This project was made for the Quantitive measures of market risk course at the AGH UST in 2021/2022. All provided methods are from scratch as a result of my work after hours, when I was solving given tasks (topics).

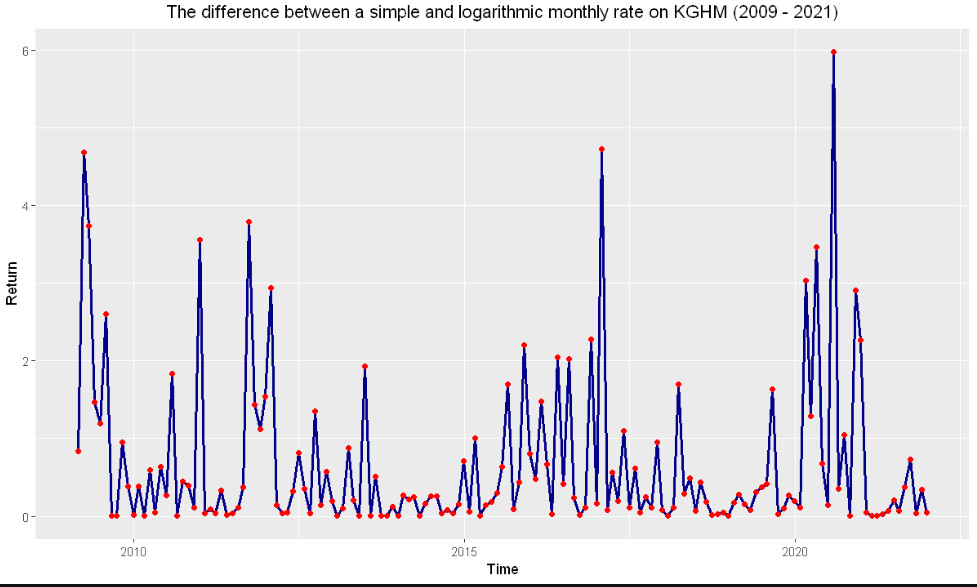

Analysis of Features Affecting Rate of Return

- simple rate of return

- logarithmic rate of return

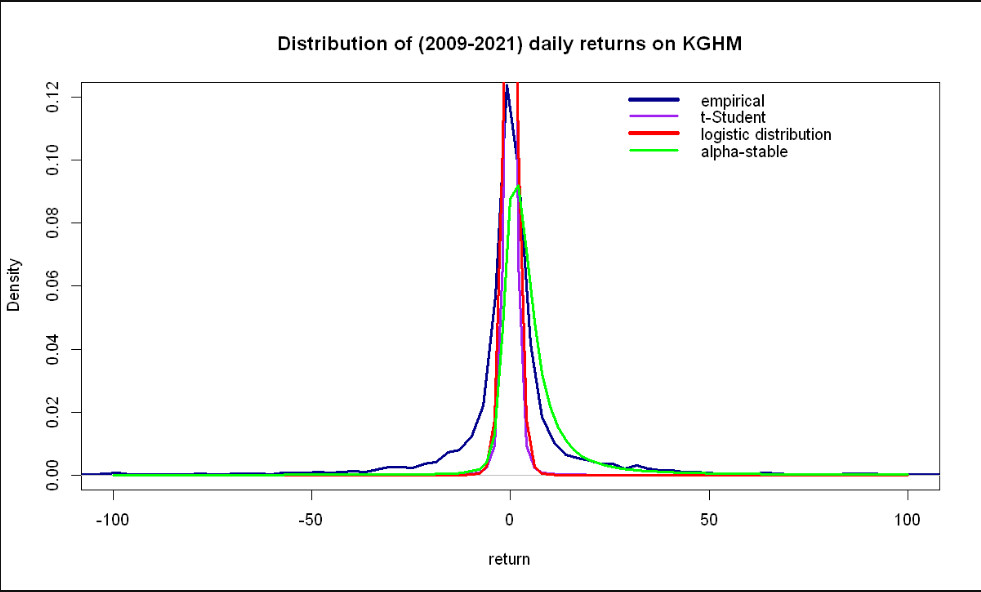

- Shapiro-Wilk test

- Anderson-Darling test

- Jarque-Bera test

- Distribution of returns

Credit risk reduction models

- company rating

