This Jupyter notebook creates, trains, and evaluates machine learning models to automate trading decisions for emerging markets investing.

Specifically, it carries out the following steps:

- Implements a baseline trading strategy based on dual Simple Moving Averages (SMAs) using the Support Vector Machine (SVM) C-Support Vector Classification (SVC) model.

- Adjusts the training data size and the moving average windows to optimize the algorithm.

- Trains a model using a different machine learning model and compares its performance to the baseline model.

This Jupyter notebook makes use of the following Python libraries:

- Pandas

- PyViz - Holoviews and hvPlot library

- Datetime

- Numpy

- Matplotlib

- scikit-learn

To use this notebook:

- Install Jupyter lab Version 2.3.1 and Python 3.7.

- Pandas should already be included in the dev environment distribution. If not, install it.

- Install scikit-learn.

- Install PyViz visualization package.

- Install hvPlot version 0.7.0 or later.

- Install NodeJS version 12 or later.

Open the notebook in Jupyter lab and you can rerun the analysis.

precision recall f1-score support

-1.0 0.43 0.04 0.07 1804

1.0 0.56 0.96 0.71 2288

accuracy 0.55 4092

macro avg 0.49 0.50 0.39 4092

weighted avg 0.50 0.55 0.43 4092

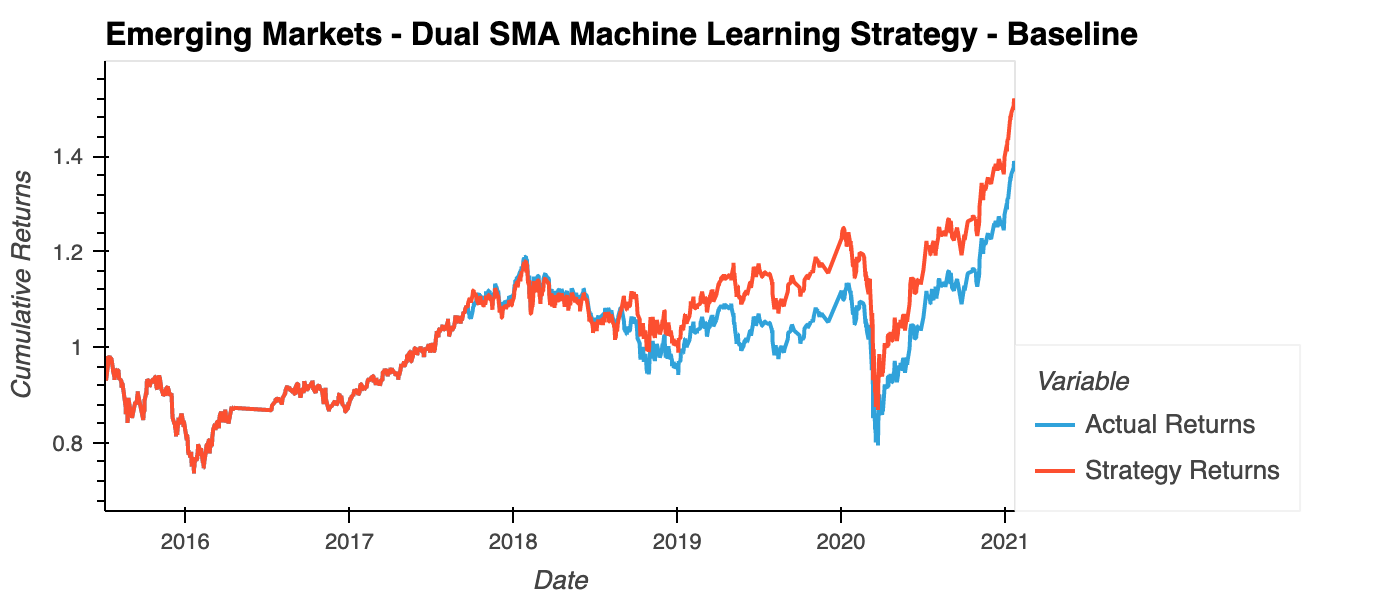

The baseline model had an accuracy of 55%. The Strategy Cumulative Returns were 151.8%, and the Actual Cumulative Returns of the emerging markets data were 138.7%. So for the baseline case, the model performed 13.1% better than the underlying assets.

