- $47,500 USDC main award pot

- $2,500 USDC gas optimization award pot

- Join C4 Discord to register

- Submit findings using the C4 form

- Read our guidelines for more details

- Starts May 23, 2022 20:00 UTC

- Ends May 28, 2022 19:59 UTC

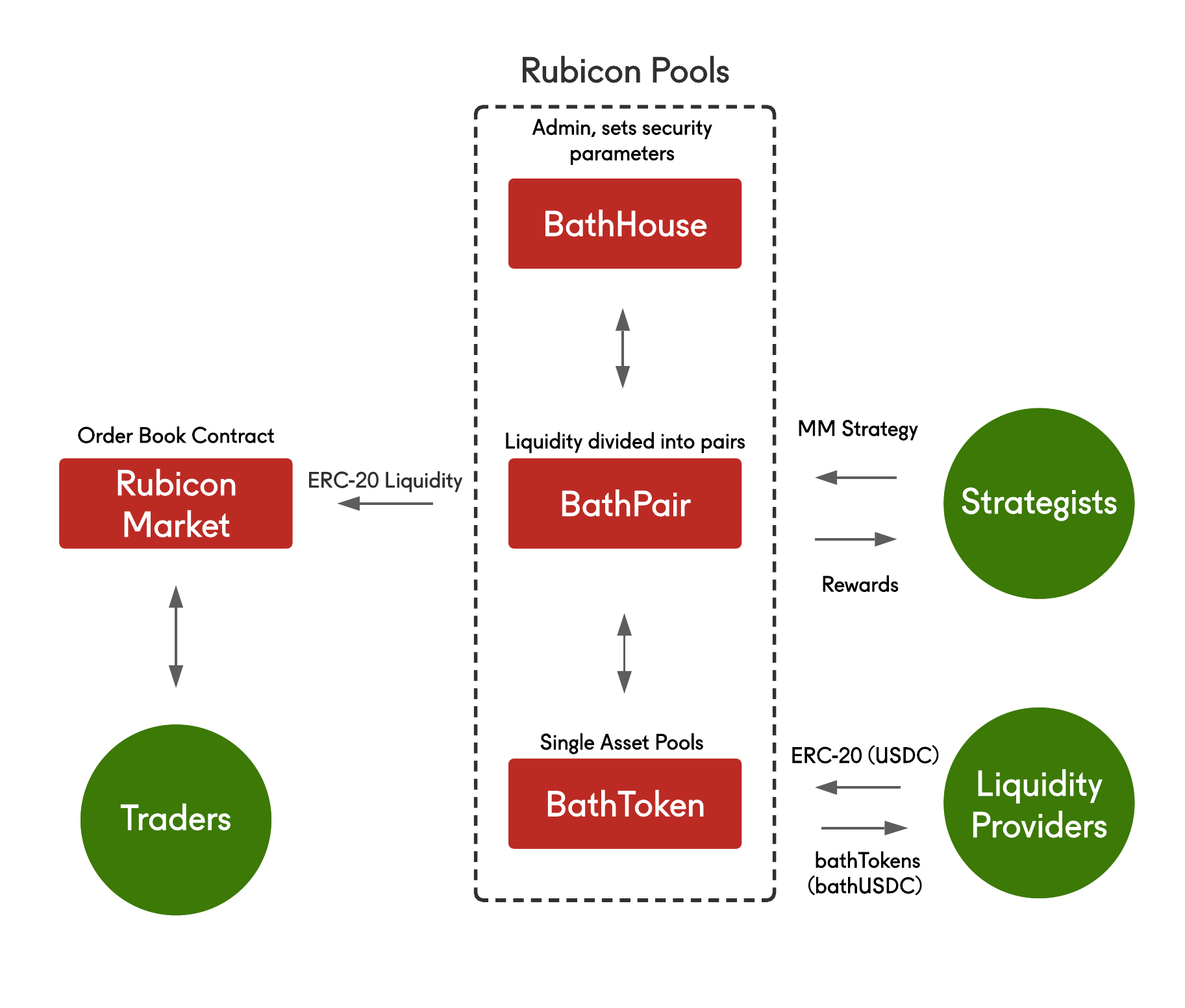

The scope of this contest is the core of the Rubicon Protocol v1, an open order book and democratized liquidity system for Ethereum. Rubicon Pools is a novel order book liquidity system and is the main focus of the contest. This system makes it easy for LPs to enter single-asset liquidity positions, strategists to market-make & trade with that liquidity, and both LPs and strategists to profit. The core contract of the protocol is RubiconMarket.sol; this contract contains the order book that handles all ERC-20/ERC-20 trading on Rubicon.

Please see the 4 core contracts that are the main focus of this audit and more details below (those under “Core”); effectively this is rubiconPools/ and RubiconMarket. Note, there are more minor contracts noted under “Periphery” - these are also included in the scope of the contest.

Rubicon is an open order book protocol for Ethereum. The protocol is Layer 2-native and will launch across multiple L2 networks such as Optimism, Arbitrum, zkSync, and Polygon.

The Rubicon protocol is currently live on the Optimistic Ethereum network. You can use it today on the Rubicon App.