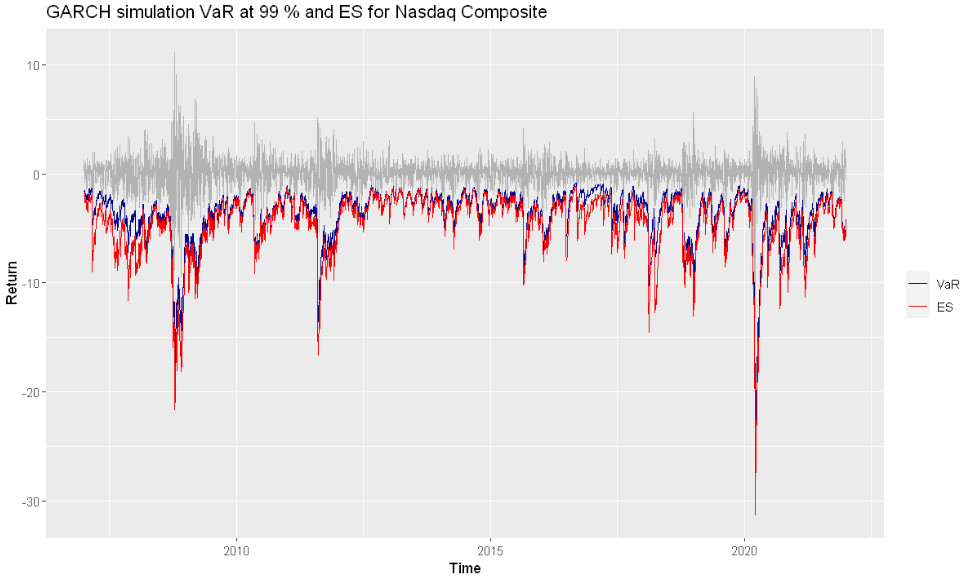

Review of Value at Risk estimation methods

a) VaR and ES calculation methods:

- Historical

- Weighted historical

- EWMA

- GARCH

b) Backtesting methods:

- Christoffersen test

- Kupiec test

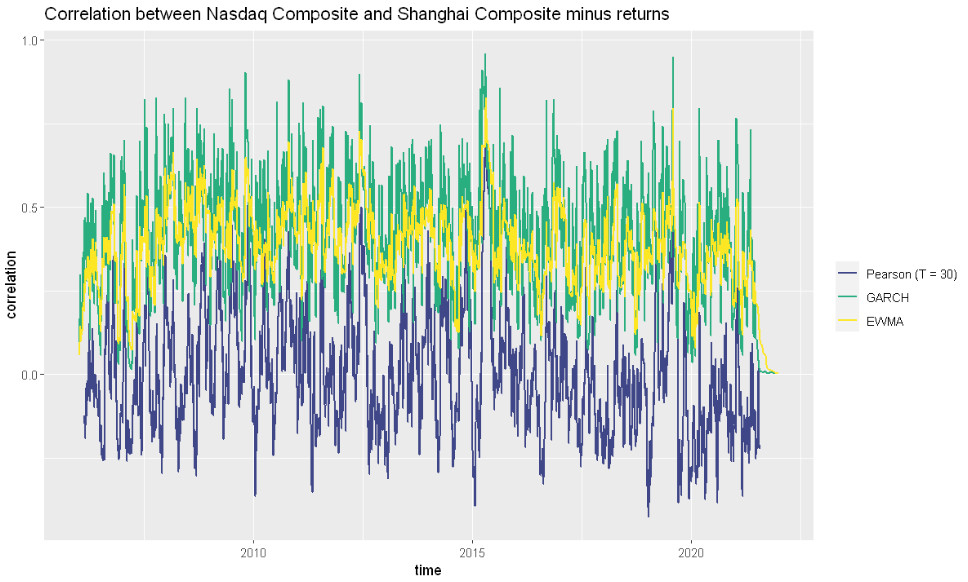

Portfolio VaR Calculation and Correlation Monitoring

- Correlation monitoring

- VaR calculation for portfolio (EWMA and GARCH)

- R programming language (obligatory)

- Jupyter Notebook

- Yahoo Finance https://finance.yahoo.com/

- Stooq https://stooq.pl/