Analysis of marketing funnel dataset provided by a fictional organization adnu, the largest department store in Latin American marketplaces.

To answer these questions from analysing the data.

-

SR/SDR Optimization:

Which SR or SDR should talk with each kind of lead?

-

Closing Prediction:

Which deals will be closed?

-

Customer Lifetime Value:

How much a customer will bring in future revenue?

- MQL Data

- 8000 unique MQL IDs

- Roughly 5.5k is

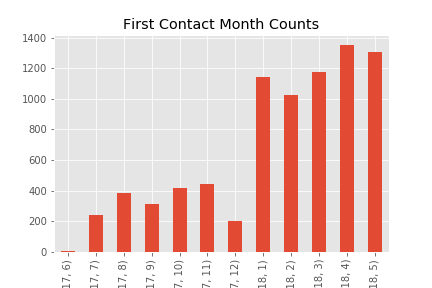

online searches, social media and direct traffic(70%), 12% isunknownand rest are sources likeemail,referralsetc. - 2018 data is much more (3x, roughly ~6k) in comparison to 2017 data (~2k).

- Closed Leads Data

- 842 unique

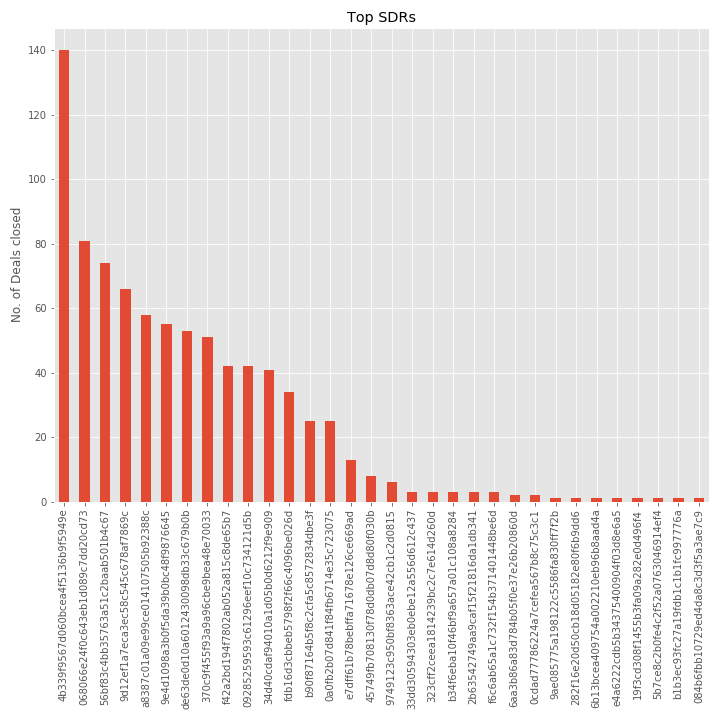

MQL_IDsshowing 842 closed deals mapped to unique seller_ids (1-1 mapping) - 32 unique Sales Developement Representative

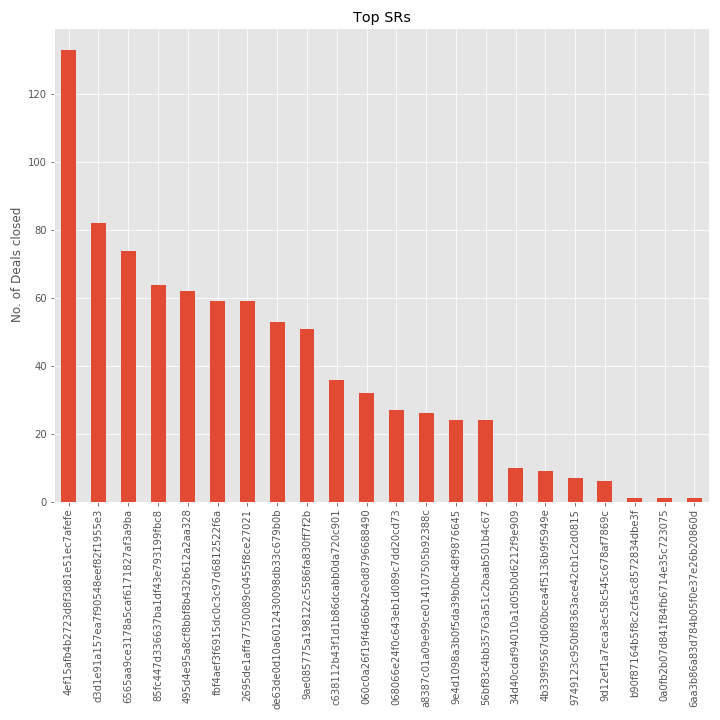

SDRwith the max one SDR converted was 140 sellers - 22 unique Sales Representatives

