Vasantha Mutyala (V-MalM) / Valense Acquah-Louis (Tema-2021) / Saiyid Kazmi (saiyidmkazmi) / Debra Potts (dschoen24)

CLICK HERE TO DOWNLOAD SLIDE DECK

CLUSTERING AND PREDICTION CODE BANK

-

The essence of this project is incorporating the magic of Machine Learning in the realm of stock analysis, a daunting task itself. Investing in stocks continues to be risky because of their unpredictable nature. Some factors that contibue to this uncertainity are human phycology, natural calamities, change in political scene, pandamic, war etc. We will be doing a technical analysis for this project. Our final objective is to visualize the results of not only clustering stocks with similarities as well as predict and compare the results of our prediction against real-data.

-

For time-series forecasting, we used LSTM, an artificial recurrent neural network (RNN) architecture used in the field of deep learning.

- Cluster stocks using machine learning given open, last, close, volume, etc

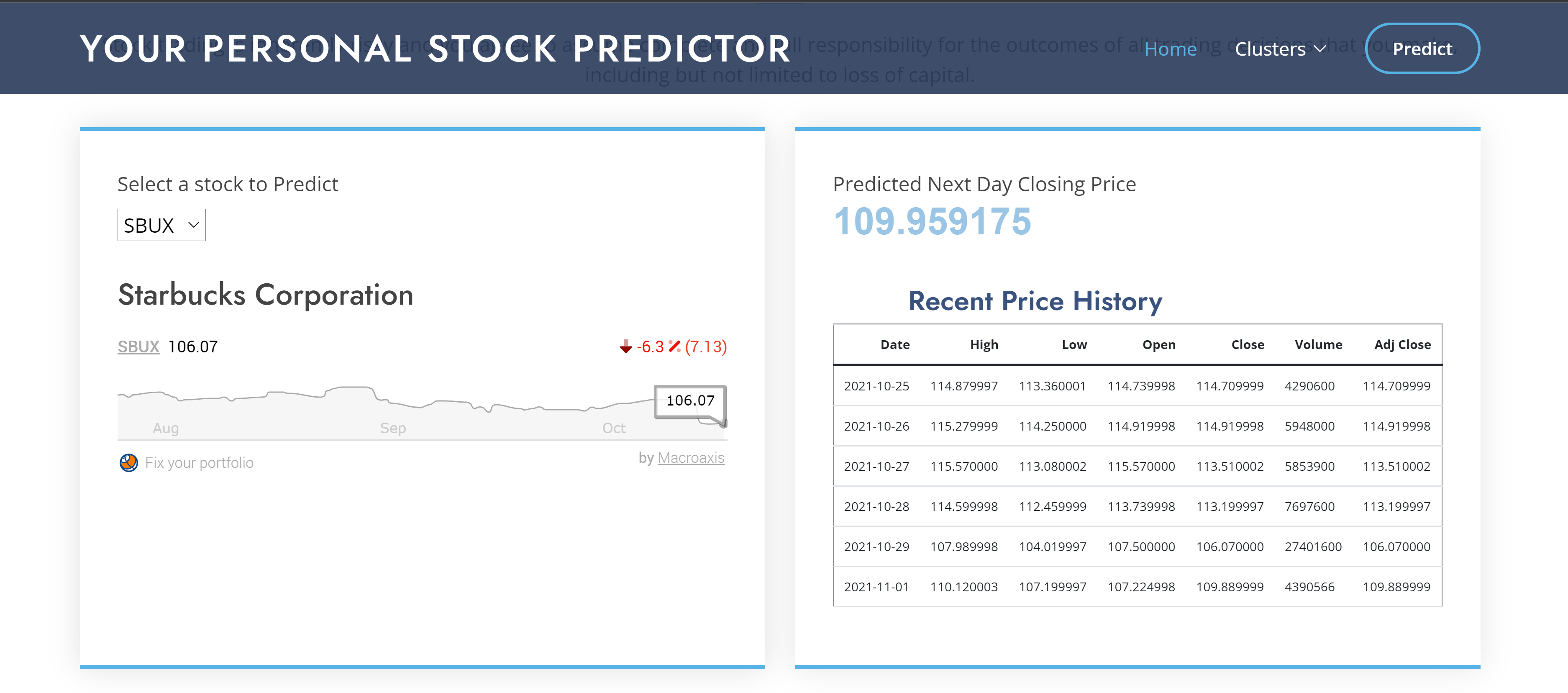

- Predict stock movement one day into the future using a time-series model

- Create an interactive APP to Predict Closing Price for any given stock

- Python

- Pandas

- Pandas Datareader

- Tableau

- Matplotlib

- HTML/CSS/Bootstrap

- JQuery

- LSTM

- Scikit-Learn

- Realtime Stock data from Yahoo Finance

- S&P500

- Nasdaq100

- Dow30

- Time series is a sequence taken at successive equally spaced points in time. It allows one to see what factors influence certain variables from period to period, for example, how the daily closing value of a stock,changes over time.

