Solves the mean-variance optimization problem using the Critical Line Algorithm developed by Harry Markowitz. A description of the algorithm is available in his 1959 monograph Portfolio Selection. This implementation is based on the 2000 edition of the book Mean-Variance Analysis in Portfolio Choice and Capital Markets by Markowitz and Todd.

(v1.0) pkg> add https://github.com/ungil/Markowitz.jl.gitSee examples/frontier.jl

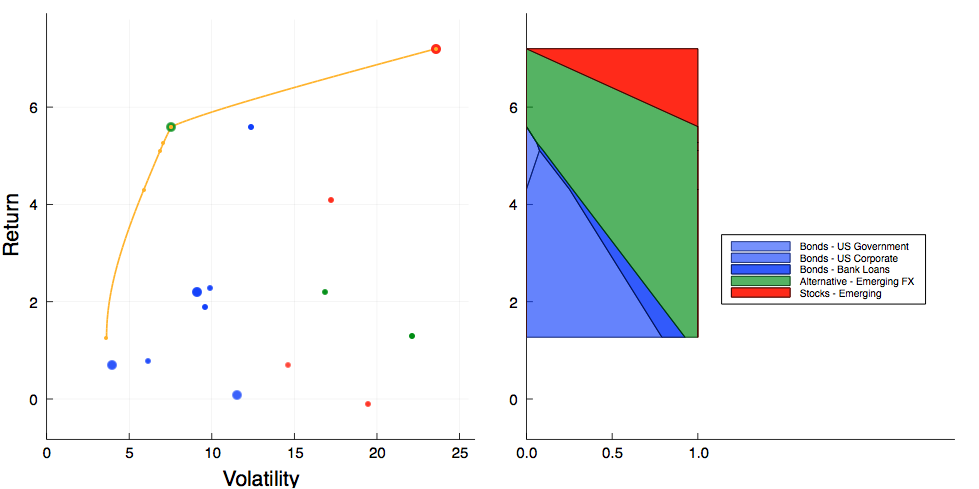

m = markowitz(E, V, names=assets)

unit_sum(m) # total weight = 100%

f=frontier(m)

plot_frontier()

optimal(f) # volatility, return and weights for the minimum variance portofolio

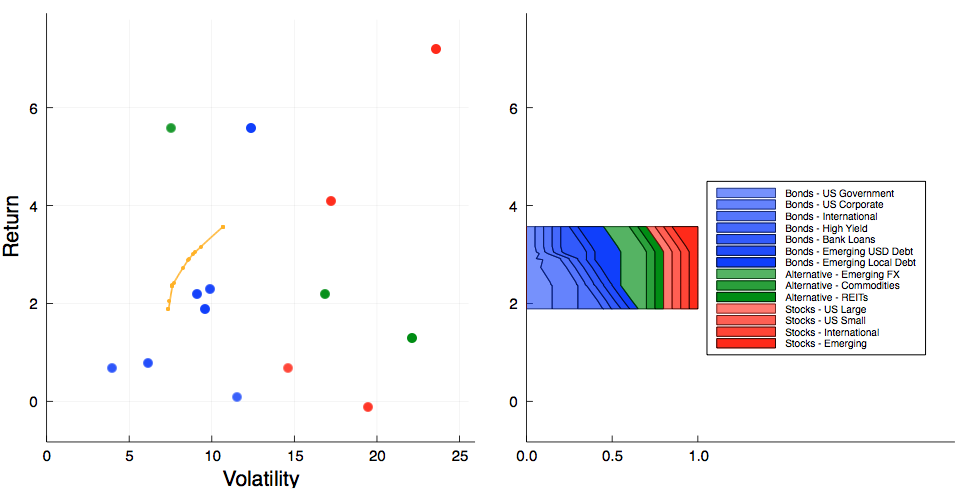

optimal(f,4) # volatility, return and weights for the optimal portofolio with return = 4m=markowitz(E, V, names=assets, lower=0.05, upper=0.15) # min 5%, max 15% per position

unit_sum(m)

f=frontier(m)

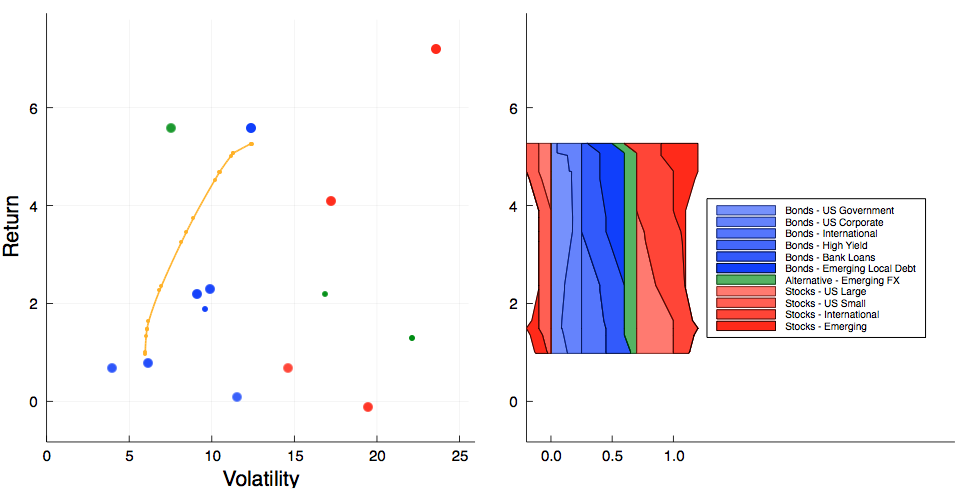

plot_frontier()m=markowitz(E, V, names=assets, # asset bounds by class: stocks -10/30, bonds 0/20, alt. 0/10

lower = -0.1 * (class .== :EQ),

upper = 0.3 * (class .== :EQ) + 0.2 * (class .== :FI) + 0.1 * (class .== :ALT))

unit_sum(m)

add_constraint(m, 1 * (class .== :EQ), '>', 0.3) # net equity exposure between 30% and 60%

add_constraint(m, 1 * (class .== :EQ), '<', 0.6)

add_constraint(m, [1 1 0 0 0 0 0 0 0 0 0 0 0 0], '=', 0.25) # US govt + Investment Grade = 25%

f=frontier(m)

plot_frontier()