In this repository, multiobjective portfolio optimization is performed using two different optimization methods. In addition to traditional financial objectives, the optimization methods take in consideration environmental, social, and governance sustainability of portfolio.

Portfolio optimization traditionally aims to select assets that bring the most return on investment with the least risk. However, for some investors, there are also other factors to consider in addition to direct financial gain. Technology has made stock investing more easily approachable than ever, and growing number of new investors search not only to get return on their money but also to invest in companies with sustainable business. The term ESG-investing means buying in companies with their environmental, social, and governance strategies in consideration.

-

Clone this repository using

git clone https://github.com/bonskotti/multiobjective-portfolio-optimization.git -

Install requirements using

pip install -r requirements.txt. In addition, you should have Glpk installed. Easy way to do so is with conda:conda install glpk. -

Run either optimization_e_constraint_method.py or optimization_ref_point_method.py to solve the problem.

data = pd.read_csv('data/final_data.csv') # load data

n,p = params(data) # organize parameters and get names of companies

obj_i = 4 # select objective to be optimized

# set constraints

constraints = [

0.09 # return

,0.6 # sustainability

,2 # dividend yield

,1 # clean energy use

#,15 # p/e ratio

]

b_tol = 0.1 # tolerance for beta

solve_problem(p,n,obj_i,constraints,b_tol)

global data

data = pd.read_csv('data/final_data.csv',index_col=0) # load data

objectives = ['Expected return',

'Sustainability',

'Dividend yield',

'Clean energy use',

'P/E ratio']

n = 30 # number of companies

x0 = [1/n]*n # start with equal weights

ref = [0.1,0.5,3,1,15] # aspiration levels for objectives

tol = 0.1 # tolerance for beta constraint

solve_problem(f,x0,ref,tol)

Note: Calculation of ideal and nadir vectors is computationally expensive - if you are in a hurry, decrease the number of companies (n) when solving with reference point method.

ESG-related data is from three sources:

-

Robecosam ranks companies by ESG-scores, from 0 to 100. https://yearbook.robecosam.com/ranking/

-

Clean200 ranks companies by their solutions for transition to clean energy future. No scores, company either is on the list or not. https://www.asyousow.org/report-page/2020-clean200

-

ScienceBasedTargets ranks companies by their science-based climate actions. No scores, company either is on the list or not. https://sciencebasedtargets.org/companies-taking-action/

Financial data is from two sources:

-

Yahoo Finance

-

Nasdaq

After preprocessing, final dataset consists of 361 companies, listed in NYSE, NASDAQ, OMXCO, OMXHE, and OMXST.

For objectives, following are used:

- Maximize expected return.

- Maximize environmental, social, and corporate- sustainability.

- Maximize dividend yield.

- Maximize clean energy use.

- Minimize price-earnings ratio.

- Optimize portfolio volatility.

In this problem, portfolio volatility is optimized using Sharpe's beta. Portfolio is set to be as volatile as whole market in average, so beta is aimed to be equal to 1.

For decision variables, proportional amount (weight) to invest in company i is used.

For constraints,

- Sum of weights should be equal to one.

- Weight of a single asset should be between 0 and 1.

Optimization is performed using two methods,

- Epsilon-constraint method.

- Reference point method.

1. Epsilon constraint method

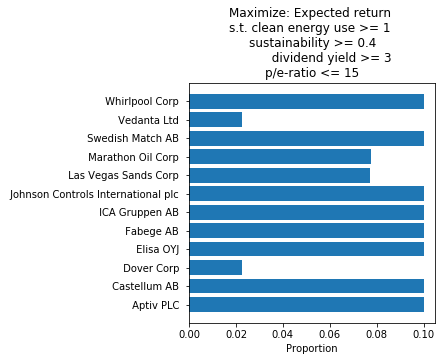

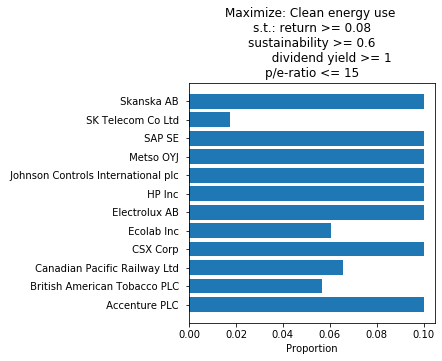

Some of the Pareto optimal solutions obtained:

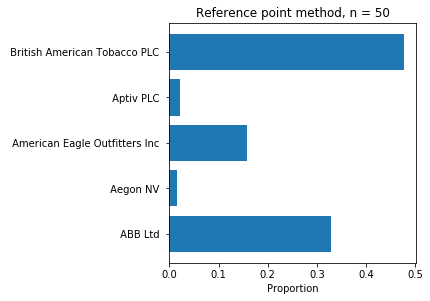

2. Reference point method

Both of the optimization methods can be used interactively with the decision maker. To demonstrate this, a simple CLI-based solver application is under development. At the moment, the solver supports epsilon-constraint method.

Simply run solver.py.

Select your optimization method :

Epsilon constraint method, press 1

Reference point method, press 2 (not yet available)

> 1

Select an objective to be optimized:

Expected return, press 1

Sustainability, press 2

Dividend yield, press 3

Clean energy use, press 4

P/E ratio, press 5

>4

Set bounds for other objectives.

Bound for Expected return: 0.09

Bound for Sustainability: 0.7

Bound for Dividend yield: 2

Bound for P/E ratio: 20

Results in

Beta

0.9

Companies to invest in:

ABB Ltd 0.05

Accenture PLC 0.05

Amdocs Ltd 0.05

AstraZeneca PLC 0.05

Ball Corp 0.05

Canadian Pacific Railway Ltd 0.05

Castellum AB 0.0490507539982457

CNH Industrial NV 0.000949246001754104

Coca-Cola European Partners PLC 0.05

CRH PLC 0.05

CSX Corp 0.05

Cummins Inc 0.05

Ecolab Inc 0.05

Electrolux AB 0.05

HP Inc 0.05

Johnson Controls International plc 0.05

Kimberly-Clark Corp 0.05

Kone OYJ 0.05

Metso OYJ 0.05

SAP SE 0.05

Skanska AB 0.05