- Other examples of time series are heights of ocean tides, daily, weekly, monthly sales.

- Trend (how data is increasing or decreasing over time)

- Seasonality (variations specific to a particular time frame)

-

Forecasting

- Used LSTM time series to forcast next day's close price

-

Pattern and outlier detection

- Used clustering to make diverse stock portfolios by detecting patterns in stocks that move similarly with an underlying trend i.e., for an given period of time how stocks trend together. The analysis was based on 3 indices S&P 500, NASDAQ 100 and DOW 30.

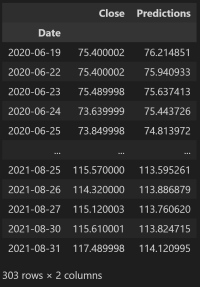

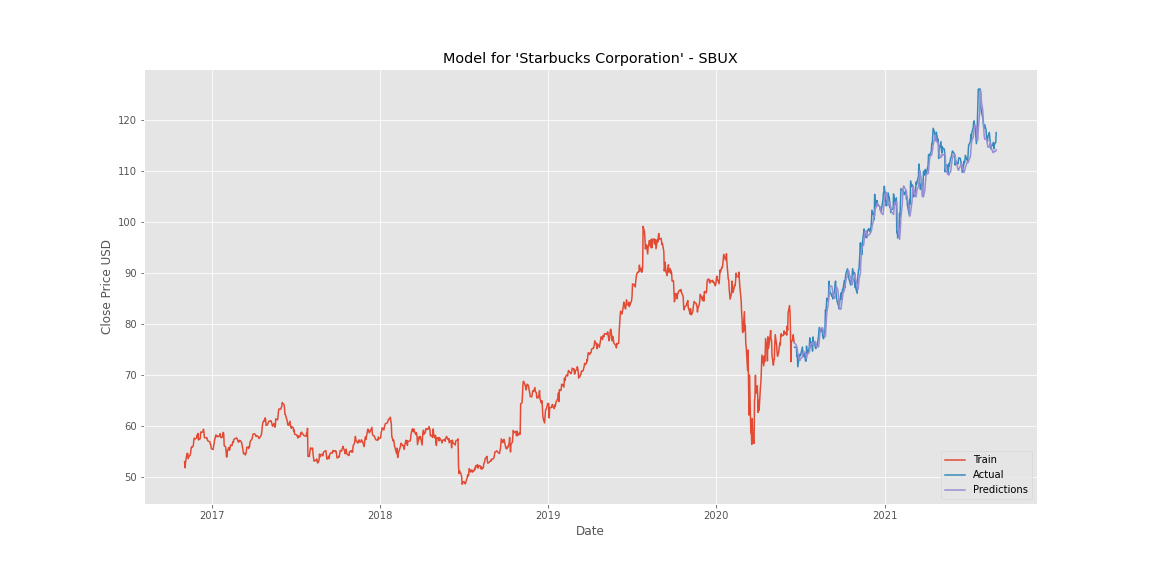

We built a LSTM model to predict next day closing price for a given stock.

Traditionally, models like ARIMA (AutoRegressive Integrated Moving Average) has been used for time series analysis. ARIMA requires data to be stationary by removing trend and seasonality. LSTM, on the other hand, can work with non-stationary data and hence, its was our choice.

-

We sourced our data from Yahoo Finance’s realtime stock price dataset using Pandas Datareader, a Python package that allows us to create a pandas DataFrame object by using various data sources from the internet. It is popularly used for working with realtime stock price datasets. Our model is built on using 5 years of data.

-

Used 120 days moving window. That means , the model takes in 120 days of close prices and predicts the closing price for 121st day.

Moving window explained:

In our project, the first data point is the first 120 days of data.

The second data point is the first 121 days of data but not including the first.

The third data point is the first 122 days of data but not including the first and second. And this pattern continues for all the dates of the given period.

Code - Step By Step:

Click here for complete Code

Data prep

Read real-time data from Yahoo Finance into a Dataframe using Pandas Datareader.