precision recall f1-score support

-1.0 0.44 0.02 0.04 1732

1.0 0.56 0.98 0.71 2211

accuracy 0.56 3943

macro avg 0.50 0.50 0.38 3943

weighted avg 0.51 0.56 0.42 3943

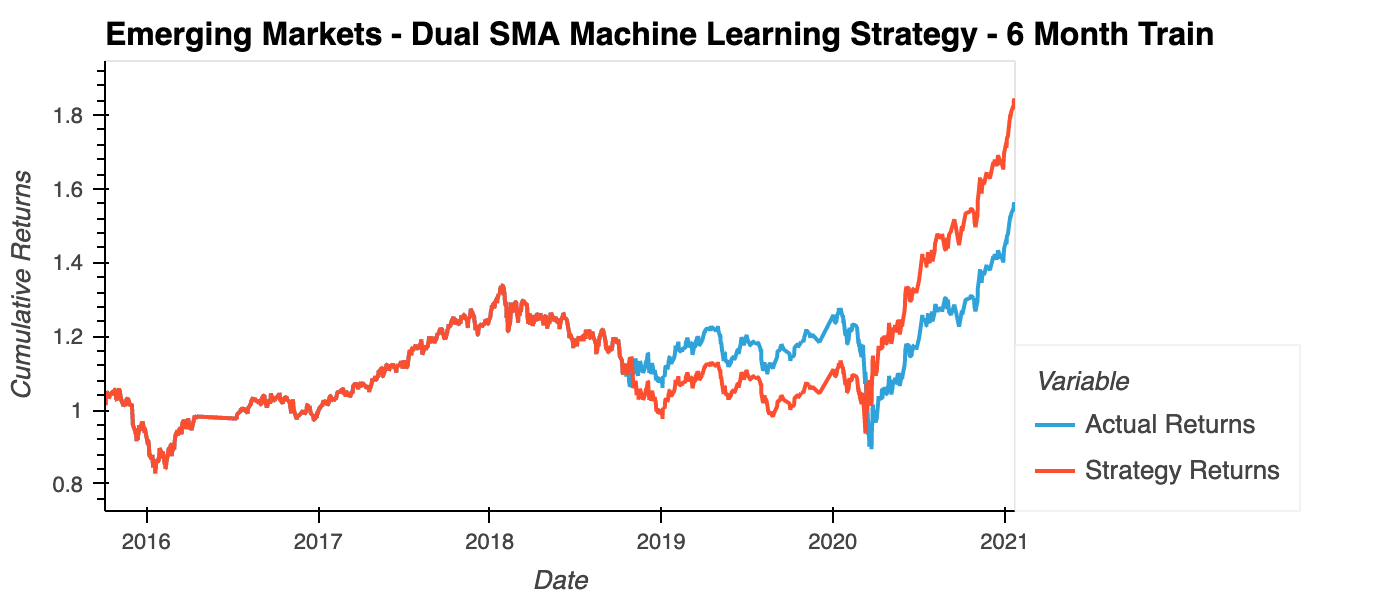

When the model was trained with 6 months of data instead of 3, overall the model performed better than the baseline. The accuracy went up to 56%, the Strategy Cumulative Returns went up to 184.2%, and the Actual Cumulative Returns of the emerging markets data went up to 156.0%. Note there was a period about 1 year where the model performed worse than the underlying assets, but in the end the model performed 28.2% better than the underlying assets.

Also note the reason the Actual Cumulative Returns went up compared to the baseline was because the 6 months of training data changed the amount of data available used by the cumulative product comparison.

