- Impermanent Loss, simple calculation

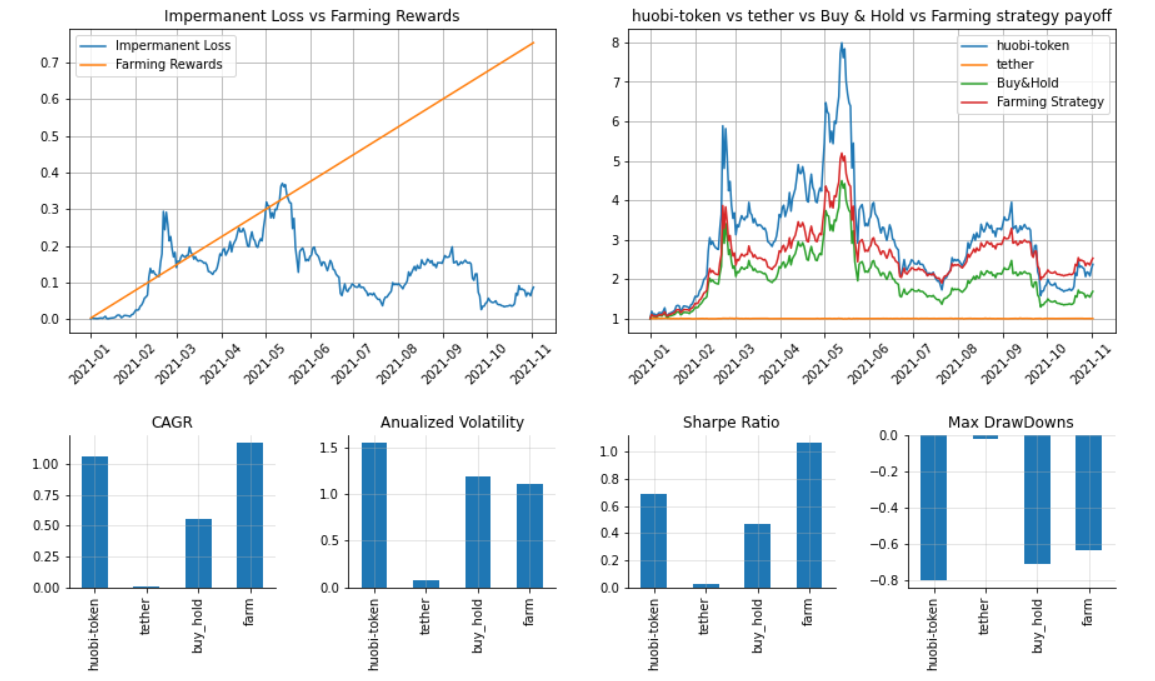

- Compare Buy & Hold with Staking and Farming

- Complete list for DeFi protocols TVL, volume and more

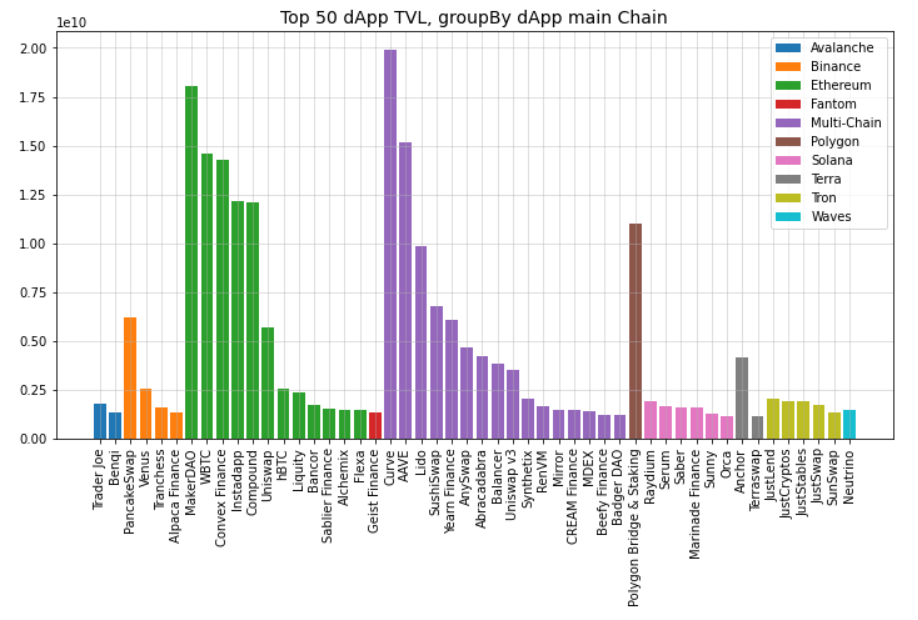

- Example listing top20 DeFi dapps by TVL

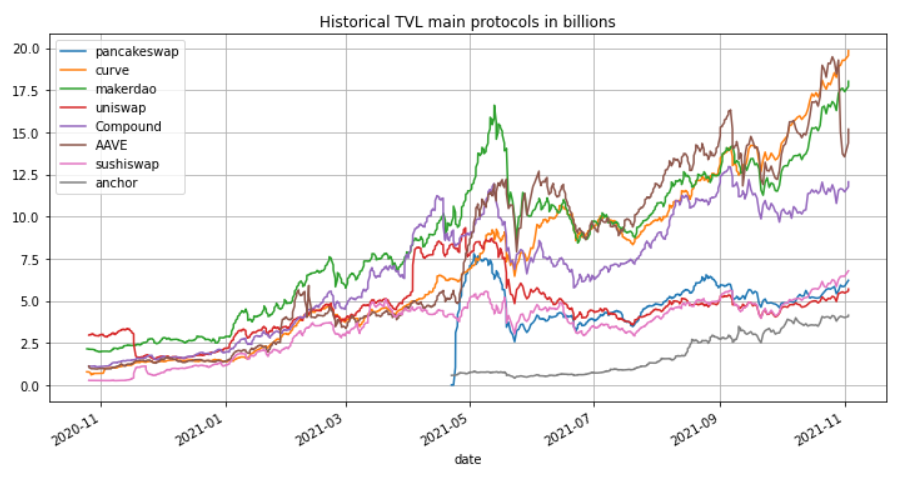

- Example show historical TVL for one or more protocols

- API endpoints

- Get IDs list

- Live prices

- All exchanges and prices for each coin

- Historial prices por each coin

- Simulate Farming Strategy

- All token prices real time

- All pairs liquidity, volume and more

- Get data in real time for one token

- Get data in real time for one pair

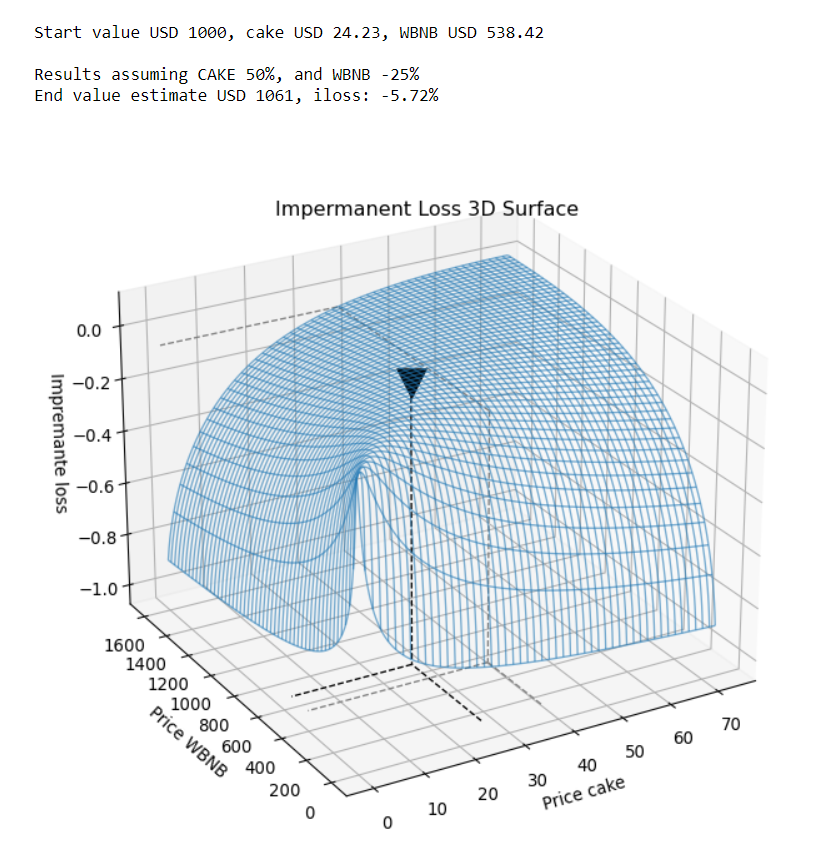

- Simulate invest in LP considering impermanent loss, 3D graph

pip install defiimport defi.defi_tools as dft

# Impermanent loss for stableCoin & -20% return token

dft.iloss(0.8)-0.62%

import defi.defi_tools as dft

# Impermanent loss for stableCoin & +60% return token

dft.iloss(1.6, numerical=True)0.027 # Same as 2.7%

import defi.defi_tools as dft

# Exercise: Get returns after 20 days, assuming token A is a stablecoin, token B perform + 150%

# individual staking pools for both = 0.01% & 0.05% daily

# liquidity-pool farming rewards =0.2% daily & Earn by fees/day = 0.01%

dft.compare(days=20, var_A=0, var_B=150, rw_pool_A=0.01, rw_pool_B=0.05, rw_pool_AB=0.2, fees_AB=0.01){

