Sacrifice now to benefit later or sacrifice later to benefit now

Effective budget planning involves allocating inflows of cash over a period of time to outflows such as regular bills, expenses and investments while ensuring that you are not spending more than you have. A method to this approach is to estimate how much you would spend in each category while keeping note of how much cash you have left in your budget.

As we know expenses usually come in at different intervals. For example, a rent payment may occur like clockwork each month while expenditure like food occur more frequently and fluctuate in value. An approach to tackling this irregularity in expenses is by specifying the budgeted amount and time period (how often we would see this budgeted expense "come out"). Then, inflows of cash can also be specified by amount earned and over what time period. Finally, total expenditure can be calculated independent of the time period and full allocation of cash influx can be determined.

An important thing to note is that some months may have a negative cash flow (spending more than you earn) but this can be made up by having a positive cash flow (spending less than you earn) in either previous months (borrowing from the past) or future months (borrowing from the future). The goal is to ensure that over a certain period of time you are not continuously going over budget.

The intention of this project is to keep track of cash flows over a time period and have full visibility of where cash is flowing. It is also intended to keep track of the budget and determine if it needs to be adjusted by drawing attention to over and under expenditure.

- See where we are over or under budget early

- The earlier we can spot over or underspending the quicker we can adjust the budget or our spending habits

- Inform spending habits into the future

- Spending habits are not always visible and it's hard to be conscious of spending over a period of time

- Guide investments when cash flows are higher (unexpected underspending or extra cash coming in)

- Provide structure to spending while allowing for flexibility in lifestyle habits

First, the budget is determined using moneysmart's budget planner (recommendation: use the excel spreadsheet for ease of use). Here, the inflows and outflows are specified along with their specific time periods. Then we can determine an appropriate time period to review if the budget is on track or if we are overspending / underspending. In this case an expenses statement of one month (e.g. bank statement or credit card statement) can be enhanced (manually for now but could be automated using classification ML) by specifying which budget category a particular purchase is associated with.

In our case the monthly expenses statement is in CSV format and has the following structure;

Date,Description,Debit,Credit,Balance,Category,Sub-Category

The Category and Sub-Category columns should be manually added and are filled in by categorising each expense on a monthly basis. Since it is a monthly statement a single date row can be used to determine the expense month during automated processing.

Firstly, we need to take the budget from the planner above and determine the expense budget per month using the view tool in the planner. This data can be fed into the processor in the following format:

monthly_budgetYYYYMMDD.csv (dated to keep track of budget changes -- tool should take latest budget)

category,sub-category,budget

The tool should then be run monthly to generate a report (format TBD) on monthly expenditure. The intention is that it will use the allocation for each category and subtract the debits from the expenses statement. At the end the remaining budget will either be negative, positive or exactly zero. The remainder should "carry" to the next month. A positive value will be added to the monthly allocation for the particular category, while a negative value will be subtracted from the allocation. For example, consider a category called Groceries with the sub-category Groceries. If the monthly budget is $500 and the total expenditure for the category in January is $650 then the remainder is -$150. Now in February the same categorisation had an expense of $450. Taking the monthly budget of $500 we subtract the $150 from January and then subtract the $450 from February to arrive at -$100. This -$100 will carry to the month of March.

The tool should be able to determine if you are consistently overspending in a category (e.g. negative for 3 months or more) and flag it in future reports for evaluation. Constant and significant underspending should also be flagged by the system to review manually. Putting your money to work effectively is just as important as ensuring you are not overspending.

Yearly expenses (e.g. insurance charged annually, other annual subscriptions) will make a monthly budget look bad. For 11 months out of 12 you will be over-budget in these annual expense categories. There should be a system in place to ensure false positive flags are not generated for irregular fixed expenses.

- Start of the budget (t=0) begins using earliest monthly statement using the name format:

SpendAccount[A-Z0-9]*_YYYY-MM - At the start of the budget there is no carry from the previous month

- Each month of generation uses previous monthly statements to determine spending habit flags (non-MVP) and carry budget through to the latest month

- Running the generator should create a report for the latest month that has a statement (e.g. in April we will have a March statement and figure out how much remains in the budget for each category for April)

- Allows to plan spending habits for the coming month by reviewing what is above or below the usual budget allocation

- When running, the system should find the latest budget allocation using the format discussed above

- For months that occurred BEFORE the latest budget (i.e. expense statement from 2022 Feb should use the budget defined up to the end of Feb not after)

- Report should be printable and have visual cues to highlight over and underspending (e.g. overspending == RED while underspending == GREEN)