#Get the stock

ticker = 'SBUX'

stock ="Starbucks Corporation"

# n days, here we will use n days historical data to predict next day closing

ts_points = 120

today = datetime.today()

# 5 years of stock data to be retrived

start_date = (today - timedelta(days=5*365) ).strftime('%Y-%m-%d')

# to make sure the test and train data is different from data we use to predict ,

# we are bringing last 5 years minus 2 months. Because it is a stock prediction, this window might have to be much smaller because stocks fluctuate quite often. We have written the code in such way that this value can be changed depending on how often this module would have to be retrained.

# We have tried with 0(no gap), 31 days and 62 days. All of these predicted very close with slight tuning of hyperperameters.

end_date = (today - timedelta(days=62) ).strftime('%Y-%m-%d')

stock_df = pdr.DataReader(ticker, data_source="yahoo", start=start_date, end=end_date)# Checked for nulls and sort data on Date(index) just to be sure it is in ascending order.

# Date is an index but to be sure , let's sort

stock_df = stock_df.sort_index(ascending=True)

# check for nulls

stock_df.isna().sum()# Close price has been used for our analysis.

# Isolated ‘Close’ Price from dataset and converted into an array.

# DF with only close

TSdata_df = stock_df.filter(['Close'])

TSdata_arr = TSdata_df.values # this creates an array of Close PriceScale the data and split

# Scale the Data

scaler = MinMaxScaler(feature_range =(0,1))

scaled_data = scaler.fit_transform(TSdata_arr)

# split

training_data_len = math.ceil(len(TSdata_arr) * 0.75)

training_data_len

# Created scaled training dataset

train_data = scaled_data[0:training_data_len]Build X_train, y_train following moving window method

X_train = []

y_train = []

for i in range(ts_points, len(train_data)):

X_train.append(train_data[i-ts_points:i,0])

y_train.append(train_data[i,0])LSTM network expects a 3D input (No_of_Samples, number of time steps, and number of features) no_of_features = 1 (Close)

X_train = np.reshape(X_train, (X_train.shape[0], X_train.shape[1], 1))Build LSTM Model

We built an LSTM with 2 layers, each with 50 nodes, a dropout layer, 1 dense layer and one output layer with one unit.

Tuning Dropout, batch size and epochs were adjusted while training the model.

-

"DROPOUT is a regularization method where input and recurrent connections to LSTM units are excluded from activation and weight updates while training a network. This has the effect of reducing overfitting and improving model performance." --machinelearningmastery.com

-

"For models like LSTM, the BATCH SIZE is critical to learn the common patterns as important features. For a model to be able to figure out what are the common patterns and features across the input train samples we need to provide the samples as batches. By providing, a number of samples, a batch at a time, we can introduce a set of samples to the model so the model can distinguish the common features by looking at all the introduced samples of the batch." --medium.com

-

"The number of EPOCHS is a hyperparameter that defines the number times that the learning algorithm will work through the entire training dataset. One epoch means that each sample in the training dataset has had an opportunity to update the internal model parameters. An epoch is comprised of one or more batches." --machinelearningmastery.com

model = tf.keras.models.Sequential()

model.add(tf.keras.layers.LSTM(50, return_sequences=True, input_shape=(X_train.shape[1],1)))

model.add(tf.keras.layers.LSTM(50, return_sequences=False))

model.add(tf.keras.layers.Dropout(0.2))

model.add(tf.keras.layers.Dense(25))

model.add(tf.keras.layers.Dense(1))Used 'adam' as optimizer, 'mean_squared_error' as loss function Trained our Model

model.compile(optimizer='adam', loss='mean_squared_error')

model.fit(X_train, y_train, batch_size=64 ,epochs=30)After testing accuracy, we saved our model.

model.save('../assets/Model_'+ticker+'.h5')Then we built our test data set .

# Bring in the last (120 values) from training set so when X_test is used to predict , predictions have same shape as Y_test

# The for loop starts with 'ts_points' that means the resultant array will have 120 less rows and hense the above step

test_data = scaled_data[training_data_len-ts_points:]

X_test = []

y_test = TSdata_arr[training_data_len:]

for i in range(ts_points, len(test_data)):

X_test.append(test_data[i-ts_points:i,0])

# convert the data to a numpy array to use it in LSTM MODEL

X_test = np.array(X_test)

X_test = np.reshape(X_test, (X_test.shape[0], X_test.shape[1], 1)) Predicted price for X_test. Calculated root mean square error for both training and test data. Used scaler.inverse_transform to transform predictions . Compared predited close price with actual close price.