SRwith the max on SR related to 133 unique sellers. - 33 unique

business segmentswithhome_decorbeing the most closed segment (105 leads) - 8 unique

lead typeswithonline_mediumbeing the most popular one (332 leads) - 9 unique

lead behaviourprofiles withCATbeing most popular one (407 leads) - There is not much data for columns

has_company,has_gtin,average_stockanddeclared_product_catalog size - 3 unique

business typeswithresellerbeing the most popular one (587 leads) - Top 5 SDRs contribute to 50% of the closed deals. Same goes for SRs

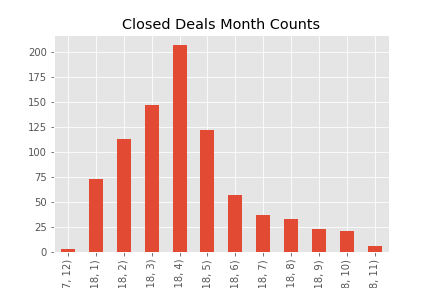

- The closed deal data starts from

December 2017and is at peak inApril 2018.

- 842 unique

- Sellers Data

- 3095 unique sellers

- 611 unique cities in which these sellers reside

- 23 states

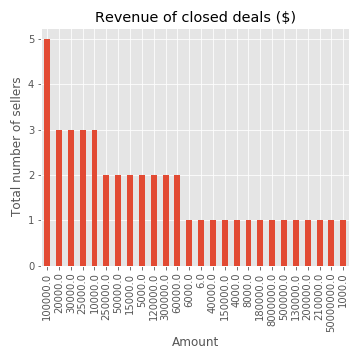

- Orders Data

112650orders data with98666unique order ids (meaning ~12% (13984) orders contains more than one item).32951unique products which are ordered.3095unique sellers.- Mean average cost per order is

120with minimum order amount being0.8and maximum being6735. - Mean average frieght value amount per order is

20with minimum value at15.8and maximum going to401.