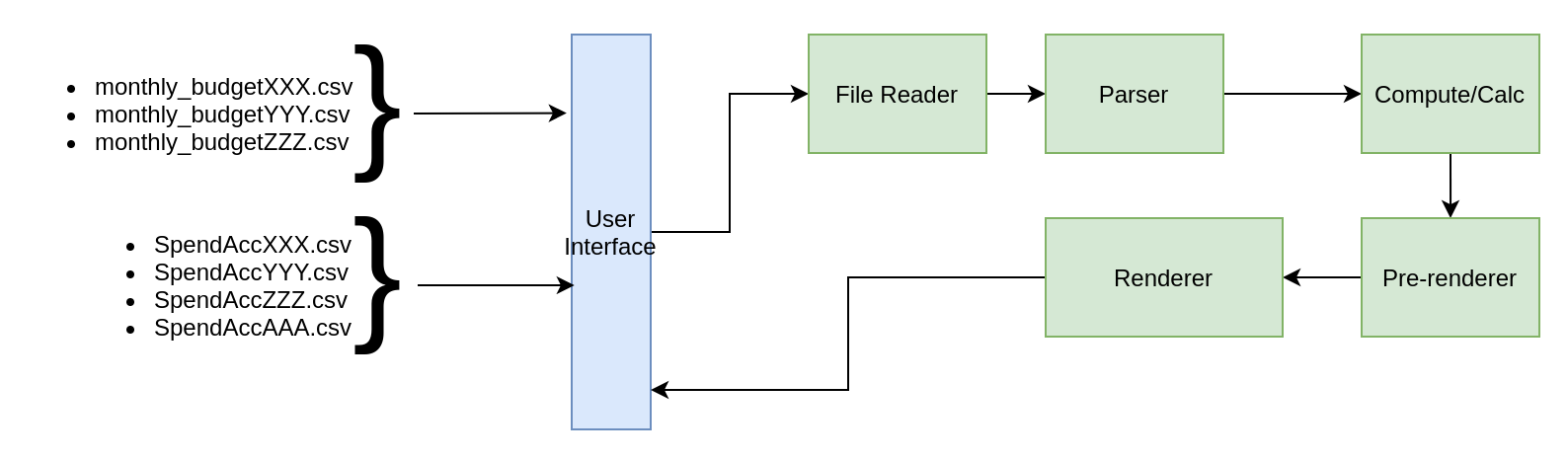

- Basic CLI for generating the reports

- Basic file reader that will read from disk where the CLI is run from

- Basic CSV parser which will read the file contents and represent the budget and statements as in-memory dicts

- Uses prev. statements to compute future reports; oldest statement is t0

- The most granular information is per month; does not include information on a daily expense view

- All computations are stored in-memory

- The pre-renderer will take data from the compute/calc module and transform it into a standardised form that each renderer can understand

- The system can support multiple renderers and for MVP will support CSV and HTML (rendered using

makotemplating library)

Monthly Allocation (Budget) Prev. Month Remainder Avail. Budget Spend Remainder Next Month Avail.

Category X Y Z A B C D

Sub-Categories X Y Z A

...

Total XX YY ZZ AA BB CC DD

...

Complete Total XXX YYY ZZZ AAA BBB CCC DDD

- Categories will remain fixed (it is expected this will not change in future revisions)

- Sub-categories also remain fixed -- in future versions the system should support changes in sub-categories such as addition or removals between reporting periods

- The solution to provide some flexibility is that if a sub-category needs to be removed, it should be removed from all past budgets and statements -- same for additions

- A statement MIGHT BE missing a spend in categories and sub-categories (e.g. if there were no expenses for a category) but the budget MUST NOT be missing any categories and sub-categories included in the statement

- Each line entry in the expenses statement MUST have a valid category and sub-category

- Spending habit flags

- Generating report for previous months retroactively (MVP should only generate report for latest reporting month)

- Habit flag blocklist -- irregular expenses should not be flagged as discussed above

- Prettify monthly budget report using graphs, etc

- Gain insights into spending habits to guide how to better utilise income to achieve financial goals

- Process invoices for finer grain categorisation of spending

- e.g. Shopping at Woolies may involve buying cosmetic items (potential sub-category) which could be separated from general groceries into it's own sub-category

- Must be able to link an invoice to a debit on the monthly statement to eliminate double-charging

- Categorise same/similar descriptions to highlight where regular spending occurs (e.g. popular take-out or regularly visit same cinema)

- Handle adding or removing categories and sub-categories

- Spend projections -- given the actual budgeted value (e.g. $8 each month is ~$100 at an annual frequency) are we projected to spend over or under budget?

- This is critical for irregular category spend (e.g. yearly budgeted items) where at a monthly view it looks like we are always overspending (recent purchase) or underspending (not spent yet) without a true view of the situation