This contains our project for the course Data Mining, titled Stock Market Predictor. The project applies various Models (such as ARIMA, SVM, various ensemble approaches) in a Dataset of Stock Market for 5 Years , plus Technical Indicators, Wikipidea hits, News mentions and other such features.

This project deals with the time series analysis of the stock market and then using it to predict future trends. Stock Market:- A stock or share is a financial instrument that represents the percentage of ownership in a company or corporation and represents a proportionate claim on its assets and earnings (what it generates in profits).

Every stock exchange can be represented by a Stock Index value, which is an average value calculated by combining several stocks. This value helps in representing the entire stock market and predicting the change in the market’s movement over time. Early researches used machine learning to create models using the time series data which can predict or forecast sequences or outcomes. But this approach turned out to be very difficult because of the complex features involved in this prediction.

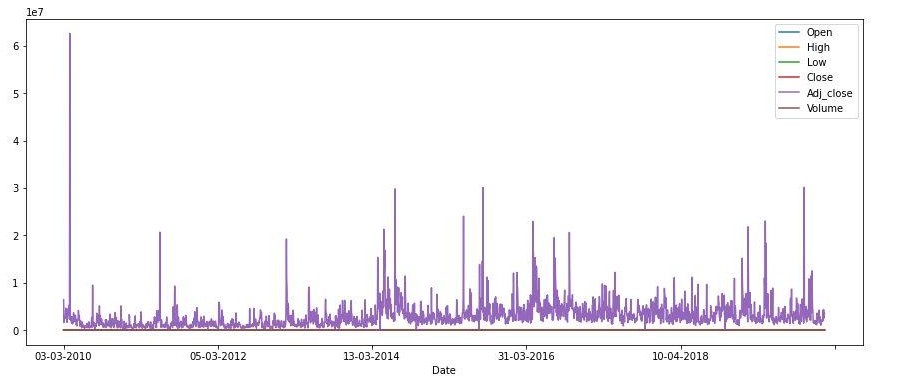

Yahoo Stock (from March 2010 to March 2020) has been collected to be used in training. The companies used are part of the Nifty50 group of companies as of 17 November 2019 .The dataset collected consists of 8 features (date, open, high, low, close, volume, adj close, comp). To this dataset we added features like Technical Indicators, number of wiki hits, news mentions for each company, each day.

Fig1: Shows the closing price trend of Adani Ports for over 10 years-

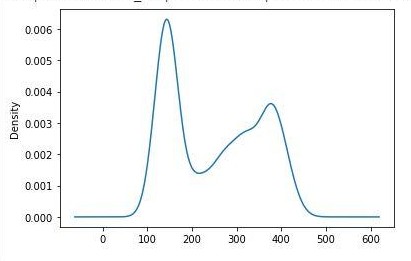

Fig2: This is a KDE plot of the closing price of Adani Ports over 10 years-

We see that the data is not Gaussian (normally distributed).

Similarly, we need to analyze the trend of the company to which we fit our model and make

appropriate transformations to the data prior to modeling and then run the model on it.

We see that the data is not Gaussian (normally distributed).

Similarly, we need to analyze the trend of the company to which we fit our model and make

appropriate transformations to the data prior to modeling and then run the model on it.

We include some technical indicators such as RSI, MA(moving average), MACD, etc. The number of Wiki mentions and google news mentions will be used as indicators for every company in the Nifty50 group. Also, the same is done for the related products of each company. The relation between the company and its products is determined by the Google knowledge graph which is then adjusted based on its result score.

● SVR:- Support Vector Regression works on the principle of Support Vector Machine. It allows the prediction of a non-linear model without changing any explanatory variables, based on the functions of the kernel like linear, sigmoid, polynomial, radial basis, etc, rather than the distributions of the dependent and independent variables underlying it. In SVR we try to fit the error in a threshold.

● SARIMA:- Seasonal Autoregressive Integrated Moving Average (SARIMA) model is an expansion of the ARIMA model. SARIMA is used to forecast a time series on the basis of some past values. It also supports the seasonal data which is not a part of the ARIMA model. It includes three hyperparameters- autoregression, differencing and moving average to add the seasonality feature in the model.