Plotted training, test and actual data. Below is a quick demonstration of how our model has predicted.

Clustering is an Unsupervised Machine Learning process that splits a dataset or observations into groups that are like each other. The clustering was performed on the datasets using K-Means and PCA on 3 different calculated features.

- Movement

- Percent Change

- Volatility

K-Means is an SkLearn/ SciKit-Learn model. This model aims to group several observations / datasets into clusters (K-Clusters) where each observation within the cluster shares similarities like

- Mean

- Variance

- Patterns etc. K-Means identifies the number of centroids in the dataset then assigns the nearest cluster where the centroids remain as small as possible.

Click here for Code

Movement is a measure of identifying the trend direction of a stock. It is measured by determining the average changes in open and close price of the stock to help determine if the stock is going in an uptrend (rising movement) or downtrend (declining movement).

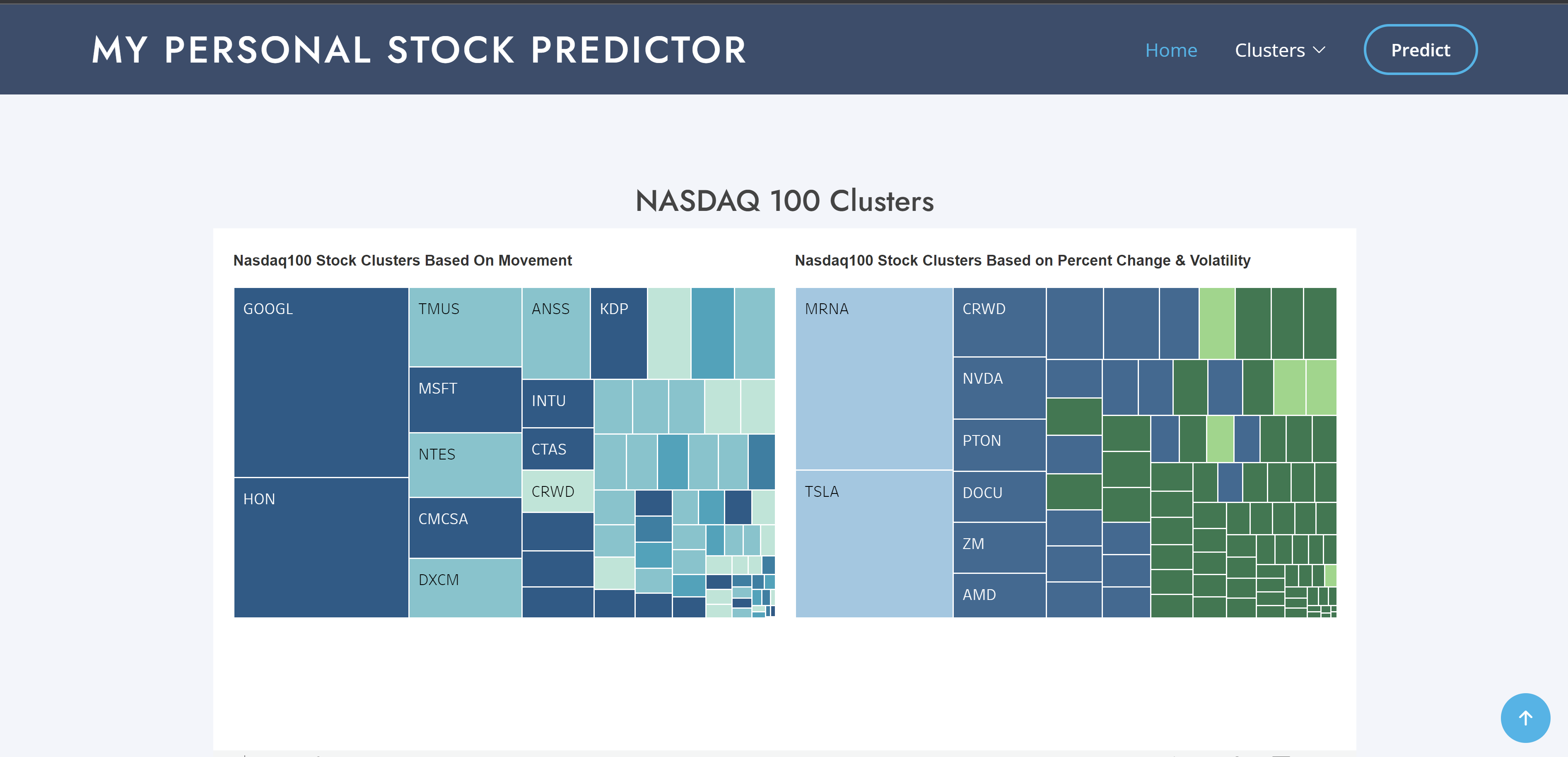

Using Movement as a feature, clustering was performed on the three stock indices resulting in charts displayed here.

