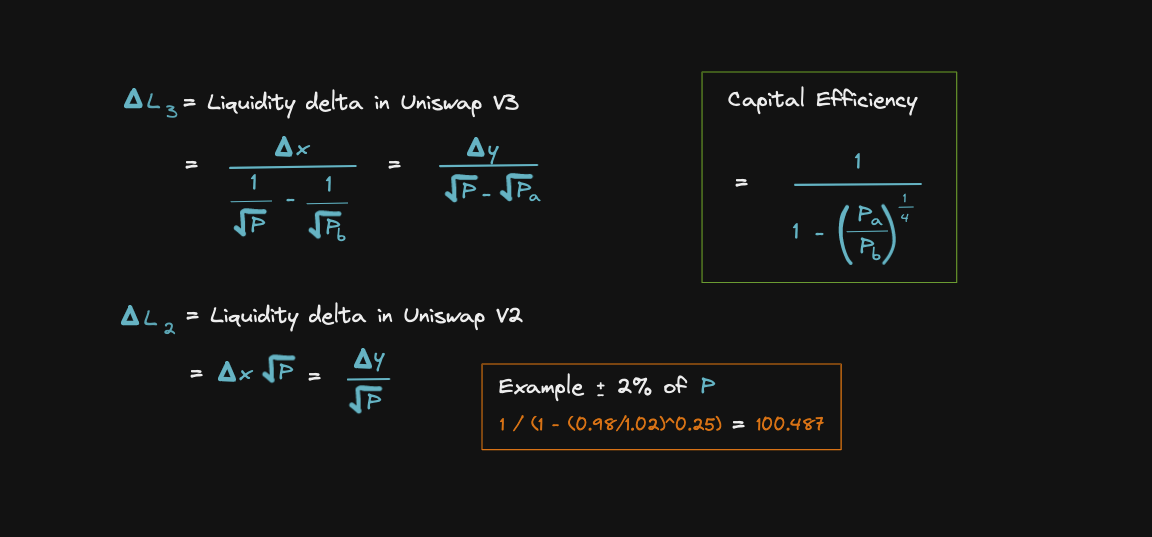

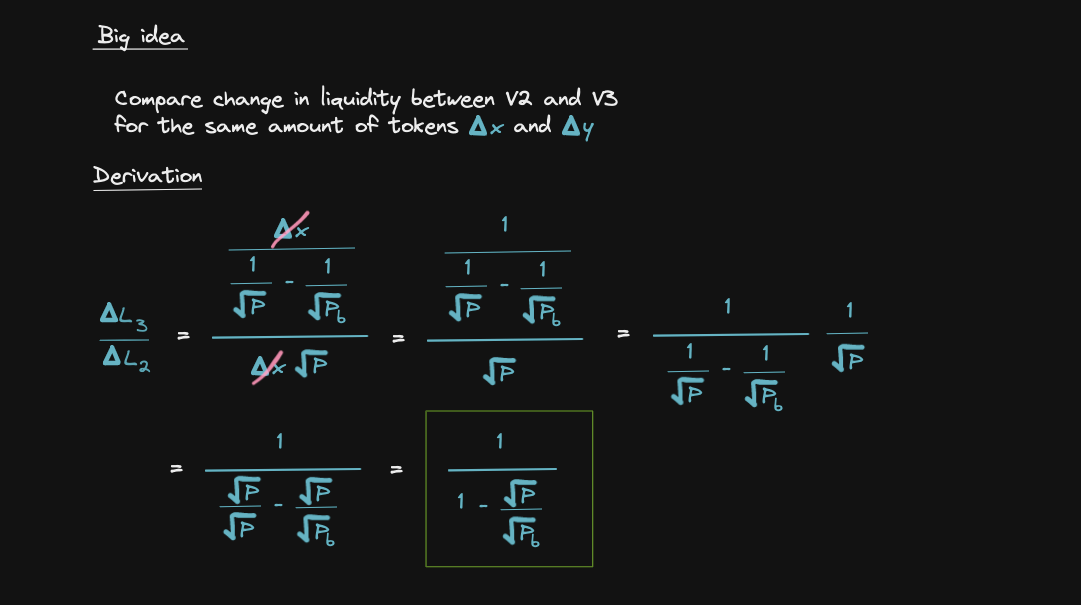

If we were to add the same amount of tokens to Uniswap v2 and Uniswap v3, then how much more can we increase the liquidity in Uniswap v3 if we were to narrow the price range?

Let's start with these equations from Liquidity Delta section to derive the capital efficiency equation

As an example, we calculated the capital efficiency if we were to provide liquidity +/- 2% of the current price P

In other words, if we were to provide the same amount of token to Uniswap v2 and Uniswap v3, the amount of tokens are deltaX and deltaY

However, in Uniswap v3, let's say that we provide the liquidity for the price range +/- 2% of the current price, then the liquidity in Uniswap v3 is about 100 times greater than in Uniswap v2.

