⌥ ⌥ ⌥

Decentralized NFT Options

Just as in traditional art market ...

... the financialization of NFTs is inevitable

[

](https://conveyr.xyz/)

## Table of Contents

- [In a nutshell](#in-a-nutshell)

- [Concept](#concept)

- [Product](#product)

- [Technical Implementation](#technical-implementation)

- [Business Potential](#business-potential)

- [License](#license)

- [Thanks](#thanks)

## In a nutshell

- NFT holders are not incentivized enough to become option writers, despite the financial upside

- Our goal is to attract NFT holders to become option writers and bootstrap the NFT options economy

## Concept

- NFT owners can 'write options' on their NFTs

- Option callers can purchase the options, at a given strike price, for a given premium and time

- JPEG X options are **european**, **cash settled**

- If the option expires _in-the-money_, the sequence goes as follows:

- The NFT holder can provide the strike vs. market price difference to option caller, or

- Option caller can receive the NFT at option's strike price, or

- NFT is auctioned off

- If the option doesn't expire _in-the-money_, option premiums are distributed to NFT owners

- NFT owners are incentivized to gain passive income and provide liquidity

- NFT is returned to owner, even if the option goes against them

- Option coverage solution is created to protect the owners from large lump sum expense, at expiry

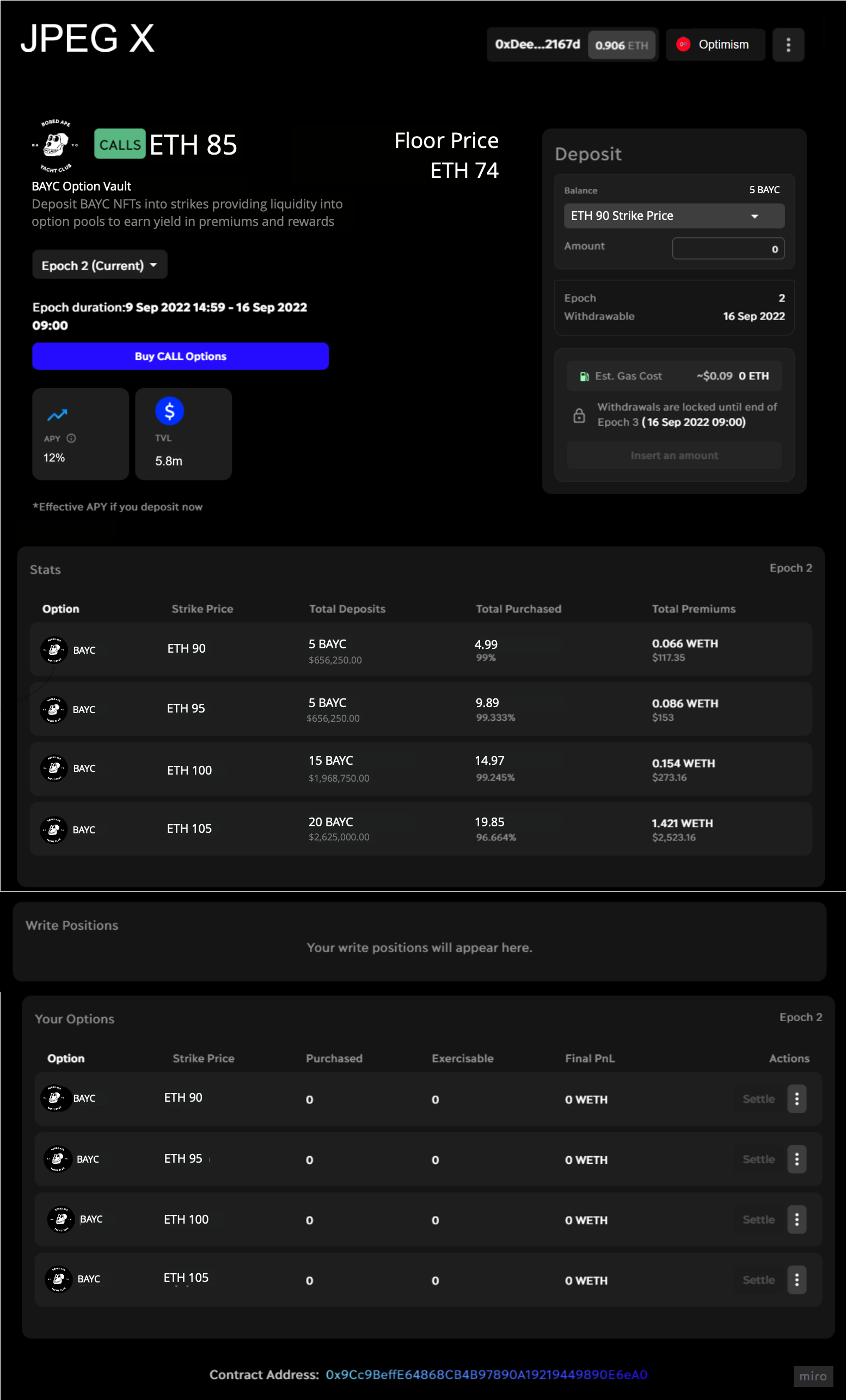

## Product

- Protocol defines strike price and premium pricing options

- Protocol stakes the NFT for the option duration

- NFTs are pooled with other NFTs OF THE SAME COLLECTION

- At staking time, the NFT owner has the option to subscribe to option cover stream

- The option cover stream continously balances the strike to market price differential for the owner

- Ensuring the NFT owner doesn't loose the NFT or has to pay large lump sum, on _in-the-money_ option expiry

- Incentivizing NFT owner to provide their NFTs, improve liquidity and realize financial upside