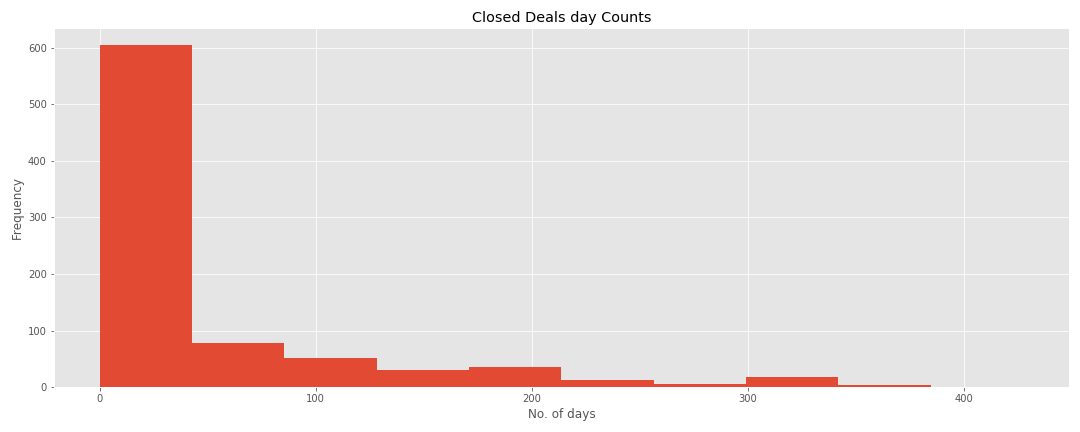

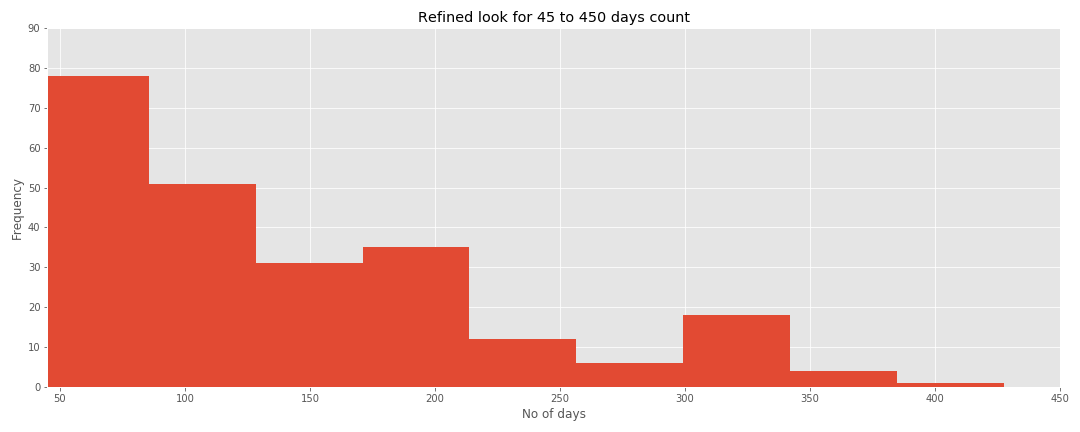

Average number of days - 49, left skewed date ranges with many outliers

4b339f9567d060bcea4f5136b9f5949e (140), 068066e24f0c643eb1d089c7dd20cd73 (81), 56bf83c4bb35763a51c2baab501b4c67 (74)

