Sophisticated Scalper Bot for BitMEX using orders imbalance analysis

The idea behind this script is to spot micro-extremes (to the upside or the downside) and anticipate the reversal. To achieve that, it uses a modelisation of the market behaviour for the last 3 days (autogenerated) and applies a RSI computation onto the delta between the buyers and the sellers for the last 14 periods (each modification of the orderbook is counted as 1 period). As another filter, we use regular Bollinger Bands applied on an 1-minute timeframe to avoid being caught in a defavorable jump. It works at the tick level and is best suited for ranging-type price action.

Warning : The model generation can take up to 2 hours (I'm working on a solution).

Configuration

Just replace the key and secret fields with yours and adjust the number of contracts traded in sydom.py

Run pip install -r requirements.txt

Execution

python sydom.py

During the first run, the script will automatically generate a model (if missing) based on the 3 previous days of price action. This model is retrained every day at 6:00 AM UTC. Basically, you don't have anything to do once the bot is launched...

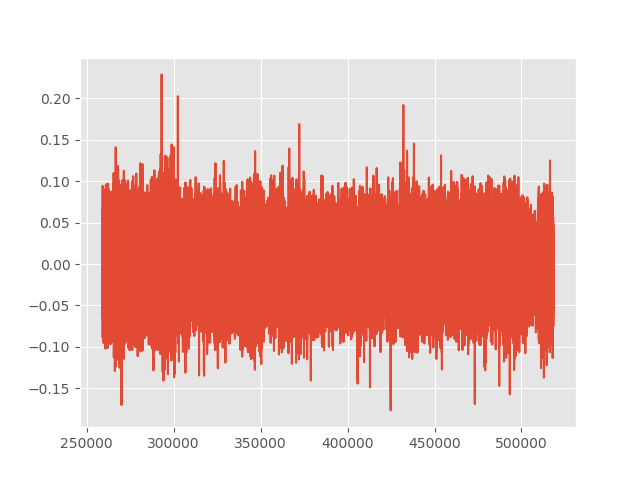

This is what you get at the end of each model generation. It helps to check if the model_thr setting value is optimum. You have to look for a level where the spikes are about to reverse. Generally, 0.05 for ETHUSD is fine... This value is in ABSOLUTE terms !

SyDOM has a telegram community for discussions on using SyDOM Bot and automated trading on BitMex : https://t.me/sydombot

Donations to allow further developments

BTC: 3BMEXbS4Neu5KwsiATuZVowmwYD3UPMuxo

The article and the relevant codes and content are purely informative and none of the information provided constitutes any recommendation regarding any security, transaction or investment strategy for any specific person. The implementation described in the article could be risky and the market condition could be volatile and differ from the period covered above. All trading strategies and tools are implemented at the users’ own risk.