- Otherwise NFT owner might need to pay lump sum price differential between strike and market price, to keep NFT

- Protocol will automatically distribute the share of option premiums to NFT owners in the collection

- Distributions will happen when the option doesn't expire _in-the-money_

## Technical Implementation

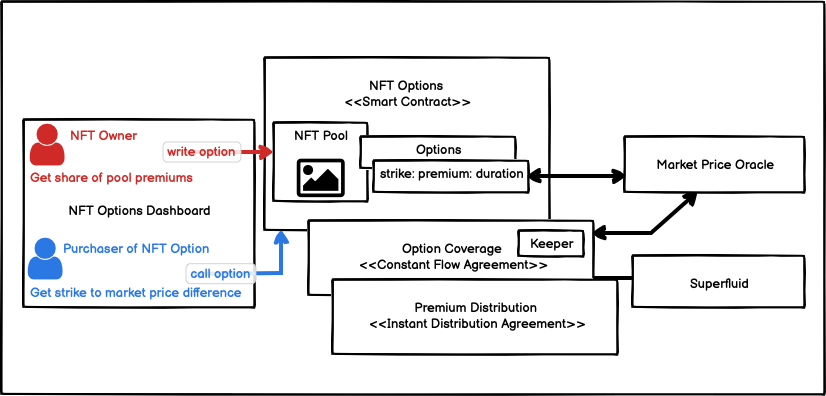

- Smart Contract defines option details per NFT Collection and stakes NFTs

- Strike Price

- Premium Price

- Duration

- Pricing Oracles will be used to establish Strike Price

- Bonding curves will define strike to premium price for multiple options

- Martket price will be retrieved by Oracles

- Bonding curves will be used to define premiums

- Smart Contract governs the option expiry and distribution of profit shares to writers or of strike:market price differential to callers

- To distribute the shares of NFT pool's premiums to NFT owners, Superfluid IDA is used

- Ensures gas efficient distribuition of pool shares to multiple addresses

- To create an ongoing option coverage to NFT owner, Superfluid CFA is used

- Provides ongoing balancing of strike to market price differential for option writers, in a sigle transaction.

- Keeper will be used for ongoing stream monitoring and flow rate adjustments within the epoch

### The flow:

## Business Potential

- Notional value of single stock options was over 10% higher than spot in 2021

- This trend shows no sign of slowing crypto option platforms, such as LRA Opix and Z are growing

- We see the same happening for NFTs, despite the bear 🧸, the top 10 NFT collections

- Total over 2.5 million E in market cap

- Over 3 million in daily trading on OPC alone

- No team has succeeded yet in finding product market fit and gaining any significant traction.

- The financialization of NFTs is inevitable

## 🧐 License

Licensed under the [MIT License](./LICENSE).

## 💜 Thanks

Thanks go out to all of the many sponsors and [ETHOnline](https://ethglobal.com/events/ethonline2022/home)

# jpegwebdev

# jpegwd

# jpegwd