"buy_hold": "75.00%",

"stake": "75.60%",

"farm": "71.96%",

"Best": "Stake"

}import defi.defi_tools as dft

metadata, df = dft.getProtocol('Uniswap')

metadata{

"id": "1",

"name": "Uniswap",

"address": "0x1f9840a85d5af5bf1d1762f925bdaddc4201f984",

"symbol": "UNI",

"url": "https://info.uniswap.org/",

"description": "A fully decentralized protocol for automated liquidity provision on Ethereum.\r\n",

"chain": "Ethereum",

"logo": "None",

"audits": "2",

"audit_note": "None",

"gecko_id": "uniswap",

"cmcId": "7083",

"category": "Dexes",

"chains": ["Ethereum"],

"module": "uniswap.js"

}import defi.defi_tools as dft

import matplotlib.pyplot as plt

df = dft.getProtocols()

fig, ax = plt.subplots(figsize=(12,6))

n = 50 # quantity to show

top = df.sort_values('tvl', ascending=False).head(n)

chains = top.groupby('chain').size().index.values.tolist()

for chain in chains:

filtro = top.loc[top.chain==chain]

ax.bar(filtro.index, filtro.tvl, label=chain)

ax.set_title(f'Top {n} dApp TVL, groupBy dApp main Chain', fontsize=14)

ax.grid(alpha=0.5)

plt.legend()

plt.xticks(rotation=90)

plt.show()### Historical TVL

import defi.defi_tools as dft

import pandas as pd

exchanges = ['pancakeswap', 'curve', 'makerdao', 'uniswap','Compound', 'AAVE','sushiswap','anchor']

hist = [dft.getProtocol(exchange)[1] for exchange in exchanges]

df = pd.concat(hist, axis=1)

df.columns = exchanges

df.plot(figsize=(12,6))Endpoints available, some examples:

* dft.getGeckoIDs()

# coinGecko first 5000 ids

* dft.geckoPrice("bitcoin,ethereum", "usd,eur,brl")

# coinGecko quotes

* dft.geckoList(page=1, per_page=250)

# full coinGecko cyptocurrency list

* dft.geckoMarkets("ethereum")

# top 100 liquidity markets, prices, and more, for eth or other coin

* dft.geckoHistorical('cardano')

# full history containing price, market cap and volume

* dft.farmSimulate(['huobi-token','tether'], apr=45)

# Simulate farming strategy with apr=45%

import defi.defi_tools as dft

ids = dft.getGeckoIDs()

ids[:10]['bitcoin', 'ethereum', 'binancecoin', 'tether', 'solana', 'cardano', 'ripple', 'polkadot', 'shiba-inu', 'dogecoin']

import defi.defi_tools as dft

dft.geckoPrice("bitcoin,ethereum", "usd,eur,brl"){"ethereum": {"usd": 2149.85, "eur": 1807.58, "brl": 12208.77},

"bitcoin": {"usd": 60188, "eur": 50606, "brl": 341802}}import defi.defi_tools as dft

df = dft.geckoMarkets("ethereum")

print(df.info())

# returns top 100 ethereum quotes by volumeIndex: 100 entries, IDCM to FTX.US

Data columns (total 9 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 base 100 non-null object

1 target 100 non-null object

2 last 100 non-null float64

3 volume 100 non-null float64

4 spread 100 non-null float64

5 timestamp 100 non-null datetime64[ns, UTC]

6 volume_usd 100 non-null float64

7 price_usd 100 non-null float64

8 trust_score 100 non-null object

dtypes: datetime64[ns, UTC](1), float64(5), object(3)

memory usage: 7.8+ KB

import defi.defi_tools as dft

df = dft.geckoHistorical('cardano')

print(df)price market_caps total_volumes date 2017-10-18 00:00:00 0.026845 6.960214e+08 2.351678e+06 2017-10-19 00:00:00 0.026830 6.956220e+08 2.815156e+06 2017-10-20 00:00:00 0.030300 7.855800e+08 8.883473e+06 2017-10-21 00:00:00 0.028588 7.412021e+08 5.308857e+06 2017-10-22 00:00:00 0.027796 7.206698e+08 2.901876e+06 ... ... ... ... 2021-04-13 00:00:00 1.319790 4.223483e+10 5.005258e+09 2021-04-14 00:00:00 1.422447 4.565529e+10 5.693373e+09 2021-04-15 00:00:00 1.456105 4.676570e+10 8.920293e+09 2021-04-16 00:00:00 1.478071 4.730118e+10 5.151595e+09 2021-04-17 03:47:55 1.433489 4.595961e+10 5.152747e+09 [1278 rows x 3 columns]