For detailed documentation of the Rubicon protocol please visit our docs

A number of key smart contracts house the primary operations of the Rubicon protocol. Please see below for an overview of our current smart contract infrastructure.

At a high level, Rubicon revolves around a core smart contract RubiconMarket.sol that facilitates peer-to-peer trades of ERC-20 tokens using an open order book.

Rubicon Pools is a separate system of smart contracts that enables passive liquidity provisioning on the Rubicon order books.

Please note, this repo is a reproduction of v1.2.0 found here: https://github.com/RubiconDeFi/rubicon-protocol-v1.

Here are a few resources to help you learn more about Rubicon:

- Live App on Optimism!

- Whitepaper - Highly recommend you read this to learn all you need to know about Rubicon!

- Documentation

- Live Deployments

This contract acts as the administrator of the Rubicon Pools system. It permissions strategists (via approveStrategist) that can access user funds (via placeMarketMakingTrades on BathPair.sol), manages key state variables across the protocol, and allows for the creation of Bath Tokens (via createBathToken). Importantly, BathHouse has an admin that is the EOA administrator of the entire protocol in v1.

This contract is the strategist’s sole entry-point (via placeMarketMakingTrades) into Rubicon Pools in order to market-make (on RubiconMarket.sol) for the purposes of creating yield for themselves and LPs. The strategist cancels their outstanding orders (in part to maintain correct outstandingAmount accounting on BathToken.sol) while maintaining an active book of bids & asks. The strategist also uses Bath Pair to claim their rewards (via strategistBootyClaim), rebalance filled liquidity between pools (via rebalancePair), or rebalance filled liquidity with an external venue (via tailOff, today exchanging with UNI v3). Note the rebalancing process returns funds to their respective Bath Token and to the Bath Pair to await claim by strategists.

This contract represents a single-asset (underlyingToken) liquidity pool that users deposit into, in order to receive Bath Tokens (ERC-20 Token). This token follows the EIP-4626 share model. Users deposit funds to receive shares and redeem those shares when withdrawing to receive their funds back in addition to any yield strategists successfully generated for them.

Please note, that the Bath Token tracks assets that it has a claim on, but have been placed by a strategist into the order via outstandingAmount. This is a crucial accounting measure so underlyingBalance tracks the best-guess ERC-20 value the pool has a claim on. This effectively mark-to-market’s the outstandingAmount to its amount when it left the Bath Token for Rubicon Market.

The goal of the Bath Token is for liquidity providers to pay a service fee to strategists for generating yield for the Bath Token vault. Note that in v1, the strategist can return funds at a loss to LPs and their reward is realized whenever fill is handled by the strategists. In future versions, the strategist role will be decentralized, bond assets when market-making with LP funds, and pay rewards relative to returned profits.

Note that the Bath Token looks to both the Bath House (via onlyBathHouse) and the Bath Pair/strategists (via onlyPair) as permissioned actors. The Bath House admins key storage variables while strategists access funds and manage liquidity positions. Special care should be taken to make sure no malicious actors can access ERC-20 funds, namely the underlyingToken, of Bath Token.

This is the core order book contract of the protocol. Rubicon Market allows for easy order book trading of any two ERC-20 assets. Here is live documentation as well as documentation made by OasisDex.

This contract acts as a convenient router for calls that access the core protocol. Features of the Router include the ability to swap between any two ERC-20s by simply trading through RubiconMarket. Moreover, the Router provides helpful queries like getBookFromPair and has wrappers to support native asset (like ETH or MATIC) interactions with the core protocol.

This contract makes it easy for Bath Tokens to payout their withdrawers any bonusTokens they may have accrued while staking in the Bath Token (e.g. network incentives/governance tokens). This contract is a minor modification of the Open Zeppelin Vesting Wallet contract. BathBuddy releases a user their relative share of the pool’s total vested bonus token during the withdraw call on BathToken.sol. This vesting occurs linearly over Unix time and is unchanged from the OZ contract; modifications were only made to the custom release() implementation.

Please note, in practice, Rubicon uses Transparent Upgradeable Proxies to make sure all contracts can be iterated and improved over time. Please see this helpful resource for learning more about the Proxy Upgrade Pattern. A Rubicon admin (different from the contract admin that acts as BathHouse admin) acts as the proxy admin for all smart contracts in v1.

Please note that there are some deprecated storage variables that are intentionally left in core contracts to allow for consistent contract abis across networks and respect the proxy upgrade pattern on Optimism. These storage variables will not be paid any bounty and are included for consistent contracts cross-network despite additional deployment costs.

- Any loss of or malicious, non-strategist use of LP funds in

BathToken. Any non-approved strategist (chosen by admin EOA) moving LP funds (excluding the rightful owners) is an error in v1. - Bath Tokens should account for their underlying assets and payout depositors correctly when withdrawing.

- Gas optimization

- Re-entrancy or potentially malicious external calls

- No outside, non-approved actors should modify any state variables within the system. Note, that this should only be possible in

openBathTokenSpawnAndSignalin which case the user-created Bath Token is added to the system, but still only manageable from a strategist perspective from system-approved strategists

$ npm i

$ (in a separate instance) npm run ganache

$ npm run test

$ truffle compile #to compile