We've looked at time series and what they might look like. Now why do we need to model time series? Essentially, you're trying to find patterns and understand the data in a way that you can use this information to (hopefully) make accurate predictions about the future.

In this lesson you'll learn about two basic time series models: the White Noise model, and the Random Walk model.

You will be able to:

- Explain what the goal is of time series modeling

- Understand and explain what a White Noise model is

- Understand and explain what a Random Walk model is

- Understand the mathematical formulations of Random Walk and White Noise models

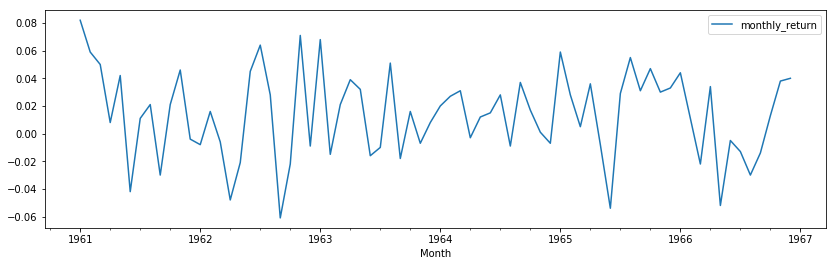

The white noise model is the simplest example of a true stationary process - basically what we were talking about when we looked at the plot for data without trend (the monthly NYSE returns). Let's plot this again below:

import pandas as pd

from pandas import Series

import numpy as np

import matplotlib.pylab as plt

%matplotlib inline

nyse = pd.read_csv("NYSE_monthly.csv")

col_name= 'Month'

nyse[col_name] = pd.to_datetime(nyse[col_name])

nyse.set_index(col_name, inplace=True)

# Draw a line plot using temp and .plot() function.

nyse.plot(figsize = (14,4))

import matplotlib.pyplot as plt

plt.show();The white noise model has three properties:

- There is a fixed and constant mean

- There is a fixed and constant variance

- There is no correlation over time (we'll talk about correlation in time series later, essentially, what this means is that the pattern seems truly "random).

A special case of a White Noise model is Gaussian White Noise, where the constant mean is equal to zero, and the constant variance is equal to 1. You'll see later on that a white noise model is useful in many contexts!

More information on White Noise series can be found here. You can disregard the content on autocorrelation functions for now, we'll cover that later!

Contrary to the white noise model, the random walk model, however

- Has no specified mean or variance

- Has a strong depencence over time

The changes over time are basically a white noise model. Mathematically, this can be written as:

Where

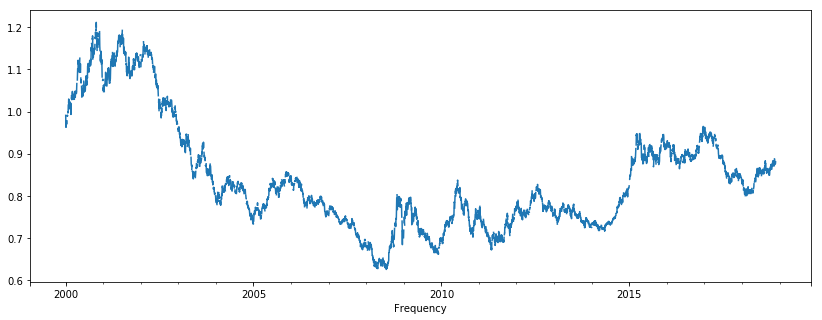

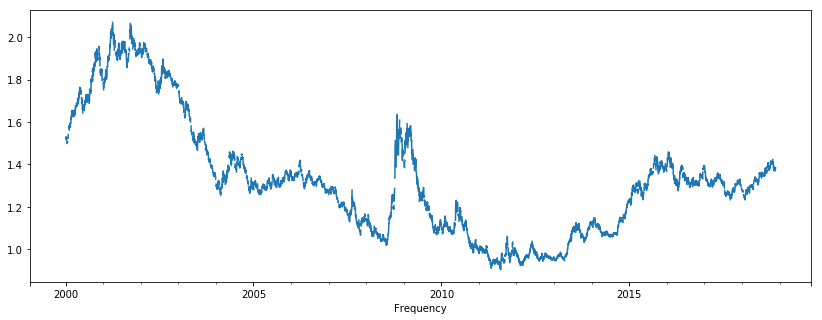

Random walk processes are very common in finance. A typical example is exchange rates. The idea is that generally speaking (and unless any drastic events happen), tomorrow's currency exchange rate will be strongly influenced by today's exchange rate, with a small change (either positive or negative). The data set below contains the exchange rates for the Euro, Australian Dollar, and Danish Crone with the US Dollar, from January 2000 until November 26, 2018.

xr = pd.read_csv("exch_rates.csv")

xr['Frequency'] = pd.to_datetime(xr['Frequency'])

xr.set_index('Frequency', inplace=True)

xr.tail().dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

| Euro | Australian Dollar | Danish Krone | |

|---|---|---|---|

| Frequency | |||

| 2018-11-22 | 0.876962 | 1.378672 | 6.543541 |

| 2018-11-23 | 0.880902 | 1.383721 | 6.573115 |

| 2018-11-24 | NaN | NaN | NaN |

| 2018-11-25 | NaN | NaN | NaN |

| 2018-11-26 | 0.880049 | 1.378509 | 6.566224 |

xr['Euro'].plot(figsize = (14,5));xr['Australian Dollar'].plot(figsize = (14,5));More on random walk can be found here (to read up to where autocorrelation is covered).

An extension of the Random Walk model is a so-called "Random Walk with a Drift", specified as follows:

Here, there is a drift parameter

Great, you now know how a Random Walk and Moving Average model work. In the next lab, you'll practice your knowledge!