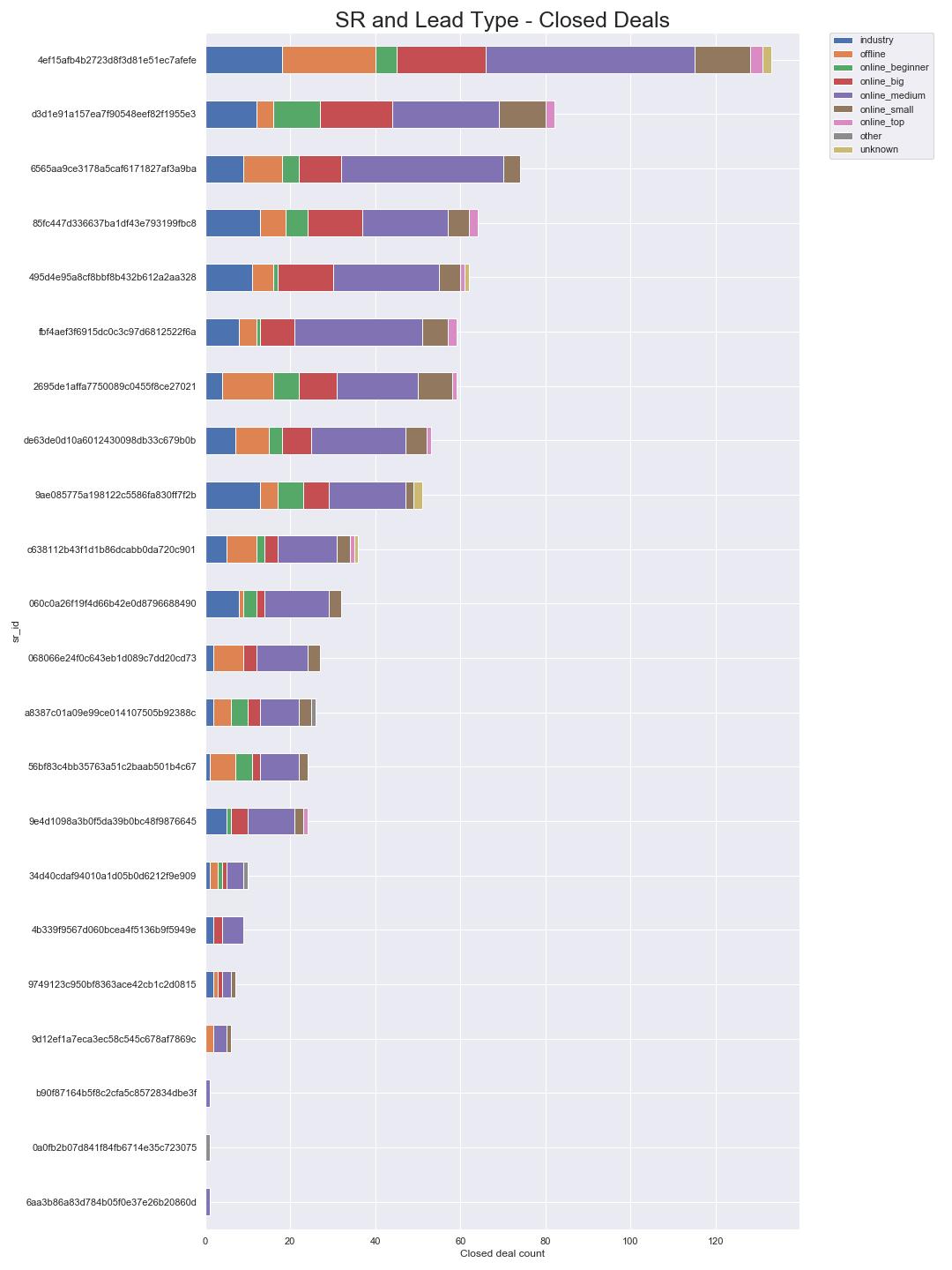

4ef15afb4b2723d8f3d81e51ec7afefe (133),d3d1e91a157ea7f90548eef82f1955e3(82),6565aa9ce3178a5caf6171827af3a9ba (74)

- SDR -

4b339f9567d060bcea4f5136b9f5949eSR -4ef15afb4b2723d8f3d81e51ec7afefe21 closed deals together - SDR -

de63de0d10a6012430098db33c679b0bSR -d3d1e91a157ea7f90548eef82f1955e319 closed deals together - SDR -

4b339f9567d060bcea4f5136b9f5949eSR -6565aa9ce3178a5caf6171827af3a9ba18 closed deals together

Home Decor, Health and Beauty, Car_accessories, household_items are few of the top business segments where deals were closed with business types who are usually resellers and manufactures

4. In the closed deals, which sellers have declared their revenue alongwith segment which can be used to guesstimate income/revenue of adnu

- Total number of closed companies are:- 841

- Total number of companies about which Adnu provided who declared monthly revenue: 45