From the image of the various indices S&P500 and NASDAQ100 can be grouped into 5 clusters to represent the various stocks that are moving in the same direction whereas DOW30 has 3 clusters.

Click here for Code

Percent change measures the difference of closing price from the beginning of a time period to the end of a time period.

Volatility is the reflection of the degree to which price moves. Volatility was calculated using Standard Deviation.

These two features were used to perform clustering on each of the indices.

Clustering helps to identify the stocks that are showing an uptrend and the ones that are showing downtrend.

Visualization

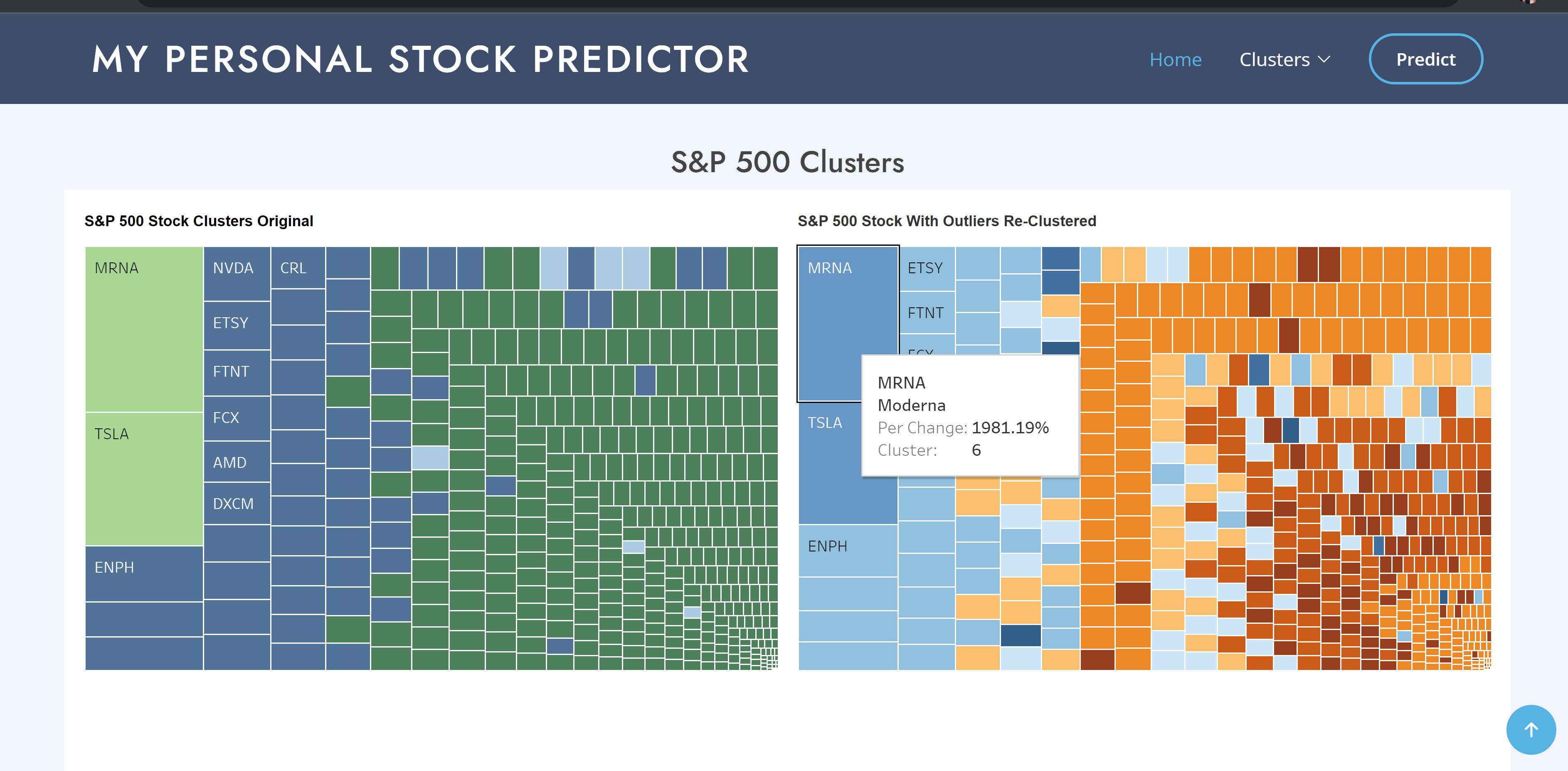

Within Tableau,two separate Treemap charts were created for each of the indices - S&P 500, Nasdaq 100 and Dow 30.

