This post describes how to apply reinforcement learning algorithm to trade Bitcoin. This repository provides an implementation aims to reproduce the result.

-

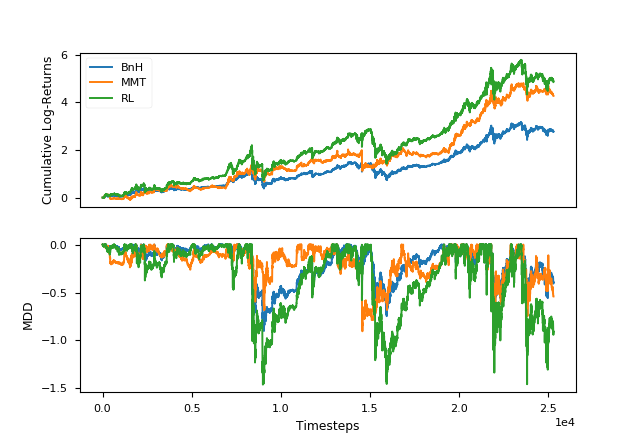

BnH

A buy-and-hold strategy that always hold 2 Bitcoins starting from the beginning of the test period.

-

RL

A trained RL agent making trading decisions to hold 0~4 Bitcoins given the current market condition.

-

MMT

A momentum strategy that holds 4 Bitcoins when the 30-period SMA cross-over than the current closing price and 0 Bitcoin otherwise.

Dependencies

- Python3.6

- NumPy 1.17.1

- Pandas 0.25.1

- Matplotlib 3.1.1

- PyTorch 1.2.0 (CPU only)

The minute-by-minute data is downloaded from Kaggle. I resample them into 15-minute interval and compute all the features we need. Then I save the two dataframes under bitcoin-historical-data.

Note that,

-

I delete the row indexed

2017-04-15 23:00:00after resampling since there is a clear error. This is done in theremove_outlier()method under theDataclass. -

Due to request, I include the 15-minute data in

bitcoin-historical-data(due to size constraint on GitHub, I cannot update the 1-minute data and the feature dataframe generated from the 15-minute data.)

# E.g. clone to local (say to Downloads)

cd ~/Downloads/trading-bitcoin-with-reinforcement-learning/

# Usage: python main.py <path-to-one-minute-data>

# If argument not provided, the default file path

# './bitcoin-historical-data/coinbaseUSD_1-min_data.csv' is given

python main.py ./bitcoin-historical-data/coinbaseUSD_1-min_data.csvNote: I observed substantial variability in the test result therefore the equity curve you got may not be 100% the same as mine.