precision recall f1-score support

-1.0 0.44 0.85 0.58 1740

1.0 0.58 0.16 0.25 2227

accuracy 0.47 3967

macro avg 0.51 0.51 0.42 3967

weighted avg 0.52 0.47 0.40 3967

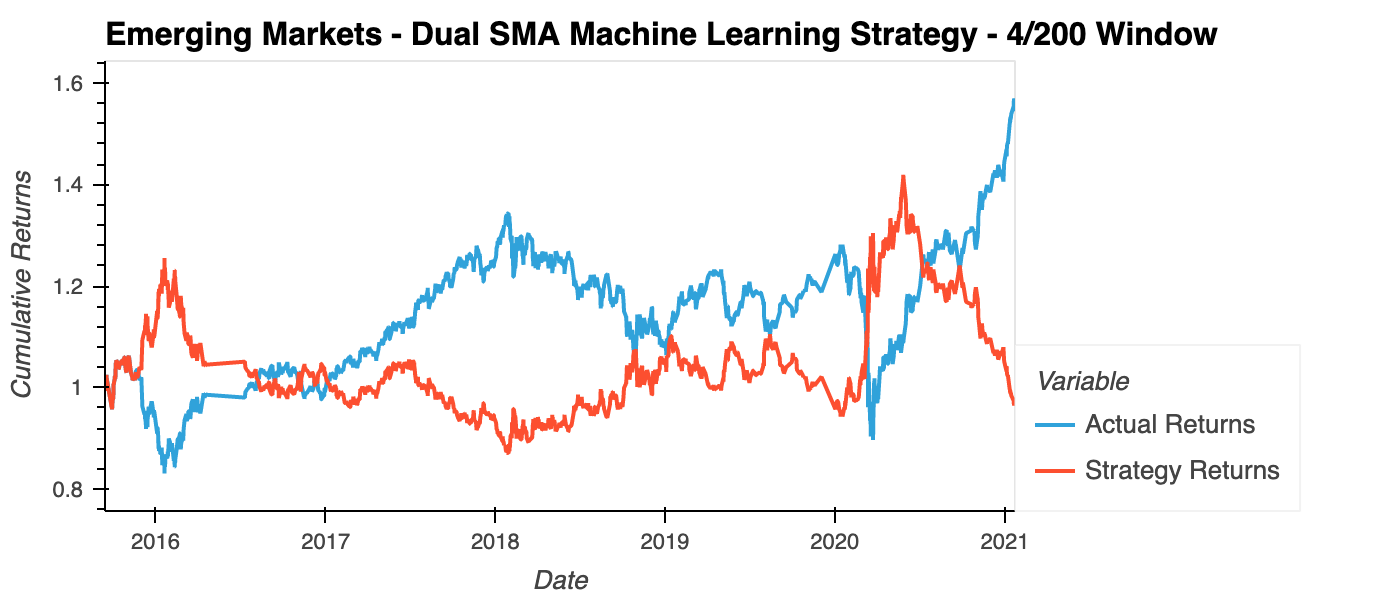

When the SMA fast/slow windows were changed from 4/100 days to 4/200 days, it had a negative impact on the model. Compared to the baseline, the accuracy went down to 47%, the Strategy Cumulative Returns went down to 96.6%, and the Actual Cumulative Returns of the emerging markets data went up to 156.6%.

Note the reason the Actual Cumulative Returns went up compared to the baseline was because the 200-day window changed the amount of data available used by the cumulative product comparison.

precision recall f1-score support

-1.0 0.44 0.57 0.50 1732

1.0 0.56 0.44 0.49 2211

accuracy 0.49 3943

macro avg 0.50 0.50 0.49 3943

weighted avg 0.51 0.49 0.49 3943

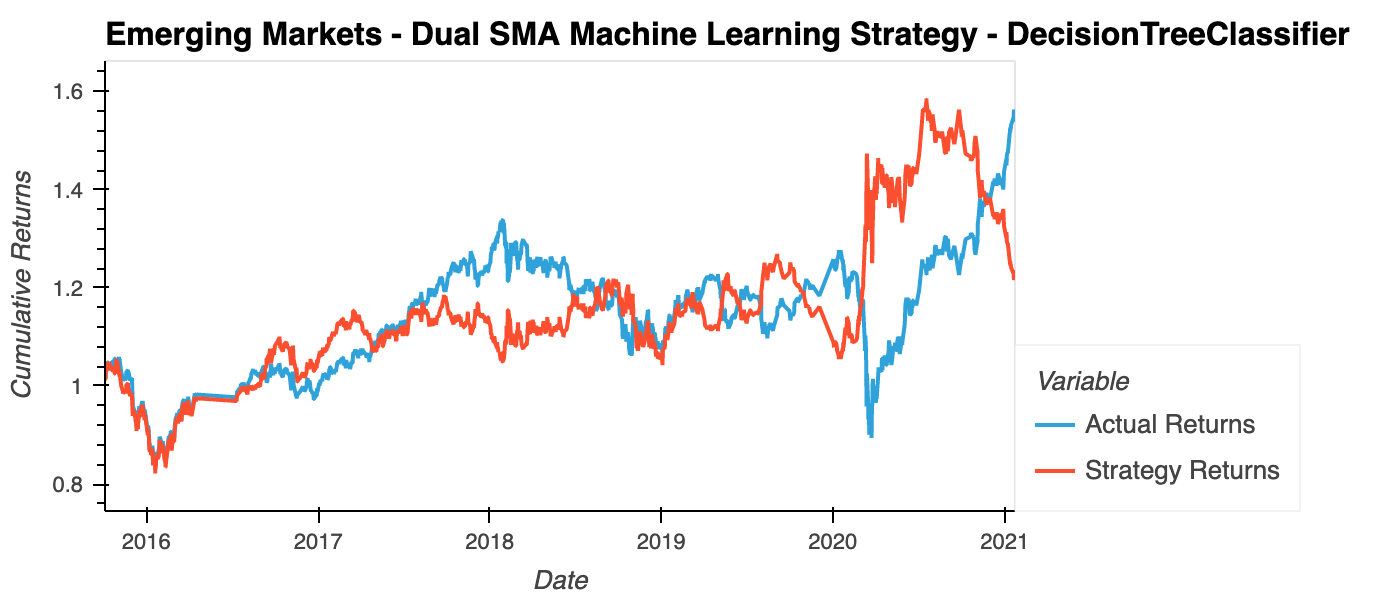

The new model built using a DecisionTreeClassifer performed worse than the baseline model and the 6-month Trained SVC model. It performed slightly better than the SMA Window Tuned SVC model, although that is not a fair comparison because the new model was also built using 6 months of training data.

Compared to the baseline, the accuracy went down to 49%, the Strategy Cumulative Returns went down to 121.8%, and the Actual Cumulative Returns of the emerging markets data went up to 156.6%.

Note the reason the Actual Cumulative Returns went up compared to the baseline was because the 6 months of training data changed the amount of data available used by the cumulative product comparison.

Based on the overall model accuracy and the comparison of Strategy Cumulative Returns with Actual Cumulative Returns of the emerging markets data, the recommended machine learning model is the 6-month Trained SVC model.

When backtested, this model produced cumulative returns of 184.2%, compared to cumulative returns of 156.0% of the underlying emerging markets assets.

Michael Danenberg

MIT