import defi.defi_tools as dft

pair = ['huobi-token','tether']

apr = 45

dft.farmSimulate(pair, apr, start='2021-01-01')Downloading huobi-token

Downloading tether

{'Token 1': 'huobi-token',

'Token 2': 'tether',

'start': '2021-01-01',

'fixed APR': '45%',

'Buy & Hold': '68.90%',

'Impermanent Loss': '-8.66%',

'Farming Rewards': '75.45%',

'Farming + Rewards - IL': '153.02%'}

import defi.defi_tools as dft

df = dft.pcsTokens()

print(df) name symbol price price_BNB updated

0x0E09FaBB73Bd3Ade0a17ECC321fD13a19e81cE82 PancakeSwap Token Cake 24.0636 0.0450 2021-04-17 04:29:08.332

0xbb4CdB9CBd36B01bD1cBaEBF2De08d9173bc095c Wrapped BNB WBNB 534.2575 1.0000 2021-04-17 04:29:08.332

0x0F9E4D49f25de22c2202aF916B681FBB3790497B Perlin PRL 0.2091 0.0004 2021-04-17 04:29:08.332

0xe9e7CEA3DedcA5984780Bafc599bD69ADd087D56 BUSD Token BUSD 1.0000 0.0019 2021-04-17 04:29:08.332

0x7130d2A12B9BCbFAe4f2634d864A1Ee1Ce3Ead9c BTCB Token BTCB 62166.5517 116.3604 2021-04-17 04:29:08.332

... ... ... ... ... ...

0xB6802C06A441BA63624751C53C7c0708b75F06EC FinalMoon FINALMOON 0.0651 0.0001 2021-04-17 04:29:08.332

0x2cF0DA1EB4165d73156CE1E32450e4A0E1c1791b FairUnicorn FUni 0.0000 0.0000 2021-04-17 04:29:08.332

0x5CeD26185f82B07E1516d0B013c54CcBD252A4Ad Peaches PEACH 0.1130 0.0002 2021-04-17 04:29:08.332

0x2bA64EFB7A4Ec8983E22A49c81fa216AC33f383A Wrapped BGL WBGL 0.1000 0.0002 2021-04-17 04:29:08.332

0x019bE1796178516e060072004F267B59a49A0801 Pepper Finance PEPR 0.1819 0.0003 2021-04-17 04:29:08.332

[854 rows x 5 columns]

import defi.defi_tools as dft

pairs = dft.pcsPairs(as_df=False)

print(pairs){"updated_at": 1618645355351,

"data": {"0x0E09FaBB73Bd3Ade0a17ECC321fD13a19e81cE82_0xbb4CdB9CBd36B01bD1cBaEBF2De08d9173bc095c":

{"pair_address": "0xA527a61703D82139F8a06Bc30097cC9CAA2df5A6",

"base_name": "PancakeSwap Token",

"base_symbol": "Cake",

"base_address": "0x0E09FaBB73Bd3Ade0a17ECC321fD13a19e81cE82",

"quote_name": "Wrapped BNB",

"quote_symbol": "WBNB",

"quote_address": "0xbb4CdB9CBd36B01bD1cBaEBF2De08d9173bc095c",

"price": "0.04503969270521829587",

"base_volume": "5473068.824002232134035221",

"quote_volume": "239997.1228321299572591638",

"liquidity": "1076144814.0632013827775993748053",

"liquidity_BNB": "2007551.221740467021401314"

},

}import defi.defi_tools as dft

dft.pcsTokenInfo('cake'){"name": "PancakeSwap Token",

"symbol": "Cake",

"price": "24.03353223898417117634582253598019",

"price_BNB": "0.04503467915973850237292527741402623"

}import defi.defi_tools as dft

dft.pcsPairInfo('cake','bnb'){"pair_address": "0xA527a61703D82139F8a06Bc30097cC9CAA2df5A6",

"base_name": "PancakeSwap Token",

"base_symbol": "Cake",

"base_address": "0x0E09FaBB73Bd3Ade0a17ECC321fD13a19e81cE82",

"quote_name": "Wrapped BNB",

"quote_symbol": "WBNB",

"quote_address": "0xbb4CdB9CBd36B01bD1cBaEBF2De08d9173bc095c",

"price": "0.04503969270521829587",

"base_volume": "5473068.824002232134035221",

"quote_volume": "239997.1228321299572591638",

"liquidity": "1076144814.0632013827775993748053",

"liquidity_BNB": "2007551.221740467021401314"

}import defi.defi_tools as dft

dft.value_f, iloss = dft.iloss_simulate('cake','bnb', value=1000, base_pct_chg=50, quote_pct_chg=-25)- twitter user @JohnGalt_is_www