The first Treemap chart is based on Market Movement (the change in share prices based on supply & demand) which we categorized by color diversity for each cluster within the index.

The second Treemap chart is based on percent change (returns) and volatility which we also categorized by color diversity for each cluster within the index.

Click here for Code

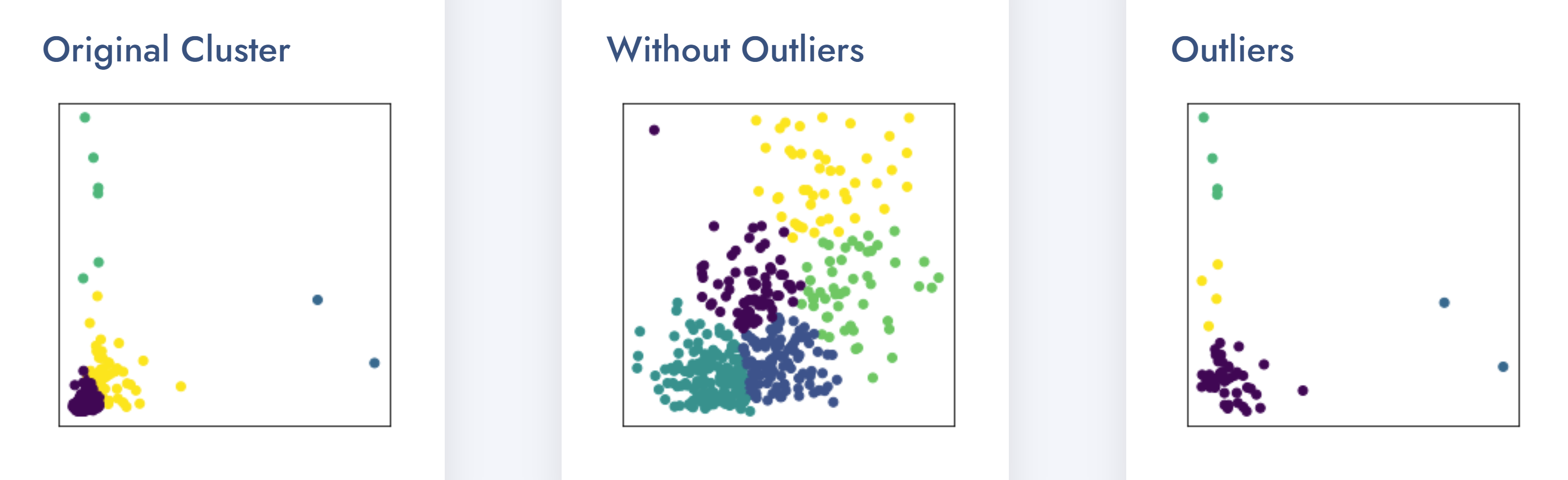

Outliers for our project were stocks that differ from all the other stocks so are detached from the other stocks.

looking at the percent change and volatility Treemaps for S&P500, it was observed that the data was skewed. The treemap on the right is representing the data after being reclustered.

How skewed data can affect the clustering? What steps can be taken to separate the outliers and get better clusters without compromising our Data.

The original scatter plot (S&P500) of the data as it has the outliers we do not get a clear or distinct visualization of our clusters due to the outliers. So steps were taken to separate the clusters.

Using quartiles, the upper and lower bounds of the returns and volatilities of the dataset. The records above and below the upper and lower bounds were removed to obtain a new dataset. This dataset was then scaled and clustered using KMeans and an elbow curve was plotted.

When a scatter plot of the dataset with no outliers was plotted (One in the center), clear clusters were seen.

Stocks are inherently risky and difficult to predict, but with this analysis, it can be concluded that ML technology can be used to diversify our portfolio by watching how groups of stocks are moving, whether they are moving uptrend or downtrend. By retraining and keeping our predictor model up to date, we can gain a reasonable insight into how the next day's closing looks like.