- Total percentage information for closed company revenues - ~5.5%

-

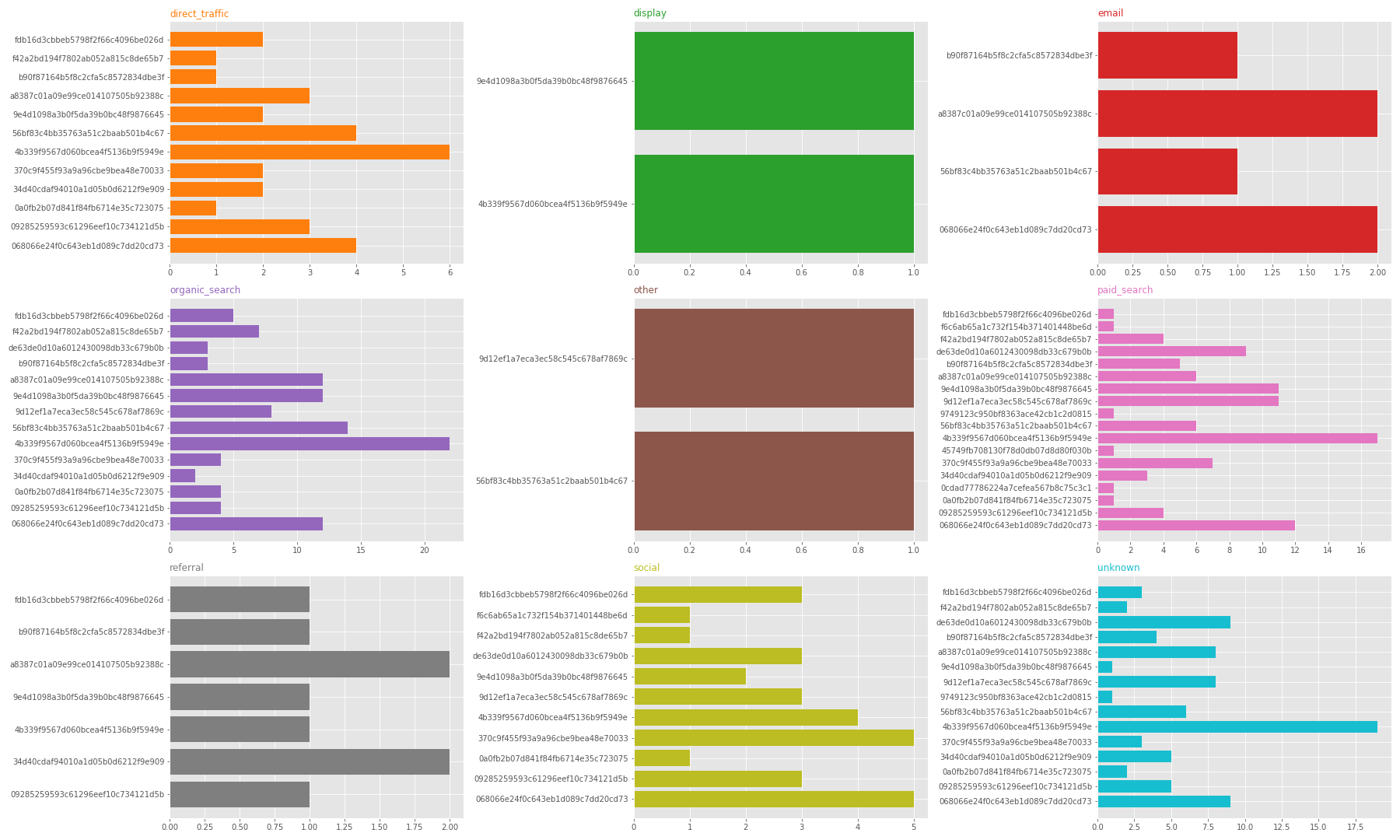

In the raw MQL data, online search

(organic and paid)took up 50% andsocial, email and referraltook up 26%. Rest was through different sources. -

In the closed deals data, online search

(organic and paid)took up 55% andsocial, email and referraltook up 15%. Rest was through different sources. -

We see a growth of unknown sources from 17% in MQL data to 23% in closed deals data.

-

We can also see how SDRs are interacting with the leads and closed counts for each origin source containing different SDRs who are prominent in converting from online searching.

We see that we had got the data of 841 closed deals mapped from 8000 MQL dataset.

When combined with seller dataset, we see that out of those 841 closed deals, we have only 379 present out of 3095 sellers in seller dataset (~45%) and rest seller data we don't have.