We calculated the ratio of liquidity delta for Uniswap v2 and for Uniswap v3

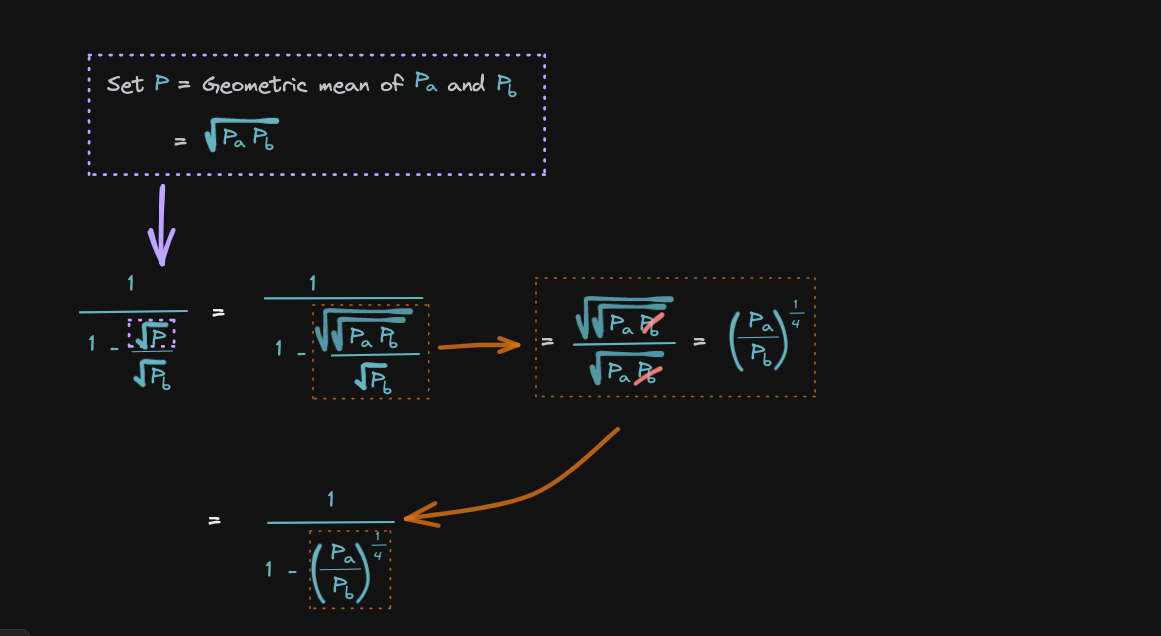

Next, let's replace the current price P with another number

- We're going to say that the current price

Pis the geometric mean ofPaandPb - We take the equation highlighted previously in green

- We replace the

sqrtPhighlighted below by the geometric mean of Pa and Pb (sqrt(PaPb))

