It's an experimental tool made for fun and learning purpose I wouldn't personnaly based my investement on it.

This repository is made to optimize performance of your saving portfolio. The optimization is based on sharpe ratio to optimize performance over volatility.

You can configure the ticker you want to benchmark in config.py file.

This benchmark take data from yahoo finance you can use all available ticker of yahoo : stocks, ETF, crypto ...

The source code will generate a large number of portfolio with different proportions for each given asset.

Then it will calculate sharpe ratio of each one of this portfolio to try to find the best performing one with volatily as low as possible.

Then it will return the best proportion to be used in a portfolio for each asset.

If I put stocks = ["BTC-USD", "^IXIC", "^GSPC"] (ticker for Bitcoin, NASDAQ-100 and S&P500 respectively)

and BTC as a great sharpe ratio compare to S&P500 and NASDAQ-100, the return value could be something like :

"BTC-USD": 0.7

"^IXIC": 0.2

"^GSPC": 0.1

This mean that the best portfolio for the period of time given would be to have a portfolio composed of 70% BTC, 20% NASDAQ-100 and 10% S&P500.

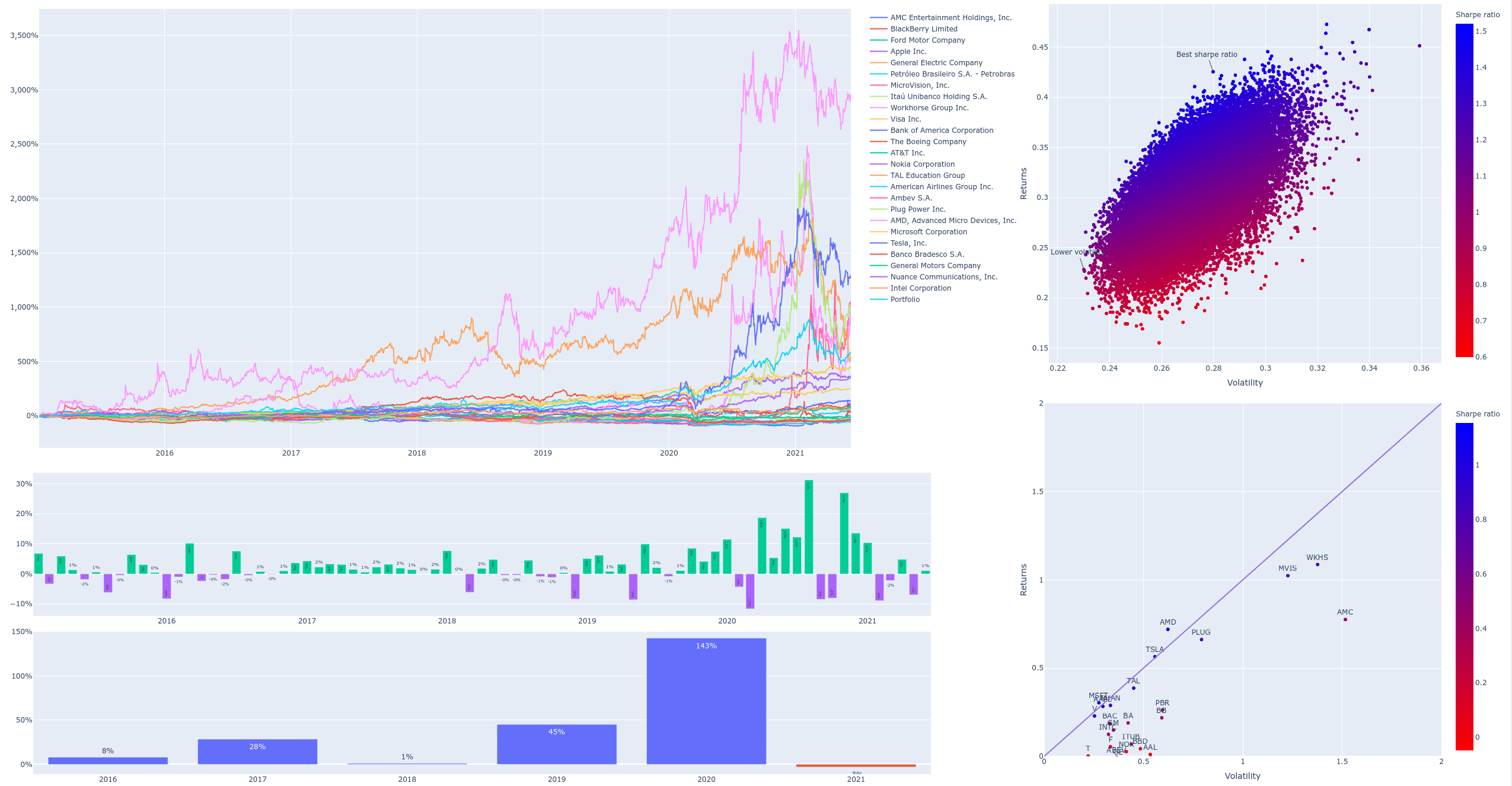

It will create different graphs at the end of the process, the first graph will shown performance of each asset, the second one the sharpe ratio of all the portfolio generated.

The 3rd one performance per month and per year for the "optimized" portfolio, and the last one the sharpe ratio of each asset.

install python 3.8 or above and poetry (pakage manager) on your computer.

Once done use

poetry install at the root folder to install all required dependencies.

Run

poetry run python finance_benchmark/src/portfolio_optimization.pyYou can also use -f <int> as command argument, to filter assets which means that the algorithm will be ran multiple time and each time it will remove the less performing assets. This is usefull when you compare a lot of assets.

You can configure the ticker you want to use inside config.py file, by using an array called assets.

You can also change the target time period with startdate, and the number of portfolios (num_portfolio which will be randomly generated.

Ultimately you can change polite_name variable to rename ticker wich will be shown on the (1) graph.