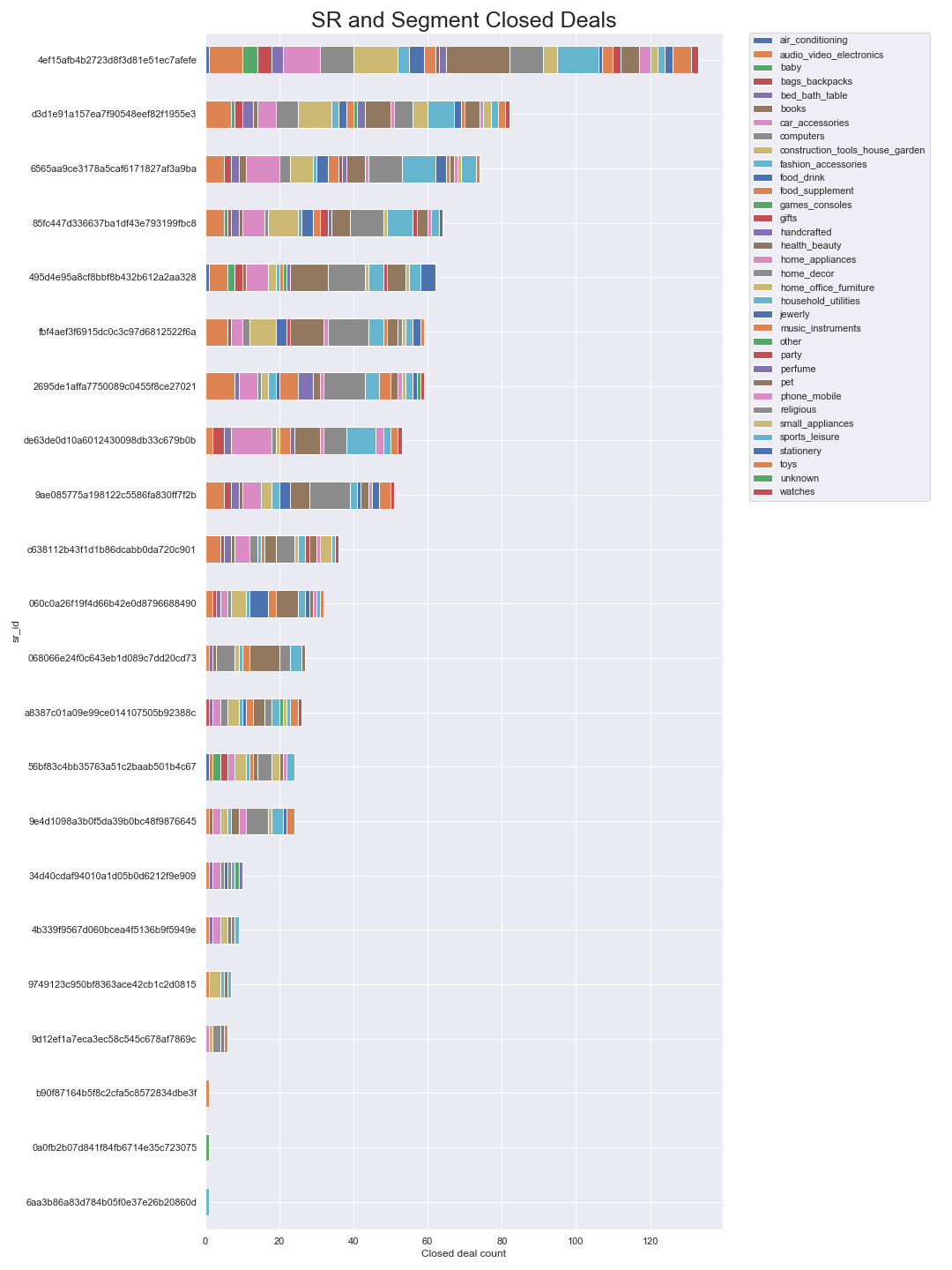

From these plots, it is evident that

- SRs aren't assigned only specific business segments as they are getting exposed to all segments. They are given leads as and when they come.

- This also shows that some SRs are just good at selling anything irrespective of the lead type or business segment.

Eg - SR_id - 4ef15afb4b2723d8f3d81e51ec7afefe has 133 closed deals ranging in myriad of business segments which are unrelated and from all types of leads (online,offline,email,industry,etc)

- From 2017 to 2018 we have a significant rise in leads and therefore also a significant rise in closed leads

Though, the significant rise is not due to a more effective process, rather because more leads fill in the forms on the landing pages.

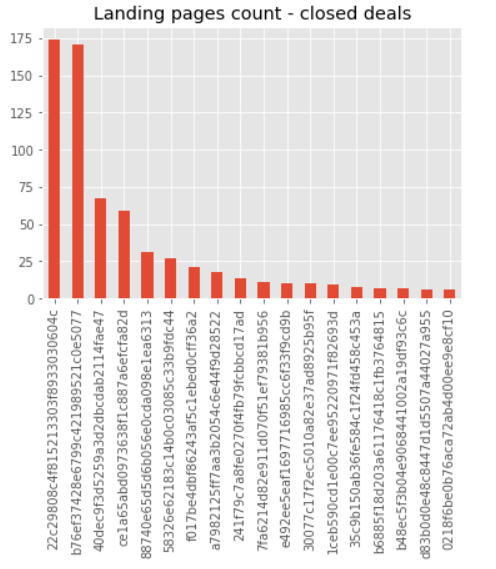

We see two landing pages holding ~50% of the closed deals out of a total of 495 landing pages.

Predicting closing days (derived by taking difference of won_date and first_contact_date) i.e days taken to close a deal by selecting features which are there in mql table namely

landing_page_idorigincontact_month(derived from first_contact_date)contact_year(derived from first_contact_date)

Using RandomForestRegressor, we get -

- Mean Absolute error in predicting closing days

(Training):- 28.09278260107115 - Mean Absolute error in predicting closing days

(Testing):- 44.297685735063965

Importance of features being -

contact_month 0.466704

landing_page_id 0.222467

contact_year 0.196732

origin 0.114096

Using XGB,

Training Score- 0.554293136069641Test Score- 0.39574759177096813

Predicting order price (derived by aggregating orders data and joining it with closed deal data) i.e total revenue of sold items till now per seller using features such as

business_segmentlead_typelead_behaviour_profilebusiness_typelanding_page_idorigincontact_month(derived from first_contact_date)closing_days(derived by taking difference of won_date and first_contact_date)

Using RandomForestRegressor, we get -

- Mean Absolute error in predicting revenue amount

(Training):- 984.8478500733135 - Mean Absolute error in predicting revenue amount

(Testing):- 1286.4537171052634

Importance of features being -

closing_days 0.324933

business_segment 0.266370

lead_behaviour_profile 0.109720

landing_page_id 0.101673

origin 0.089613

lead_type 0.080434

contact_month 0.023464

business_type 0.003792

Meaning that closing_days and business_segment are important to predict incoming revenue of the seller

Also, a TPOT random regressor ran for 10 generations gave this pipeline -

- One hot Encoder

- RandomForestRegressor

- LassoLarsCV

TPOT score = -4376958.974890612