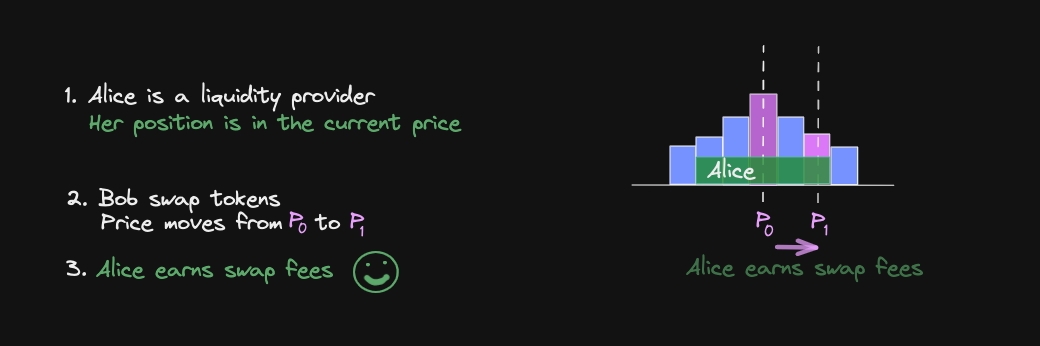

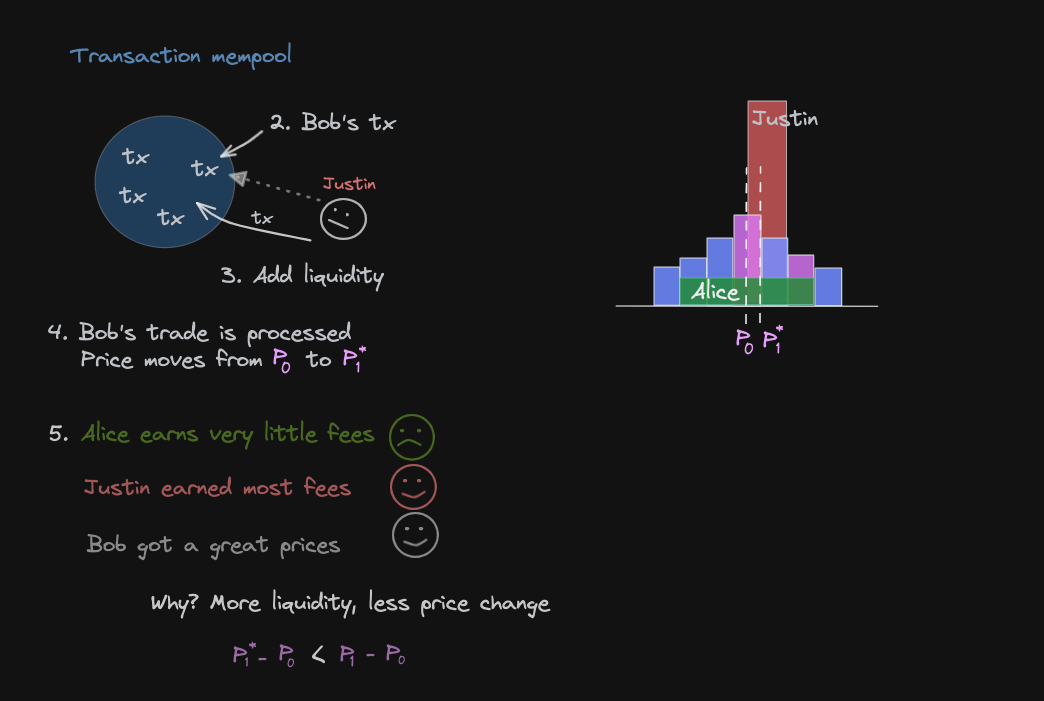

Alice is a liquidity provider and Bob swaps tokens.

From this trade, Alice earns some fees :)

This is how normally how a liquidity provider will earn some fees

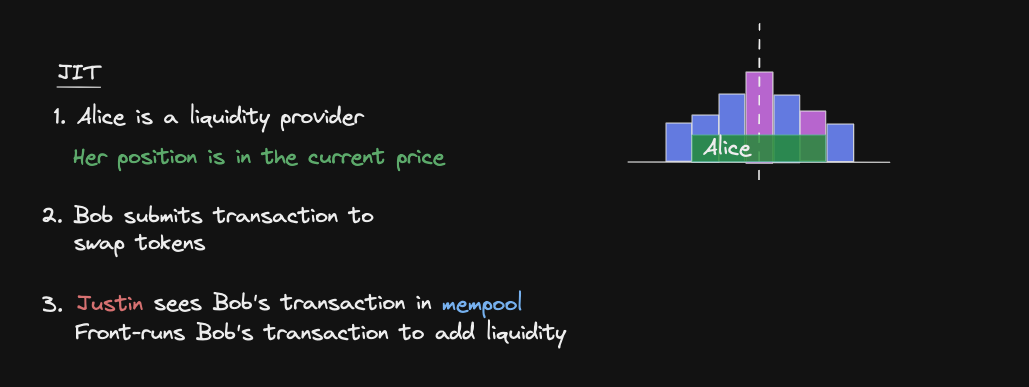

Let's see how just-in-time liquidity will change how the liquidity providers earn fees

In this case, Justin sees Bob's transaction in mempool and front-runs Bob

In the example above we assume that Justin has a lot of liquidity in a narrow price range including the current (shown in red)

Close to the current price P0, Aloce has provided liquidity as shown in the green area

Whereas in the same price range, Justin provided liquidity as shown in the red area, a lot more than Alice

This means that when a trade executes in this price range, Justin will earn the majority of the fees (after Bob's trade is processed)

Note that the price change from P0 to P*1 is less than the change from P0 to P1

This is beause there is a lot of liquidity arount the current price range in the second case => the price moves very little, this is called just-in-time liquidity

hardhat.config.js

networks: {

hardhat: {

forking: {

url: `https://eth-mainnet.alchemyapi.io/v2/${process.env.ALCHEMY_API_KEY}`,

},

},

}Note: Replace the ${} component of the URL with your personal Alchemy API key.

npx hardhat test test/swapV3.test.jsThis contract assumes that token0 and token1 both have same decimals

Consider Uniswap trading fee = 0.3%

You can find Uniswap pools referenced below. Select a pool with the highest TVL

You can find official Uniswap documentation below:

- [-] Uniswap V3 TWAP

- [-] Further reading

- [-] Unit test

- [-] Flash Swap

- Flash Swap test

- Uniswap V3 Capital Efficiency (maths)

- Uniswap V3 Just In Time Liquidity (maths)

- Deploy on mainnet

See the open issues for a full list of proposed features (and known issues).

Contributions are what make the open source community such an amazing place to learn, inspire, and create. Any contributions you make are greatly appreciated.

If you have a suggestion that would make this better, please fork the repo and create a pull request. You can also simply open an issue with the tag "enhancement". Don't forget to give the project a star! Thanks again!

- Fork the Project

- Create your Feature Branch (

git checkout -b feature/AmazingFeature) - Commit your Changes (

git commit -m 'Add some AmazingFeature') - Push to the Branch (

git push origin feature/AmazingFeature) - Open a Pull Request

Distributed under the MIT License. See LICENSE.txt for more information.

Reda Aboutika - @twitter - reda.aboutika@gmail.com

Project Link: https://github.com/Aboudoc/Uniswap-v3.git